Brazil Update

The Brazilian stockmarket has been one of my highest conviction ideas. I am not just talking about today, but back in 2003. Back then Brazilian equities were dirt cheap, and under-owned. The Asian crisis of 1998, which morphed into an emerging markets crisis, kept investors away. I can even recall our recommended exposure at the firm where I world, being zero. That wasn’t before the fall, but afterwards.

Emerging markets comprise 80% of the world’s people, land mass, and natural resources, yet don’t bother, said the strategist. Not only that, but they were also dirt cheap, and a commodity bull market was forthcoming. He couldn’t have been more wrong. Emerging markets beat the world until 2011, and Brazil was out in front. In simple terms, the Bovespa beat the world eight-fold.

Brazil in the Lead

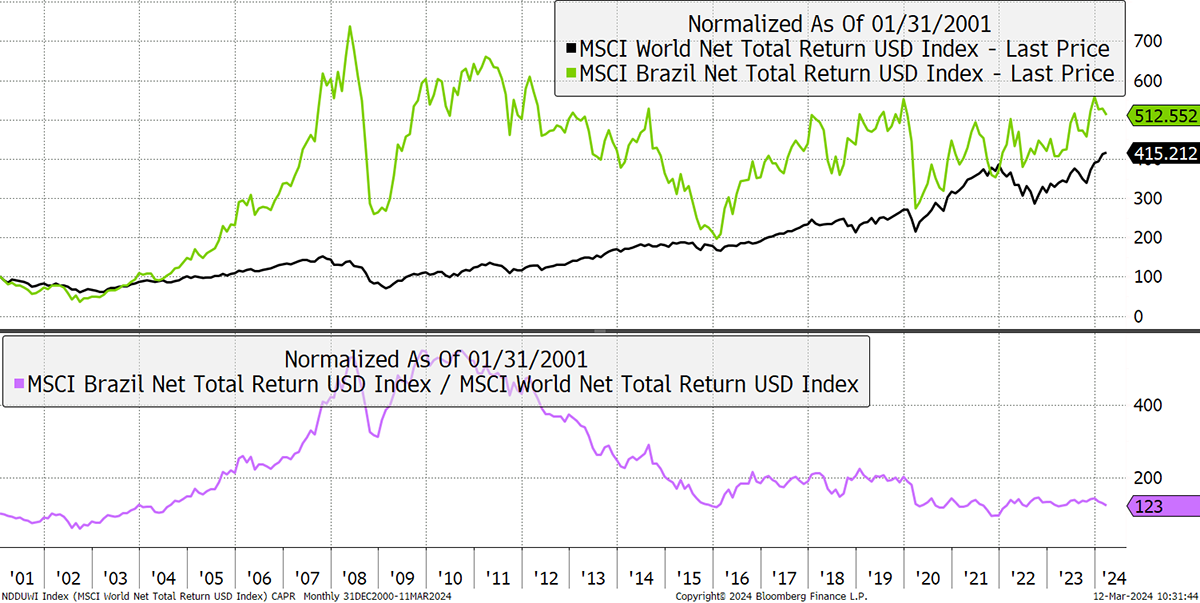

The Bovespa Index data goes back to the early 1990s, but it doesn’t tell the whole story. There were also dividends, and lots of them. Using total return data and comparing it to the world, we get a more precise picture of the fate of Brazilian equities. When you add those dividends back in, you realise it was more of a matter of the rest of the world catching back up than Brazil going backwards. Such was the outperformance in an era of heightened commodity demand.

Brazil vs the World Total Return

That is encouraging because a broken economy doesn’t look like this. Despite all the success of technology dominating the world index these days, Brazil is still 23% ahead since 2001. Bringing in more countries and regions, it’s quite the picture. The USA is in second place, just behind Latin America. You can see why I like it. /

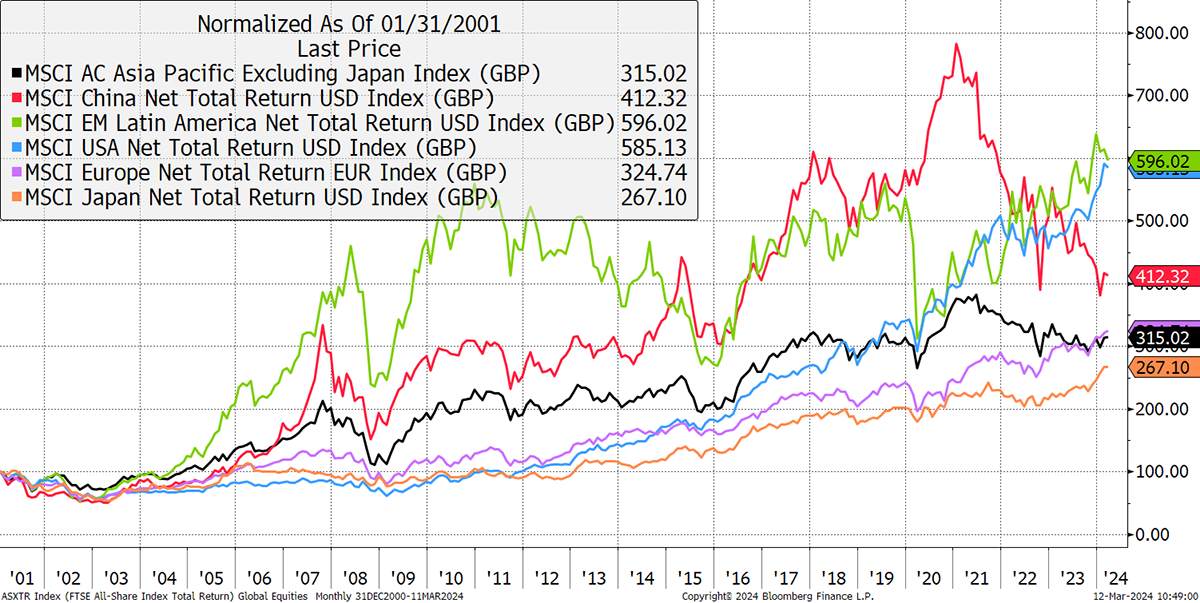

Global Equity Returns

In case you are wondering, the UK and Europe are twins, so there is no need to show both. They are ahead of Asia and Japan, but only slightly. It is also interesting to see how China surged and collapsed. You have probably seen different indices showing much worse performance from China. The MSCI China Index includes the China-US listed technology stocks such as Tencent (700 HK), Alibaba (BABA US) and PDD (PDD US).

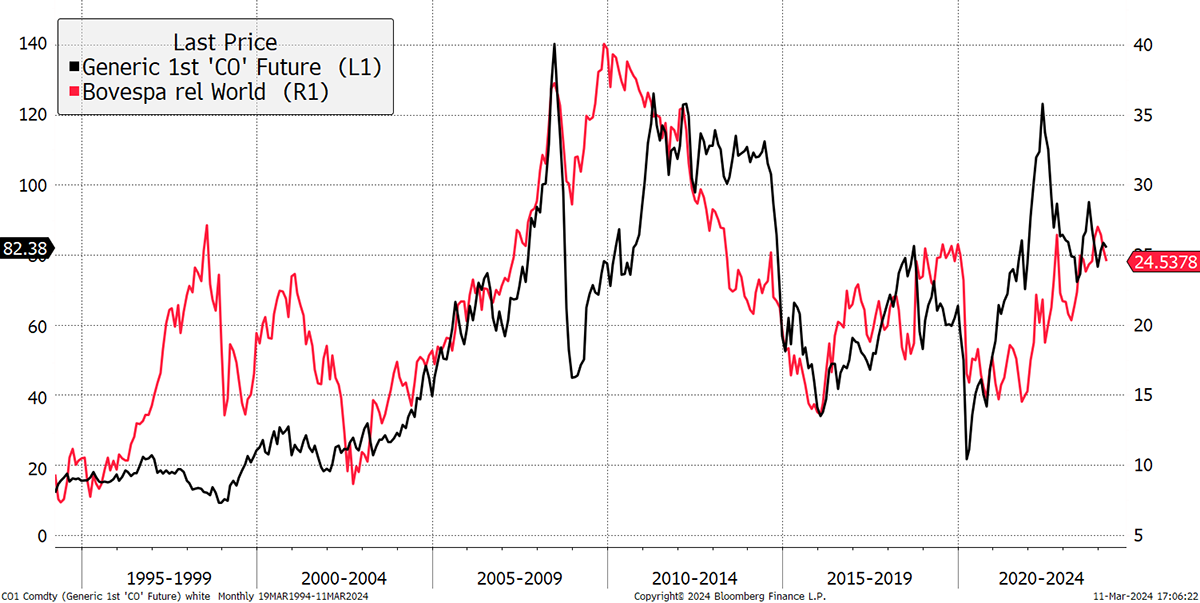

The bottom line is that Latin America is an underappreciated star, and when I sensed it had turned the corner in 2022, I felt the portfolios should be exposed. The local market is impressive, and companies like Embraer are world leaders in the aircraft industry. But when it comes down to it, Brazil is a commodity producer, and the financial markets respond to commodity prices. I show the relative performance of the Bovespa, along with the oil price.

Brazil and Oil

The state oil company, Petrobras, makes up around 16% of the index and reported last week. There was a lower-than-expected dividend payment as the company embraced the green transition by presidential order. The market knocked the shares down by 17%, which explains the downward move in the index and the currency.

I would say that most governments are embracing the green transition, and what President Lula has just done, is nothing compared to what the UK prime minister did to the oil and gas companies operating in the North Sea, where profits were super taxed. Moreover, Petrobras claim they will not “do a crazy energy transition” and will be one of the last oil companies standing.

Lula presided over the bull market between 2003 and 2008, and I don’t think we should be too worried at this point. But my confidence on this relatively high conviction trade, represented in both portfolios, might be tempered if the situation gets any worse, or a better opportunity arises.

I had expected Brazil, and the region, to deliver superior results. I am hoping the market reaction is overdone, and for the time being, no action. I shall be following events closely.

Action

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority. https://register.fca.org.uk/

© 2024 Crypto Composite Ltd