Before Bitcoin, We Had Silver

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio Issue 108;

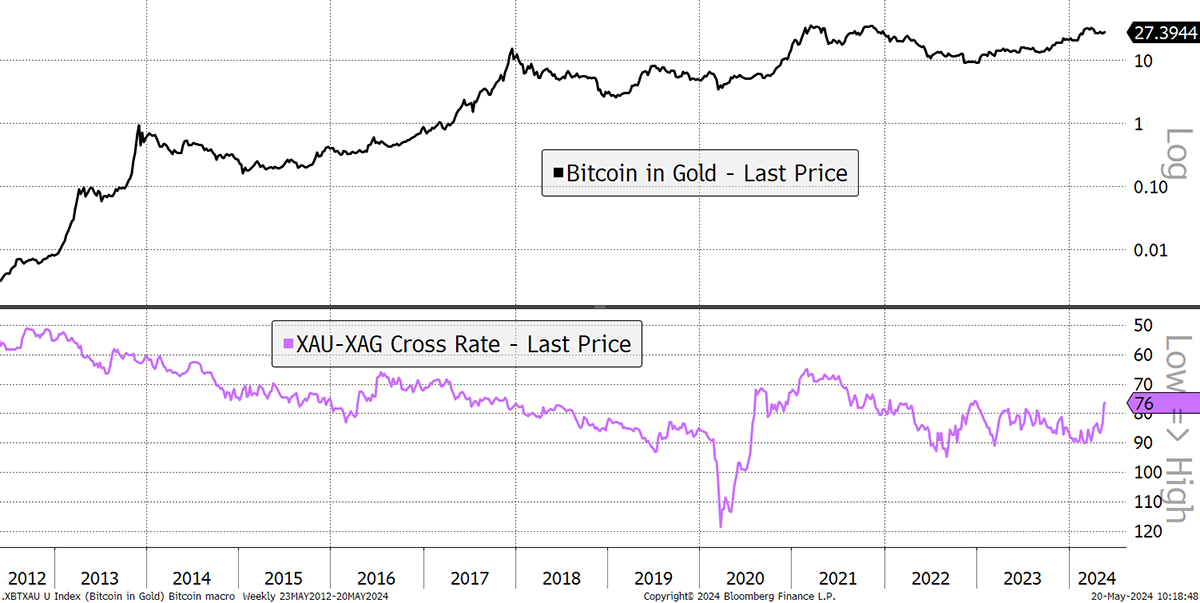

I couldn’t help but notice the BTC Silver (XAG) pair emerging in recent days. It’s an interesting development because pre-Bitcoin, silver was the asset of choice for those forecasting the end of the dollar and debasement. But, as Bitcoin grew in size and credibility, rising from 1/100th of a gold ounce to 30 ounces, silver got left behind.

Bitcoin and Silver in Gold

Over the past couple of weeks, silver has rallied 21%, even beating Bitcoin despite the high correlation. Naturally, correlations come and go, but this one is interesting because crypto and commodities seem to be in sync.

Bitcoin and Silver

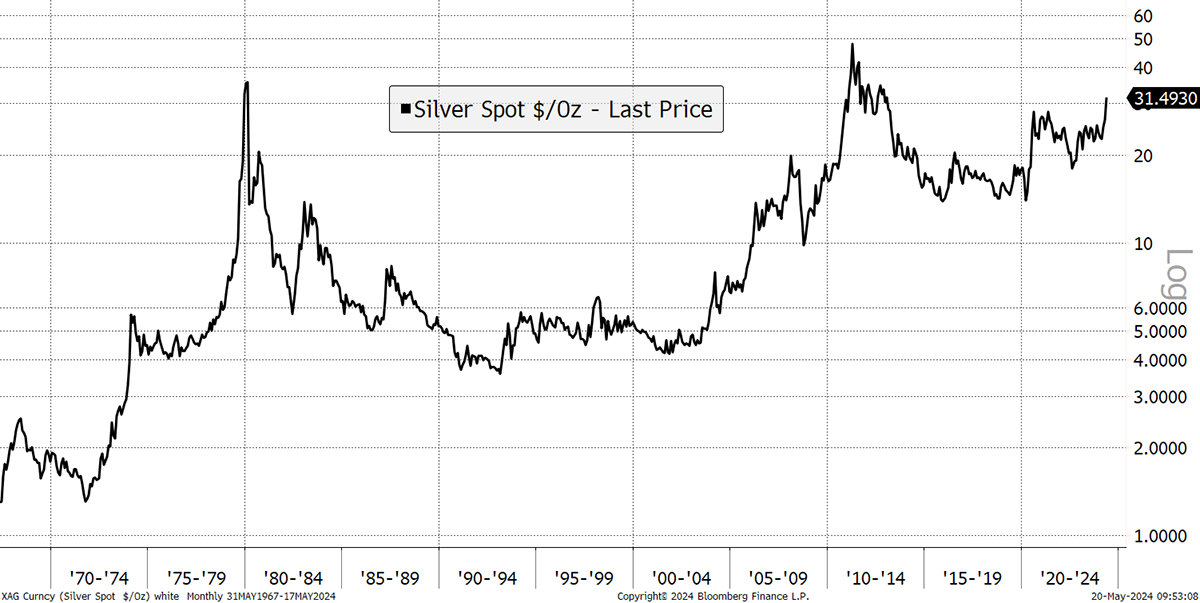

In the long term, this is an important moment for silver because it has broken out above $30/ounce, which is a ten-year high. Silver has tested $50 twice, in 1980 and 2011. The bulls, including myself, see $50 being retested. But is silver breaking out to an all-time high? We will have to wait and see.

Silver Long-Term

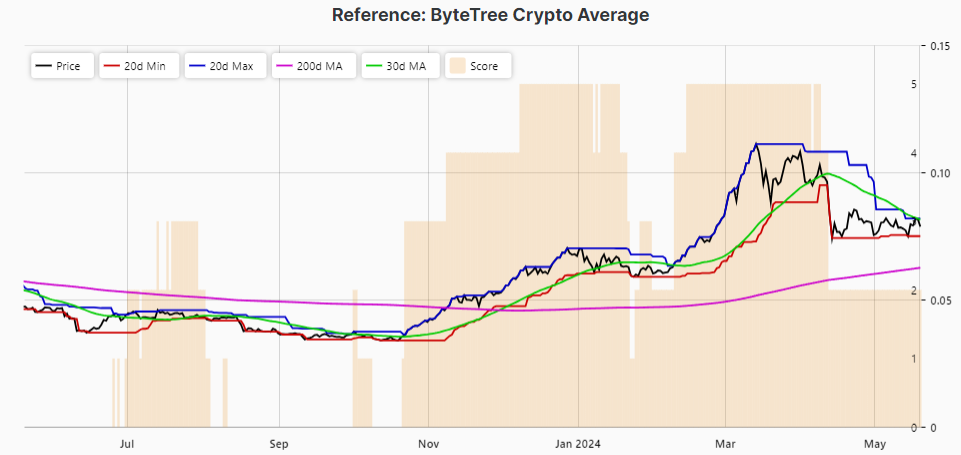

It’s relevant because crypto breadth remains weak, as shown by the cooled ByteTree Crypto Average (BCA). Few tokens are performing, and even Bitcoin has seen a slowdown in ETF flows.

ByteTree Crypto Average (BCA)

I stand by my Bitcoin predictions in the last issue of ATOMIC. That is Bitcoin will compound at 25% IRR this cycle into 2028, and the breakout will likely come in October, or Uptober. That was the case in the last two halving cycles when we had to wait post-halving for the next bout of strength.

The market has swung to commodities, and it’s silver’s turn. What should crypto investors do in the meantime? Remain patient.

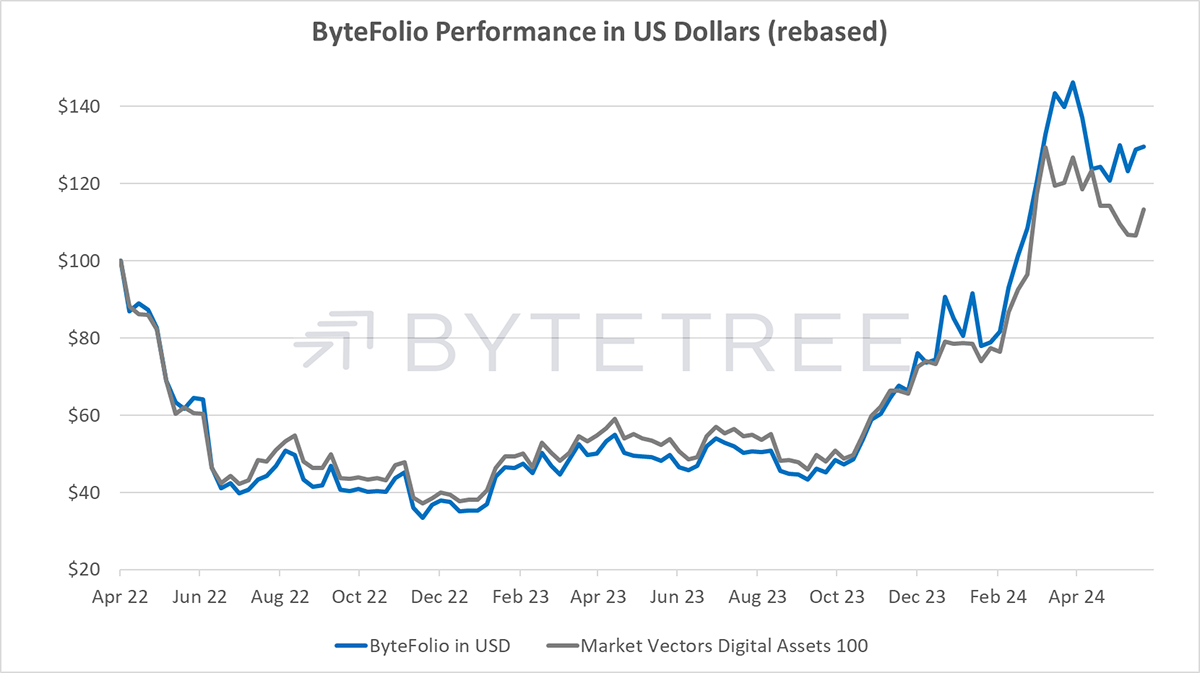

ByteFolio Performance in USD

ByteFolio will be delayed next week due to the May Bank holiday in the UK. It will be published on Tuesday.