ByteTree offers actionable, high-quality investment guidance at an affordable price with a focus on risk management and performance. The sheer quantity of information available online can be overwhelming, so we help investors by distilling our advice into model portfolios, explaining every new investment recommendation in real time.

In this Q2 2025 update, we review the performance of our model portfolios in The Multi-Asset Investor and our special situations service, Venture. I will also touch on our other services in Global Trends, ByteFolio, and our proprietary Bitcoin and Gold ETF (BOLD).

Letter from Charlie Morris, CEO

The second quarter of 2025 was marked by the early crash in markets as tariffs took hold. There was a fear that global trade would grind to a halt, but it proved short-lived, as President Trump backed off. Stockmarkets quickly rebounded in what has been one of the most remarkable “V” shaped rallies on record. Yet underlying this is a weak US dollar, which fell 4% in the first quarter, and another 7% in the second, totalling 11% this year. This has coincided with continued weakness in the bond market, where government budget deficits have become a cause for concern. In the US, the government spends 7% more than it raises in taxes each year, and in the UK, 5%. Market watchers know that this is an unsustainable position.

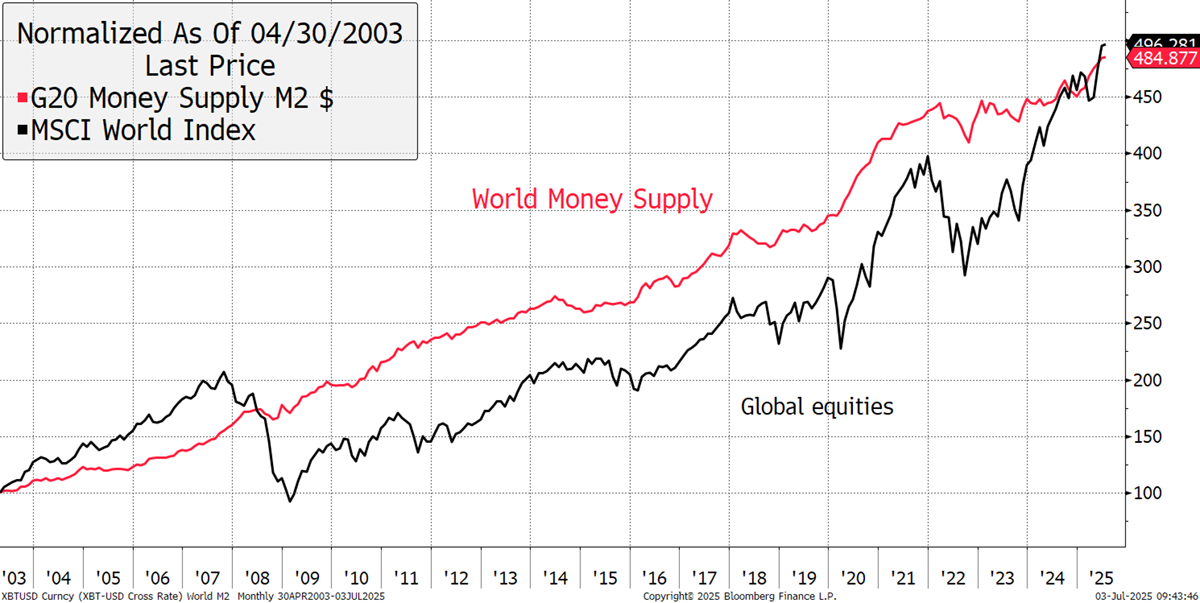

Such fiscal concern over public finances would normally cause havoc in financial markets, but high deficits and other forms of monetary stimulus seem to be fuelling a bull market in equities and, more recently, commodities and digital assets as well. It is remarkable how the total money supply from the G20 nations, now $109 trillion, has matched the capital returns of the stockmarket over the past two decades. There can be little doubt that as new money is created, it finds its way into financial markets.

G20 Money Supply and the Stockmarket

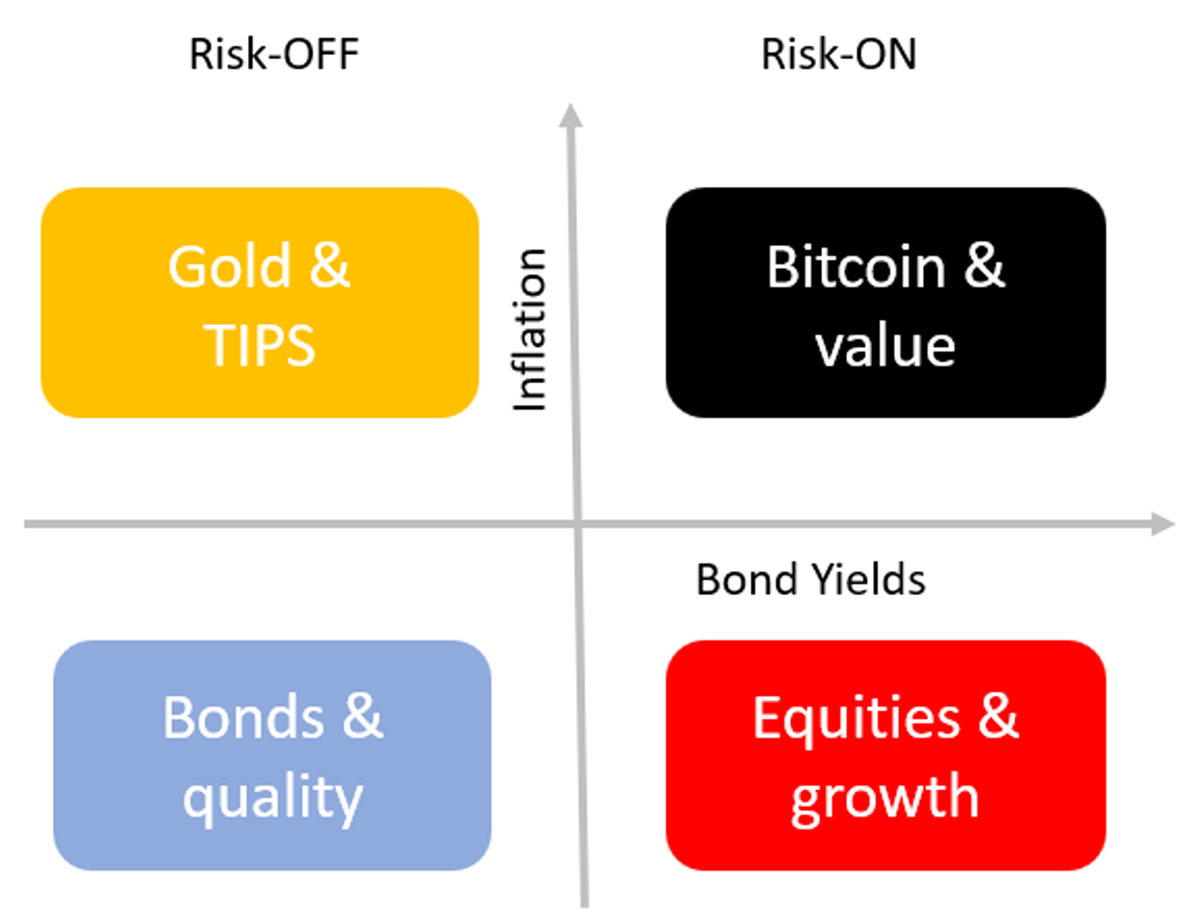

But that money isn’t shared equally, and at the heart of the ByteTree investment process lies the Money Map. It outlines the investment strategy most suited to different macroeconomic environments. When times are good, stay on the right, and when bad, stay on the left. When inflation rises, stay high; when it is low and stable, duck.

The ByteTree Money Map

ByteTree portfolios are built around the Money Map. I use this idea to identify the key areas in which to focus, and more importantly, the areas to avoid. Above all, this is how to diversify a portfolio by having exposure to each quadrant, whatever the weather, because macroeconomic environments can change quickly.

In constructing portfolios, I aim to have more exposure to not only the favoured quadrant but also to the adjacent quadrants, with less in the least favoured quadrant. In recent times, this has meant having more Value and less Quality in the portfolios, while staying broadly neutral in Growth and gold. At some point, this will change, most likely if there are clear signs that inflation is under control and interest rates cool. That’s the great hope, but it could just as easily be the other way around. Quality will return to the fore at some point, and the good news is that quality stocks have eased back over the past couple of years and are starting to offer good value.

With a falling dollar and a rising money supply, stockmarkets are buoyant. A key theme of the year is the lag of US equities. While the S&P 500 is up 5% this year, that soon translates to -3% in GBP. In contrast, European and some emerging markets have fared much better. After a long period of US stockmarket dominance, the tables have turned. While large US companies are great businesses, the valuations are uncomfortably high, but when you look around the world, good opportunities can be found.

A key development in Q2 has been the launch of ByteTree Global Trends, where the team write a weekly note, GTI: Top 200, on Monday mornings (free) covering the world’s largest 200 companies. This project unlocks an important part of our investment process, where we scan for trends around the world to keep our clients well-informed, with the best ideas finding their way into the portfolios. Premium clients can access our 2,500-stock spreadsheet, detailing these trends each week. We plan to launch actionable follow-ups in Quality, Value, and Growth in Q3, enabling active investors to see our more detailed interpretation of the key stocks on the move. Watch this space.

Explore our free and premium subscription tiers on Global Trends.

The Multi-Asset Investor

Soda

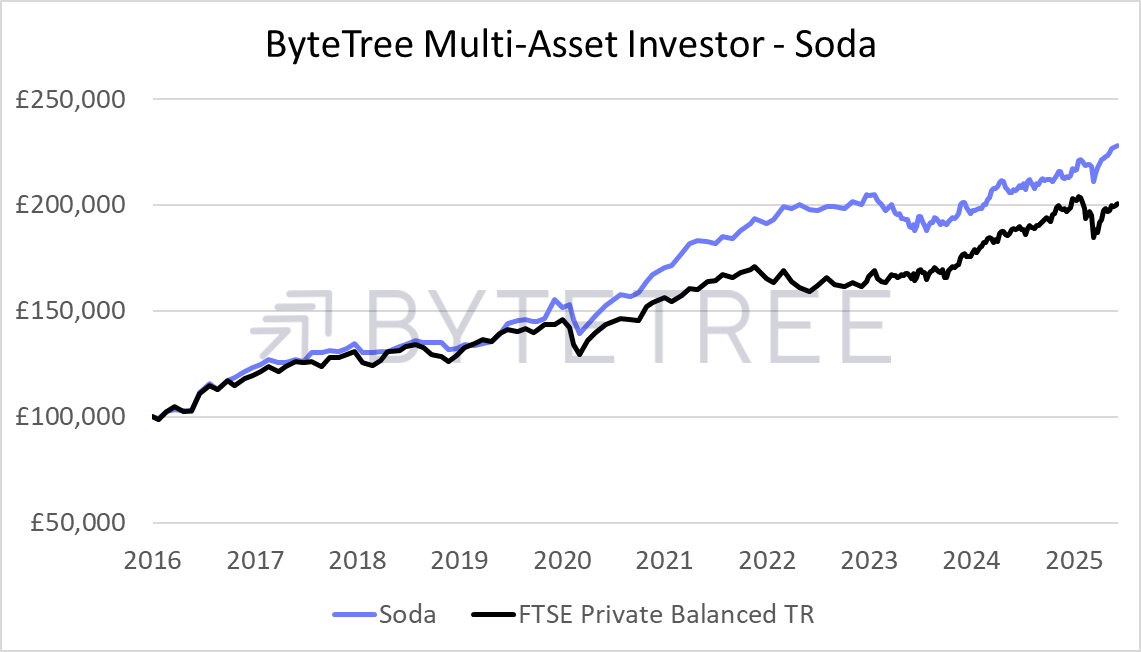

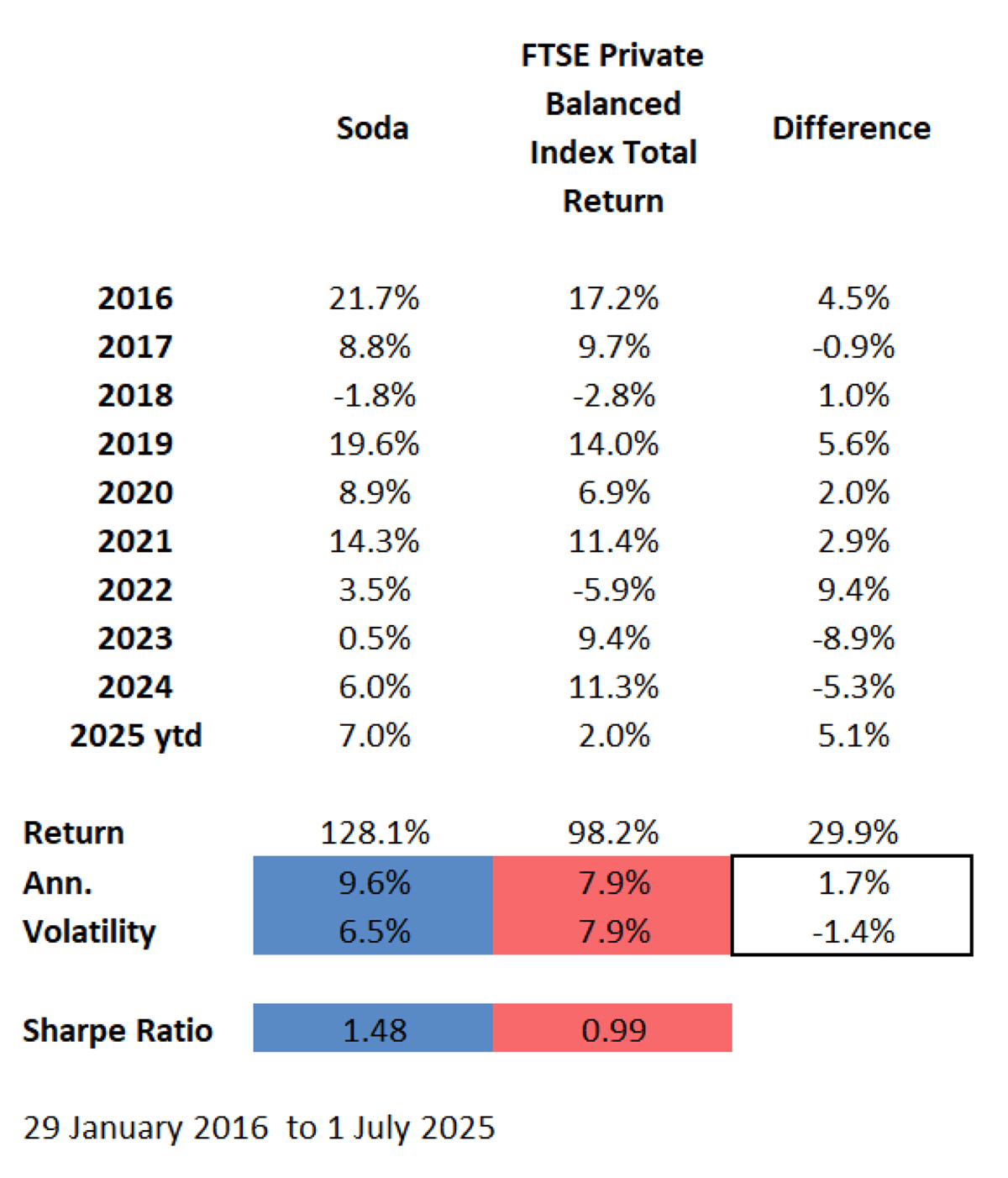

Long-term performance has picked up since the rough patch in 2023 and 2024, preceded by a strong 2022, when Soda had a good bear market, only to give back some of the relative gains during the recovery. My stubborn refusal to chase US technology stocks is the primary reason, which is a view I held then, and a view I still hold today, as they are fundamentally high-risk investments. Instead, exposure has turned towards the rest of the world with positions in the UK, Japan, Asia, and Canada.

Soda Performance since Inception

Performance has been broad-based, but the equity and private equity investment trusts have generally done well over the quarter. The best performer was the BlackRock World Mining Trust, which was boosted by a near-closing of the discount. Private equity and the family office-style trusts have been slower, but mainly due to their unlisted investments. A continuation of strong market liquidity should unlock the latent value in these trusts and could become a significant performance driver in the second half of the year.

The bond question remains. It is not yet clear that the bond market presents an opportunity despite real yields being at record-high prices. If long-term inflation expectations were rising, then index-linked bonds would be in high demand, but this isn’t yet happening. Instead, we have a surging gold price, driven by central bank demand and expectations for persistent monetary inflation. Index-linked bonds compensate for consumer inflation, rather than monetary inflation, and that is another thing entirely. It could simply be that bond yields are not yet high enough to be attractive for prudent investors.

On a year-on-year basis, the 2023/4 soft patch is clear. I very much hope that Soda has turned the corner and is back on track. One important aspect that is often glossed over in reviewing performance data is the risk. The FTSE Balanced Index has been 1.4% more volatile than Soda, which I hope highlights that the Soda Portfolio is more resilient than the market when things turn sour.

Soda vs the FTSE Private Balanced Index

Whisky

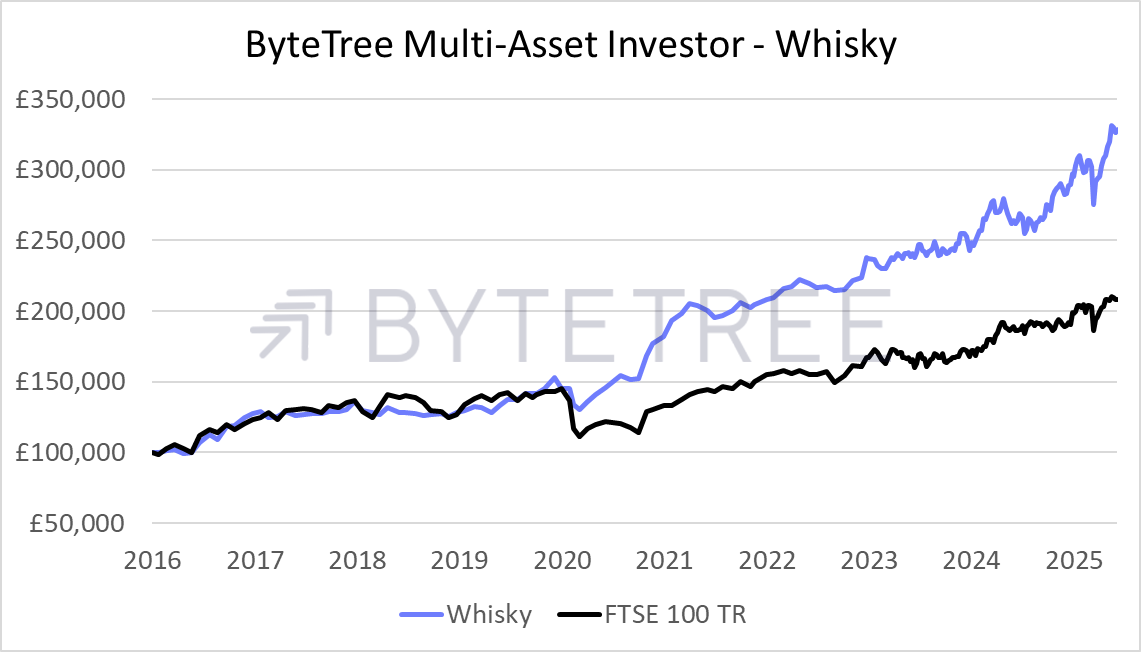

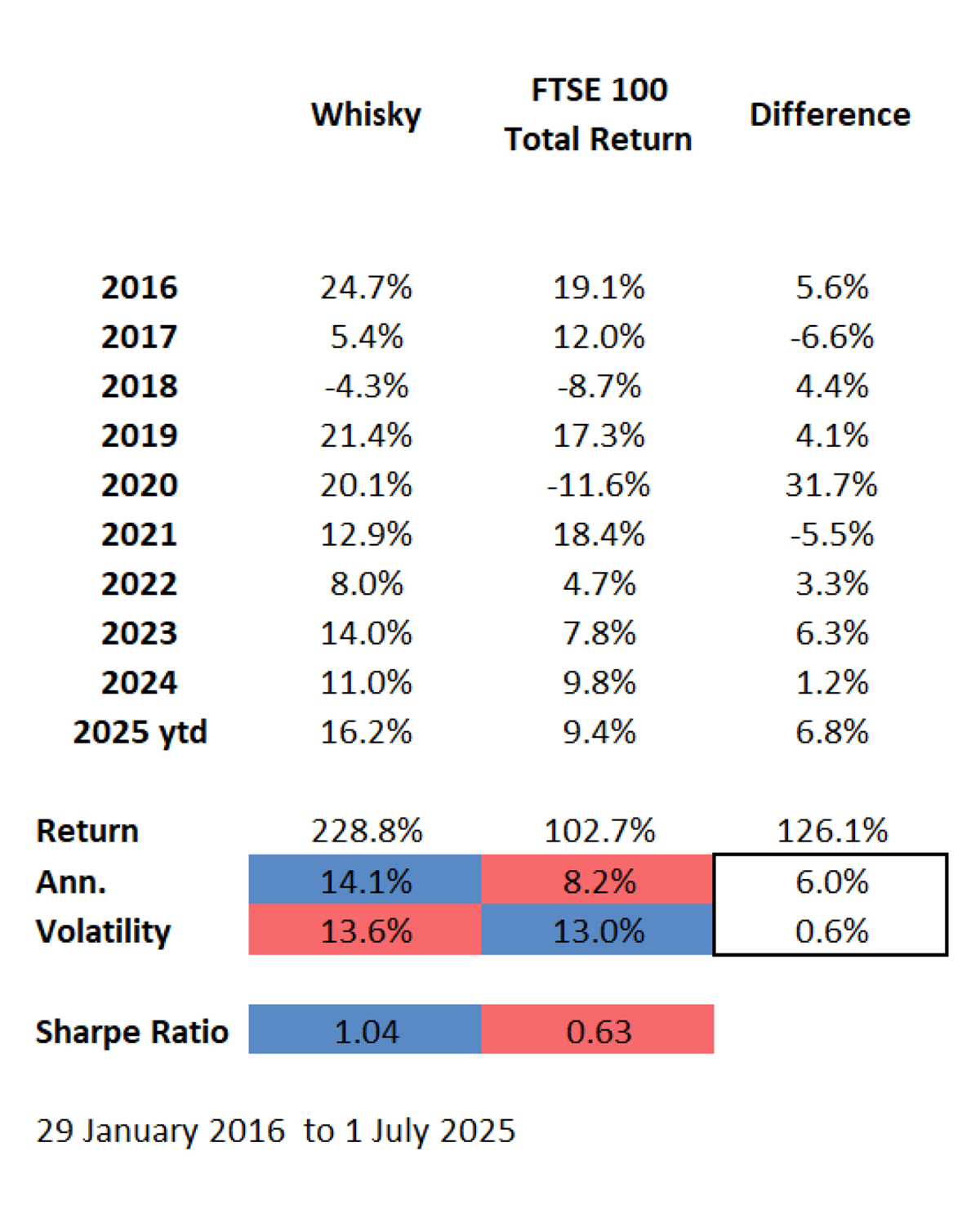

Whisky is now 126.1% ahead of the FTSE 100 since inception. It has risen by 16.2% this year, which is 6.8% more than the market. Things have been going well because good companies trading at low prices, my specialty, continue to be rewarded.

Whisky Performance since Inception

While there are a few European stocks, the main effort comes from UK stocks. JET2 rose 49% in Q2, which is well deserved. When we bought it, it was trading with an enterprise value close to zero. That is, the company held cash on its balance sheet before ticket sales, similar to the market cap. JET2 is a smooth operator and as efficient as Ryanair, but at a fraction of the price, probably because it trades on AIM. Like so many stocks held in Whisky, it was simply a matter of waiting for the market to deliver the valuation it deserves.

Other strong stocks in Q2 included the German potash producer K+S (+29%), Netherlands-based Allfunds (+38%), and the VanEck Blockchain ETF (+57%). Man Group and DCC were slightly negative, but not materially so. Their time will come because they are great companies at low prices. The portfolio was active in Q1, but less so in Q2, especially in June. When things are going well, it’s best to leave it alone, and that is what I have done.

Whisky vs FTSE 100

A 228.8% gain since 2016 is the same as the world index, but that undersells Whisky’s achievements. The results were achieved primarily through UK value investing, with only periodic light exposure to US tech, which overwhelmingly drove the overall market. Since its inception, Whisky is 26% ahead of the UK favourite fund, Fundsmith, and 75% higher than the global value index.

Looking ahead, I am very interested in the value that is coming through in quality stocks. They have been rich in recent years, but the derating is underway and will hopefully soon be behind us. Not only do quality stocks make good returns over the long term, but they do so with less risk. This is good news because when we have to call time on this bull market, it will be an easy decision to increase exposure to quality.

The Multi-Asset Investor, backed by Charlie’s experience and a nine-year track record, is open to new subscribers. Explore our subscription tiers.

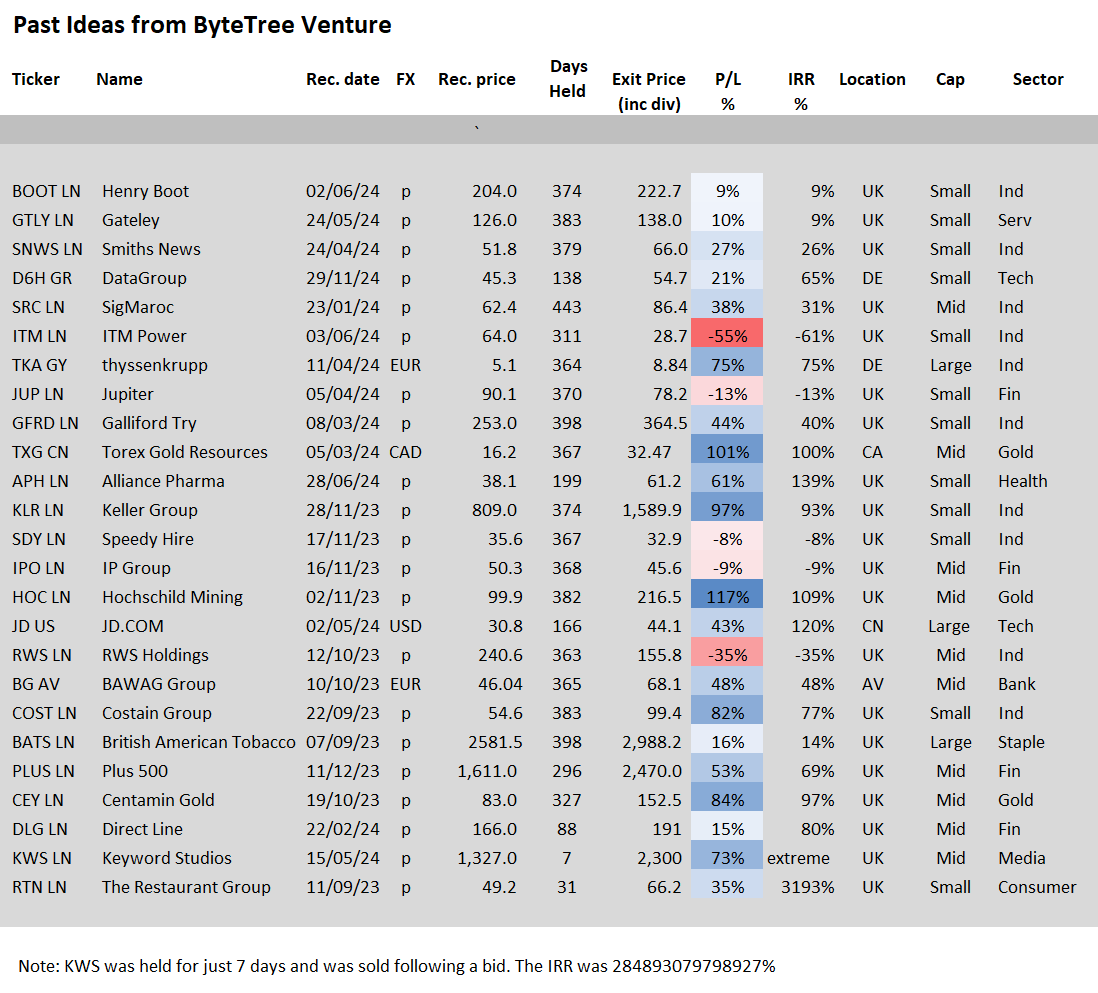

Venture

Venture has nothing to do with venture capital. Instead, it identifies value opportunities in equities that are unsuited to the Whisky Portfolio. Typically, they are too illiquid, too risky, or too exotic. I see the opportunities and publish them for an audience interested in these special situations. Twenty-five stocks have now rolled off the line, which is typically a one-year holding period. There are a further 27 stocks in progress, with more to come. The last three months have seen many of these recent sales continue to flourish, which is what happens after a period of market strength.

Venture: Past Recommendations

Venture began in September 2023, a time when UK small and mid-cap value was abundant. There are still many good opportunities, but I am being more selective as the ideas coming through are generally more speculative with no profits, and sometimes, no sales either. It is important that cheap stocks are cheap for good reason. The aim is to keep the list at around 30 companies, with additional opportunities arising as needed, which is most likely to occur following the emergence of new investment themes. Venture clients also enjoy a monthly update covering the key news and events for each company held.

Venture is a tip sheet, as opposed to a portfolio, designed for experienced investors seeking a little extra. The current portfolio holds several gold miners, oil producers, technology stocks, pharmaceuticals, real estate, and brands. Upgrade to ByteTree Pro to access Venture.

ByteTree BOLD Index

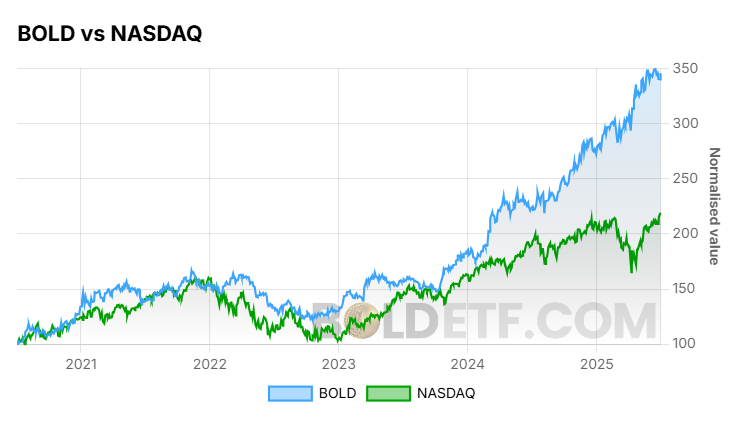

BOLD blends Bitcoin and Gold on a risk-weighted basis. The index rose 5.7% in Q2 in GBP and is up 13.6% this year. BOLD is covered in our monthly rebalancing reports, which are available to read for free here. I show BOLD vs the Nasdaq over the past five years.

BOLD vs NASDAQ

ByteFolio

Digital assets, or crypto, are often ridiculed by serious investors just as internet stocks were laughed ridiculed a generation ago. Stablecoins have grown to a total issuance of $239 billion and have caught the attention of governments. What enables stablecoins? The answer is the tokens held in ByteFolio. I will leave this section short because crypto is a minority sport, and performance is published every week.

ByteFolio and Token Takeaway are available in our standalone crypto subscription tier.

Media

This quarter, we have hosted and participated in some spectacular webinars.

- Global Trends Investor: Finding the Strongest Trends with CAPR. Charlie Morris, Rashpal Sohan and Kit Winder introduce ByteTree’s newest product.

- What’s Better than Bitcoin and Gold? Charlie Morris in conversation with Nick Hubble from Southbank.

- Bitcoin and Gold in 2025: Meet the Managers. Charlie Morris in discussion with fellow Bitcoin and Gold fund managers Jeroen Blokland and Mark Valek.

- The BOLD Index – Blending Bitcoin with Gold. Charlie Morris’ keynote address at Mining Forum Europe.

- Bitcoin and Gold in 2025 with Russell Napier. Our discussion with Professor Russell Napier is behind a paywall at his request.

Trustpilot Reviews

Thank you to ByteTree clients who left reviews on our Trustpilot; it helps immensely. I highlight a couple of recent reviews below.

Summary

The performance data over the past quarter will soon be forgotten because of the nature of markets. What is important for investors is not to celebrate success but to understand how things can change, and that change can happen quickly. Having ByteTree on your side can be a very good investment.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd