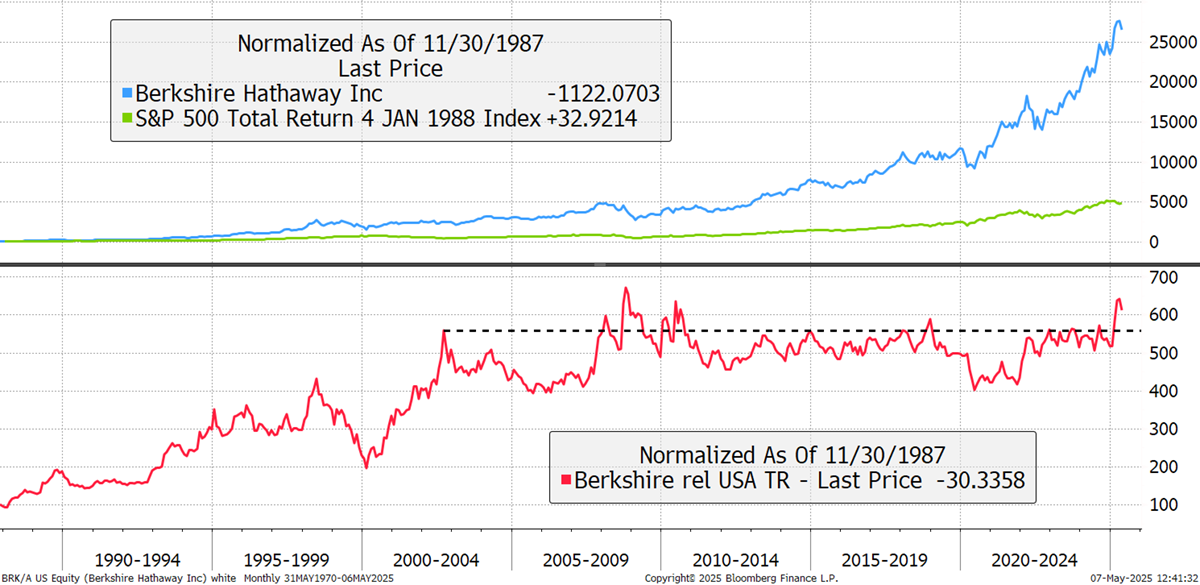

Last weekend, Warren Buffett announced that he was stepping down from Berkshire Hathaway (BRK) after 55 years as CEO. Since 1987, $100 invested is now worth $25,000, which is five times more than the S&P 500. If you start the clock in 1970, which my chart won’t allow, the returns are even higher. It is a remarkable track record that investors should learn from. However, it should be noted that most of the excess returns occurred pre-2002, with a little thereafter. Still, when your company has $1.1 trillion to invest, that’s a feat in its own right.

Berkshire Hathaway vs the US Stockmarket Total Return

At the age of 94, he’s alive and well, but has felt it is time to stand down and hand the reins to his successor, Greg Abel. Spare a thought for Greg, as it’s one hell of a pair of shoes to fill.

Buffett and his late sidekick, Charlie Munger, proved to be a formidable pair. The idea was to hold insurance companies with a solid investment strategy, to deliver superior returns. The insurance companies receive premiums from customers long before claims are made, leaving a float that could be invested.

Conservative investment means different things to different people. Traditional insurance companies would invest their float in short-term bonds and collect the interest. BRK chose stocks such as Coca-Cola, American Express, and in recent years, Apple. In financial jargon, BRK invested in high-quality stocks, but made sure they paid the right price.

The result was a quality equity portfolio (see this week’s Postbox for more on this) with leverage from the float. However, leverage normally costs money as you have to pay interest on loans. In this case, the float came for free (from insurance premium income), and the insurance underwritten also generated profits. They leveraged a high-quality equity strategy and got paid for the privilege. It was financial genius.

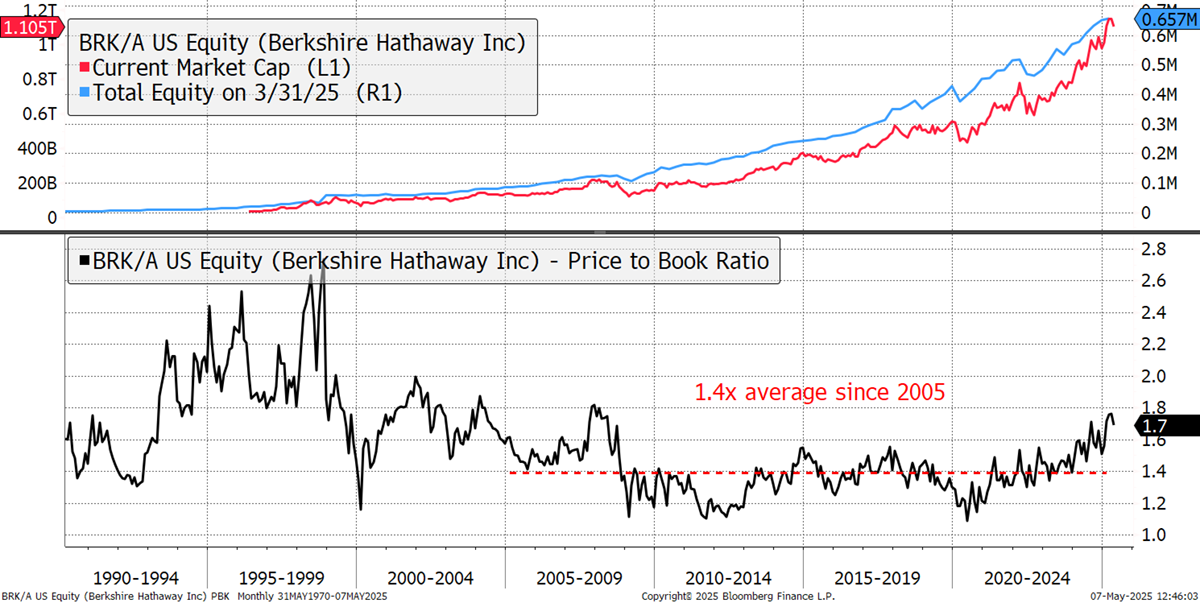

Like most investors, I saw BRK as a pool of assets and therefore tracked it using a price-to-book value. That measures the cash and assets, less debt, and gives an estimate of the fair value for BRK. One problem is that under US accounting rules, the private assets are not revalued but held at the purchase price. This meant that the price-to-book was understated, and investors were looking for clues as to what the true value was.

Today, the company holds $347 billion in cash, $288.1 billion in listed investments, and other private companies and insurance operations. With a $1.1 trillion market cap, the implied value of the private holdings is $465 billion. The cash and listed investments are easy to value, but the private companies are much harder. Currently, the privates are thought to be worth 42% of the total value.

The price-to-book ratio surged in the late 1990s, but over the past two decades, it has settled at 1.4x book. At one of the recent annual general meetings, they insinuated they would buy back their stock at 1.2x, and so they did.

Berkshire Hathaway vs the US Stockmarket Total Return

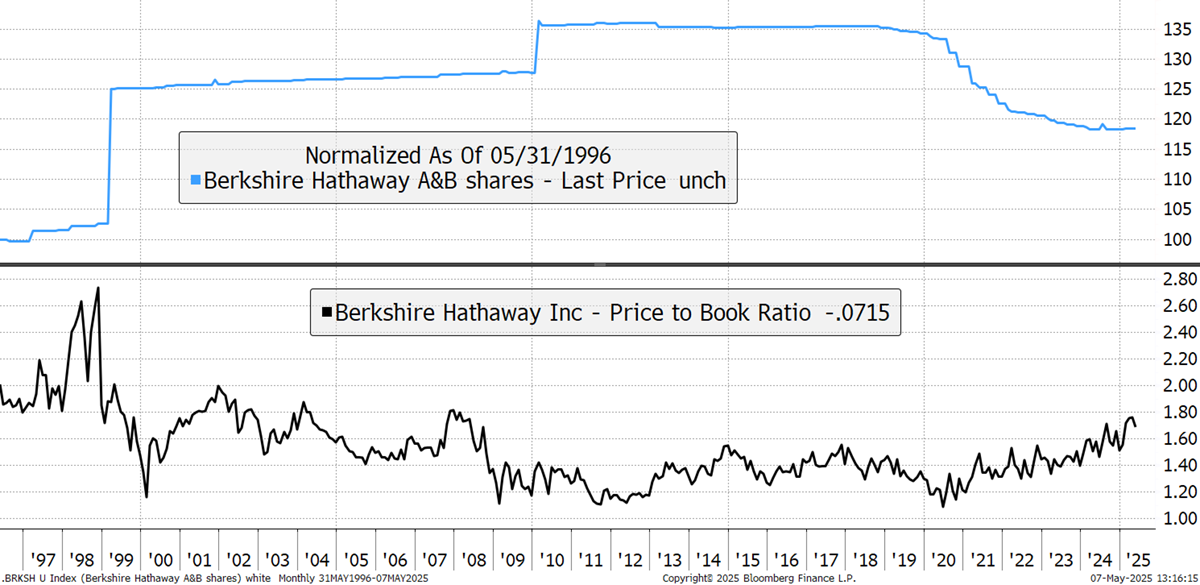

BRK stock is split into A shares and, since 1996, B shares. The A shares traded at $809,350 each last Friday but fell 5% on the news of Buffett’s resignation. 1,500 B shares are equivalent to one A share. I show the combined A and B shares, expressed in A shares (rebased to 100 in 1996).

Berkshire Hathaway A Shares in Issue (Equivalent Rebased to 100 in 1996)

Their stock was tightly guarded, and most of their acquisitions were paid in cash. Yet, in 1998, they bought General Re, one of the world’s largest insurance companies. At that time, the BRK stock was trading at the highest price-to-book ratio in years. Buffett used their inflated share price to buy assets at a knock-down price. Genius once again. In 2010, some stock was issued to buy assets after the financial crisis, even when their own price-to-book ratio had fallen. That means the assets they bought must have been dirt cheap.

Then, from 2018, they started to buy back their own shares for the first time. 1.2x book was too low for them, and they retired 10% of their equity. Then, in 2024, they stopped, as the price-to-book approached a two-decade high. I read that as BRK stock is no longer undervalued. I would go a stage further and suspect the timing of Buffett’s retirement is linked to BRK’s valuation. This was the opportunity to go out on a high, with his fabulous track record intact. While most of the money was made pre-2002, it is equally impressive that he kept up with the returns from the tech era by doing old-school things.

I have held Buffett and Munger in high regard since I first heard of them around 30 years ago. I went to the annual general meeting in Omaha in 2011, have read the books, and like to feel I understand what he does and why he does it. It is humbling to see that the returns from his investments in recent years have been good but not spectacular, like they were in the past, but it is hard to be both huge and nimble. The hardest part of replicating his strategy is owning a collection of insurance companies that provide $171 billion in investment float, which last year delivered over $22 billion of earnings alone.

I suspect the price-to-book will ease back over the next few years, and the stock will once again be a buy.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd