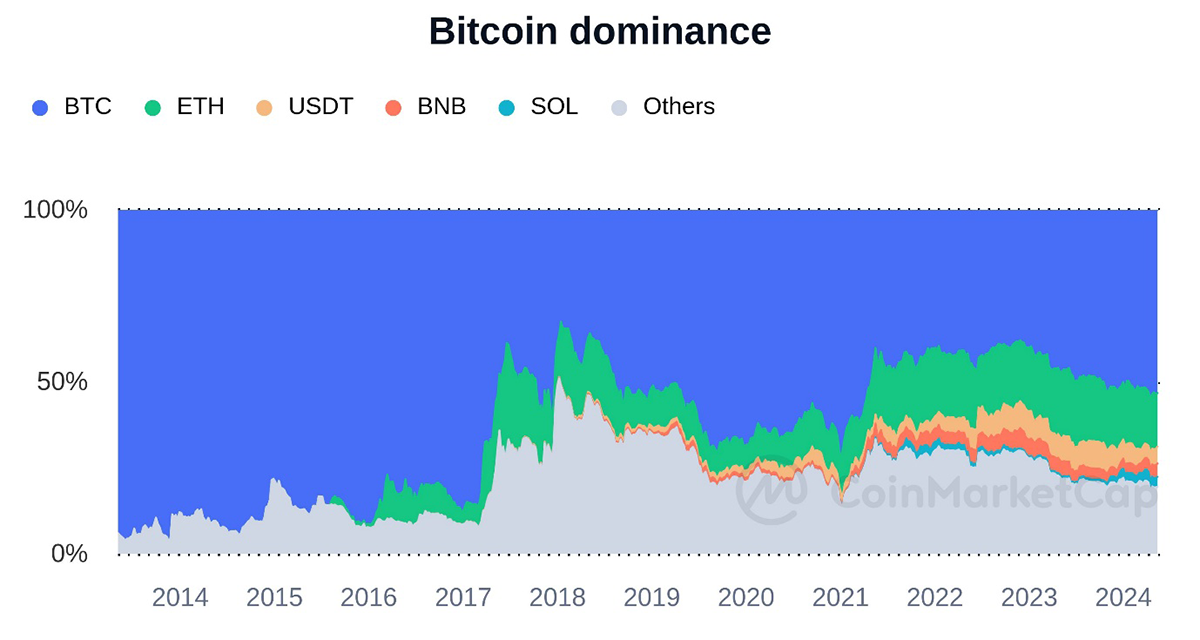

Bitcoin Dominance

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio Issue 107;

Many find it surprising that Ethereum (ETH in blue) has continued underperforming Bitcoin this cycle. There was a relative high in late 2021 (red), but that was below the levels seen in 2018. Bitcoin has done more than twice as well as ETH over the past 6.5 years.

Bitcoin and Ethereum

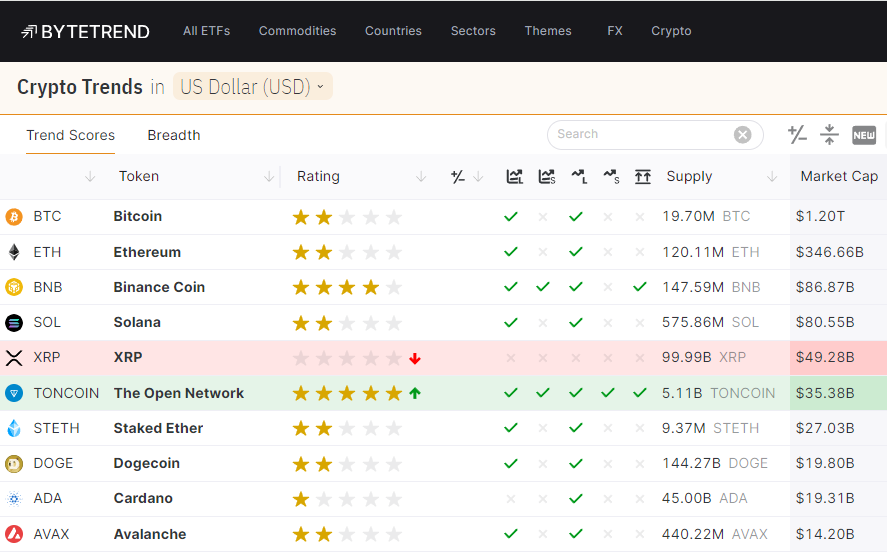

ETH remains number 2 in the space by size, but that gap is widening as the network activity shows zero growth. Number 3 is Binance Coin (BNB), which has also seen deterioration in the network traffic. The difference between Bitcoin and the rest of the pack is significant, and it is maintaining steady traffic.

Crypto Token Trends in USD

Bitcoin dominance tells the story. In 2009, there was only Bitcoin, so it dominated crypto with a 100% share. After the 2017 bull market, Bitcoin dominance troughed at 36%, while ETH was riding high. It has since surged to 53% with a $1.2 trillion valuation. ETH, SOL and BNB make up around 20% of the rest of the market, with 5% in stablecoins. The other thousands of tokens comprise less than 20% of the crypto market.

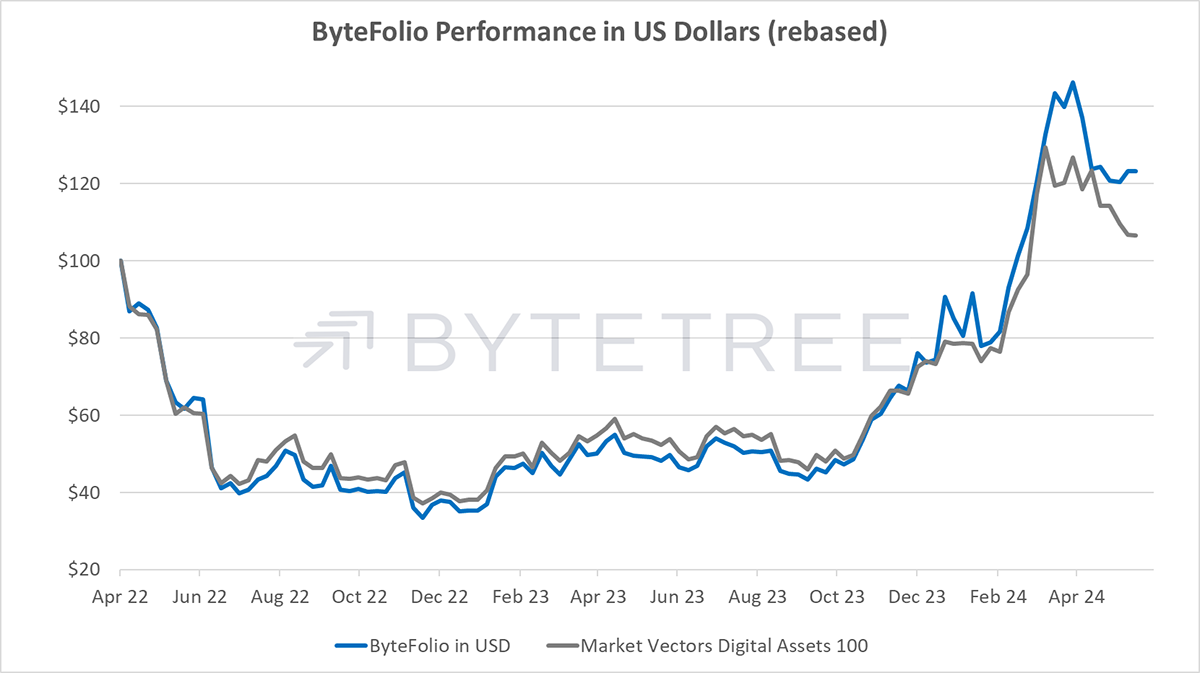

I am pleased with the portfolio performance because, as I recently showed, breadth remains weak, meaning it has been hard to outwit Bitcoin in this cycle. It is pleasing to see that ByteFolio is moving ahead of the pack and has recently proved to be more resilient. That has been our aim, to identify the winning and most credible projects and leave the rest behind.

ByteFolio Performance in USD

But we need the altcoins to perform, and while some of our holdings are punching above their weight, the market remains firmly behind Bitcoin. This week, our Bitcoin exposure increases once again.