Umami

Disclaimer: Your capital is at risk. This is not investment advice.

Two weeks ago, my piece Another Momentum Crash (momo) proved prescient, as that is exactly what happened this week. The chair of the US Federal Reserve, Jeremy Powell, aka Santa Claus, told the markets that the Fed was done and paved the way for rate cuts next year. Bonds soared, and the stockmarket was pretty receptive too. That is, of course, if you were on the right side on the momo crash.

The Magnificent 7, those big tech stocks, barely moved, but the underloved, undervalued and under-owned companies that do useful hard work in the real economy flew. Investors who stuck to fundamental investment principles had one hell of a week. Christmas came early for those in the know. Here’s an extract from my recent momo note:

To remind you, momentum is one of the great unexplained market factors. Momentum investing generates excess return over the long term, but no one is certain why, and it’s still controversial in academic circles. I think it’s very simple: successful companies (the winners) are underappreciated and underpriced. They deliver positive surprises for longer than one would reasonably expect and deliver higher gains as a result. In contrast, weak companies (the losers) generally disappoint and continue to do so year after year.

Therefore, the skill in value investing is to be able to differentiate between value and value traps. Conversely, the skill in growth investing is to keep a level head. Growth stocks should cost more, but in recent years, the market has overdone it in both directions. Value is too cheap, while growth is too dear. Periodically, the momentum effect snaps the excesses back down to earth in a momentum crash. It is not the market that is necessarily crashing, but the momentum effect (momo).

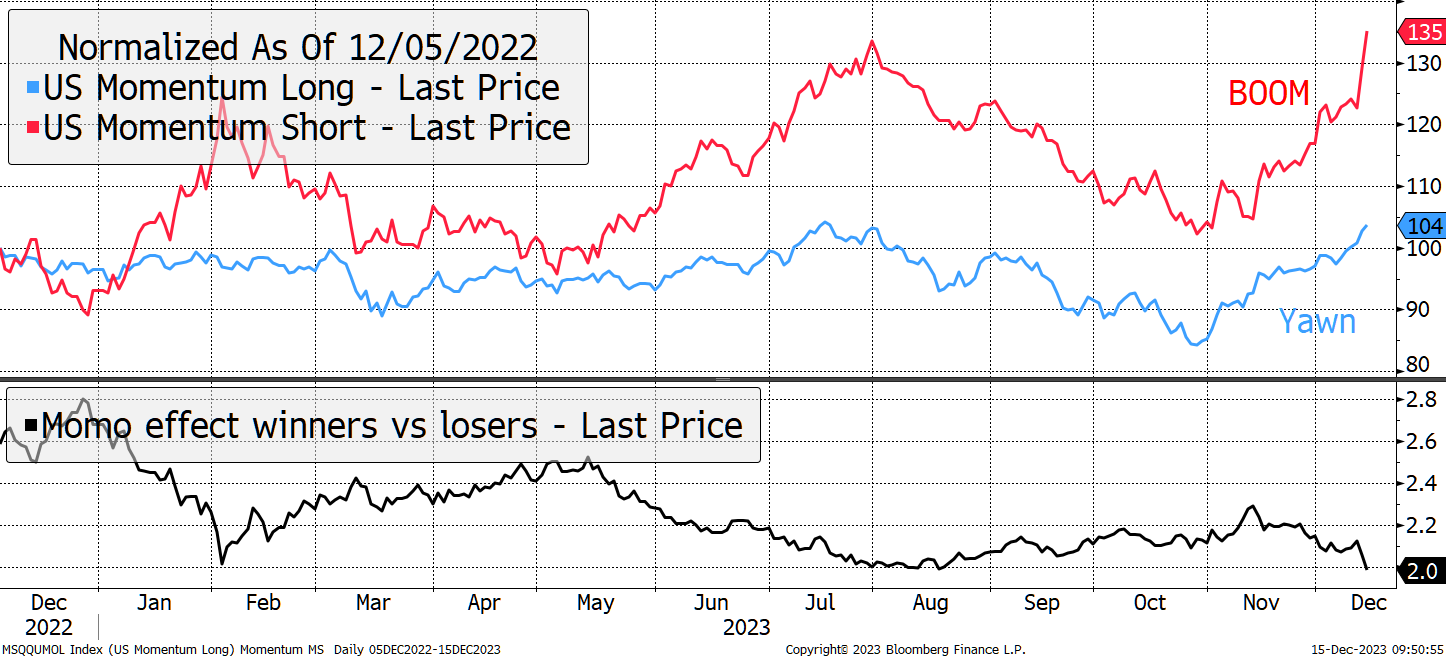

The (past) winners are shown in blue, and they just can’t keep it up. As for the losers, BOOM.

Momentum Crash

Momo in markets is a bit like what umami is to flavours. Umami was discovered by a Japanese chemist, Kikunae Ikeda, in 1908. It was the discovery of a new taste alongside salt, sour, sweet, and bitter, and is found in foods such as soy sauce. Basically, the exotic flavours that transform a dish and make you dream of Geisha.

I equate momo to umami because they are both powerful forces, and yet rarely discussed and commonly misunderstood. In financial circles, you never hear of momentum crashes, yet they are one the most powerful market drivers out there. The black line on the above chart shows winners vs losers. It has been falling since October 2022, when we had the previous momentum crash. It means the momo effect isn’t working, which confirms all is not well in financial markets.

Our portfolios have been mixed this year. Sticking to sound investment principles hasn’t always been rewarded this year. Our lower-risk balanced portfolio, Soda, hasn’t made any money this year, which upsets me, especially after such a stellar result in 2022. It is ram-packed full of value, but that hasn’t been rewarded until recently. I believe it will fly next year while the market struggles.

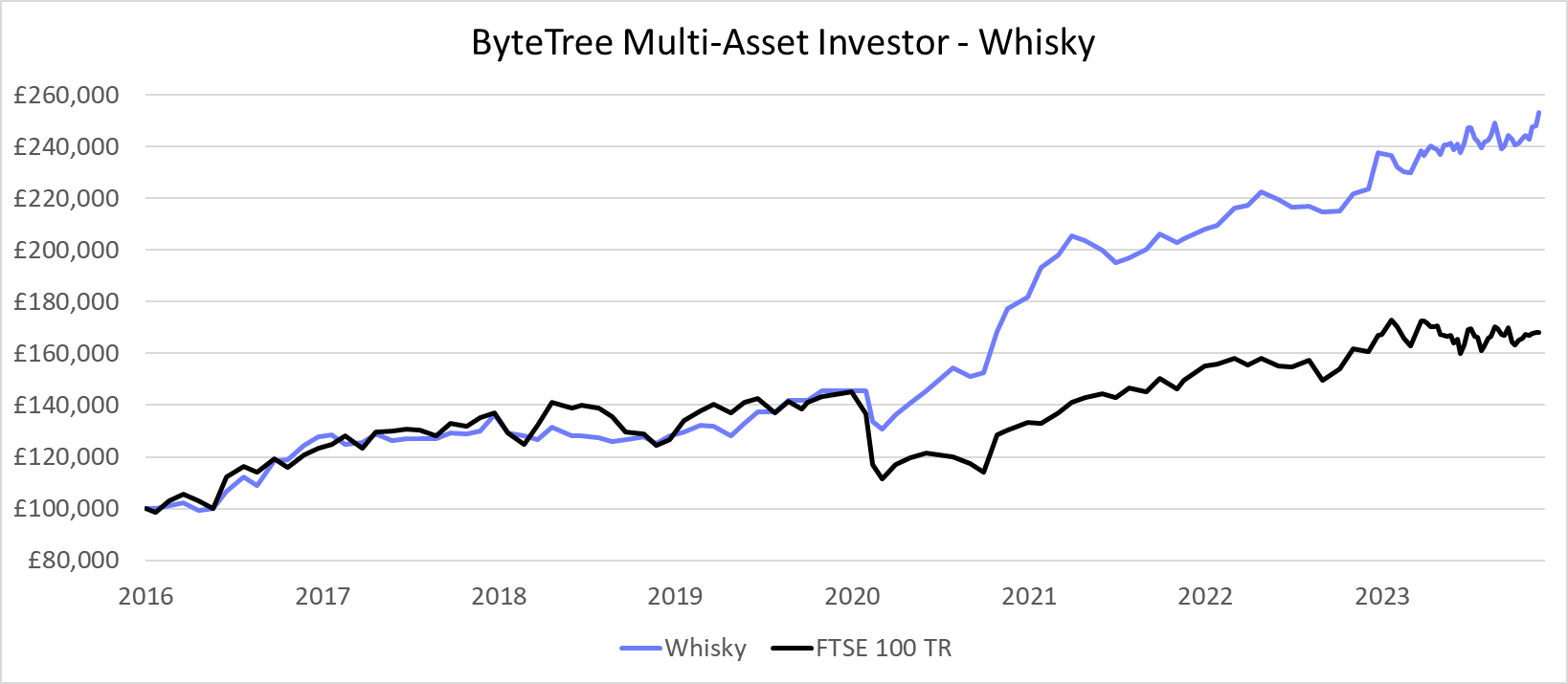

In contrast, our global equity portfolio, Whisky, has flown. It’s up 13.1% in GBP, which is remarkable, especially given it hasn’t held big tech. The track record is starting to look not just good, but exceptional.

2023 has been a challenging year in markets, a year full of contradictions and confusion. China reopened, which was going to save the world, yet it slumped. Then, the interest rate-induced recession that was all but guaranteed failed to show. It’s been tough, but we survived.

What I am most proud of during our year at ByteTree is the stunning performance of BOLD. The 21Shares ByteTree BOLD ETP (BOLD SW) is up 36% this year with volatility of just 15%. I can’t think there’s a fund out there that’s done a better job on a risk-adjusted basis (return for volatility).

Yesterday, I discussed Bitcoin and Gold in 2024 in our webinar, “You’re Better off in BOLD”. Thank you to the attendees for their excellent questions and generous compliments. I said I felt 2024 might see Gold having the upper hand, which shouldn’t surprise me if interest rates are set to fall. Remember, Gold is the bond; Bitcoin is the equity. But it doesn’t matter whether Bitcoin or Gold wins because BOLD makes it irrelevant. Watch the webinar on YouTube and download the presentation below.

ByteTrend has had a major upgrade. It’s amazing and well done to ByteTree’s tech team. Please visit ByteTrend.io and start exploring.

A Week at ByteTree

In The Multi-Asset Investor, we took profits on Centrica (CNA), which worked out well. I was concerned about the fall in the North Sea gas prices. I also made a new recommendation in Venture, which was a cash cow; I mean double cream. The Venture portfolio also responded well to the momo crash. We now own 14 dirt-cheap stocks and will probably end up with around 30. Next year should reward them handsomely.

There was much more output in crypto. In Token Takeaway, Ali looked at Solana (SOL), a potential “ETH killer”. I wrote ATOMIC and highlighted how the miners were once again earning $10 billion per year., I also discussed alt season in ByteFolio, where the leading tokens push ahead of bitcoin. We added new tokens in preparation.

I met up with friends last night, and I was the only one not wearing a Christmas jumper. I still don’t own one. Does that make me a grinch?

Have a great weekend,

Charlie Morris

Founder, ByteTree

Comments ()