Trade in Soda;

Passive investors are currently not passive at all; they are growth investors, and massively so. We are at one of those times in history when being a passive investor is a very bad idea. Passive investing, whereby you hold low-cost index funds, is an efficient way for long-term investors to participate in the stockmarket, especially if they wish to disengage. The passive investor does little or nothing, perhaps periodically rebalancing between bonds and equities. The low costs are appealing, but then there’s often an advisor who seems to offset much of that benefit. It all looks so easy, and it is, but the outcomes will differ widely, depending on the era you invest over.

There are alternatives to growth, and the primary one is value. This week, I’ll be adding another Value Fund to the Soda Portfolio, but before we get to that, I will explain why value investing is now a critical choice. The tech bubble has popped, and the index party is over, and probably for years.

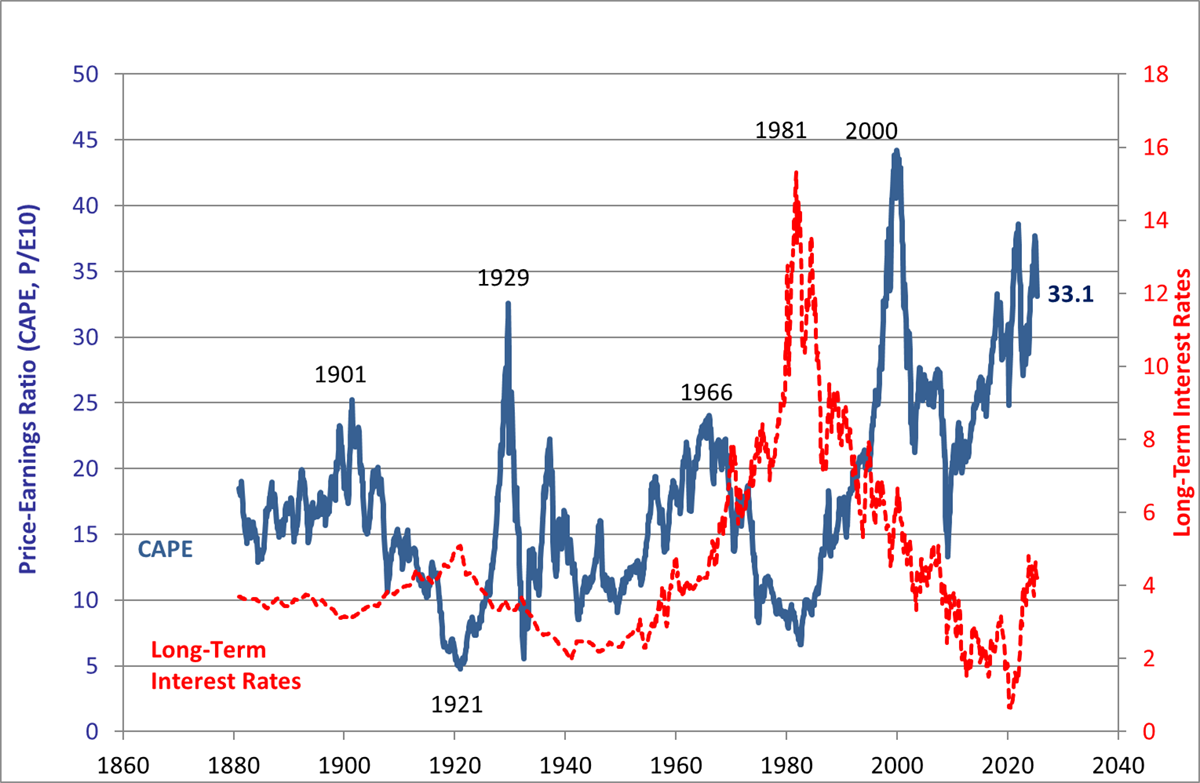

The last time the world index was hyped, rather like it is today, was in the late 1990s. The Cap Shiller data makes the point very clearly. The stock market has been this rich in 1929, 1966, 2000, and recently. It means the leading companies in the index, where passive investors have high exposure, are highly valued. Conversely, passive investors have the least exposure to the value stocks that are undervalued.

The blue line shows the cyclically adjusted price-to-earnings (CAPE) ratio, measured in years. Currently, it would take 33.1 years of company profits to pay for an investment in the US stockmarket. In 1921, it cost just 4.8 years and in 1982, 6.7 years.

US Stock Price, Interest Rates and Cyclically Adjusted Price Earnings Ratio (CAPE) since 1871

When the profits were just a few years, the stockmarket was much cheaper, and therefore much less risky, but it wouldn’t have felt that way at the time. There would have been bad news about the economy and fear in the air. Psychologically, it would have been a difficult time to invest despite it being a very good time to invest. Conversely, it would have felt much easier to invest at times when things are going well.

The World Index is currently around two-thirds US and one-third the rest of the world. In 2000, the US also had a high weight, but by 2008, that weight had collapsed as US equities slumped over the next eight years while Europe and the Emerging Markets took the lead. In 1988, the world index was also heavily skewed, and this time, around half was Japan. These things get wildly out of hand, and investors are advised to act on these periodic mega distortions and take them seriously. Their eventual unwinding is inevitable, and if investors don’t act, they’ll be swallowed up.

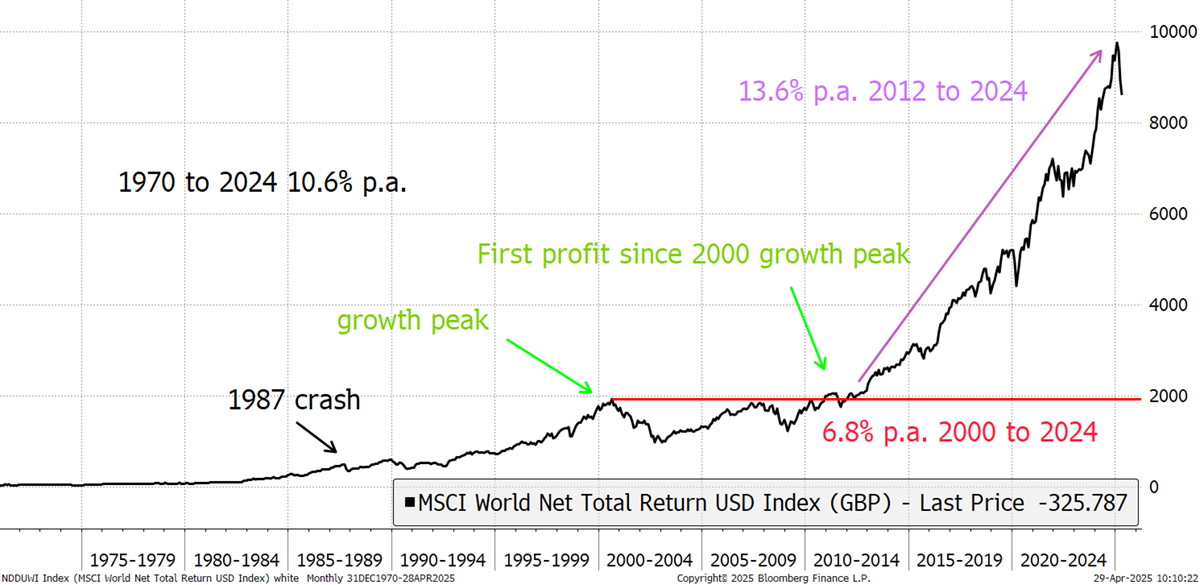

I show the world index in GBP, including dividends since 1970. Over 55 years, it has appreciated at a rate of 10.6%, with average UK inflation of 5.7% per annum. Since the 2000 peak, it has dropped to 6.8% p.a. while inflation was 3.5%. Moreover, returns were zero from the 2000 peak until 2012, when inflation ran at 3% p.a., which was a loss in real terms. Yet despite that poor start, the 2012 to 2024 era was historically spectacular, bringing the final 2000 to 2024 result to 6.8% p.a. with 3.5% inflation.

Global Equities Total Return in GBP since 1970

Where you start this journey really matters, but even more important is how you approach it. By investing in index funds, investors may not realise it, but they are making a growth choice, and the longer the bull market they buy into is, the more the growth characteristics stand out. At these times, Value has been left behind and offers active investors an opportunity to switch into cheaper stocks, that are out of favour, and with tangible value.

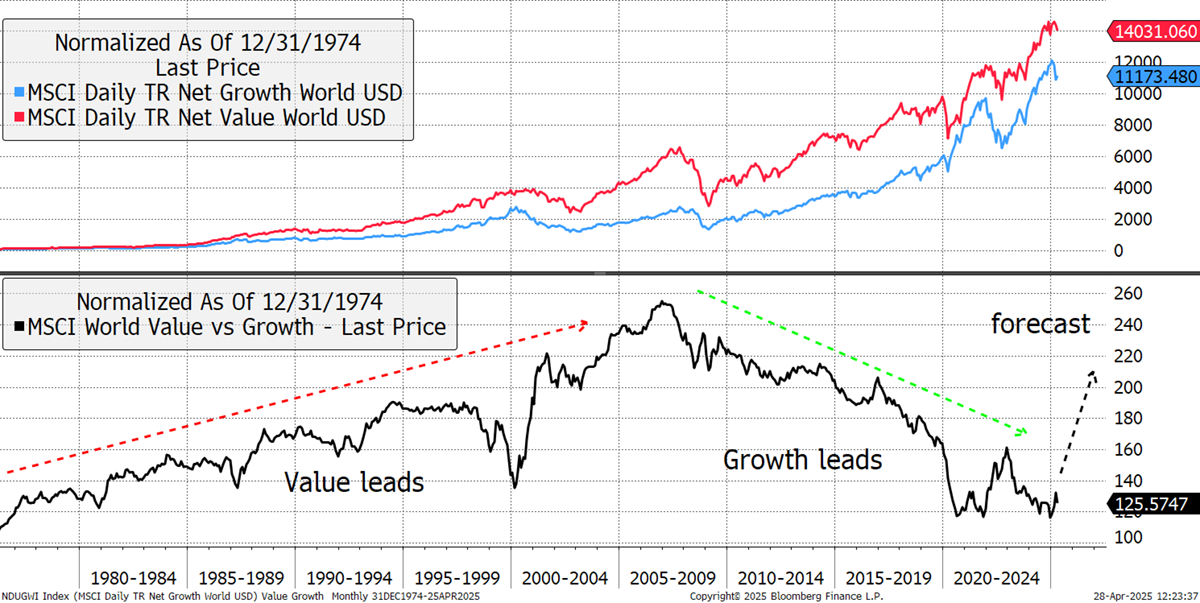

I show the world index Value (red) vs growth (blue) since 1970 below. Over 55 years, value is still marginally ahead, having been twice as good around 2008. The 1980s, 1990s, and noughties all saw value beat growth. There was a respite in the late 1990s, as the internet boom took hold, but that soon passed. The growth stocks took over after the financial crisis in 2008 and beat value until 2020. That has recently been retested in 2025, and despite growth rallying with the AI narrative after the 2022 mini-bear, it has been unable to break the 2020 level. From here, value is now much better placed than growth.

Global Value vs Growth since 1974

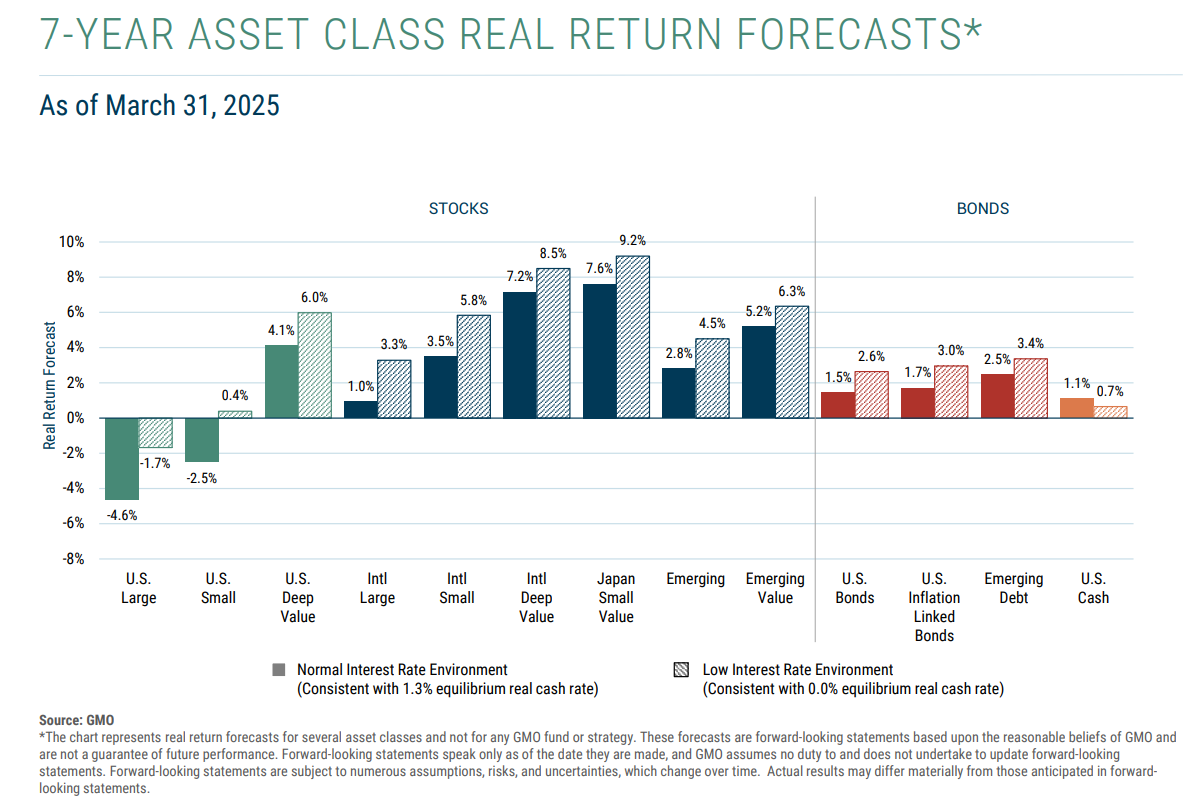

I used the world index because it holds everything, both cheap stocks and overhyped stocks. Currently, it holds much more of the latter, and by a wide margin. But just because the world index will be weighed down over the coming years, there is plenty of value around the world. GMO is a fund management company, and their 7-year asset return forecasts provide an excellent high-level view of what is on offer. I have shown it as they have expanded it, and the opportunities stand out.

GMO- 7-Year Asset Return Forecasts

At these prices, US large-caps are toxic, and small-caps aren’t much better. I sense this because when I screen for stocks around the world, US stocks rarely come up, as others offer better value. There’s always something similar and cheaper elsewhere. That said, the US does have value stocks, just not as many as elsewhere.

GMO don’t publish all of the categories, but international deep value and Japanese small-cap value stand out. International deep value is how I would describe the Whisky portfolio, although it has once again become UK-centric. The Soda Portfolio has also embraced value stocks through the investment trusts. I find it a much more comfortable and profitable way to invest over the long term.

Value is back, and there is plenty of opportunity around the world. I am adding a unit trust to the Soda Portfolio for the first time since 2020. I haven’t owned one for various reasons, but one was complexity. You’d be amazed how many clients struggle to buy unit trusts on their platforms. But this time, I have no choice because to embrace global value, and do it well, requires active management.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd