It’s Raining Bitcoin in London

Disclaimer: Your capital is at risk. This is not investment advice.

This week, Bitcoin ETFs were listed in London. Unusually for anything related to Bitcoin, it was a quiet affair because only professional investors are allowed to buy them. Since Bitcoin ETFs have been trading in neighbouring countries for years, the PROs have already been getting their fill.

Then, a few hours later, our partner, Zurich-based 21Shares AG, saw a trade. They will forever be the first to trade a Bitcoin on the London Stock Exchange. Congratulations to them. It might have been raining Bitcoin in London, just not very hard.

Their Head of UK, Alex Pollak, will join me on a webinar this Wednesday to discuss BOLD, our index that blends Bitcoin and Gold. Having worked at 21Shares for several years, he’s an expert on Bitcoin and crypto, and before that, he worked at iShares, so he’s an expert on ETFs as well. He also knows about BOLD because he’s heard the story from me so many times. This time, two years ago, we were in Guernsey, Channel Islands. It was an early morning in May, but it set us up for the day.

The BOLD Index rebalances on the last working day of each month, which is today (Friday). I will release the BOLD Monthly Rebalancing Report on Monday, publishing the changes to the weights. With Bitcoin +13% in May and Gold +2%, the strategy will be taking profits from Bitcoin and adding to Gold. This process not only maintains the level of risk but has added approximately 5% to performance each year. I will discuss this further with Alex at our webinar.

For those who can't make the live webinar, the recording will be uploaded to our YouTube channel, and a link will be sent to everyone on the registration list.

A Week at ByteTree

If you are interested in the London ETFs, I covered the launch in ByteFolio while our analysts looked at GALA, TONCOIN and PENDLE. In yesterday’s Token Takeaway, Ali followed up with a qualitative look at Pendle Finance, a unique dApp, and the value proposition of its native token, PENDLE.

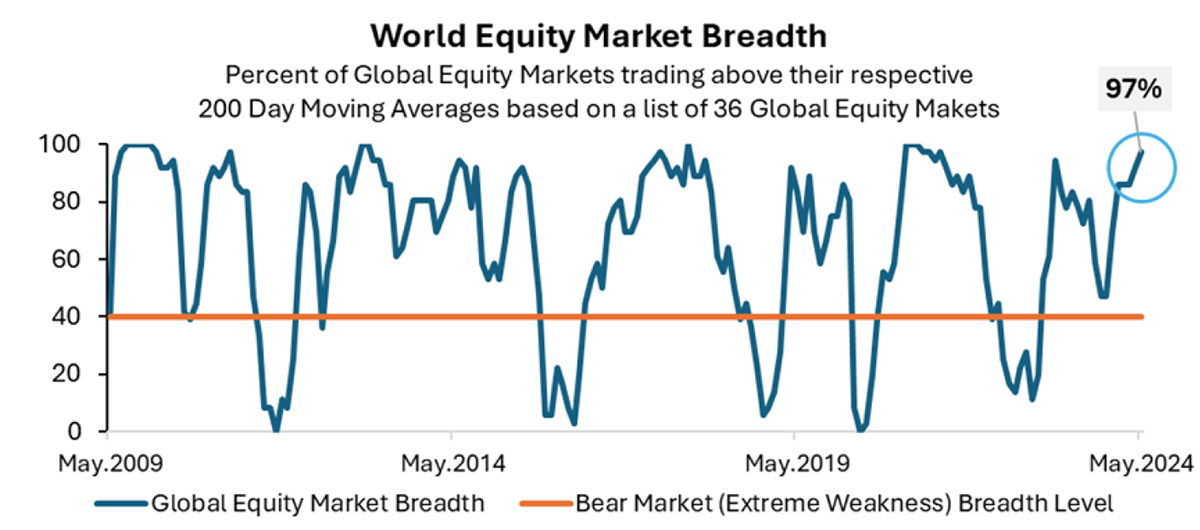

It must be the end of the month because we heard from Robin and Rashpal in their Adaptive Asset Allocation Report titled Stick with Old Faithful. Among many good observations, they highlighted the fact that 97% of global equity markets were rising. Is that good or bad, you may ask? At least, it’s good until it isn’t.

Global Equity Markets Are on the Rise

Finally, in The Multi-Asset Investor, I discussed events in emerging markets.

Have a great weekend,

Charlie Morris

Founder, ByteTree

Comments ()