GameStop Tumbles, Crypto Follows

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio Issue 111;

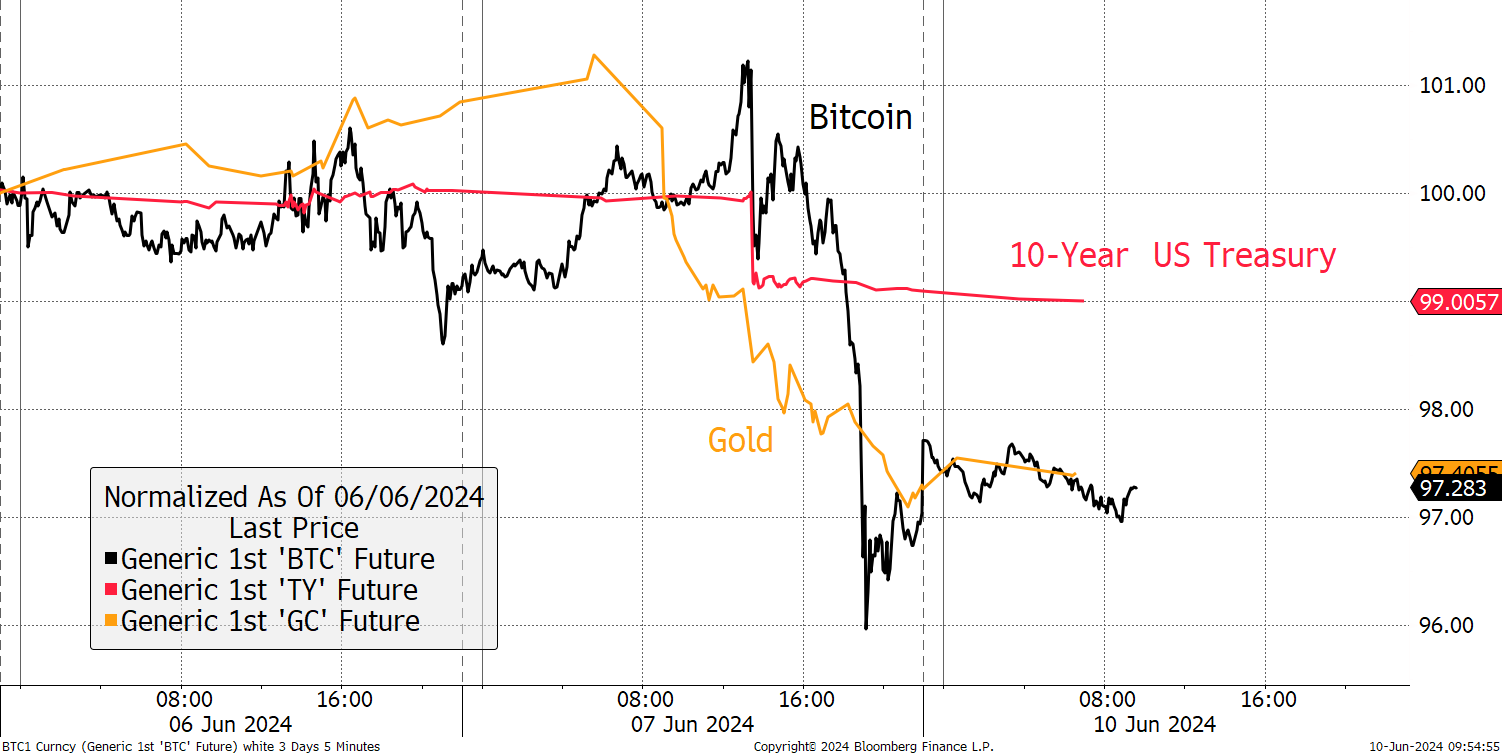

One of the reasons attributed to crypto strength over the past year, is the hope for interest rate cuts. On Friday, the US released its jobs data, and the economy is still too strong for cuts. US treasuries fell (black) along with Bitcoin and Gold, which both fell around 4%. Naturally, that is a much bigger deal for gold than it is for Bitcoin. Yet again, the new high for Bitcoin is postponed, and I reiterate my forecast for the big breakout will come in October. That time has strong seasonality and after halving, the network needs time to settle down after the halving hype.

Bitcoin, Gold and Rates

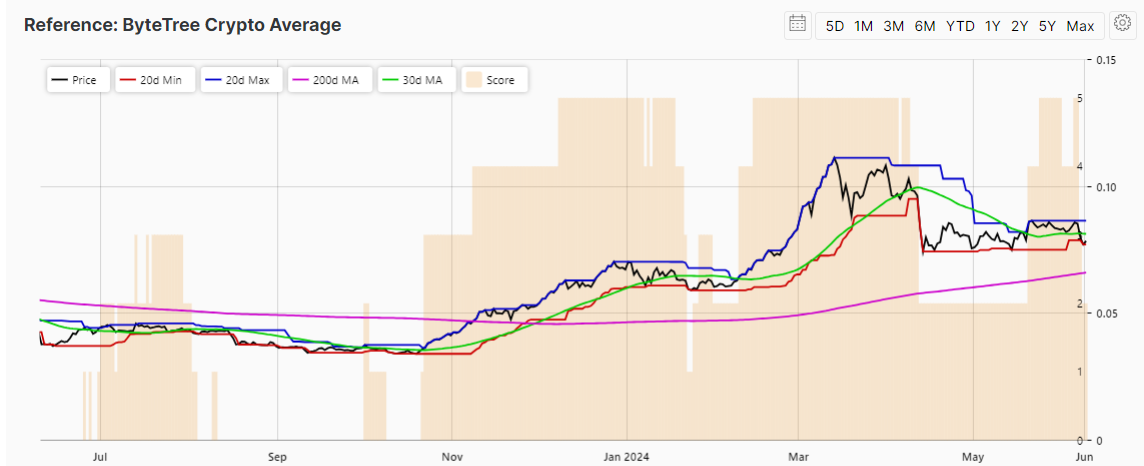

More generally, breadth remains weak, and the ByteTree Crypto Average (BCA), the equally weighted token index, has dropped to a 2 out of 5 on the ByteTrend score. That means the average token is weakening, the crypto market is slowing down and it isn't over yet.

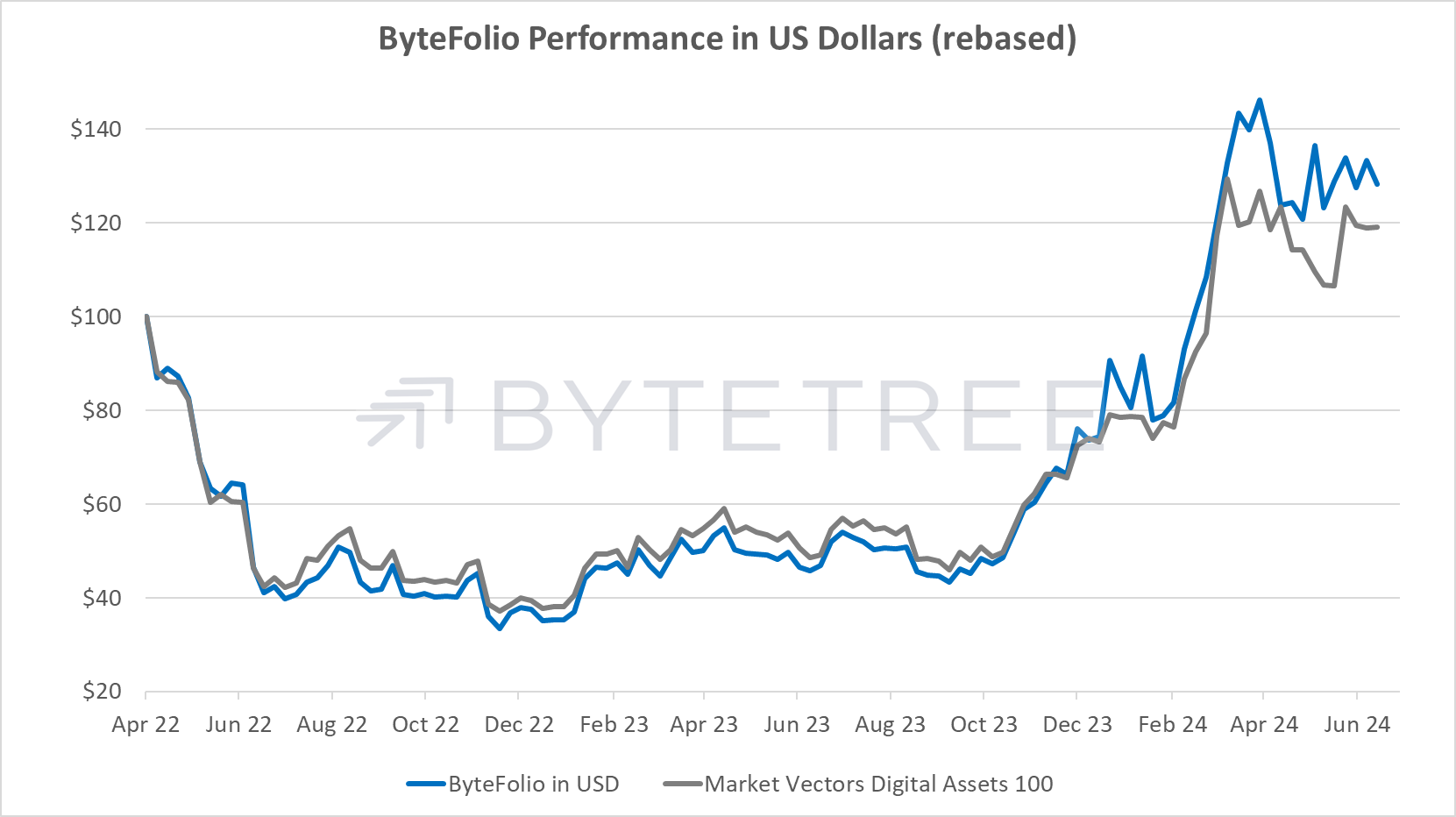

Following recent sales, ByteFolio is now comprised of half tokens, half Bitcoin, and I do not expect that to materially change until we see some strength return to the market. Continued upward pressure on bond yields, and the slower summer season, are good reasons to remain patient. We will get this alt rally one day!