The Geddes Axe

Trades in Whisky and Soda;

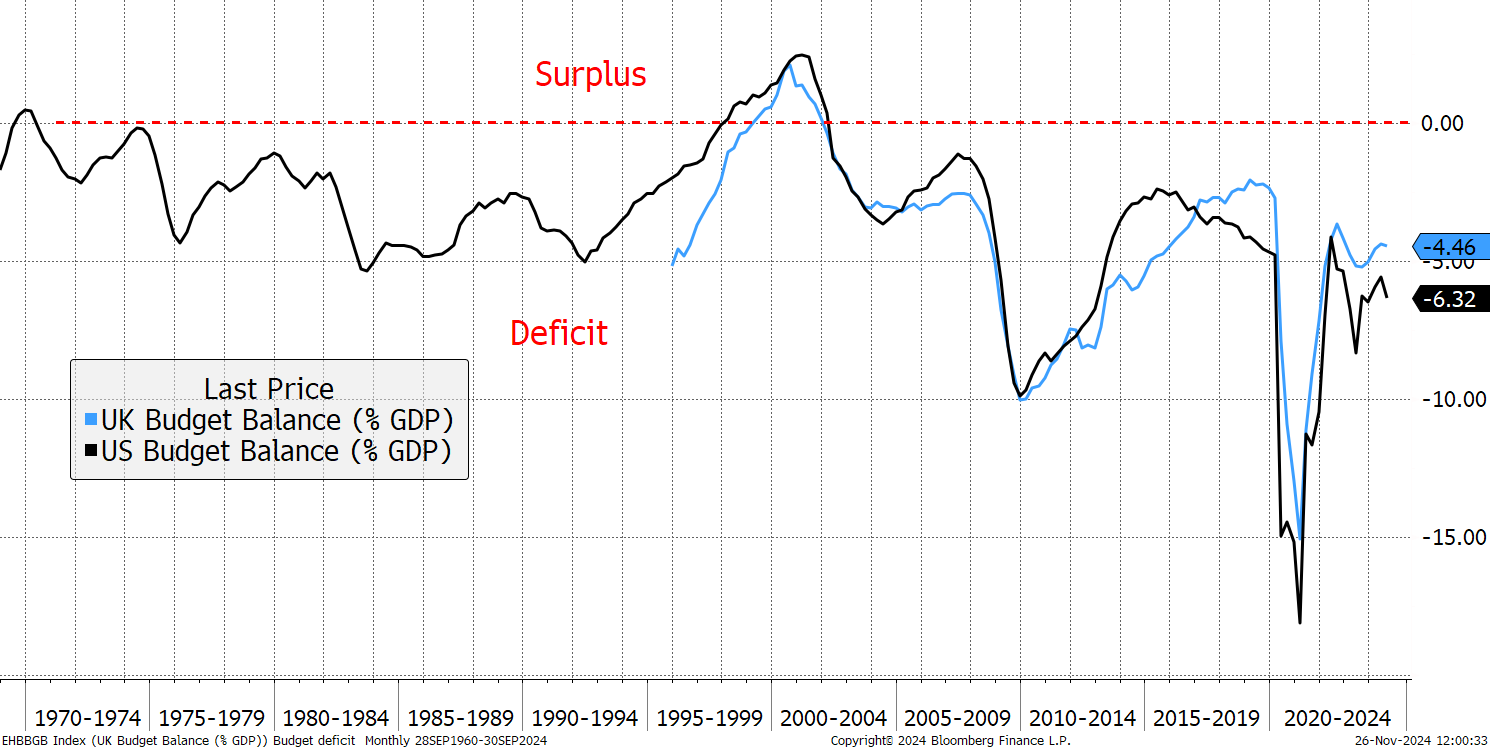

The US has a $36 trillion debt and an outsized annual budget deficit, which appears to be structural. I say that because a surplus hasn’t been registered since the stockmarket boom of 2000 when capital gains tax revenues surged. Twenty-five years later, the stockmarket has surged again, yet the tax receipts haven’t had quite the same impact as they did last time, as the deficit has become too big. The US deficit looks very similar to the UK deficit, and similar patterns can be found across the developed world, Northern Europe excepted.

Government Deficits

When asked about the deficit, President Ronald Reagan famously quipped that “the deficit is big enough to take care of itself”. Yet the 1980s never saw deficits beyond 5% and today, we have 6.3% during a period of economic expansion. Are we not supposed to fix the roof when the sun is shining?

After the First World War, the national debt had increased from £650 million in 1914 to £7.4 billion by 1919. The Prime Minister, David Lloyd George (a liberal), appointed Sir Eric Geddes with the task of balancing the books and reducing public debt. His report became to be known as the Geddes Axe, and it slashed UK public expenditure with brutal cuts, particularly targeting the armed forces. With Hitler on the rise, these were short-lived, but Geddes was successful in getting public finances back under control and restoring a sense of stability.

The biggest surprise since Trump won the US election is an outbreak of fiscal prudence. The new Department of Government Efficiency, headed by entrepreneurs Elon Musk and Vivek Ramaswamy, is a potential game-changer. Along with Argentina’s President Milei, they are the Geddes Axe of the 21st century. Their task is to roll back the state and balance the budget. If you manage to do that, the debt-to-GDP ratio will naturally fall over time. Thatcher’s household economics is back.

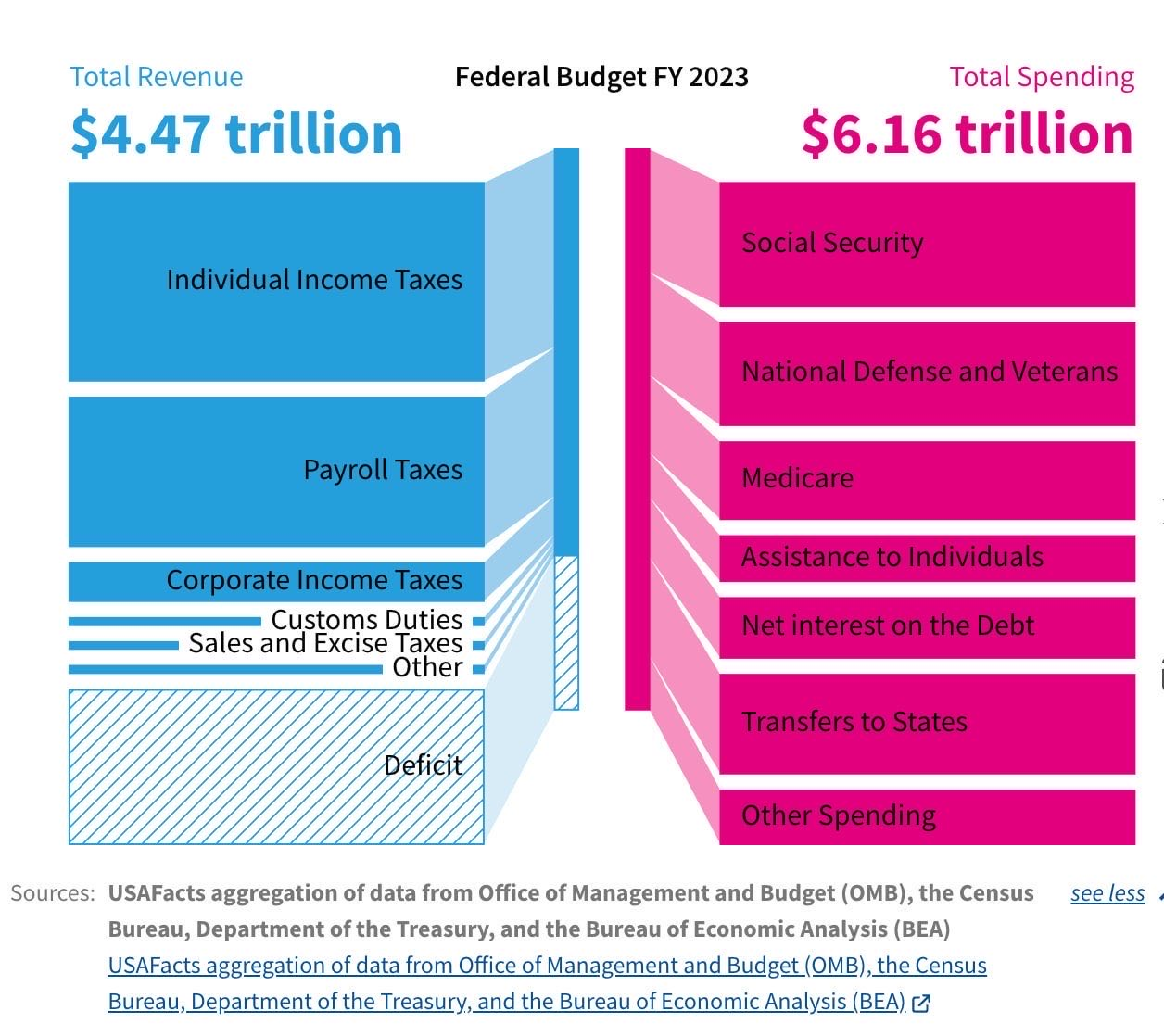

US federal tax revenues last year were $4.47 trillion, with spending of $6.16 trillion. It is a huge gap but Musk and Ramaswamy have stated they can save $2 trillion. Like Geddes, they are businesspeople rather than civil servants, and are likely to find savings wherever they look.

But $2 trillion of savings is a tall order, and Musk exaggerates, but this movement goes beyond him. Scott Bessent, a successful hedge fund manager has been appointed Secretary to the Treasury. He was a student of George Soros and a colleague of Stanley Druckenmiller. In my opinion, he’s on the financial A-list.

In the Money Maze Podcast recorded last November, Bessent quoted French painter and sculptor Marcel Duchamp, who said, “If there’s no solution, there’s no problem”.

Bessent spoke of the incredible deficits and debt, and that we have to acknowledge the debt problem in the US and globally. He clearly stated how he wants to be a “part of the solution in terms of figuring out what is a fair and equitable way to get to the other side of this”.

Jens Nordvig from Exante Data, who worked with Bessent, described him as having intellectual curiosity and a deep historical perspective that will allow him to operate in a highly uncertain new regime, and serve as a strong independent analytical voice at a time of mounting economic challenges for the US and the global economy.

He also wrote that when Donald Trump was elected for the first time in 2016, markets looked ahead to a regime of lower taxes and expansive fiscal policy. We got a growth boost from both lower taxes and larger government expenditure, especially in 2018, but 2024 is different from 2016. The Federal debt level has grown from 105% of GDP to 123% of GDP. And the fiscal deficit has doubled, from 3.1% in 2016 to more than 6% in 2024. Hence, it will be hard to pursue expansive fiscal policies in the same way as in the first Trump administration.

Another comment from Manish Singh, CIO at Crossbridge Capital, said Bessent will adopt a 3-3-3 policy by:

- reducing the budget deficit to 3% of GDP by 2028,

- boosting GDP growth to 3% through deregulation, and

- increasing daily oil production by 3 million barrels.

It’s not just Musk and Ramaswamy, but Bessent too. We are heading for an era of balanced budgets, as where the US goes, the world will have to follow. This is austerity, of Geddes magnitude, and I cannot see how it will be inflationary. It is not an environment we are used to, but it will surely be positive for the bond market. Maybe Trump wants his legacy to be the bond market guy rather than the stockmarket guy. It makes sense because Bessent will surely be advising him that the equity boom cannot last forever.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd