ByteTree BOLD Index Monthly Rebalancing Report;

The 21Shares ByteTree BOLD ETP (BOLD) invests in Bitcoin and Gold. BOLD combines the world’s two most liquid alternative assets on a risk-adjusted basis. Due to their naturally low correlation, the diversification benefits of holding both assets have been unusually high. Bitcoin prefers risk-on market conditions, while Gold prefers risk-off.

The target weights last month were 25.7% and 74.3% (Bitcoin to Gold). Price changes over the month led to the last day’s weights at 27.3% for Bitcoin and 72.7% for Gold. This means the latest rebalancing has seen 0.8% added to Bitcoin and reduced from Gold to meet the new target weights.

Three Years Since the IPO

On 27th April 2022, a time when Bitcoin was in a bear market, and investors were losing interest in Gold, we took the opposite view and saw it as a good time to launch BOLD on the SIX Exchange in Zurich, Switzerland. In the photo, I marked the occasion by ringing the cowbell when the market opened at 9 AM. Standing next to me on the left is Alistair Byas Perry, Head of Capital Markets at 21Shares AG.

Since that time, two things have changed. Firstly, Gold is beating the S&P 500 by quite a wide margin.

Gold and the S&P 500 – Past 3 years

Recall that investors had been heavy sellers of the Gold ETFs until June 2024. What many still don’t realise is that investors have reduced their Gold holdings by nearly 15% since the 2020 peak. Gold is still a somewhat contrarian trade because “Wall St” is heavily underweight.

While Gold has run ahead of the S&P 500, Bitcoin has run ahead of the Nasdaq. The launch of US ETFs in early 2024, combined with block halving in May 2024 and the Trump Victory in November, boosted sentiment. Bitcoin has done well over the period shown but is yet to be embraced by the mainstream. Not only are investors underweight Gold, but they barely own any Bitcoin at all.

Bitcoin and the Nasdaq – Past 3 years

BOLD has been a hugely successful investment strategy, mainly because Bitcoin and Gold have performed well. To my mind, that was always very likely to happen, but I didn’t know when the great rotation would start. More important to me is the resilience of the BOLD strategy. Many investors hear the investment case for these highly liquid, complementary alternative assets, Bitcoin and Gold, and simply hold both. The advantage of BOLD over that approach is that simply holding Bitcoin and Gold misses the mechanism quietly working in the background, making BOLD investors even more money.

Each month, the volatility sets the asset allocation and then rebalances the portfolio by buying low and selling high. After 36 rebalances, you can see that the 21Shares ByteTree BOLD ETP (blue) rose by 103.3%, whereas a zero-fee portfolio of Bitcoin and Gold, using the same start weights, lagged by 17% or 5.5% p.a. The fees, a mere 0.65%, were clearly worth it as they added 5.5% of value each year.

BOLD Versus Bitcoin and Gold

This is a massive win for BOLD and demonstrates the added value in the live ETP over the past three years. The strategy works because Bitcoin and Gold naturally have a low correlation. That means when one is up, the other is often down. This is a powerful combination that results in much lower portfolio volatility (risk) than might be expected.

It has been highly rewarding to see BOLD deliver such high returns. I thank all our investors, who have, in many cases, crawled over hot coals to support our product. I very much hope it is easier in the next three years to invest in BOLD than it has been in the last.

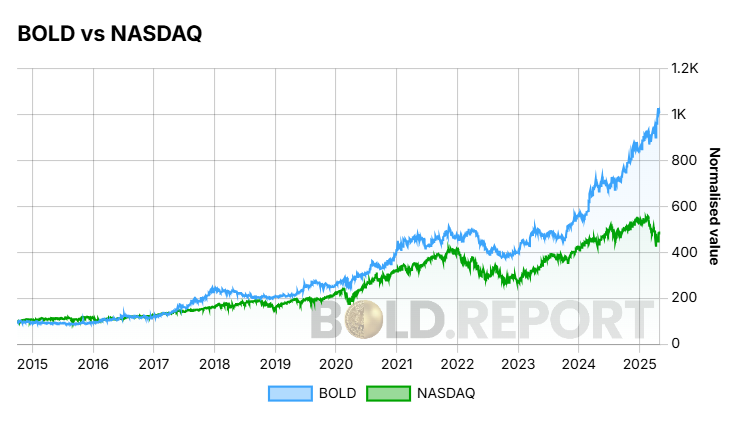

On Sunday, it had been three years since the IPO. We shouldn’t be that surprised that BOLD has performed so well over the period because the strategy has been consistent over ten years.

BOLD vs Nasdaq

The most rewarding part, as you will see later in this piece, is the extremely low volatility. Not only has BOLD done well, but it has beaten Bitcoin and Gold held independently and done so with a modest level of risk. This combination is unparalleled and something we can all be proud of.

BOLD Performance

In April, BOLD rose by 8.9%, Bitcoin rose by 12.9%, and Gold rose by 6.0%, while global equities rose by 0.2% in USD terms. It is notable that the dollar fell by 4.5% in April.