Silver Surge and the Money Map

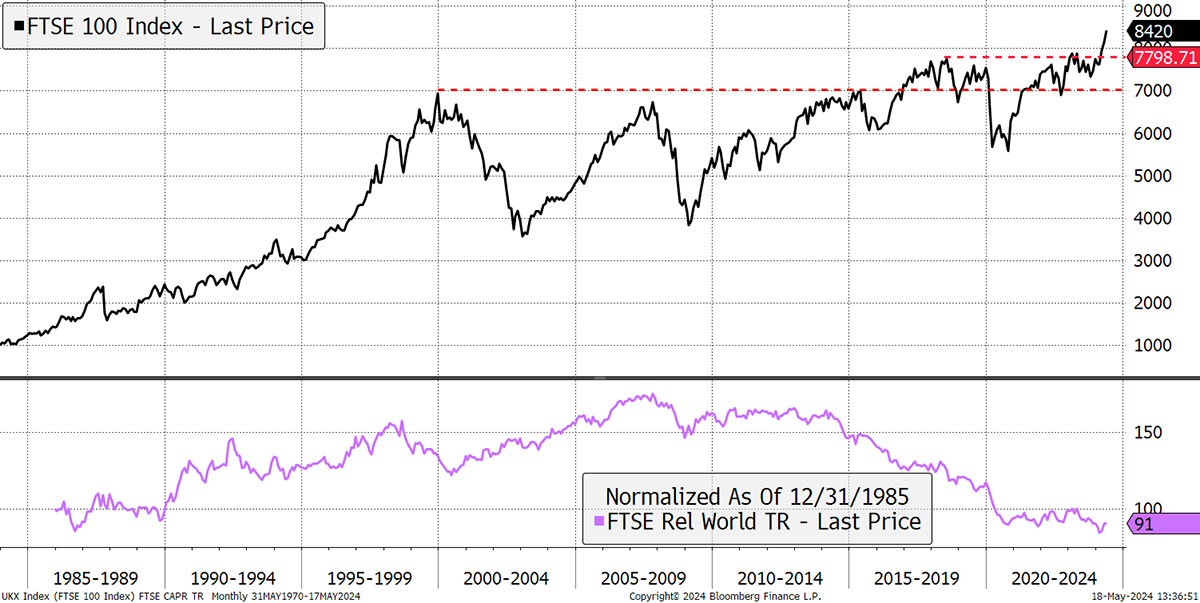

I joined the city in 1998 when the FTSE 100 was hovering around 6,000. In 2003 and 2008, it dropped below 4,000. Then, during the pandemic, it touched 5,000. After 25 years of heartbreak, the FTSE is getting going again.

The Footsie Breaking New Highs

High time you might say but it is well known that the FTSE 100 has little to do with the UK economy as it is dominated by multi-nationals. When you look under the hood, you soon see that 30% of the recent FTSE strength is down to natural resources (oil and metals), 25% banks, and 18% pharmaceuticals. Furthermore, half of the index comprises just 12 stocks, leaving 88 for the other half. Index funds aren’t quite what they seem.

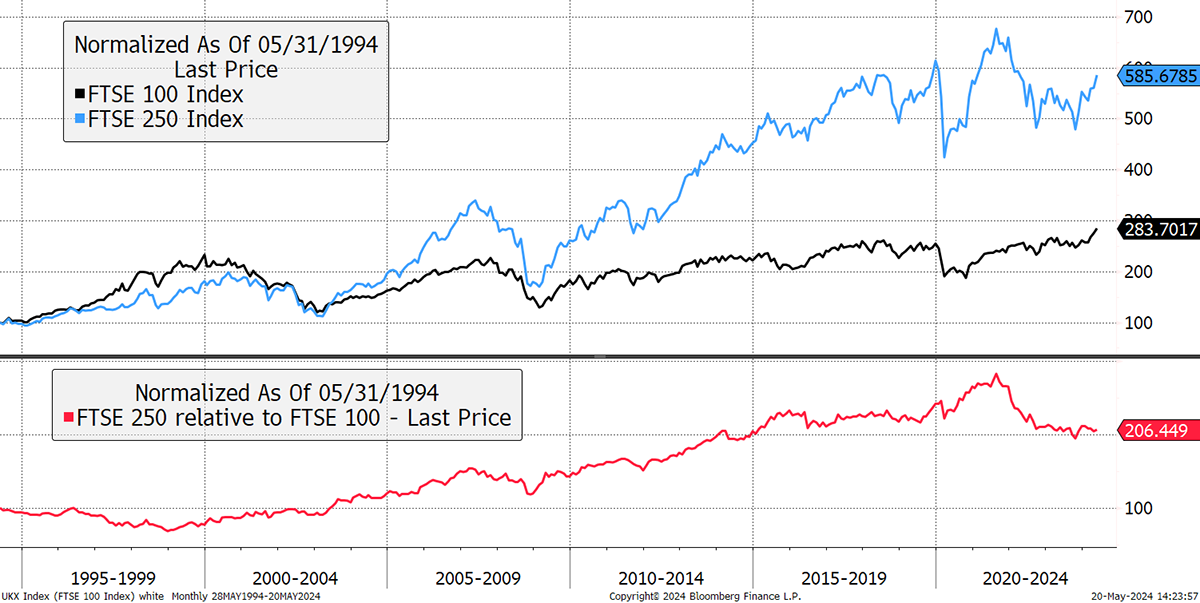

The FTSE 250 is more reflective of the economy, and the good news, perhaps, is that while it is not at an all-time high, it is rising and keeping up with the FTSE 100. Over the past two decades, the FTSE 250 has led the FTSE 100 by 2.2% p.a., including dividends. The recent strength in the FTSE 250 was also driven by natural resources, especially gold miners.

FTSE 100 and FTSE 250

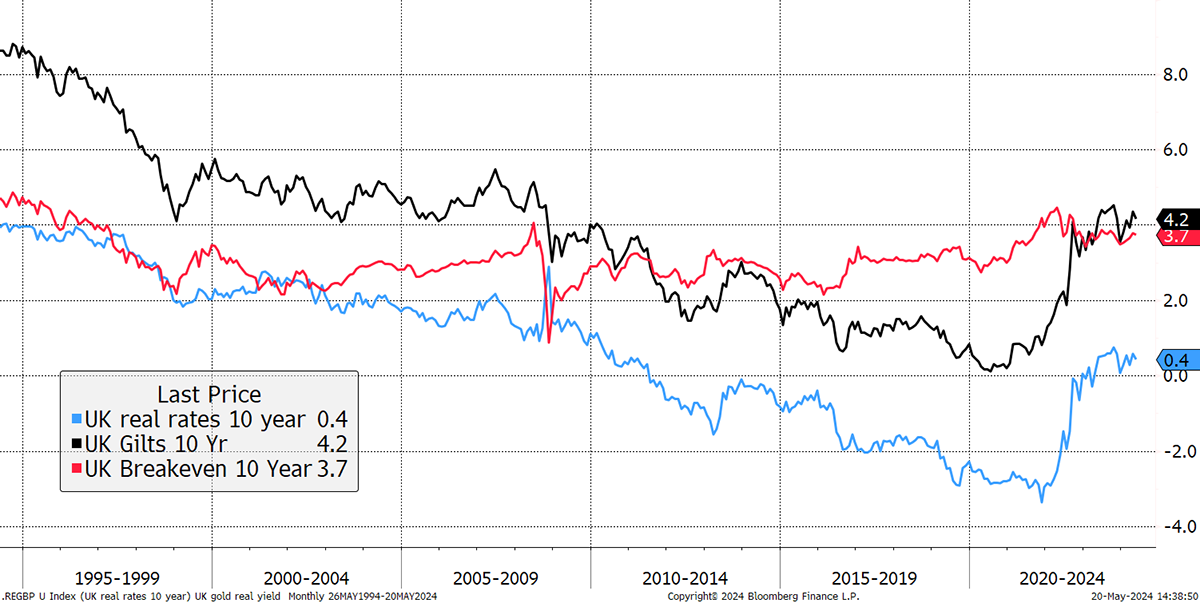

Looking at UK gilt yields (black) and inflation expectations (red), they both appear to be rising, although it is not entirely clear. But they certainly don’t seem to be falling, as is the popular narrative. If they were, you might expect property and REITS to be leading the way, but they have not. It has very clearly been commodities and banks, which prefer rising rates and inflation.

Gilts and Inflation

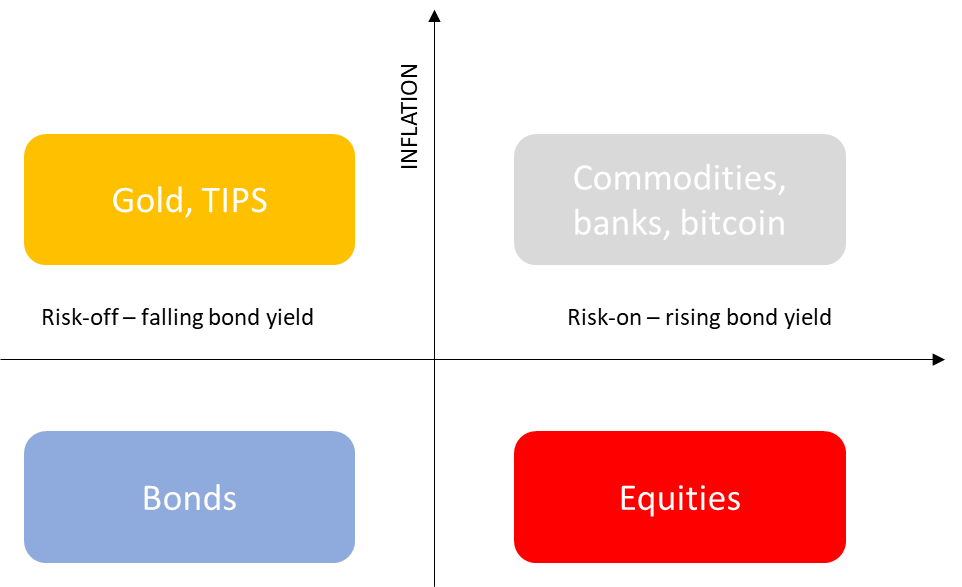

That means the financial markets are sitting in the top right quadrant of our Money Map, the friend of banks and commodities.

Money Map

Webinar: Positioning in an Uncertain World

We are hosting an Ask Me Anything webinar on Thursday, 23 May, at 4 PM BST. I will present a few slides sharing my thoughts on financial markets and then open up the floor for questions. I will be joined by my old friend Zak Mir, who is a keen ByteTree fan, and he will keep the house in order.

Please register to attend the live event.

If you can’t make it, there will be a recording. Just remember, if you have a question or comment, then please send it in.

Silver

This leads me to the silver breakout on Friday, which cut through $30 like a hot knife through butter. We have held silver since 2019, and I topped up in early 2020. It has been easy not to notice, but the position is now up by 89%, which is great.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority. https://register.fca.org.uk/

© 2024 Crypto Composite Ltd