Bitcoin ETFs Come to London

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio Issue 109;

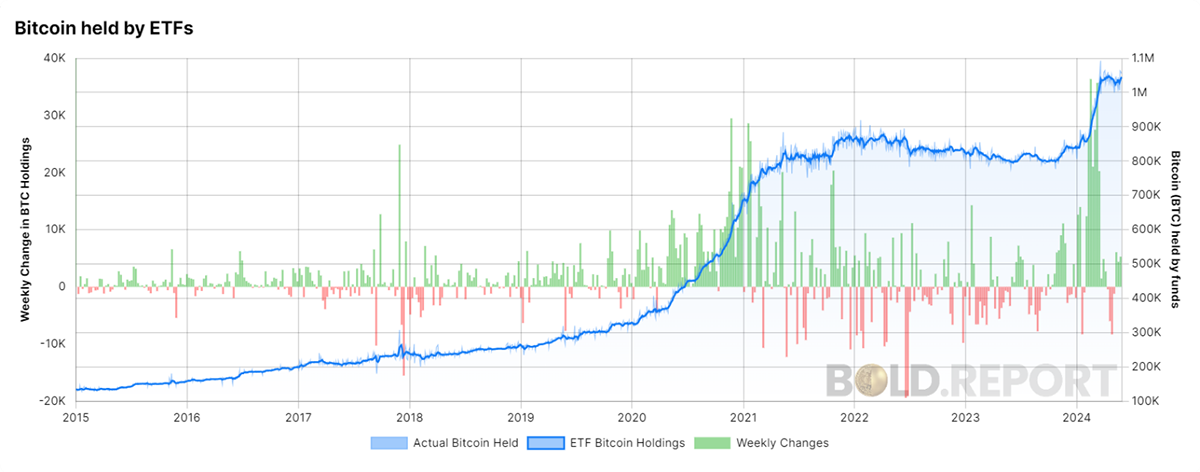

Pioneered in Sweden in 2015, Bitcoin ETFs have been the simplest and safest way for investors to access the market. Today, they can be found in Germany, Switzerland, Canada, Brazil, Australia, the USA, Hong Kong, and finally, as of today, the UK. Investors from all over the world can trade them, and according to ByteTree data, they now collectively hold 1,045,034 BTC, worth $73 billion.

Bitcoin Held by ETFs

The UK is the latecomer. UK retail investors were allowed to trade Bitcoin ETFs (also referred to as ETPs, ETNs, ETCs), but then, in October 2020, without explanation, the Financial Conduct Authority (FCA) pulled the plug and banned UK retail investors from accessing these products from January.

The UK broking community were overly enthusiastic and even went a stage further by preventing professional investors from accessing these products. The institutional consensus was the Bitcoin “problem” would soon go away, the price would collapse, and they would pat themselves on the back for saving the world. Sadly, the ban was announced when Bitcoin traded at $10,549. Today, the price is $68,070. As Bitcoin grew from strength to strength while surviving crypto scandals that had nothing to do with Bitcoin, there were no heroes left.

With the US finally approving homegrown ETFs in January and Hong Kong in April, the ban was starting to look a little lonely. Many leading financial figures from hedge funds and industry came around in support of Bitcoin, and you no longer hear the doubters calling it a Ponzi Scheme. They still dislike it but have had to find new reasons, as the old ones didn’t work.

The FCA‘s compromise has been to enable Bitcoin ETFs to be listed in London, but only for professional investors. That is underwhelming but good news because at least it means Bitcoin ETFs are no longer in the naughty corner. We can only assume that retail permissions will come in time.

Today, the London Stock Exchange has seen three companies, 21Shares, WisdomTree and Invesco, launch secondary listings from their Swiss or German-domiciled funds. Other companies such as Fidelity, CoinShares, and Global X will follow. Where is BlackRock (iShares), you might well ask?

Bitcoin ETFs on the London Stock Exchange

As I write, not a single trade has gone through because the only people allowed to trade these ETFs can already trade the other Bitcoin ETFs that are well-established in other countries. On the one hand, the FCA allowing Bitcoin ETFs is a big deal because they are a highly influential and globally respected financial regulator. But on the other, there is no money to be made from symbolic gestures.

We are pleased to see these products come to London, as a modest allocation to Bitcoin should be a mainstream idea. Furthermore, to believe the internet and artificial intelligence have a bright future, yet Bitcoin doesn’t, is to misunderstand that they are joined at the hip. As the internet grows, so does Bitcoin.

In the UK, we patiently wait for the FCA to enable retail investors to trade Bitcoin ETFs. They are the simplest and safest way for most private investors to access Bitcoin. And when they do, I believe the global wealth management industry will start to embrace this space. For starters, a 1% Bitcoin allocation will happily sit next to their 3% holding in gold. Naturally, the smart folk will buy the BOLD ETF, which does it for them.

Ethereum

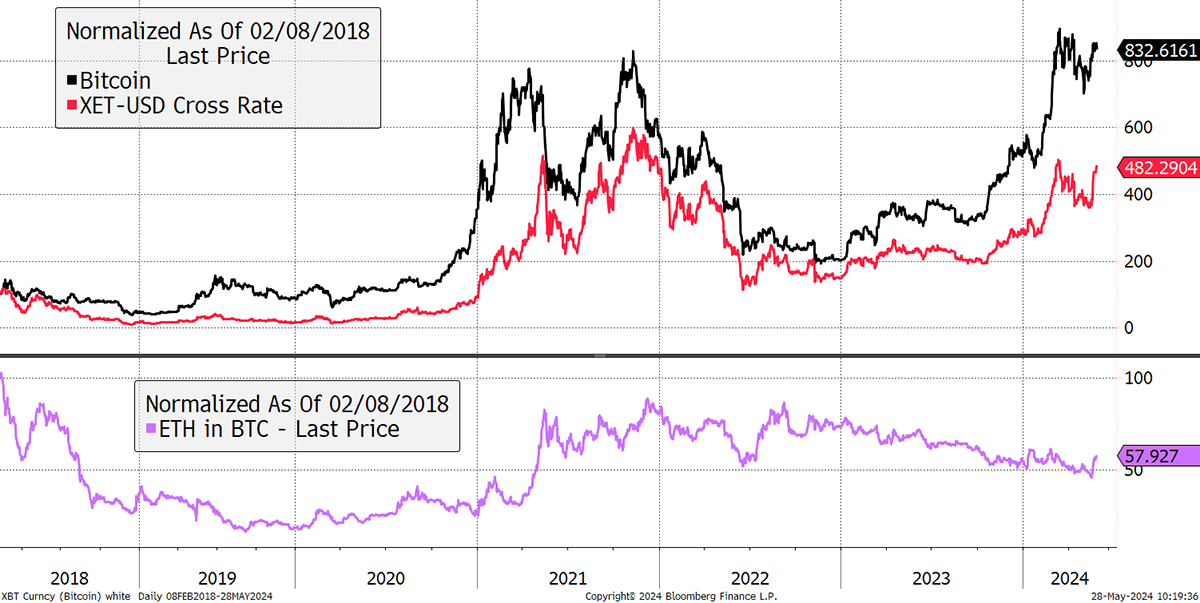

I was asked about Ethereum (ETH) in the recent ByteTree Webinar. ETH has been lagging Bitcoin since 2021 and has not shown leadership in this cycle. The ETF launches in the USA will inevitably cause some excitement, and there’s probably more to look forward to, but we do not believe the underlying Ethereum Network is growing sufficiently to warrant a medium to long-term investment that will outperform Bitcoin. After six years, and despite being at the heart of many trends such as NFTs, DeFi, tokenisation, and so on, it has done half as well as BTC (purple).

Bitcoin vs Ethereum

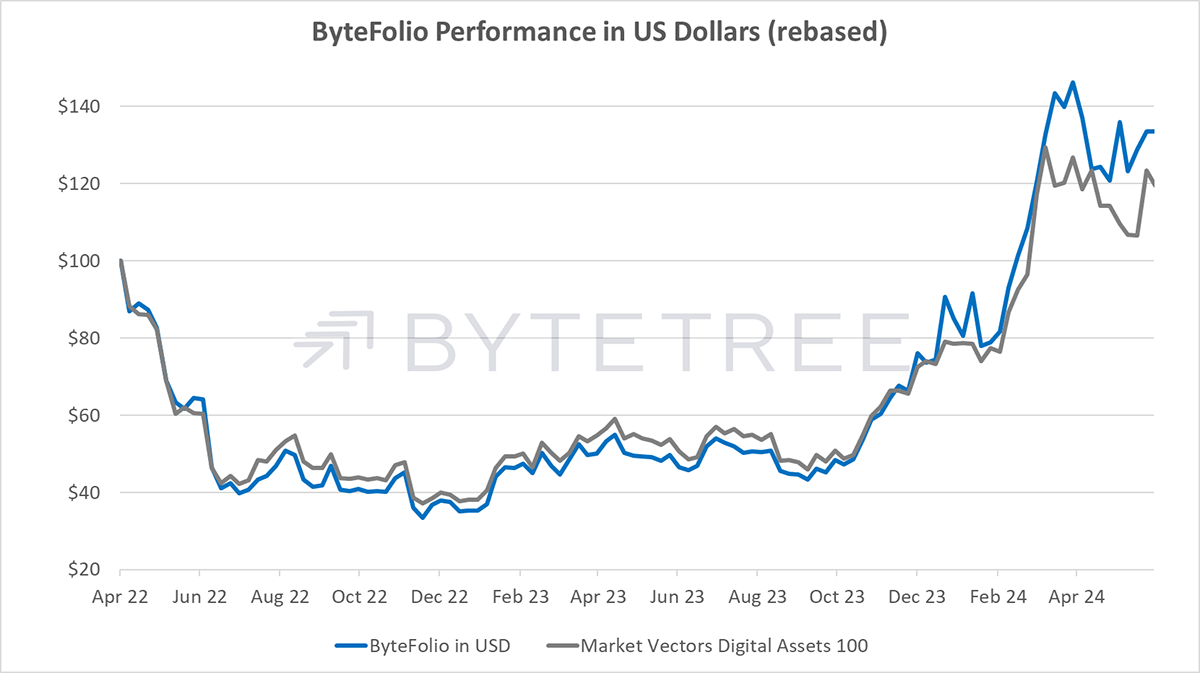

That said, the index we compare ourselves to holds ETH, and we do not, hence we have missed out on the ETH-ETF launch buzz. It may fizzle out soon.

ByteFolio Performance in USD

We believe we have the tokens that will challenge ETH over the long term.