Make Money from Narrowing Discounts on Trusts

We are starting to see the discounts on the listed investment trusts and closed-ended funds narrowing. It might appear to be a modest improvement so far, but it’s an improvement, and when these things start, they tend to keep going. With the FTSE 100 Index making an all-time high, the love should spread.

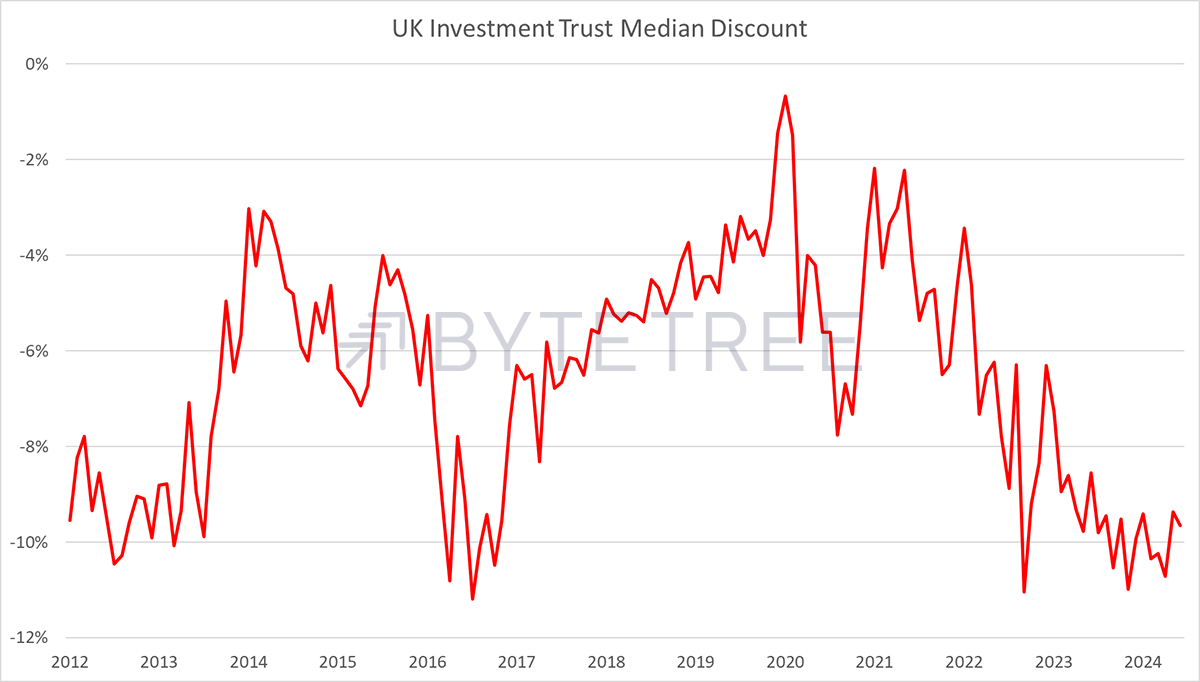

I show the median discount of the leading investment trusts in the UK. The recent levels are attractive, and outside of the extraordinary distress seen in 2008, they present a good opportunity. I show the average, which means some discounts are greater than others.

UK Investment Trusts – Median Discount

To remind you why discounts are so exciting, it is because it is basic value investing. Provided your assumptions around asset value are correct, all that is needed to return to fair value is patience. Better still, if you hold a diversified pot of assets that have been purchased at a discount, those assets will hopefully appreciate over time as well. That means you get paid twice over, by both the appreciation of the assets and the narrowing of the discount. It’s thrice when you include dividends.

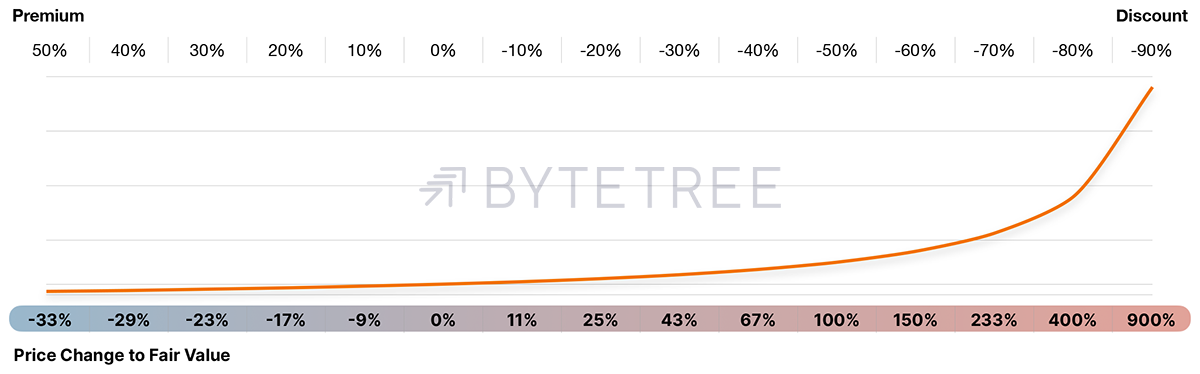

Let’s assume you bought an investment trust at a 10% discount. That means the assets would be worth (say) £100, but you only paid £90. One day, that discount should close, and when it does, you’ll make 11% plus the assets returns plus the dividends. Nice work. Now imagine that the discount is 40% or 50%. Provided those assets are in good health, you’ll potentially do twice as well as the assets themselves.

The Opportunities and Risks of Discounts and Premiums

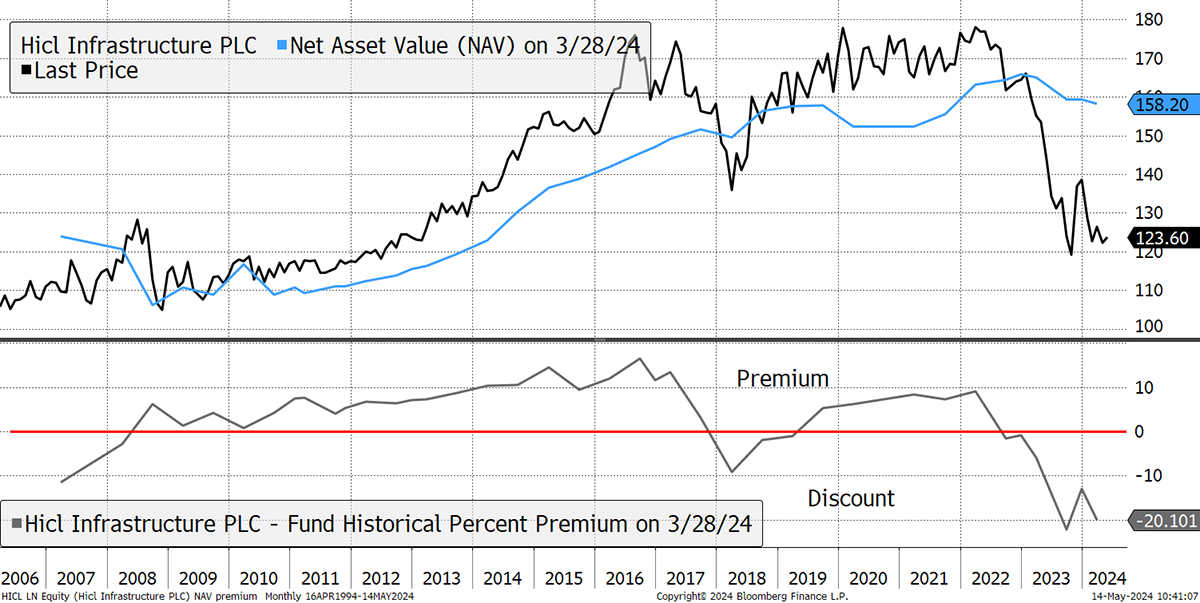

It also works in reverse. If you bought at a premium, of say, 50% when the market was excitable, then you risk a 33% loss of your capital because, as sure as night follows day, eventually, that premium will disappear. I show HICL Infrastructure, a diversified fund with a 6.7% yield. The 10% premium didn’t sound much, but turn that into a 20% discount, and it adds up to a -35% round trip, or six years of income. Premiums are dangerous.

HICL Premium to Discount

I wanted to remind you how important discounts and premiums are. If you buy at a premium, future returns are already guaranteed to lag the returns of the underlying assets. This is basically how growth investing works when the assets are trading at high valuations. There is no room for error, as the asymmetry is against you. If the company fails to deliver, investors who overpaid will lose a lot more money than they needed to.

In contrast, if you buy at a discount, there is room for manoeuvre because Benjamin Graham’s (Buffett’s coach) “margin of safety” applies. When something is dirt cheap, you can afford imperfections in the assets; you simply have to be patient.

The Soda Portfolio has plenty of these situations, and the performance is picking up as several of these discounts have started to narrow. It is at this latter stage of the equity bull market when the money is made in the less liquid investment trusts.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority. https://register.fca.org.uk/

© 2024 Crypto Composite Ltd