2024 - All About Rates

The final score for 2023 sees Soda scrape a small positive +0.5%, and Whisky a more credible +14%. Soda caught a gust in the last few weeks of the year, avoiding a negative result. Fortunately, the long-term record remains highly respectable. I shall write a performance note for all ByteTree portfolios on Friday.

I hope you had a good break. I find the Christmas pause a useful time to reflect on the year ahead. The current consensus view is that inflation is under control, the economy will slow (not crash), and interest rates will be cut.

The risk, therefore, is something else happens. Inflation proves stickier, especially from wages, while oil grinds higher. That would be tough for equities and bonds but good for gold. Alternatively, the economy could fare worse than expected as interest rates bite. Perhaps we get that long-awaited global house price crash led by China. My view is that we should not be complacent. Chinese equities are weak, especially financials, which could easily spread beyond luxury goods stocks.

Chinese Equity Weakness Could Spread

It’s not just luxury under pressure. It is also interesting how many high-quality stocks seem to have turned down. Reckitt Benckiser (RKT), Unilever (ULVR), Diageo (DGE), and similar companies abroad haven’t responded to the falling bond yields, which may be telling us something. Maybe we’ve hit peak brand, at least from the investors’ perspective.

Peak Brands

Brands have been incredible investments over the past century, but in one of the last interviews before his death, Charlie Munger pointed out that things could be changing, citing the threat posed by the likes of Aldi and Costco.

“There’s more trouble coming to big brands than at any time over the past 100 years. As an investor, you should realise that even if you haven’t seen it yet.”

What’s surprising about that statement is that it was Munger who popularised the idea of investing in brands. These companies are characterised by high margins, high returns and “deep moats” to protect them from competition. The risk here is their margins come under pressure, and they are derated by the market. It would be a devastating blow to the many investors as they hold these “defensive” companies in the belief they will never disappoint. In 2024, I think they might.

The other group that I still believe will disappoint is the Magnificent 7, the largest tech stocks. I know I sound like a broken record on this one, but I believe we are living in one of the greatest bubbles of all time, and it won’t end well. The Mag 7, as I pointed out in the Christmas webinar, don’t grow fast enough to justify their high valuations. I believe the market is mistaking the pandemic tech windfall to be the new normal. They pulled a rabbit out of the hat last year by slashing costs by firing tens of thousands of workers. They can’t repeat that trick this year.

Artificial Intelligence (AI) is a brilliant development and will blow our minds as AI’s IQ keeps on rising. I’m not sure what it is today, but you can imagine that as it crosses 100, it will take on the call centres, and when it hits 130, it’ll shake up doctors and lawyers. But it’s not just the intelligence but the persistence. We all get tired, and AI never sleeps. It is the other reason the Mag 7 have seen a revival, but I am not sure it is justified. No doubt AI increases productivity, but I am less sure of its impact on profits.

Inflation Persists

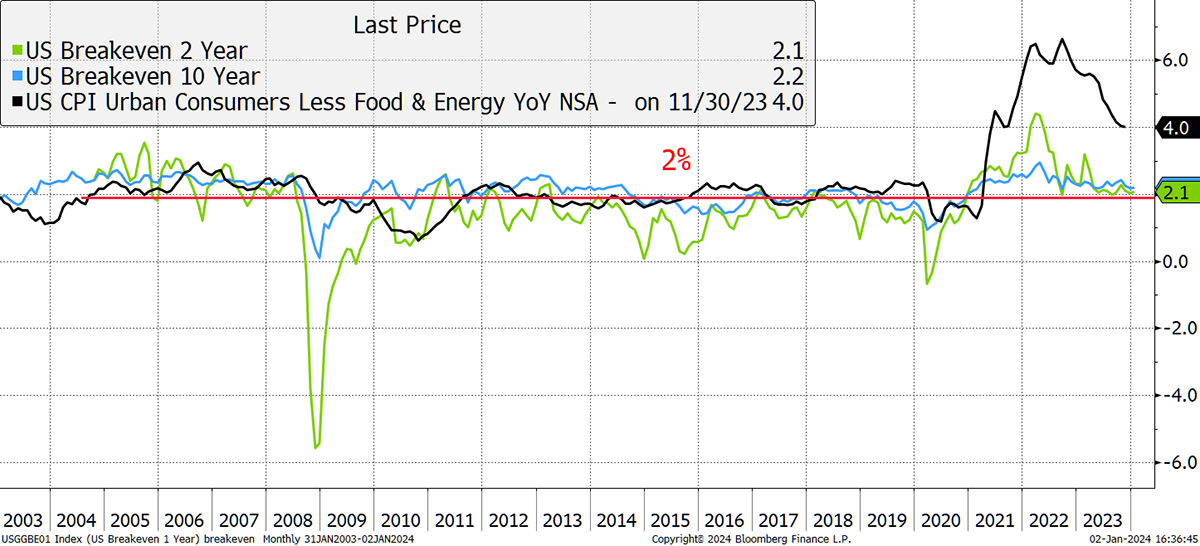

One area of complacency is inflation. I find it strange that the consensus is that it fades away unnoticed. I know that the prices of goods, energy and food have cooled, but wages have not. Inflation expectations, derived from TIPS, used to see 2% as a ceiling, yet now it looks more like a floor. Besides, CPI may be 3.1%, but core inflation is still 4%, and everyone wants a pay rise.

Core Inflation Is 4%

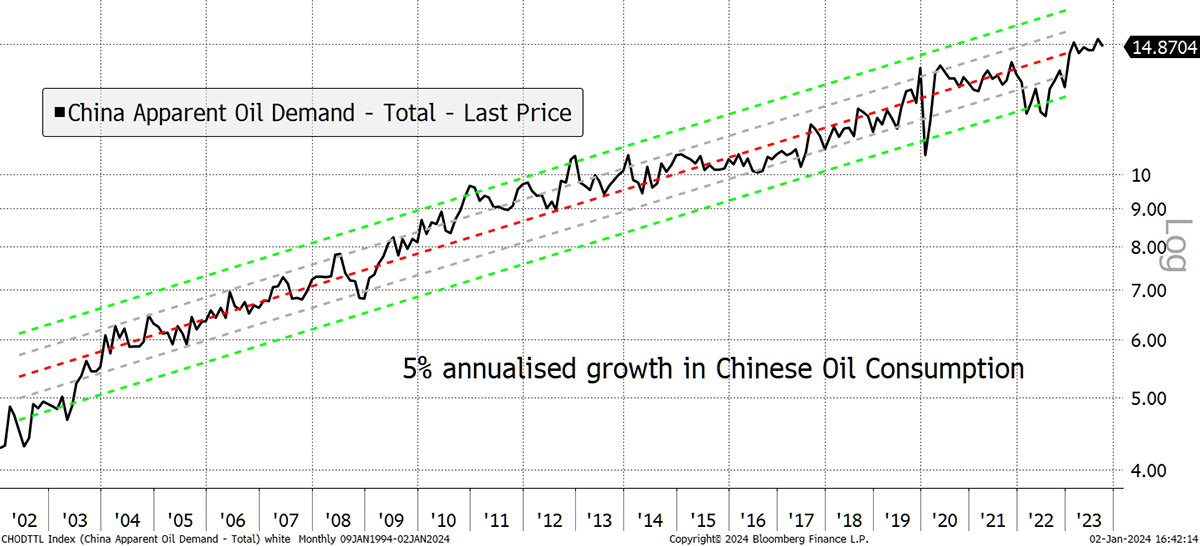

Wars are inflationary, as is diverting shipping around the cape from the Suez Canal. Oil consumption growth marches on, and even in China, where the economy is slowing, the trend growth rate is 5%.

Oil Demand Remains Strong

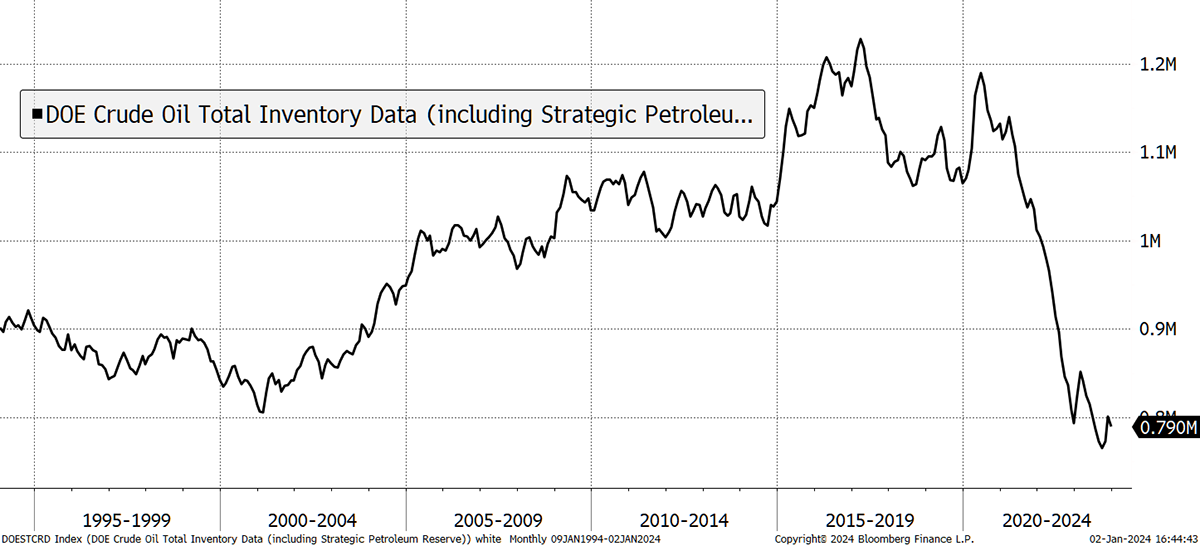

And why did the price fall from $120 to $80? One reason was the release of 400 million barrels from the US strategic reserves onto the global market to balance the Russian-induced supply squeeze. Presumably, these reserves need to be rebuilt at some point.

US Oil Reserves Depleted

We cannot be sure the fight against inflation has been won, even if it cools in the short term alongside the economy. But if it isn’t, that would upset the markets because rates would remain higher for longer, and sooner or later, businesses will need to refinance.

Against that, I’m bullish on gold, silver, bitcoin, Brazil, Mexico, Pakistan, TIPS, yen, and our fabulous bunch of undervalued stocks. There are plenty of things that could go wrong this year, but more importantly, things that could go right too.

Soda is 100% invested, but with more bonds than equities, it is still relatively defensive. Whisky has a slot for another stock, and I have a couple of ideas, but I am in no rush. It is also worth mentioning that RHI Magnesita (RHIM) reached its analysts’ price target of £34.67. Time to take profits, or are things going better than expected? I can’t be sure, but it’s still cheap.

I feel that we will fare much better in carefully selected special situations rather than high-level allocations to major equity indices. After the bizarre surge in the S&P 500 last year, driven by big tech, how can that not be true?

Action

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd