Rising Conflict and Sinking Bonds

The Middle East is on the brink, and retaliatory attacks may lead to escalation of the conflict. Normally, we would see a flight to quality into US treasuries. That hasn’t happened, which indicates what we have suspected for a long time: that they are no longer the high-quality investments they once were. One reason is the resurgence of inflation, and the other is the simple fact that government spending is out of control. From an investor’s perspective, the chances of being repaid in full, in real terms, are diminishing.

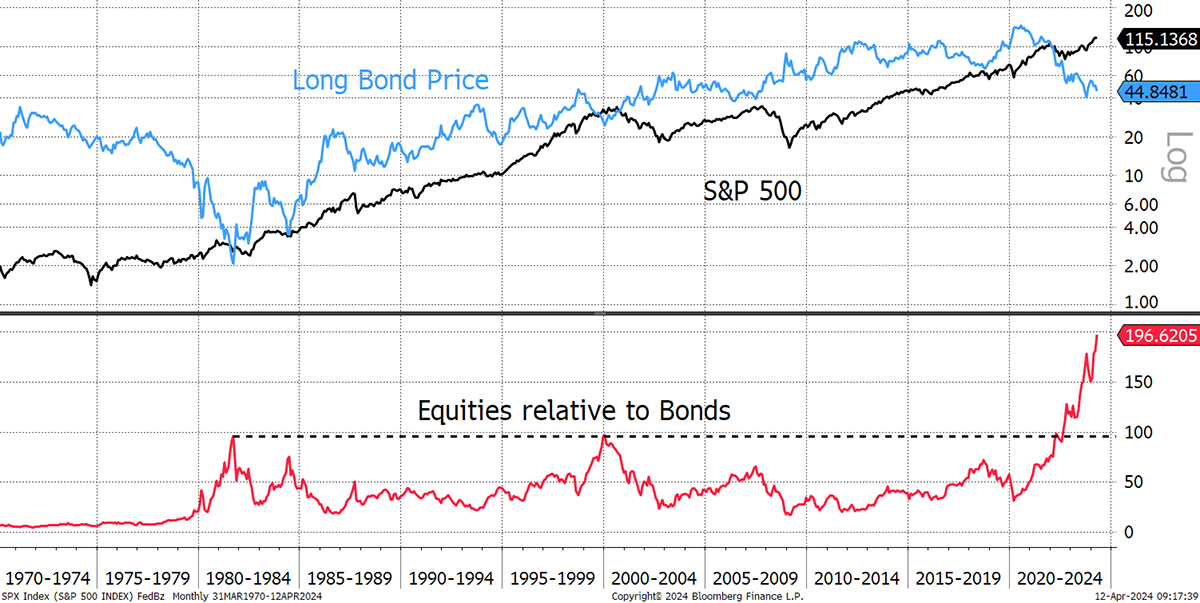

The beneficiaries have been the dollar, gold, oil, and other industrial commodities. The reaction in the short term may be knee-jerk, but it is time to drag out this chart again. It reminds us that equities and bonds are in competition, and if bonds are cheapening, at some point, equities will follow.

Bonds Still Falling

Much of the market rally since the autumn of 2022 has coincided with a stall in the bond market’s decline. I suspect that if bonds fall much further, equities will be dragged down, just as they were back in 2022. An old economy portfolio, such as ours, ought to prove more resilient than the index, but you can never be certain that you’ll be fully insulated.

Nevertheless, the portfolios are feeling the pull from strength in precious metals, industry, commodities and energy, which is good news, but I never get complacent. There are always the unknowns. Sometimes, there’s no news at all, and the market just feels it’s time to pull back.

The portfolios have started to run, which is good news, but things are starting to go wrong elsewhere. For example, the world’s most valuable company, Apple (AAPL), is increasingly being regarded as ex-growth, and we have just had proof as Samsung (5930 Korea) has just overtaken the iPhone in unit sales. As investors tire of the big tech stocks, which is inevitable, the stockmarket, as measured by the mainstream indices such as the S&P 500, may start to give way.

There is also the fact that equities have run hard for 18 months while bonds have stalled, making the relative attraction favour bonds. But in absolute terms, and with inflation rising again, they may have further to fall, and that’s what makes things difficult. Might we see falls in both?

We have done some good trades in recent months, and I very much hope we are well-positioned for the next phase of the market. That is to provide resilience first, and capital growth second. Keep doing that, and the long-term results will be spectacular.

Most importantly, let’s hope for calmer times in geopolitics.

Action

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd