Trades in Whisky;

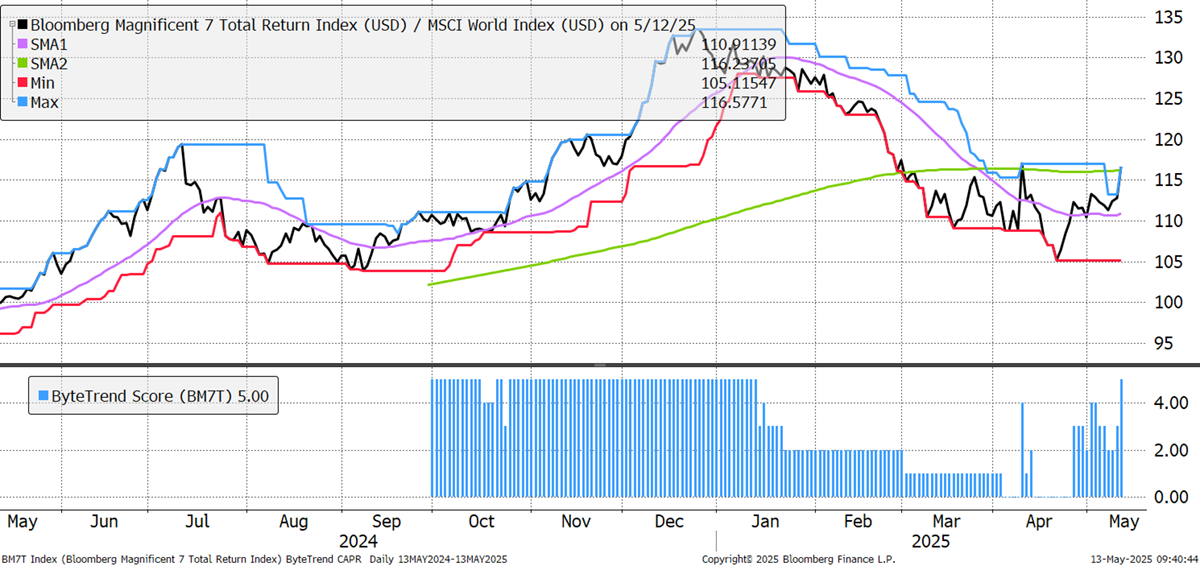

In a recent turn of events, we have seen the dollar bounce and the US stockmarket along with it. The US Magnificent 7 (Mag 7) large tech stocks (Apple, Google, etc.) have resumed a short-term uptrend against the world index, something which was last seen in January. The Mag 7 now has a ByteTrend Score of 5.

US Large Tech Stocks Are Breaking Higher Again

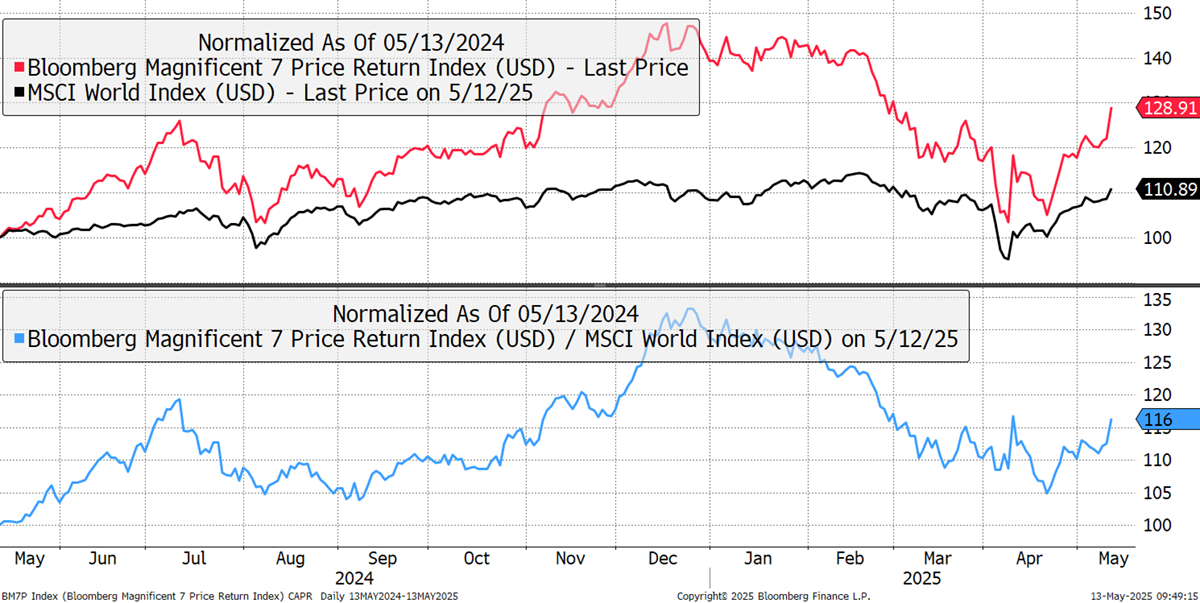

I hope many of you have now read the user guide from the Global Trends Investor (GTI), which was launched yesterday. The chart above simply takes the Mag 7 (red) and the World Index (black) from the chart below and measures the difference between them, which creates the ByteTrend score (blue) above. The data in this chart can also be visualised as the blue line in the chart below, which shows the Mag 7 in the World Index. This highlights that the Mag 7 is once again in a short-term uptrend on the charts using short-term daily data. However, it is not in an uptrend using longer-term data, which is what we focus on in GTI.

Mag 7 Versus the World

There are three components to this change. Firstly, the Mag 7 stocks rallied sharply yesterday. Secondly, the World Index only rose modestly in comparison. Finally, the dollar rose, lifting the relative performance of US stocks relative to the world. Put these things together, and the Mag 7, which were stronger than the rest of the US market, managed to reverse the 2025 decline.

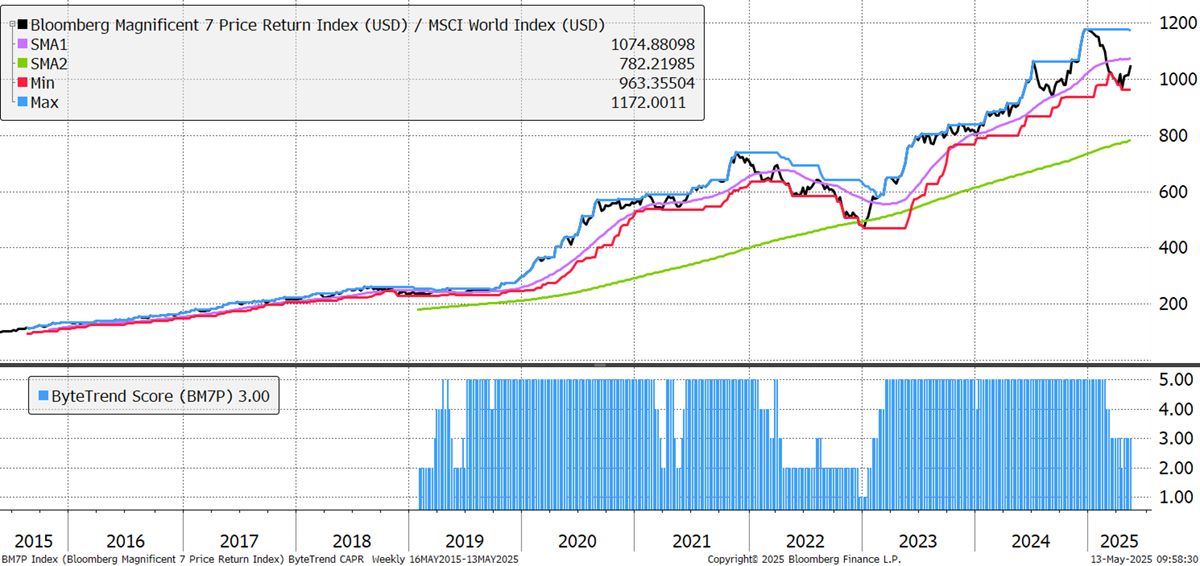

There’s more work to be done to confirm the resumption of the medium-term trend, but it could happen, especially with Trump back in bull mode. To buy the US on the back of this might turn out to be a good trade, but that’s far from certain when you consider that earnings guidance has started to slide.

US Large Tech Stocks Versus the World – Weekly data

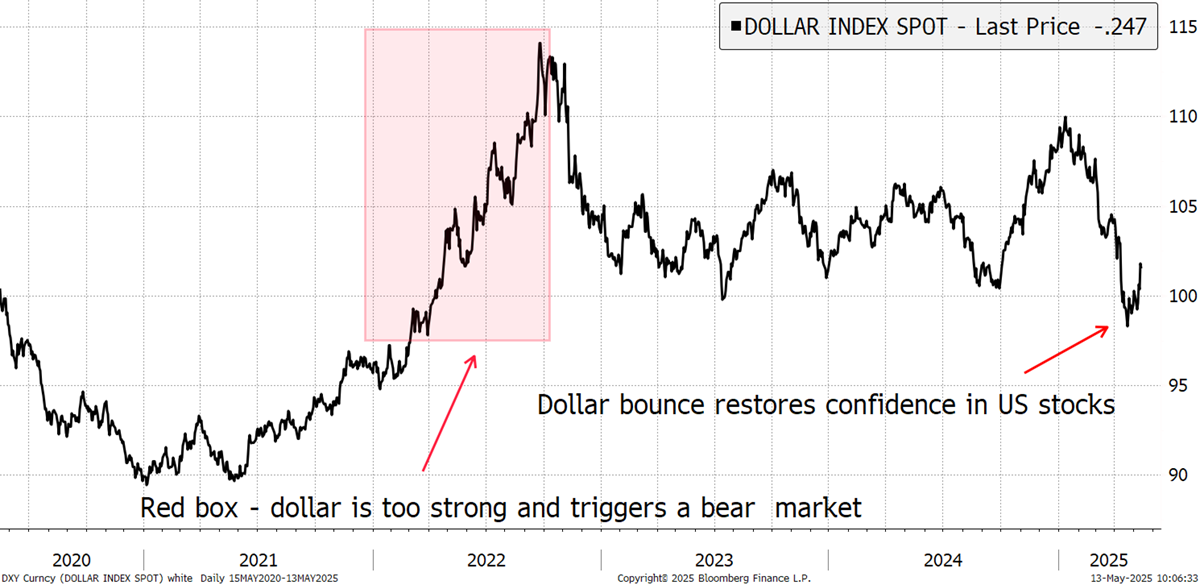

To my mind, it’s all about the US dollar. As a general rule, when it is rising, the US stockmarket beats the world and vice versa. A strong dollar reflects capital flows to the USA, and a weak dollar when they move to the rest of the world. Currently, the dollar is rallying within a downtrend, but I am well aware that this could continue.

US Dollar Rallies from Weakness

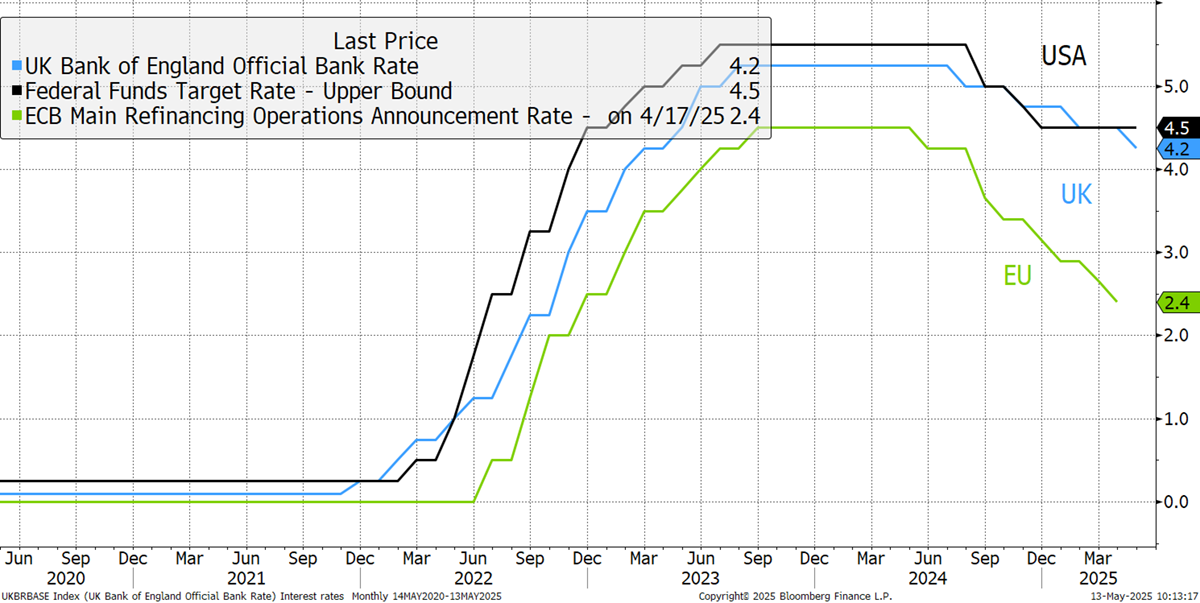

A key reason would be the US’s reluctance to cut interest rates. The European Central Bank have already cut interest rates meaningfully. The Bank of England are moving more slowly, but the US Federal Reserve remains on hold. The US are reluctant because although parts of the economy appear to be in trouble, the overall picture remains upbeat, and so rates remain higher for longer to fight inflation, which remains above the 2% target.

US, UK, and EU Interest Rates

Against the rates signal, there is the value of the dollar, which remains overpriced on value measures, but they can be pushed into the future. There is also the yen, which is weakening again, signalling a boost to global liquidity. A weak yen boosts the animal spirits because it remains a source of cheap funding (a cheap place to borrow as rates are low).

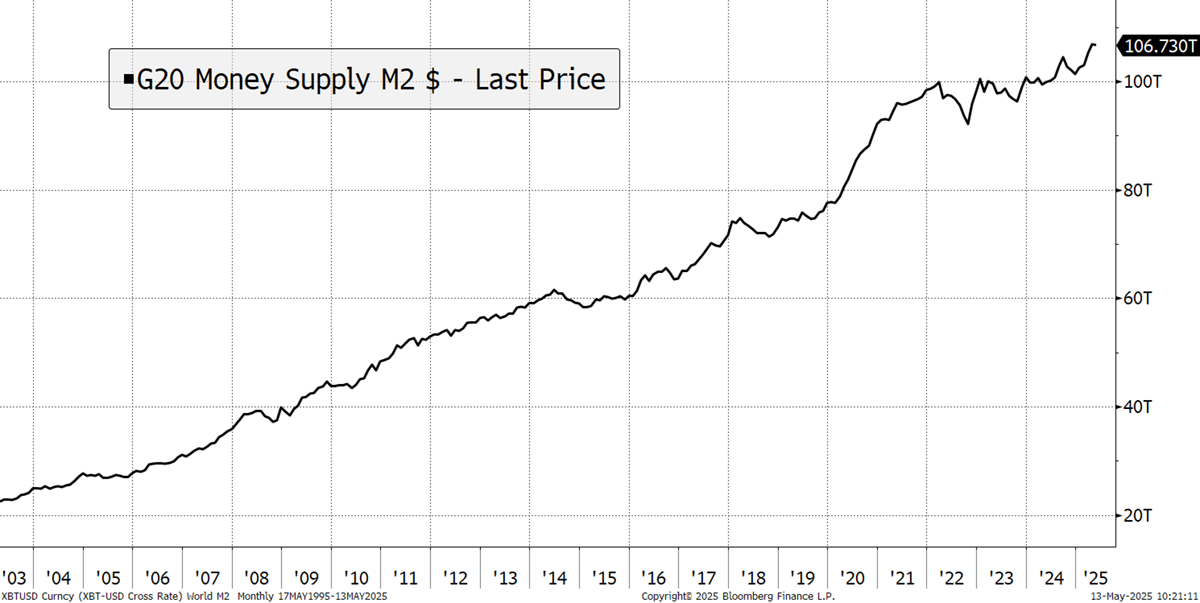

Revisiting the global money supply (M2), we have seen the 2020 surge stall at $100 trillion. The fall in 2022 encouraged an equity bear market, and over the past year, it has started to rise again. This has already been bullish for Bitcoin and Gold, which are often early in this matter, but could it be extended to a Trump boom, following his Liberation bear? Perhaps he’s enjoying his role as the Commander-in-Chief of global markets.

Global Money Supply Is Growing Again

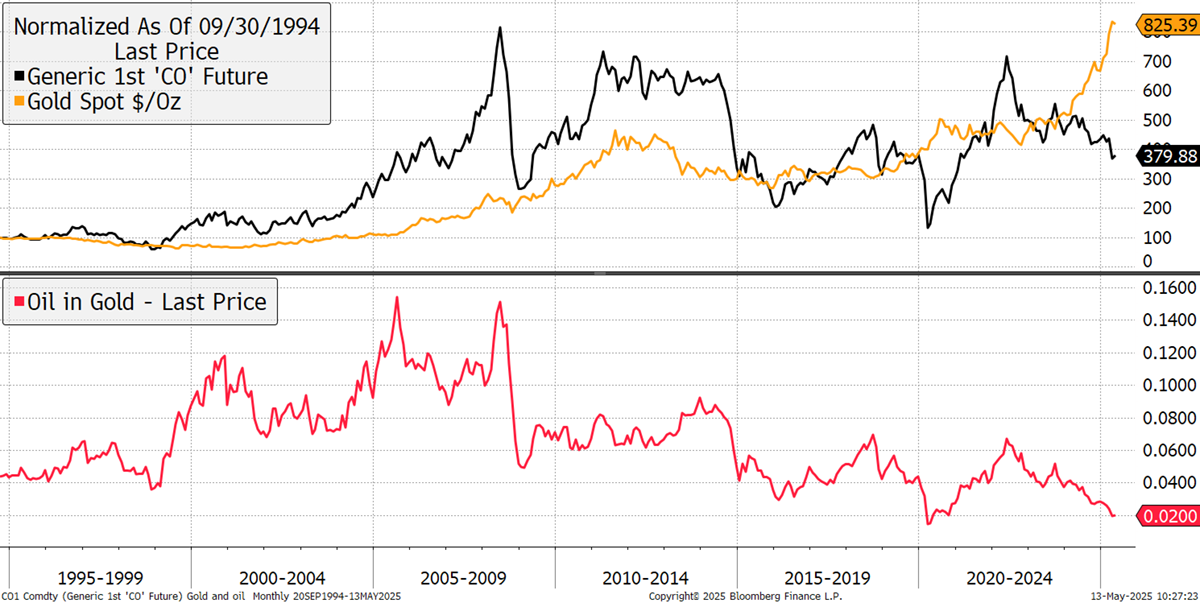

It could be that we should be looking to the technology sector once again, but while there might be some renewed animal spirits, I struggle to find value. Yet one place I can find it in abundance is in commodities. Take oil, for example, which has only ever been this low against gold in 2020, when global transport ground to a halt.

Gold Versus Oil

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd