Terrible Tariffs

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio Issue 144;

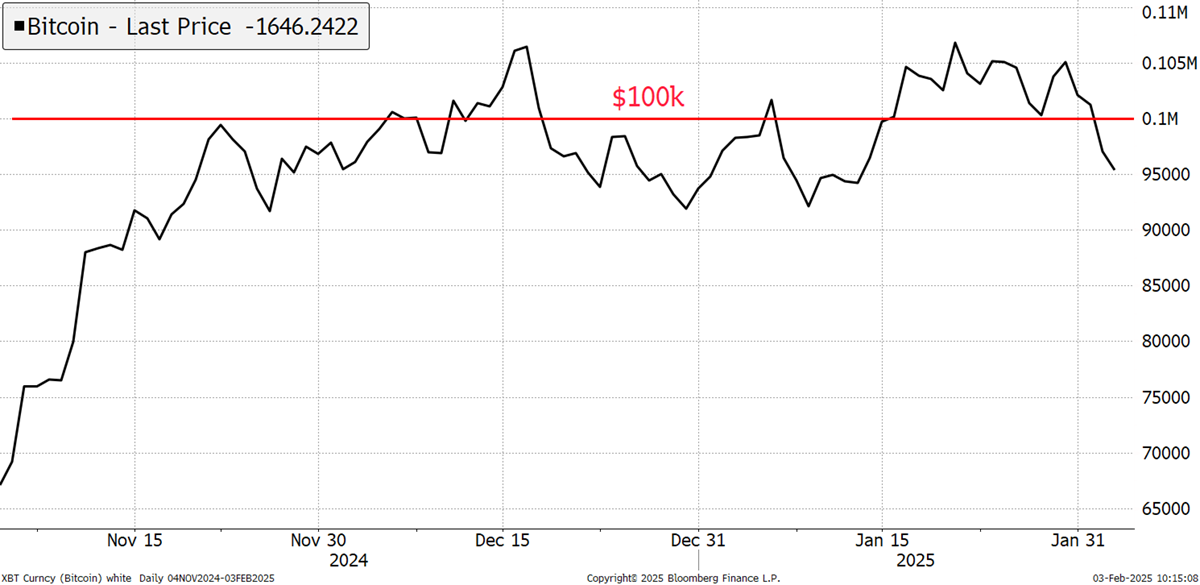

Another week goes by with Bitcoin crossing the $100k line for the nth time. This time it can be blamed squarely on Trump’s tariffs.

$100k Crossed Again

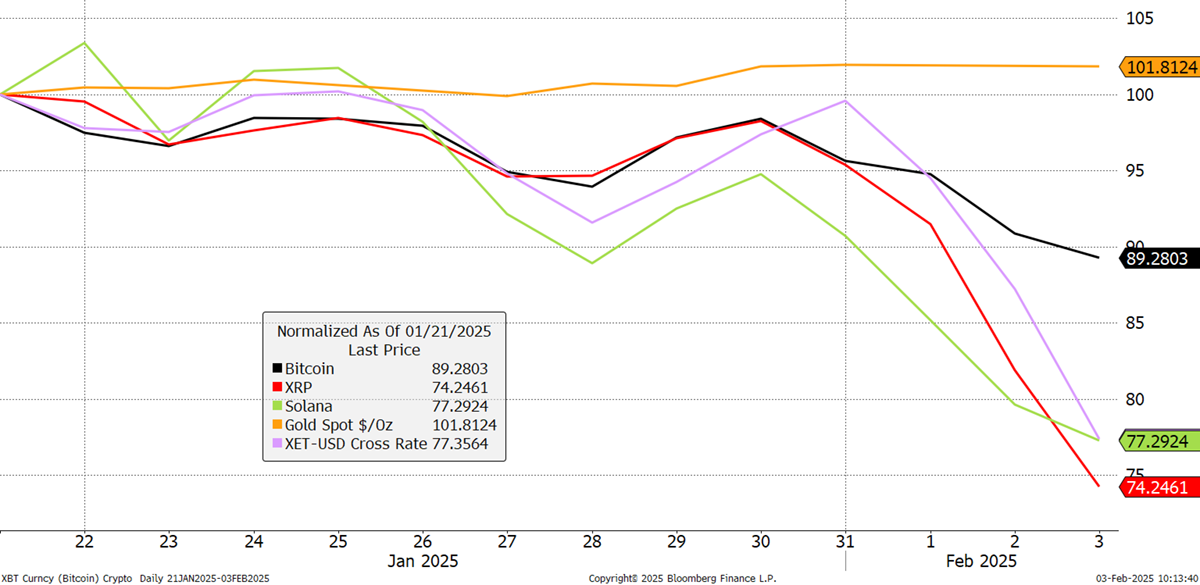

The irony is that he has been saying tariffs have been coming for months, and it assumed they were priced into market prices. Clearly not, as the reaction over the weekend has been brutal. The chart starts at the Bitcoin high on 21 January. It is remarkable how much worse the leading altcoins have been over this short period.

The Leading Altcoins Have Been Punished

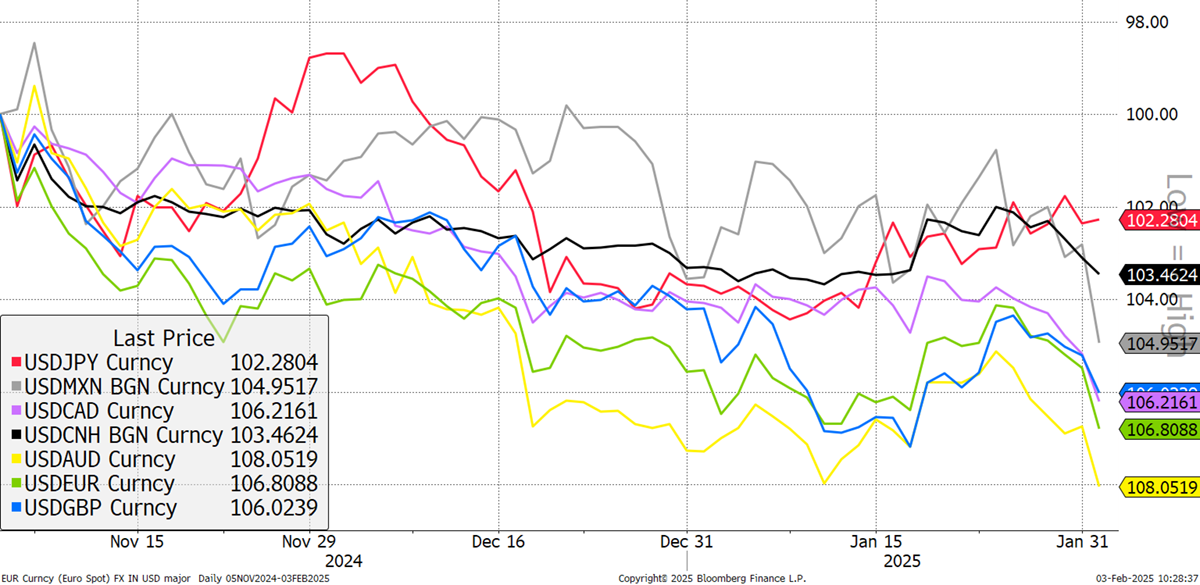

But why should tariffs on Mexico and Canada impact crypto? Firstly, there is the negative impact on the stockmarket and risk assets in general, and with that comes a jump in the US dollar. The dollar is challenging former highs, and the impact has been quite severe. A strong dollar is never good for crypto, but the good news is that it shouldn’t last.

