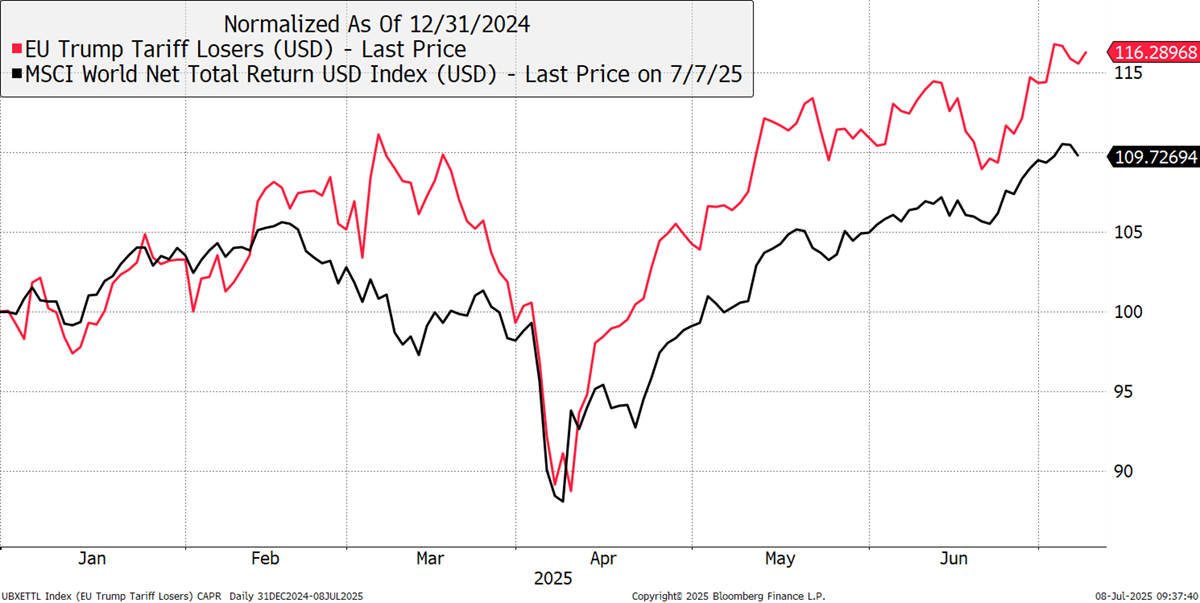

While researching tariffs, I stumbled across the USB Trump Tariff Losers Index. It’s a list of companies created by the equity strategists at UBS, identifying stocks from the UK and Europe that would likely plummet under Trump’s tariffs. It features German automobiles, British and French booze, luxury goods, and a little technology.

Tariff Losers

Yet ironically, this list of stocks has beaten the world index this year, despite being a high-conviction bunch of losing trades from a (presumably) competent strategy team. I would assume this came from the equity derivatives desk, and the idea was that their clients would short this basket of stocks, as a “hedge” against the market risks. However, had you done that, you’d be down because it has not only risen 16% this year, but outperformed the world index as well. If this had been a fund’s short book, I hope their long book really shot the lights out.

The latest targets are Japan and Korea, which face 25% tariffs on 1st August, pending deals and extensions. In April, the market was terrified by the threat of tariffs, and rightly so, but the markets have become used to them and assume that they will always be toned down, postponed, or skirted around. So far, the damage has been much less than forecasted.

Yet the market was right to be concerned in April, because global trade is under threat. Equally, the market was right to rally when that threat eased. However, the threat has now returned, not so much in the UK, but with our allies in the East. Like last time, the risk is that the market is complacent, and tariffs escalate.

The impact on inflation remains unclear because while some observers simply see higher prices, others believe that higher tariffs boost prices in some areas and reduce them in others, leaving the amount of money transacted unchanged. That may or may not be true, but we haven’t seen much change in inflation so far, and so that has been yet another calming force on global stock markets.

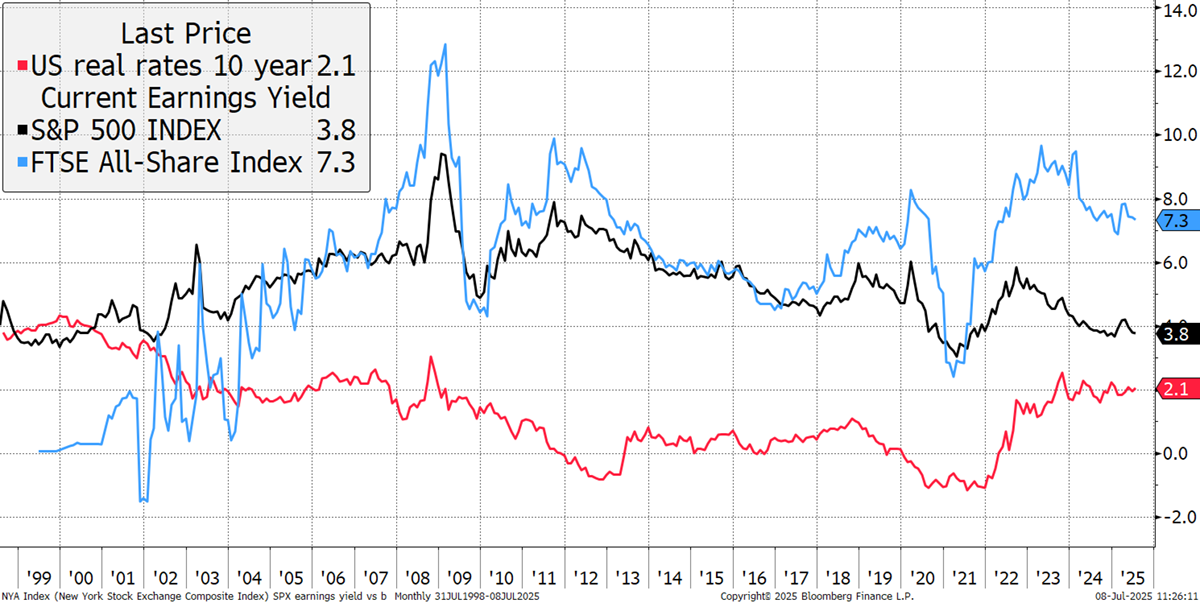

This morning, I listened to the Capital Gearing Trust Investor live update. Like you, I am wondering when their returns will pick up, but unlike some of you, I have absolute confidence that they will. I like the fact that they haven’t changed their spots and stick to their ethos. One chart they highlighted was the US stockmarket earnings’ yield, which is the price-to-earnings ratio inverted. It allows you to see the stockmarket versus bond markets on similar terms. Recall that the real yield measures the bond yield after inflation.

Earnings Yield and Real Yield

The real yield on the 10-year Treasury Inflation-Protected Securities (TIPS) is now 2.1%, shown above in red, which is historically high. The 10-year TIPS can lock that rate in for the next 10 years. The earnings yield on the S&P 500 is shown in black. It is 3.8% and low. In the UK, the FTSE All Share earnings yield is a respectable 7.3% and is shown in blue. The key takeaway is that the 10-year risk-free real yield is now close to US equities, which mustn’t be ignored. But Trump is in the White House, and he likes a rising stockmarket, yet JPMorgan’s CEO, Jamie Dimon, is worried about US treasuries because the government has been overspending, saying:

“You are going to see a crack in the bond market. It is going to happen. I just don’t know if it’s going to be in 6 years or 6 months.”

When Dimon’s crack is exposed, real yields will rise even higher, while equities will quite possibly bumble along on the back of Trump’s stimulus. But there will come a time when Dimon’s call makes TIPS too attractive to ignore; maybe that’s 3% or even more. But it can’t be too high, as 4% was enough to crash the stockmarket 25 years ago.

While things are going well, it is my job to look ahead. TIPS in the US, and their friends in the UK, linkers, offer good value. But here in the UK, the government has a spending problem that will be resolved with more taxes on the rich, many of whom will leave. In the US, the government has tried to address a spending problem with DOGE, only to follow up with the Big Beautiful Bill Act. Elon Musk couldn’t keep quiet:

"I’m sorry, but I just can’t stand it anymore. This massive, outrageous, pork-filled Congressional spending bill is a disgusting abomination. Shame on those who voted for it: you know you did wrong."

He argued that the bill undermines efforts to reduce federal spending, citing projections that it could increase the federal deficit by more than $2 trillion over the next decade. That ought to push real yields even higher and probably help the stockmarket. It’s when we actually have fixers in government, who balance budgets, that bonds will take off while equities grind to a halt. While the US showers the rich with tax cuts, here in the UK, they’ll see tax hikes.

One-way to Boston, please.

Another week passes us by. The portfolios are doing well, and I am making no changes.

Postbox

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd