ETH ETF

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio Issue 90;

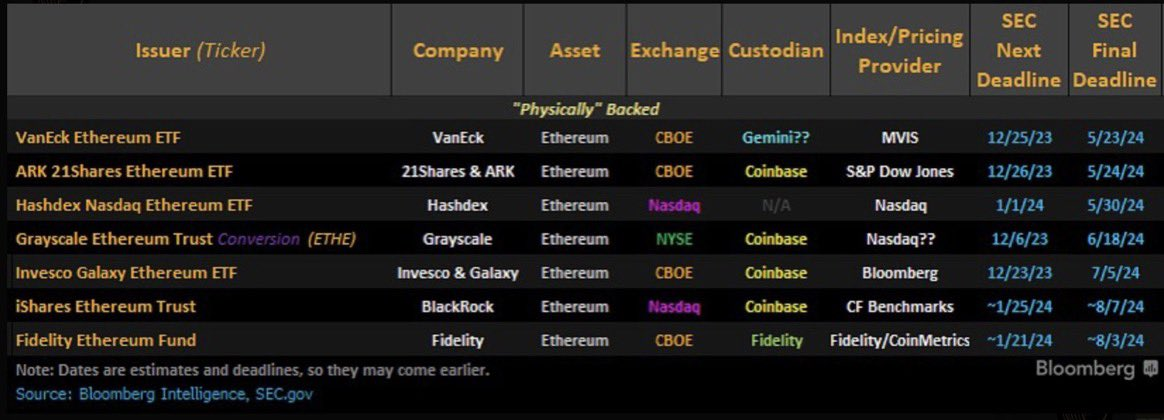

Now the US has joined in with bitcoin ETFs, the focus shifts to Ethereum. It is a simple idea, and the applications with the SEC are underway. Given approval has been given to bitcoin, it’s just a matter of time before ETH gets an ETF. It’s alphabet soup.

Ethereum ETF Filings

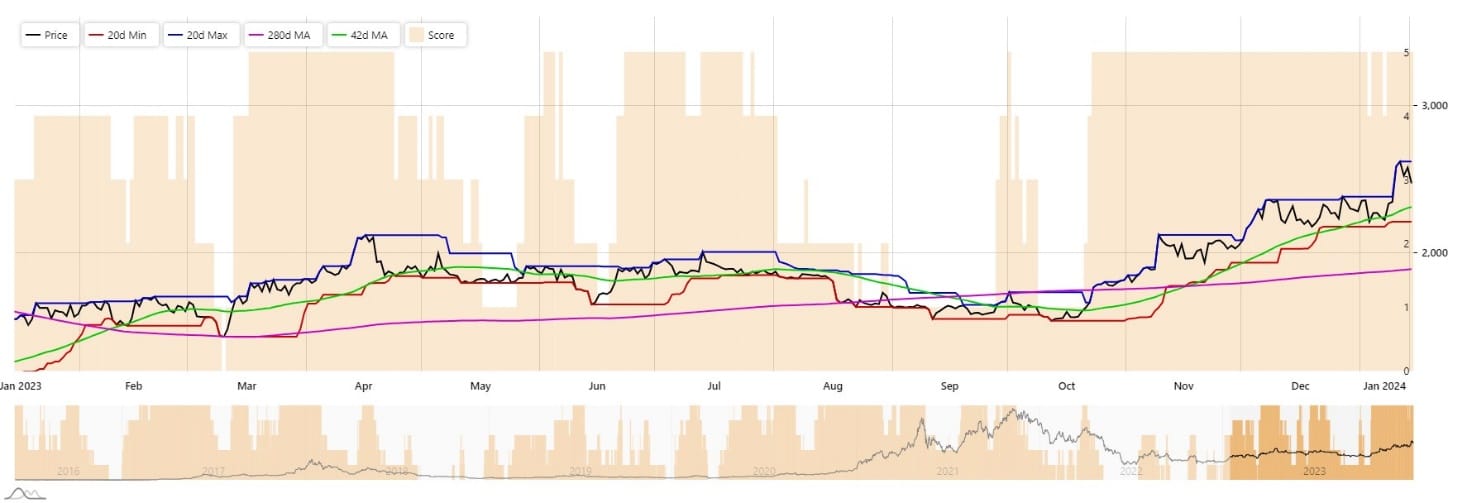

While ETH has been lagging the crypto market, especially bitcoin, there’s no question it remains in an uptrend. The price pop came about as the bitcoin ETFs were approved.

ETH in USD – 5-star

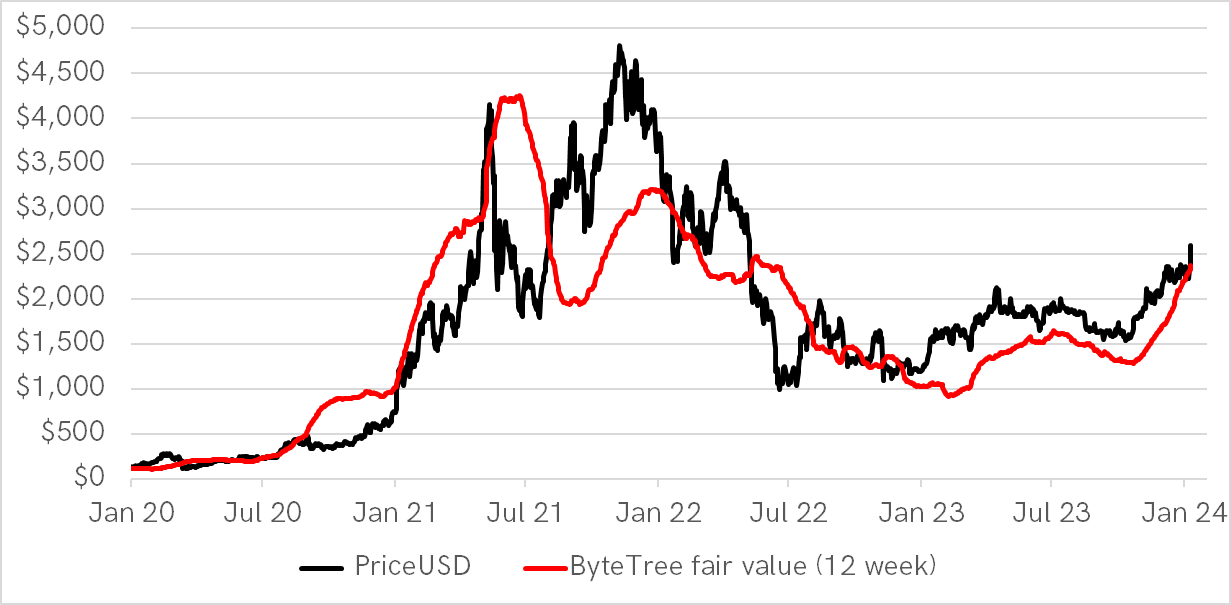

Looking at the ETH network, it’s in bullish mode and trading close to fair value, which is appealing. The chart shows the ETH price compared to the value of dollar transactional activity (calibrated). Not only is ETH back in growth mode, but it’s in line with fair value.

ETH Network is Growing with Price at Fair Value

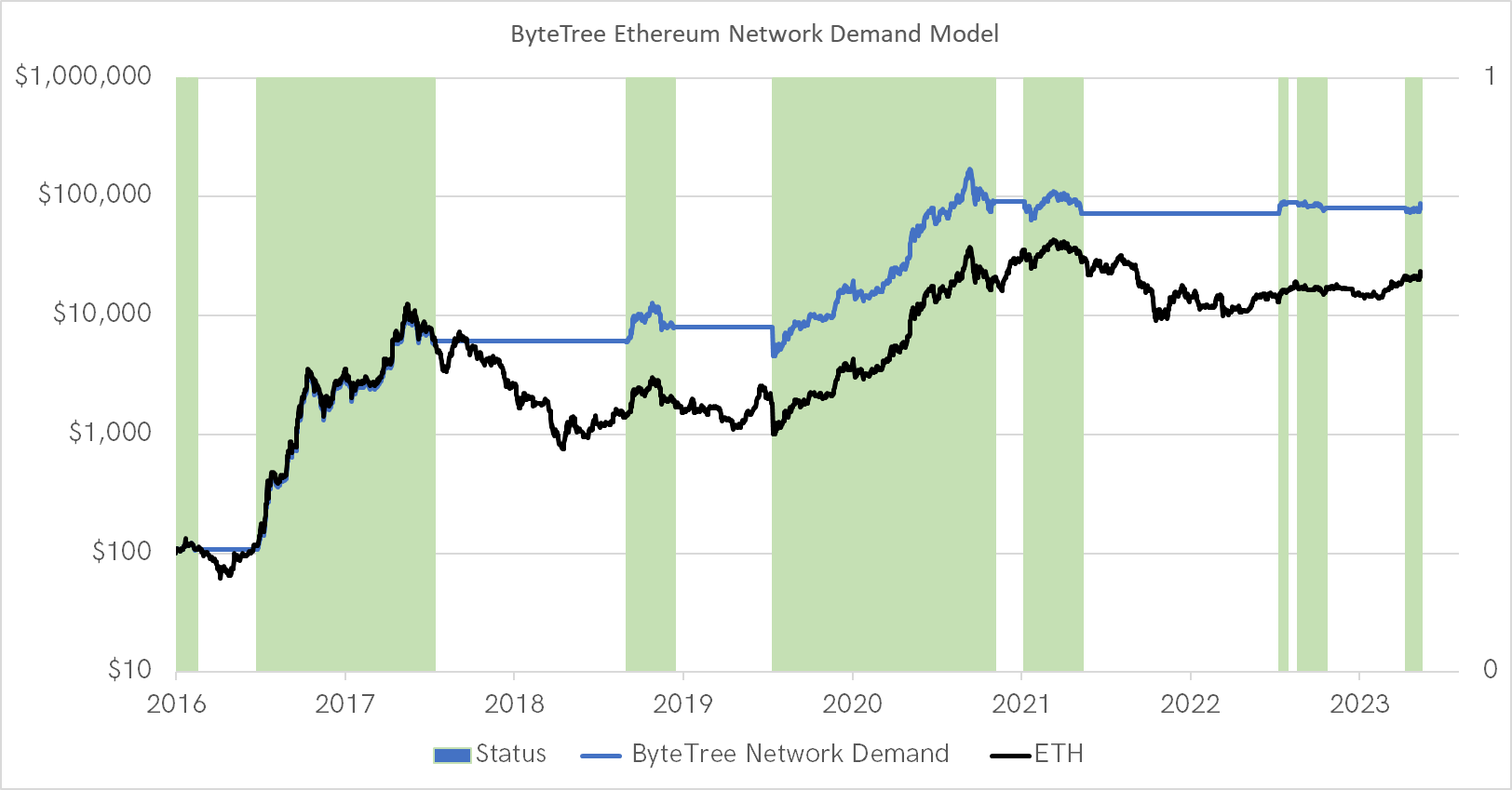

And the ETH network demand model, which we use to value and assess the state of bitcoin in ATOMIC, is back in good health. The blue line shows what happens if you only go long when the network is healthy. It goes long when the network is healthy and sits in cash at other times. It works well. The outperformance seen is on a log scale. 8x!

We don’t need to add ETH at this point, but it’s something we are investigating. My problem with it is that the network value is too big to outperform bitcoin for sustained periods. If you believe ETH will not overtake bitcoin, it can only tag along. I could be wrong about that, but I don’t think so.

Moreover, we are pleased with the portfolio as it stands and feel close to having the optimised basket to benefit from this crypto bull market.