Major Fiat Currencies Fall vs US Dollar

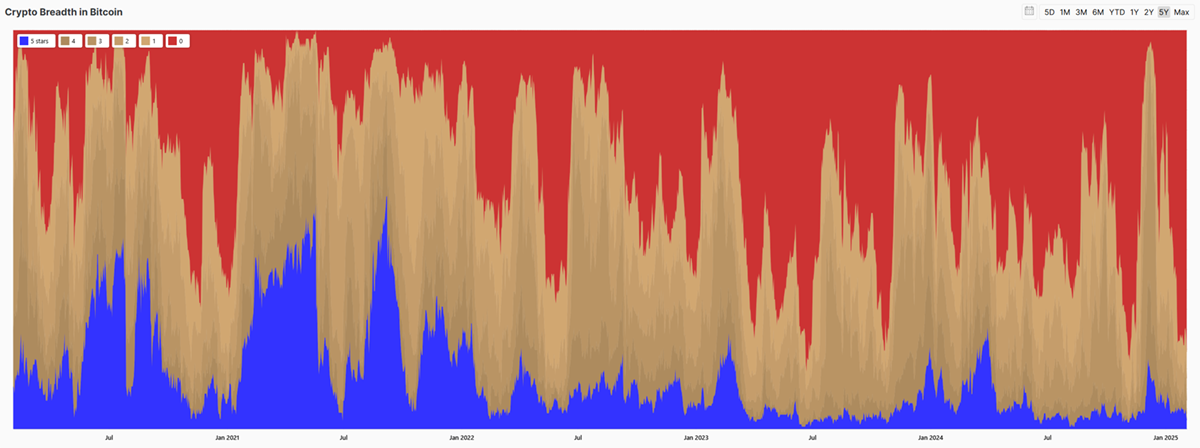

Trump wants low interest rates, and what Trump wants, Trump gets. When rates start to fall, that ought to ease the pressure on the dollar, which, in turn, will be supportive for crypto. Something needs to support crypto because while Bitcoin is still holding up quite well, crypto breadth is structurally weak. 81% of tokens are in a downtrend in BTC, which is terrible and worse than the 2022 bear market. This is further evidence that Bitcoin continues to dominate this space.

Crypto Breadth in Bitcoin

Finally, I point to our equal weight breadth indicator, the ByteTree Crypto Average (BCA), which once again scores zero. This challenges the idea we are looking for a bull market in alts.

ByteTree Crypto Average

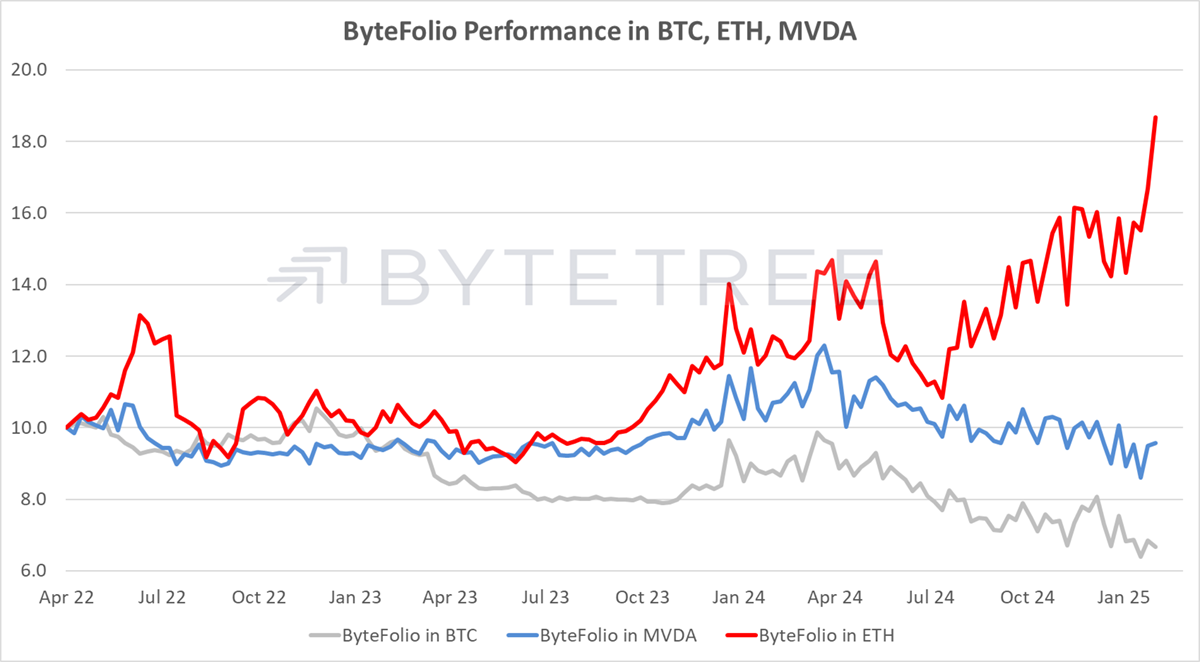

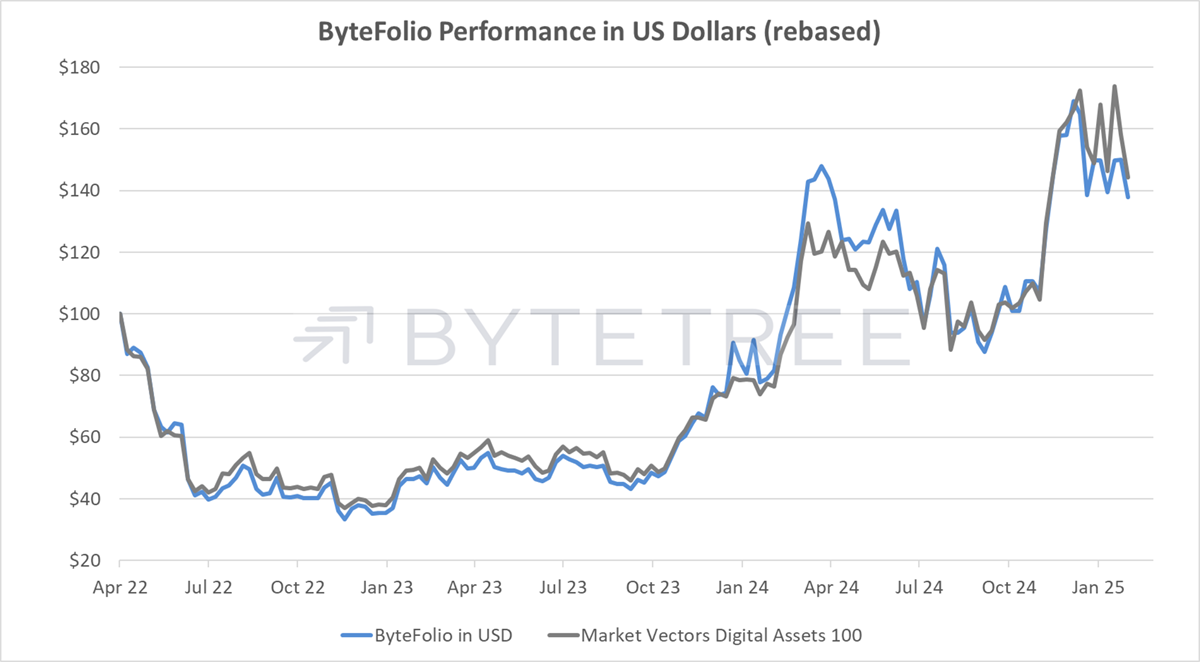

The portfolio has given back some ground, but not too much. It is flat in the benchmark, MVDA, and resilient in Bitcoin. When measured in ETH, it has done nearly twice as well. We remain defensive with a BTC-heavy portfolio until things improve.