The Portfolios have recovered well, which is welcome news, but just as the storm caused by tariffs has passed, a new one brews. Bond yields are rising again, which explains the strength in Value stocks (industrials and financials) and the weakness in Quality (consumer brands). It also explains the resurgence of Bitcoin over gold. I’ll get to that, but first, I’ll show you where the major bond markets are trading.

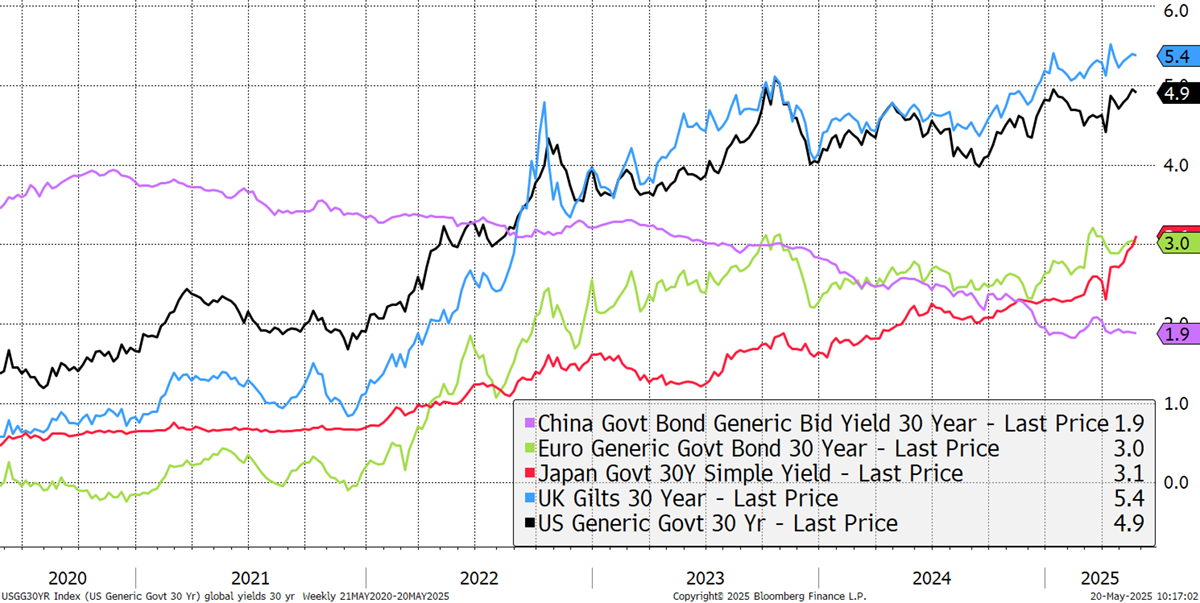

The UK 30-year gilt (blue) is now well above the levels when Liz Truss was the UK Prime Minister, albeit for a short time. US yields (black) are close behind and are also rising. Europe (green) is climbing above 3% despite seven rate cuts. Japanese yields (red) are also rising rapidly. Only China (purple) has falling yields, making them the cheapest source of funding in the world.

Major Bond Markets – 30-Year Yield

One risk is that maybe this time, the higher yields in Japan trigger another rally in the yen, just as we saw last August, which led to a short-term decline in global stockmarkets. Cheap loans from Japan, where interest rates are only 0.5%, have been plentiful, and investors borrow vast amounts of yen to fund trades around the world. A yen rally is a killer because as the yen rises, the debts of those who borrowed it increase, creating a scramble to sell their assets and repay the loan, which could result in a negative feedback loop.

A yen rally is long overdue, but Japanese policymakers are doing their very best to maintain the status quo for as long as possible. I know my last foray into the yen didn’t work, but I have little doubt it will one day. It’s a trade I might return to when it seems more likely to reward us.

Back to bond yields, and to last week’s timely question in the Postbox, yields can rise because of inflation, growth or solvency. That is, if growth improves, investors naturally favour equities over bonds, putting downward pressure on bond prices and therefore bringing yields up. The same is true for inflation, which devalues the value of a bond, as the future repayments shrink in real terms. Then there is solvency, which is the economy’s ability to service a debt. That’s rarely a problem for governments in the developed world, but the public debts have become so vast that investors are wondering: where are the limits?

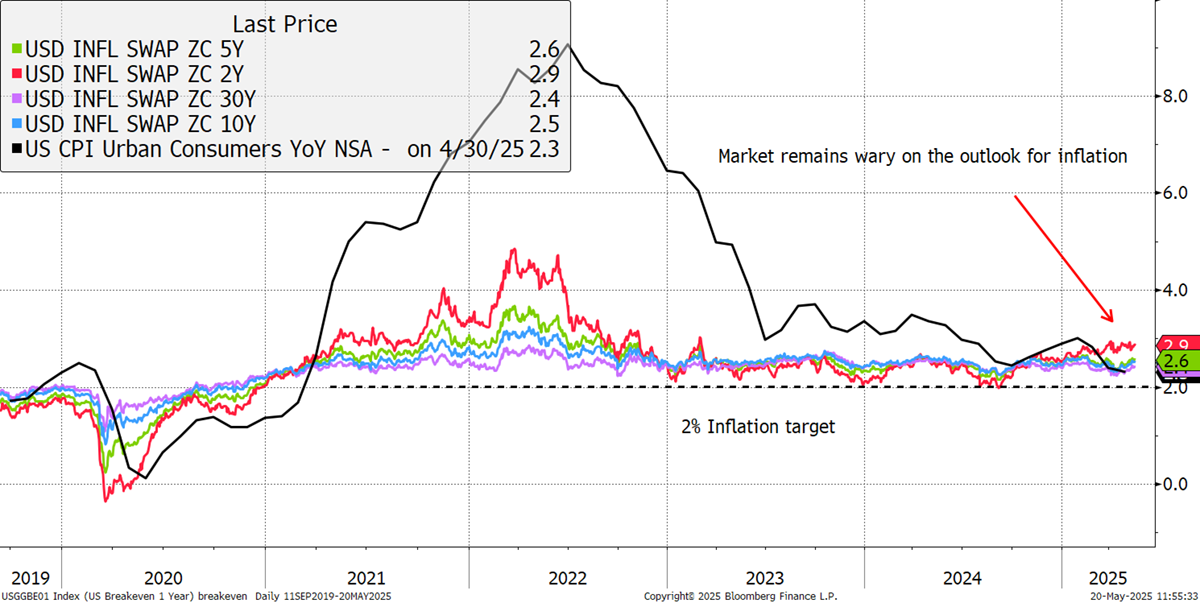

I think all three are likely reasons for the rise in bond yields. Governments are very keen on growth, and global initiatives point in that direction. There is unquestionably pressure on budgets, as governments maintain high deficits despite high taxes. Then there is inflation, which remains stubborn. Pre-pandemic, inflation sat comfortably below 2% for years, whereas today, it sits above. Indeed, recent expectations are for a rate of 2.9% when the last reading was 2.3%. Practically all of that comes from wages, with the likes of energy and food prices holding inflation back. It wouldn’t take much for that to change, and if inflation starts rising again, bond markets won’t like it.

US Inflation Expectations

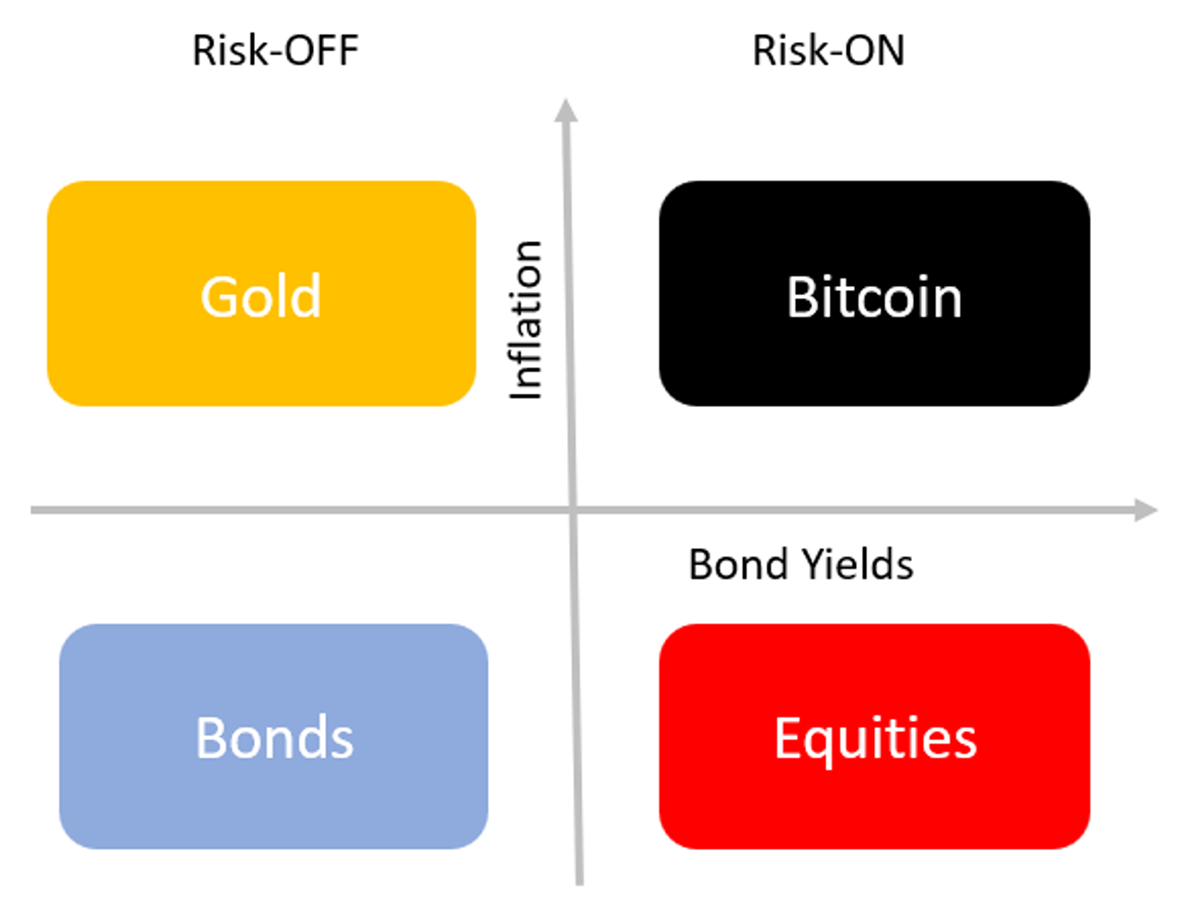

This is a dry subject in investing, but an important one to check in on from time to time. Higher inflation and higher bond yields are the sweet spot for Bitcoin, along with financials, industrial companies, and, normally, commodities. In contrast, it is not an environment in which to invest in longer-dated bonds.

The Money Map

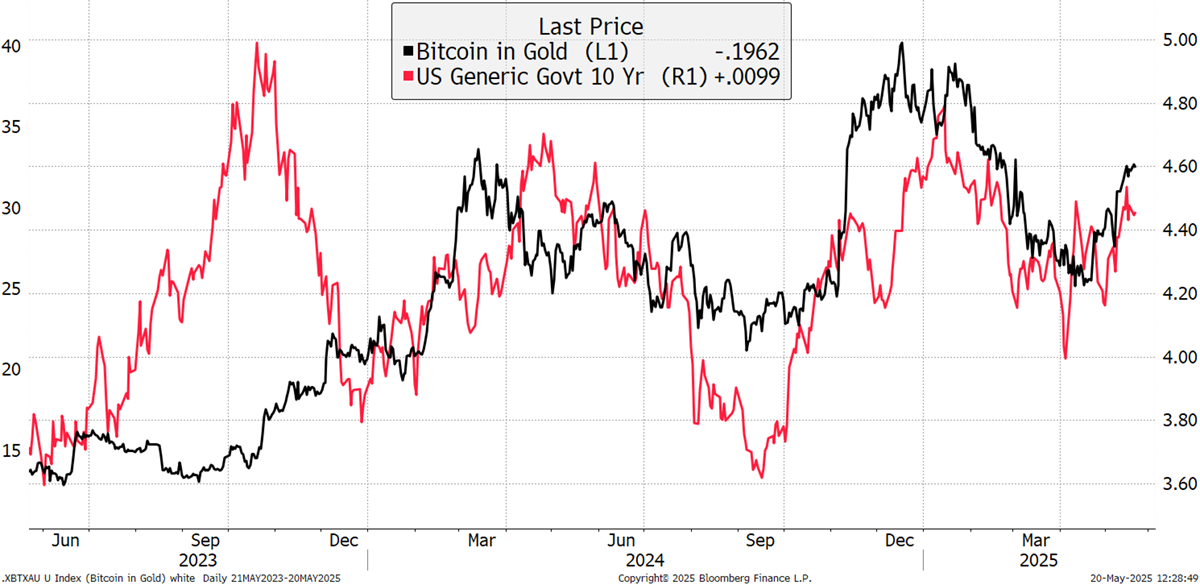

The point I made about Bitcoin versus gold is poignant. These relationships are never perfect, but I show the price of Bitcoin in gold, which is currently 32 ounces. For Bitcoin to make an all-time high in gold, one BTC would need to be worth more than 40 ounces. At the current gold price, that would imply Bitcoin would need to trade at $131k.

Bitcoin in Gold versus the US 10-Year Bond Yield

However, the point is how this relationship between Bitcoin and gold is developing within the macroeconomic framework. When the 10-year bond yield is rising, Bitcoin beats gold and vice versa. We hold some blockchain stocks, which are currently on the rise.

But the bond yield won’t rise forever, and sooner or later, it will fall. I suspect that when it does, gold will start to outperform Bitcoin once again.

In Gold We Trust Report

Gold company Incrementum has released their latest annual gold report. It’s a 443-page monster, which I still haven’t managed to get through, but please send in the highlights! The editors, Ronnie Stöferle and Mark Valek, kindly published one of my charts with the following comment:

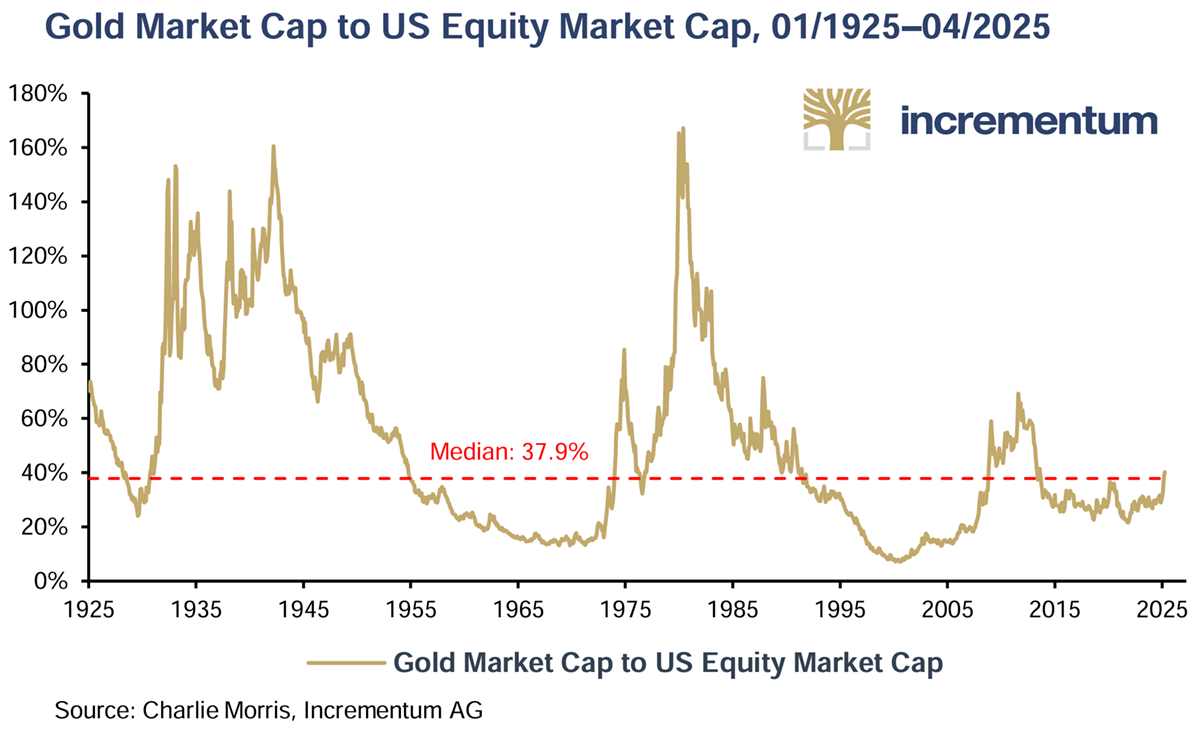

“Currently, the market capitalization of global gold holdings amounts to about 40% of US equity market capitalization, slightly above the long-term median of 37.9%. For comparison, during wartime periods and the inflationary era of the 1970s, this figure peaked as high as 160%. Even at the peak of the last secular gold bull market in August 2011, the value was significantly higher at 69.2%. This indicates that, although the current gold bull market has already gathered momentum, we are still far from the mania phases seen at past peaks. We expect the market capitalization of gold to have increased further relative to stocks by the end of the golden decade. In other words, gold is poised to remain a notable outperformer for an extended period and therefore belongs in the portfolio to a significant extent, not only for its security but also for its performance benefits.”

Gold Market Cap to US Equity Market Cap

It’s an interesting chart that looks at market caps as opposed to price. That takes the amount of gold in circulation into account, just as it does the quantity of US equities, not just the price. It’s a reassuring chart, highlighting that the gold price is not out of whack with reality, and if things go wrong, gold has been much higher before.

Imagine founding a gold business in 2003. Paul Tustain did just that.

Paul Tustain

I was very sad to hear about the unexpected death of the founder of Bullion Vault, Paul Tustain. He was killed in a motorcycle accident.

He launched Bullion Vault in 2003, in the early days of the gold bull market. He had a background in software and was early in creating a liquid vaulting service where clients could buy and sell 24/7. He has grown the company, which now has $4.5 billion in gold, $1.2 billion in silver, and a little more in platinum and palladium. There are 110,000 clients and vaults in Zurich, London, New York, Toronto, and Singapore. He leaves an impressive legacy.

I had lunch with him around 2017 at the Connaught Hotel in Mayfair. Despite being a successful entrepreneur, he proudly showed off his £30 vouchers from the FT. He pitched his new idea in whisky, which had impressive real returns. The idea was that whisky, which needs to mature for many years, would be seen as liquid gold, as a sort of fun product to invest in alongside gold. He never launched the whisky product, but had he done so, I am sure it would have been a success. He was highly intelligent, funny, and good company.

I suspect several of you are Bullion Vault clients. Be sure that his premature death should be no cause for alarm. The company is very well managed and will continue to operate as normal. My friend, Adrian Ash, works there, and the team are shocked and saddened by the news. The gold market has lost a good man.

Paul Tustain RIP.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2026 ByteTree Group Ltd