Trade in Soda;

The weekend saw military action in the Middle East on a grand scale, and by Monday financial markets had shrugged it off. The targets were nuclear facilities and not oil, and the Straits of Hormuz would remain open. Gold eased back, the US dollar rally fizzled out, and as we are becoming used to, the bond market barely reacted. The oil price quickly retreated from $80 back to $69, which is the level seen two weeks ago.

Brent Crude Oil Price

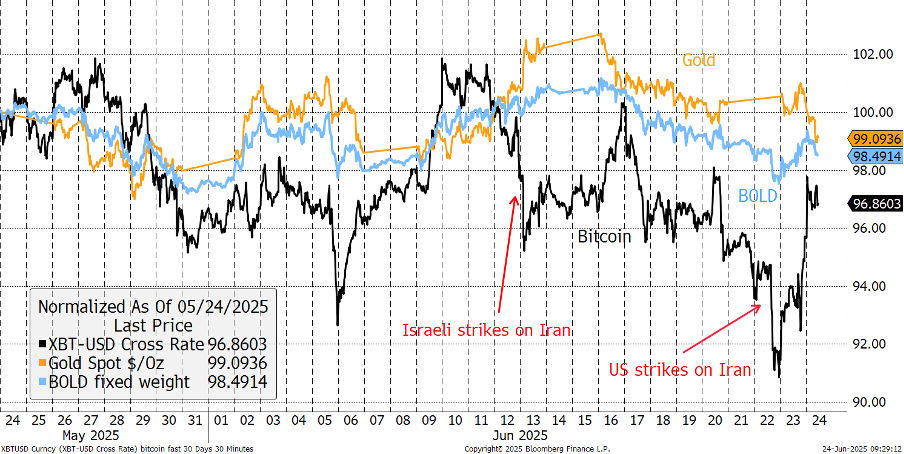

Gold’s retreat was not material, but neither was its rise beforehand. Yet bitcoin, rallied as gold fell. It is notable how gold firmed on the sound of war, while bitcoin recovered on the sound of trumpets. Gold likes war, while bitcoin prefers peace.

Bitcoin, Gold, BOLD past 30 days

Yet there is no peace as the war keep going and as President Trump eloquently put it, “we have two countries that have been fighting so long, and so hard, that they don’t know what the f**k they’re doing.”

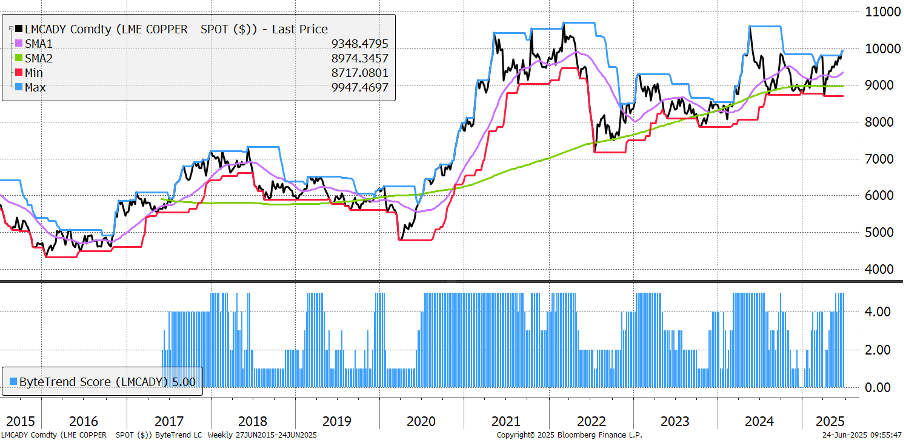

Some commodity stocks, mainly oil, have eased back since yesterday’s pause, and travel stocks have rebounded. Yet the commodity picture remains mixed. I keep a close eye on the copper price which looks interesting.

London Metals Exchange Copper Spot – 10 years

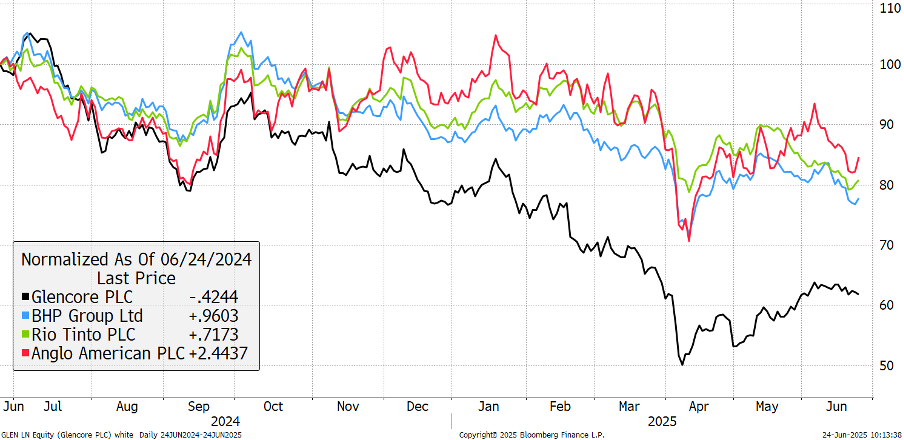

Glencore is a diversified miner, and it should be a value copper play, and so there’s hope. But it’s curious that stocks such as Rio Tinto, BHP, and Anglo American are yet to acknowledge the strength in metal prices in general. I feel we bought the right one in May, at a time when it was unusually cheap.

Major Diversified Miners

Silver, platinum, palladium, tin, and aluminium are all trending higher, and so the related companies should rally. Coal and steel remain absentees on the bull list, but prices are historically low. These, along with oil, are the missing pieces from the long-awaited commodity bull market. You’ll recall my favourite commodity index, the CRB Rind, which includes non-speculative commodities such as scrap metal, burlap, hides, cloth, lard, rubber and steers. These are real world items, and the chart suggests that broad commodity prices are attempting to enter an uptrend once again.

CRB RIND Index

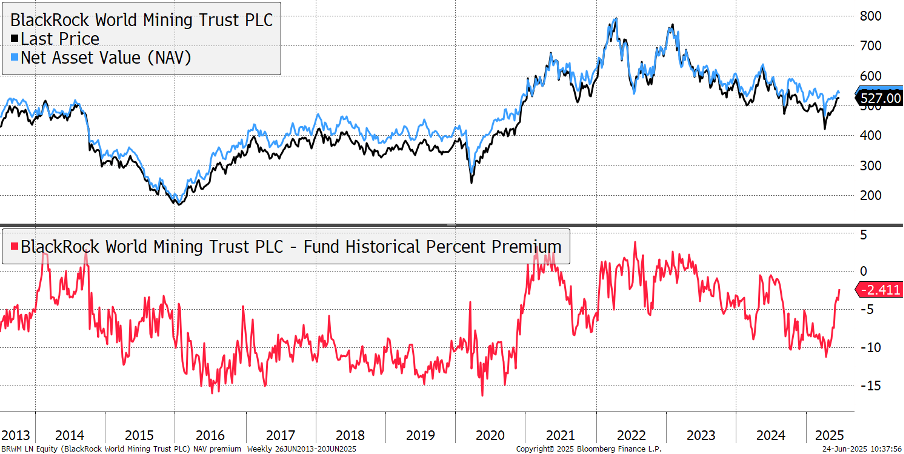

Good news came from the Blackrock World Minding Trust held in Soda. Although it holds many of the diversified miners, with Glencore the largest holding, it also holds gold, silver and copper stocks. What’s notable is how this diversified approach has worked quite well, in a volatile market, and the discount (red) has practically closed. This means the trust share price has rallied back towards fair value, implying increased demand for mining stocks. This is a positive development, and a good omen for the sector.

BlackRock World Mining Trust

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd