ByteTree BOLD Index Monthly Rebalancing Report;

The 21Shares ByteTree BOLD ETP (BOLD) invests in Bitcoin and Gold. BOLD combines the world’s two most liquid alternative assets on a risk-adjusted basis. Due to their natural low correlation, the diversification benefits of holding both assets have been unusually high. Bitcoin prefers risk-on market conditions, while Gold prefers risk-off.

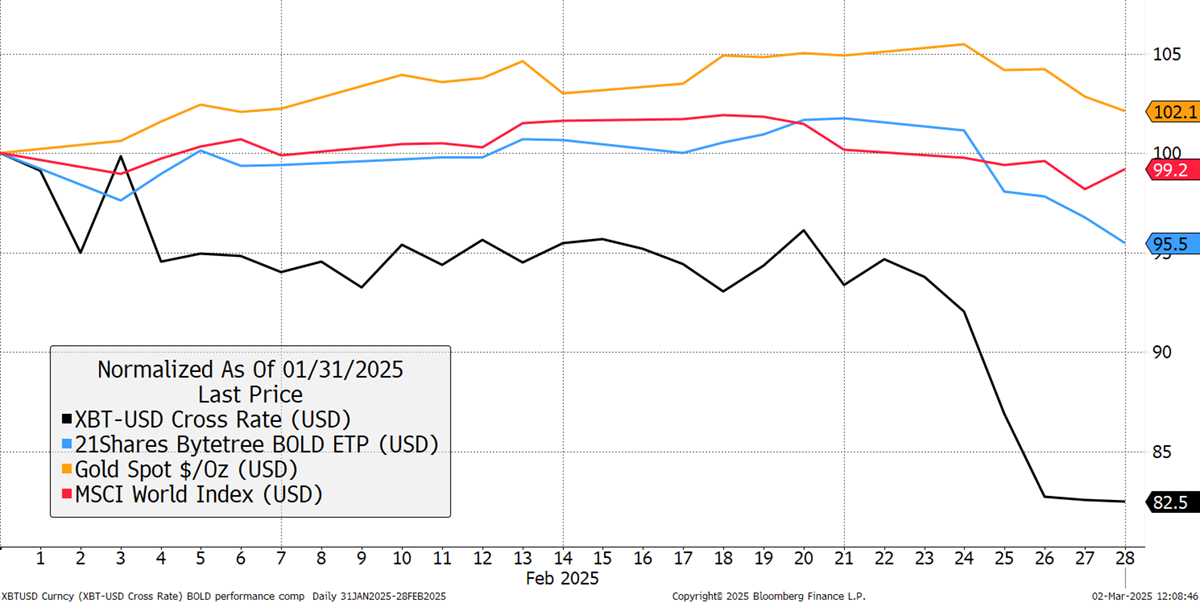

In February, BOLD fell by 4.5%, Bitcoin fell by 17.5%, and Gold rose by 2.1%, while global equities fell by 0.8% in USD terms.

The target weights last month were 24.9% and 75.1% (Bitcoin to Gold). Price changes over the month led to the last day’s weights at 20.5% Bitcoin and 79.5% Gold. This means the latest rebalancing has seen 5.0% added to Bitcoin and reduced from Gold to meet the new target weights.

Bitcoin, Gold, BOLD, and Equities in USD – February 2025

BOLD Performance

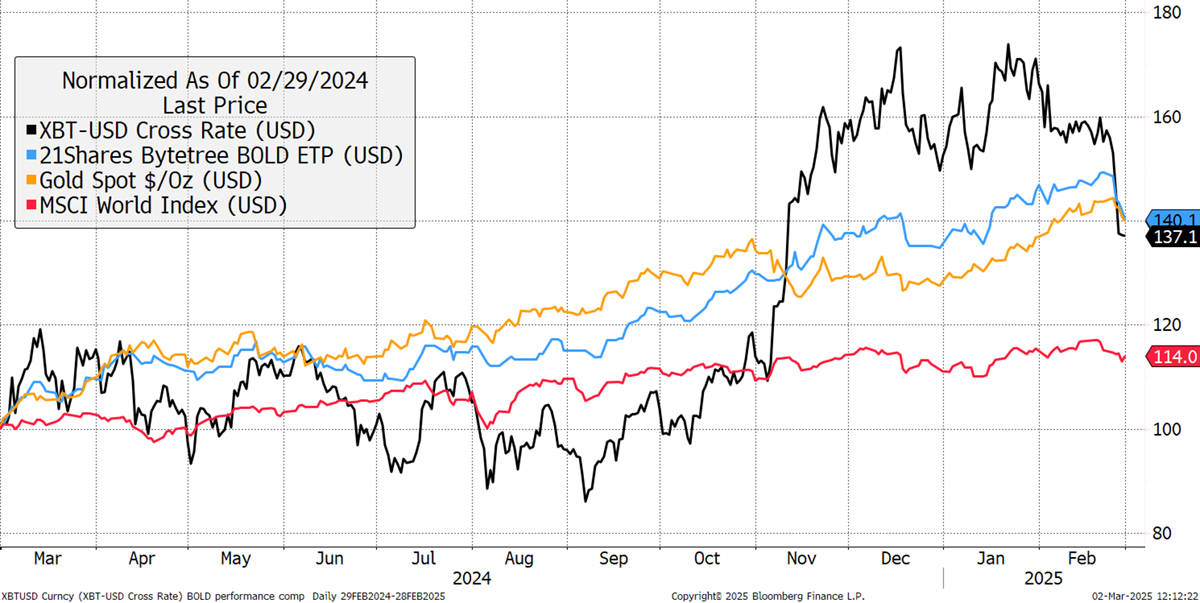

Over the past year, Bitcoin has returned +37.1%, in contrast to Gold, which has returned +39.8%, while equities rose +14.0%. BOLD has returned +40.1% in US dollars. Although slight, BOLD is ahead of both Bitcoin and Gold over the past year, demonstrating the benefits of a rebalancing strategy.

Bitcoin, Gold, BOLD, Equities - Past Year

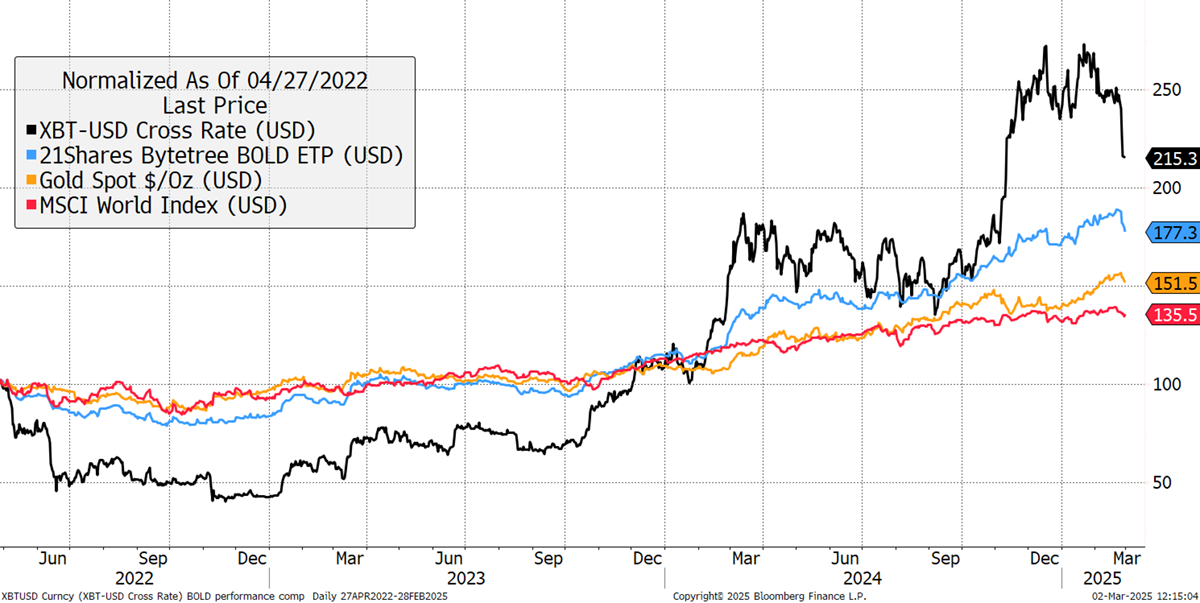

Since the inception of the 21Shares ByteTree BOLD ETP on 27th April 2022, Bitcoin is +115.3%, Gold is +51.5%, and equities are +35.5%. BOLD has returned +77.3%. A fixed 75/25 Gold/Bitcoin strategy would have returned 67.5%, once again demonstrating the power of rebalancing. That 9.8% outperformance comes after fees.

Bitcoin, Gold, BOLD, and Equities - Since Inception

Monthly Rebalancing of the BOLD ETP

BOLD allocates to Bitcoin and Gold on a risk-adjusted basis using past volatility, which is calculated using daily price movements. The less volatile asset, which has lower daily price moves, gets a higher weight in the index at the end of the monthly rebalancing.