Japan Ends ZIRP

Following years of zero interest rates, the BoJ governor, Kazuo Ueda, has ended this policy. It is a clear signal that the deflationary forces unleashed after the Japanese asset bubble in 1990 are finally over.

But don’t get excited just yet. Things are moving slowly, and this announcement has been well-flagged and is largely symbolic. Interest rates will remain in the 0% to 0.1% range for the time being. Yet, it is a very big deal because it provides further evidence, in case we needed it, that the pre-pandemic era of cheap money is over.

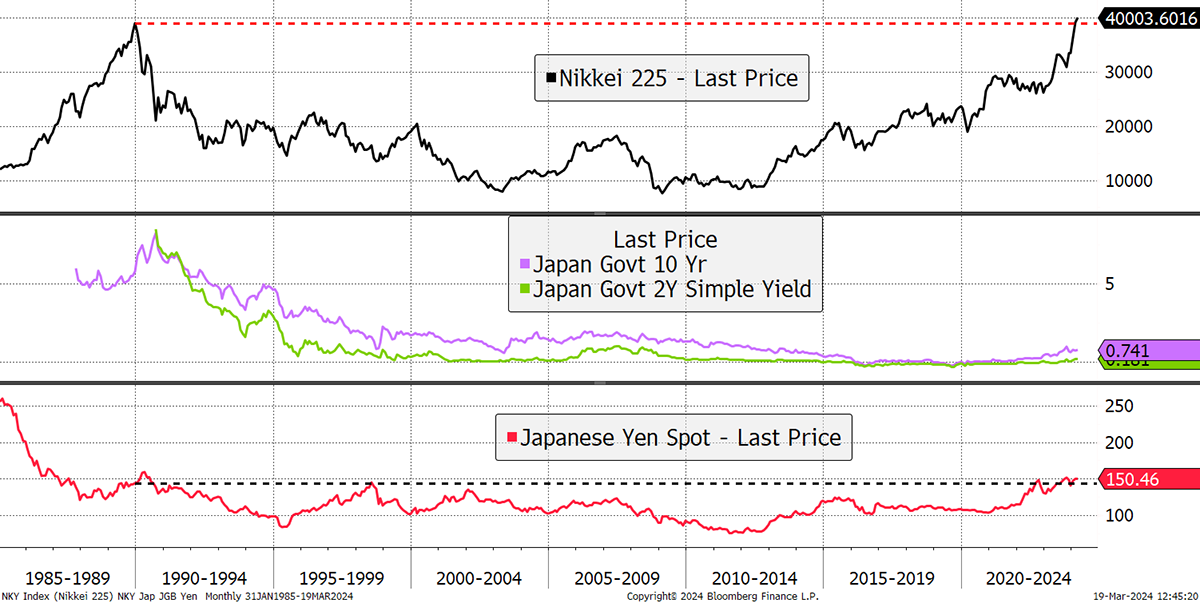

To remind you, the Nikkei touched 38,915 on New Year’s Eve 1989 and only recently managed to surpass that. It has been one hell of a wait, and I covered the Nikkei in the post box recently.

Japanese Financial Markets

The Nikkei wasn’t the only thing to register the same level 34 years later, but the yen too. During the bust, inflation was, on occasion, negative, and the yen surged against the dollar. The other observation is that 2-year bond yields (green) were zero most of the time, and the 10-year was close behind. The post-pandemic change is that the bond yields have risen with the stockmarket while the yen has fallen. Naturally, these events are closely linked.

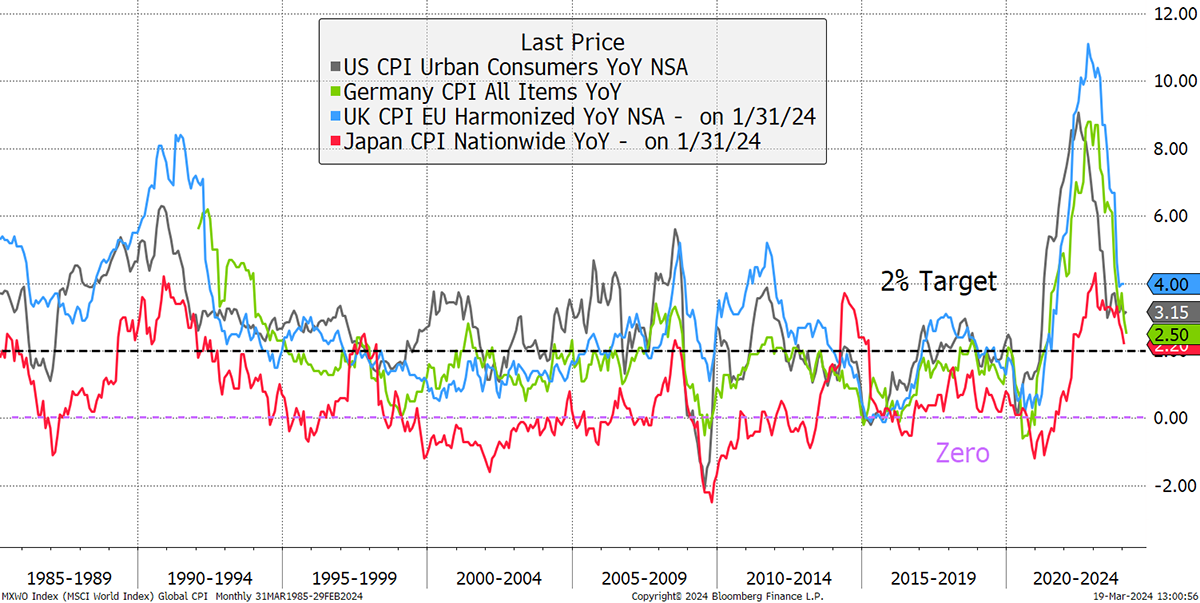

The change in inflation lies at the heart of this. The pre-1990 boom was so excessive that it took over three decades to get prices moving again, and that includes the price of land. I show CPI inflation for the USA, Germany, the UK, and Japan. Notice how the Japanese economy stood out. There was rarely inflation, and when it came, it was short-lived. After 1995, there was more time in deflation than inflation. In contrast, the other countries averaged 2%. This time may be different.

Global Inflation

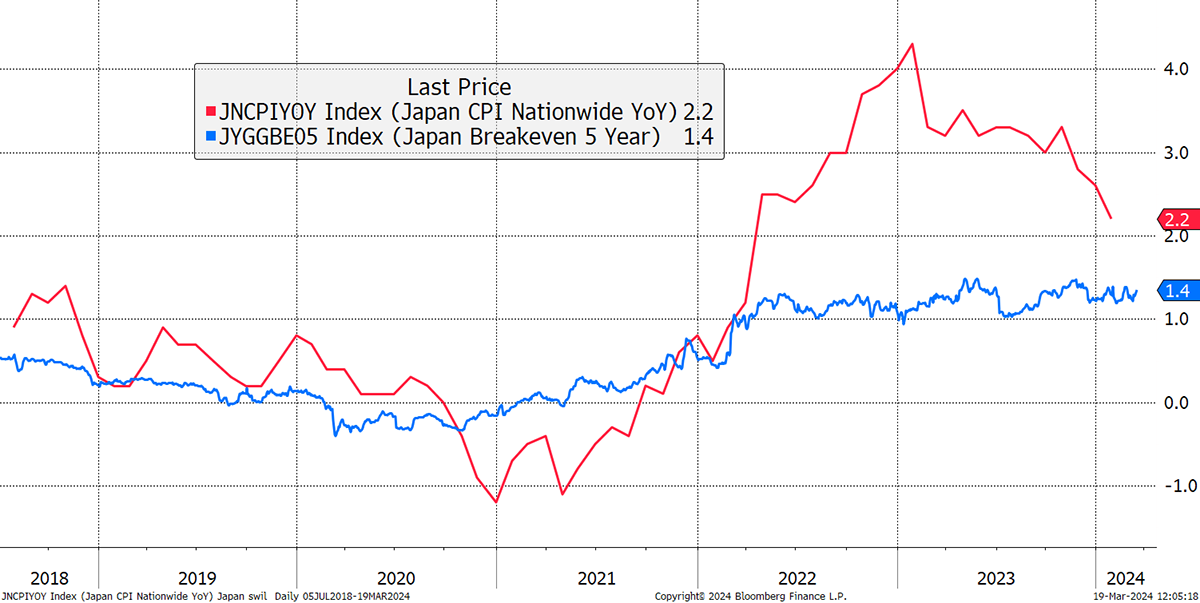

Whenever you see “this time is different” in finance, it is normally meant as a joke (because it rarely is). But sometimes it is different, which is the other joke. This time, we are seeing that five-year inflation expectations have stabilised at 1.4%. This contrasts sharply with the low and negative levels seen before the pandemic, suggesting something structural has changed.

Japanese Inflation Expectations Have Cooled

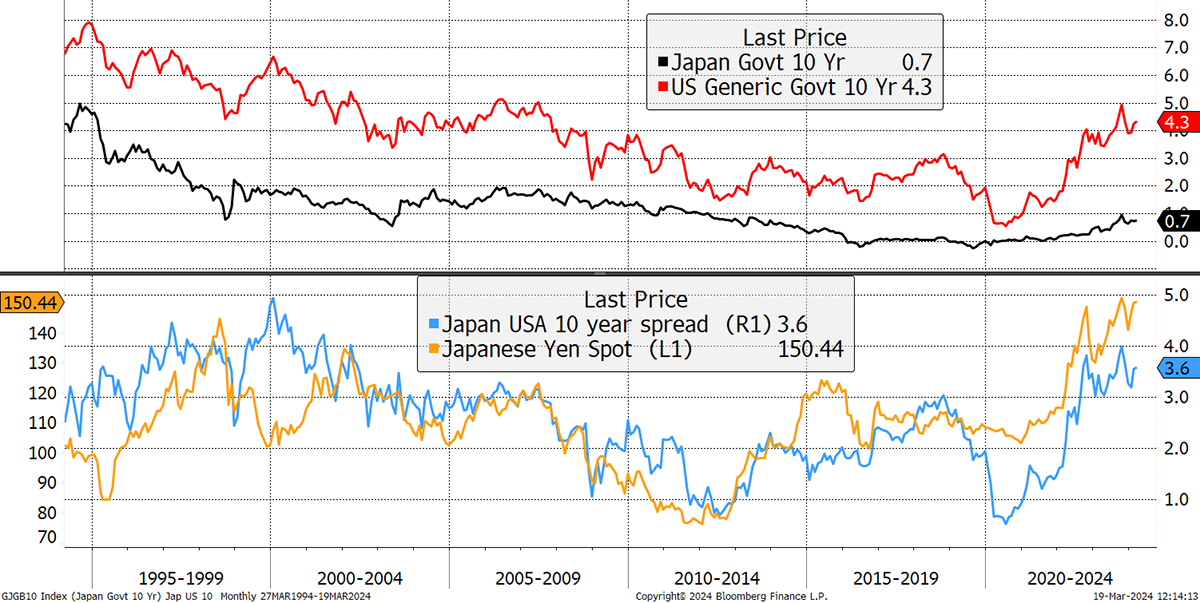

Higher inflation means higher bond yields, which challenges the idea that the yen is a perpetual funding currency. That is a currency which investors borrow cheaply to invest elsewhere in search of higher returns. That investment doesn’t have to be physical; it can simply be a deposit in a country with higher rates.

This is the point because Japan has provided the world with cheap capital for a very long time, and soon it might be taken away. We can’t be sure what this means, but it is a form of tightening, and so has risks attached.

I show the 10-year JGB and US yields in black and red, respectively, in the chart below. In the bottom half of the chart, I show the JPY-USD rate, with the difference between those rates. It’s a fit. The yen vs dollar exchange rate has largely been driven by the interest rate gap. In 2008, when US rates collapsed, the yen surged. Now that Japanese rates are likely to keep on rising at a faster rate than the rest of the world, the yen may start to see strength. High time.

Dollar Yen and Interest Rate Differentials

I had felt this relationship would close months ago. In July 2022, I recommended the yen for portfolio protection (or hedge), having felt the selloff was overdone. Yet it carried on, in part because the yen fell slightly against the dollar, but more importantly, because the pound has performed well since the Truss/Kwarteng budget.

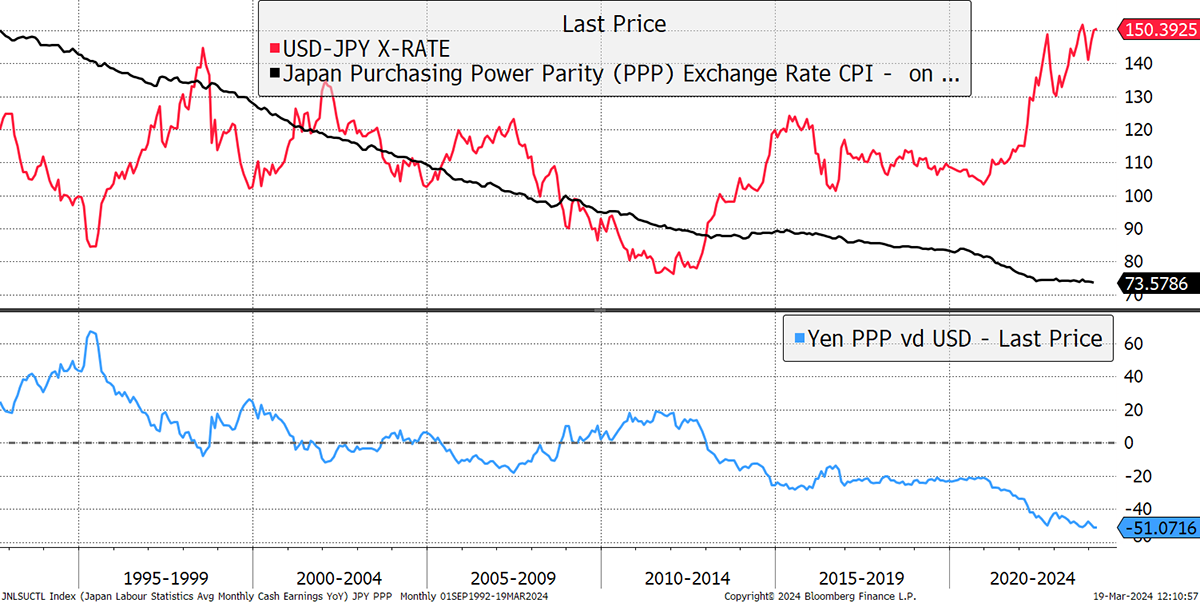

I reiterate that the yen is extraordinarily undervalued. If you wanted evidence on the ground, tourism is booming, especially with Chinese visitors, because they know a bargain when they see one. The purchasing power parity (PPP) compounds the differences in inflation over time. It tells us that a dollar of value will go twice as far in Japan than in the USA.

Purchasing Power and the Yen

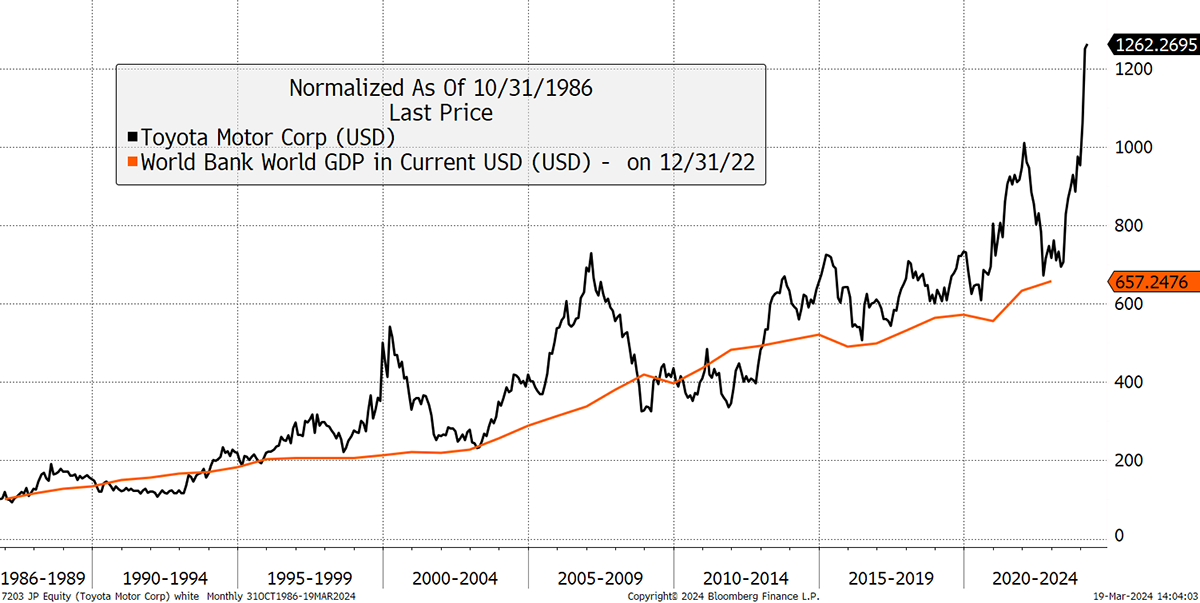

For reference, the pound is currently 3% dear, and the euro 10% cheap on the same basis. The undervaluation of the yen is extreme and, I believe, unparalleled for a developed country. The cheap yen has caused the stockmarket to surge, primarily in export markets. An example of that would be Toyota (7203), which today trades on its highest price-to-sales ratio in decades. I can illustrate that with Toyota against global GDP in USD.

Toyota Is Riding High

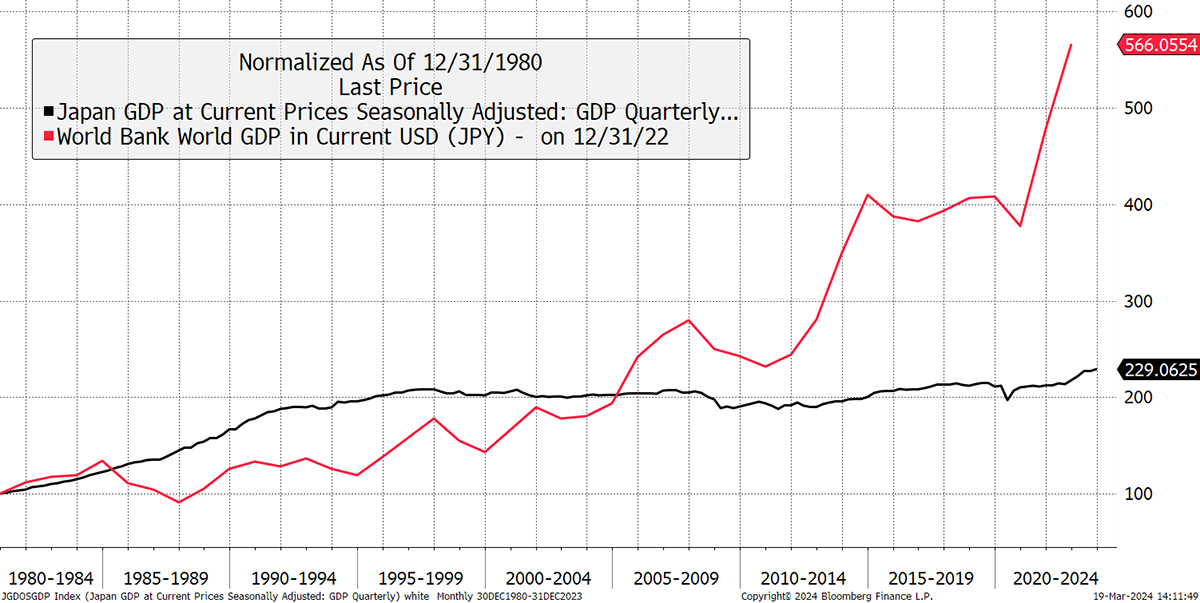

Japanese equity valuations are mixed. Companies such as Toyota and other leading manufacturers are fully valued, yet other sectors are in a very different place. To understand this, it is worth going back to the beginning and comparing Japan’s economy with the rest of the world. I show that in yen.

Japanese Growth Has Lagged the World

See how Japan outgrew the world in the 1980s and has completely stalled since 1995. It looks like it has picked up, but that is in weak yen. I now show the banks, which, despite some international operations, are largely domestic businesses.

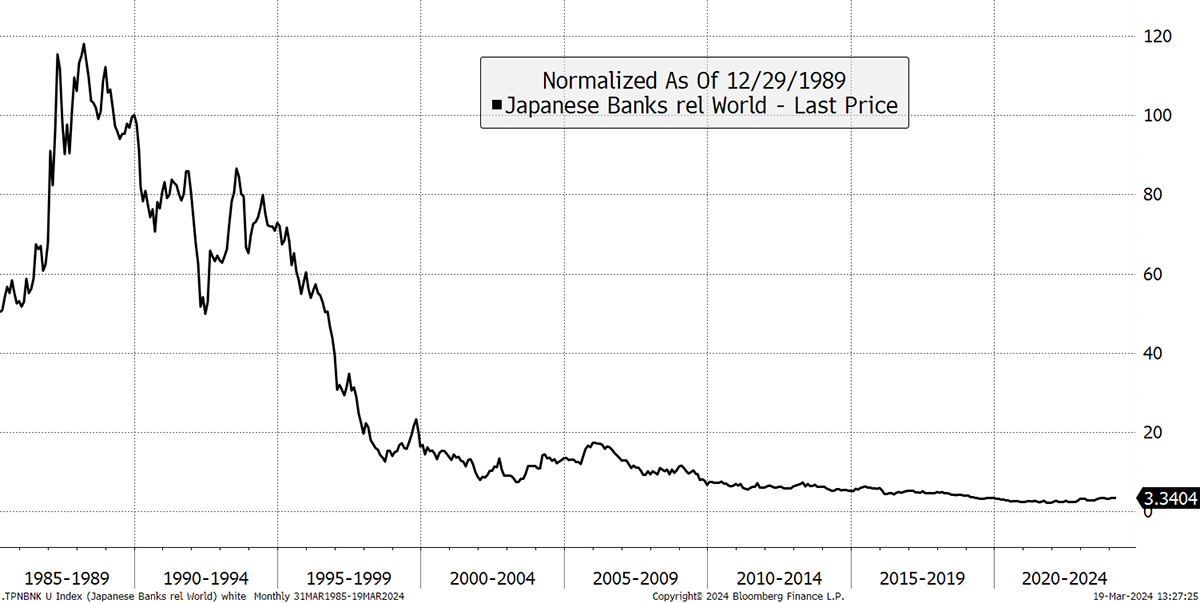

I have rebased the Japanese Banks Index to 100 in 1989 when the Nikkei peaked. Had you invested in global equities, you’d have turned $100 into around $1,200. In the Japanese banks, that would be $37, over a 34-year period. They have lagged the World index by 96.7%.

Japanese Banks Relative to the World

These banks have extraordinarily strong balance sheets, with deposits vastly outstripping their loans. It’s a bit like the situation I showed with the banks in Europe. The exit from zero rates has seen profitability return, and this will likely continue.

There are other things to discuss in Japan, such as the ageing population and the renewed role as the Asian manufacturing hub for the West as China falls foul. But what is most interesting is that Japan is an extremely wealthy nation that experienced probably the greatest asset price bubble of all time. The exit has taken its toll, but only the Japanese could have done it so rationally, persistently, and calmly.

I can’t be sure what the outcome will be except it will drive change in financial markets. Higher yields are coming, but probably slowly. The bond market is still highly priced, and so best avoided. The yen is still underpriced and is a safe haven should things turn sour. The stockmarket’s all-time high is a direct result of the cheap yen, along with the tourist boom.

I do not see a need to change our position, but the end of Japan’s zero-interest rate policy is something we need to be aware of. It might be an opportunity for us to buy domestic assets, or it may lead to macro mayhem as the world’s funding currency demands to be repaid.

Let the interesting times continue.

Action

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2024 Crypto Composite Ltd