Crypto in 2023

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio Issue 88;

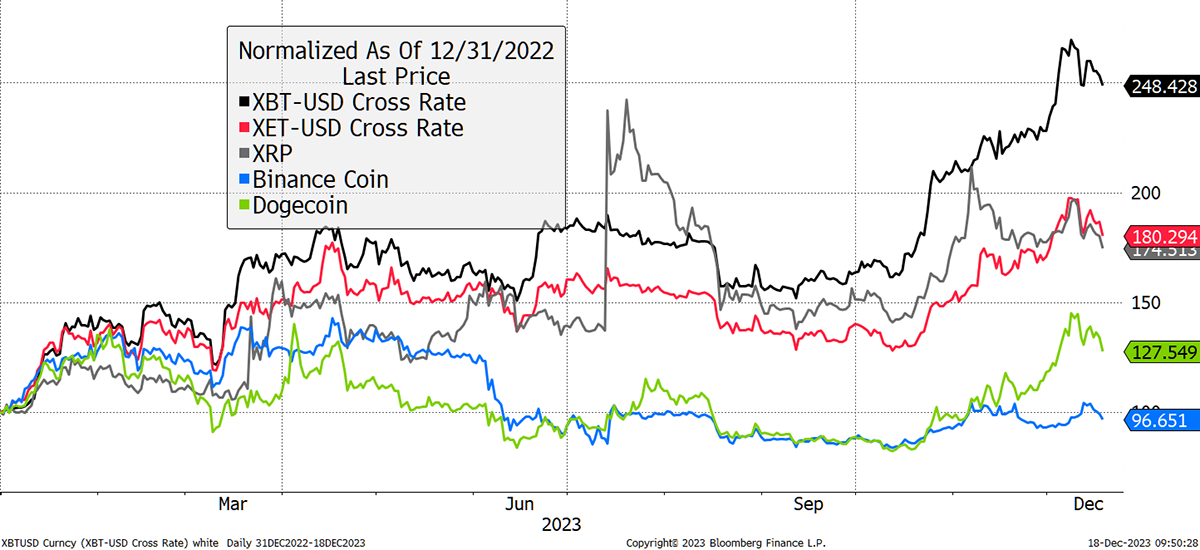

Crypto will remember 2023 fondly. Most of the big coins failed to keep up with Bitcoin, but we have become used to that in the first year of crypto bull markets. ETH and XRP were neck and neck, with BNB down slightly after a resilient 2022. DOGE, which I wish would simply disappear, made modest gains.

Bitcoin Leads in 2023

The regulators proved to be less of a headwind compared to 2022, and for good reason. 2022 saw the frauds uncovered, which had a devastating effect on the industry. In contrast, this year has seen crypto clean up. In my opinion, the great event of 2023 was Blackrock filing for an ETF. Previously, the CEO Larry Fink had been critical, but this year, he has used phrases such as “safe haven”, “revolutionise the financial system”, and “global client demand”.

It didn’t matter that the ETF hadn’t yet been approved. His change in sentiment has been well received and has proved to be a huge positive for Bitcoin’s credibility and reputation. That the world’s largest asset manager is a believer has meant all but the truly stupid have stopped describing Bitcoin as a fraud or a Ponzi scheme. Bitcoin, and crypto, emerge from 2023 with establishment backing, which shouldn’t be underestimated.

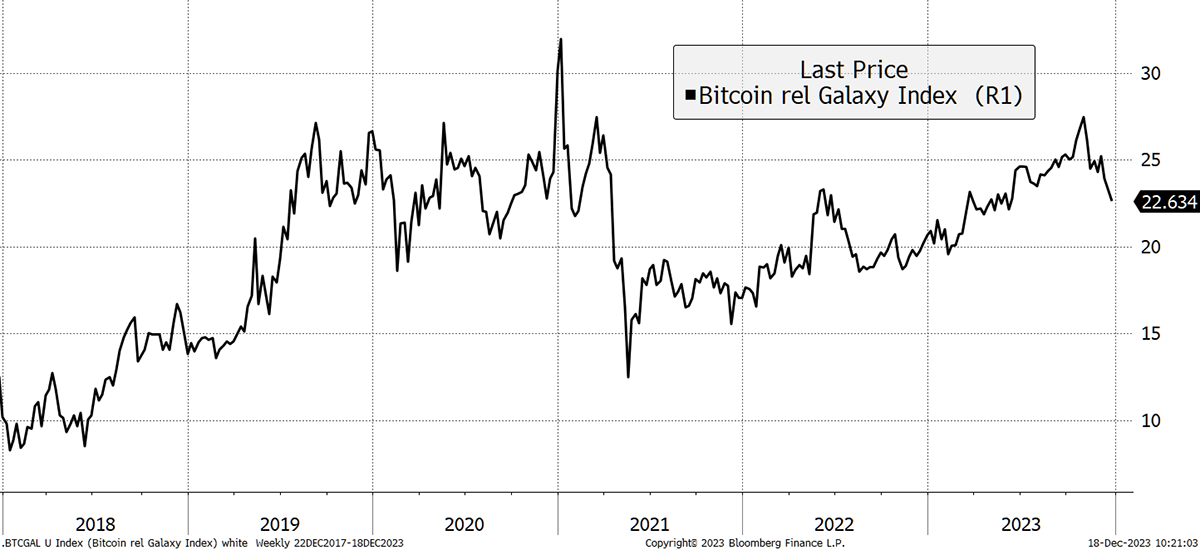

That has fuelled bitcoin this year, but the alts have done well too as Fink’s love trickles down. They are just starting to perk up, as can be seen here. Bitcoin has just started to lag alts, which will bode well for ByteFolio.

Bitcoin Starting to Lag Alts

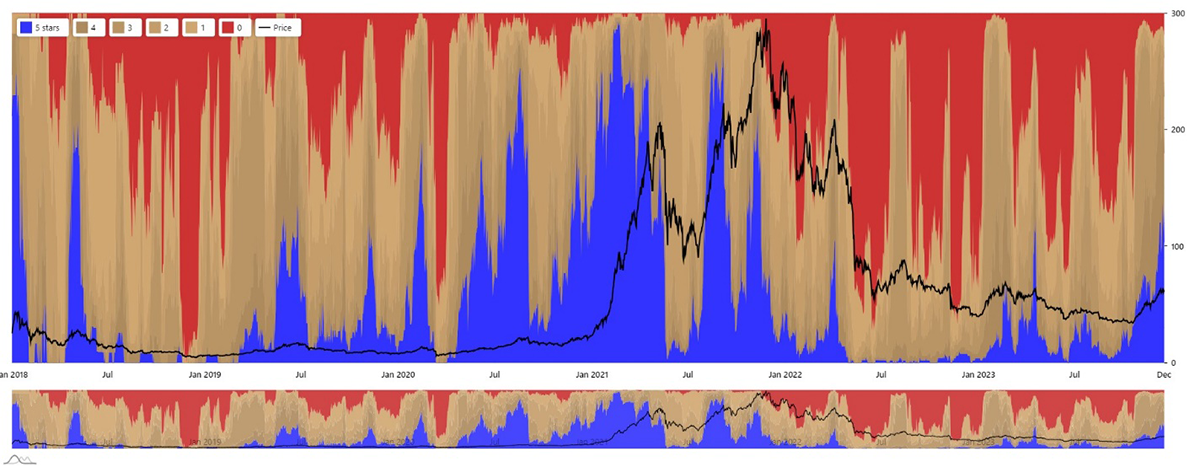

We held few tokens until the autumn when the blue skies returned and the ByteTree Crypto Average (BCA), our equally weighted breadth measure, started rising again. Crypto breadth can remain strong for quite a long time.

Better Breadth in Crypto

I am delighted with how good the BCA has been as an indicator, and the ByteTrend.io upgrade really brings it to life. It cumulates the average daily price change, which seems to trend nicely. It captures the underlying changes neatly and tells us that we enter 2024 in good health as the red skies have disappeared.

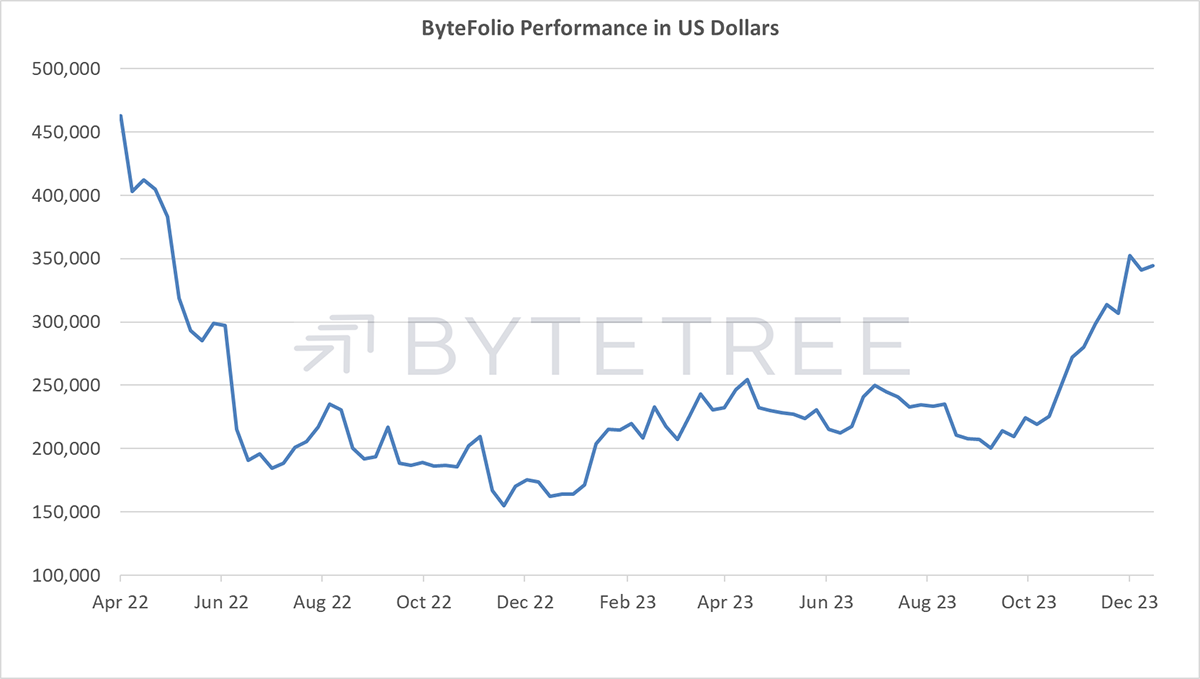

The ByteTrend Portfolio is normally measured in bitcoin because it exists to outperform bitcoin. It is hard to do, and our strategy is to embrace the crypto space in the good times and be heavily weighted in bitcoin at other times. Although just 20 months old, ByteFolio is nearly back to the start line after what has been a devastating bear market. I very much hope next year will be good for alts, and ByteFolio will be ready.

Christmas Question

If the ban on crypto ETFs is lifted next year, do you think ByteTree should launch an actively managed ByteFolio ETF, and if so, roughly how much would you be willing to invest? Please let me know: charlie.morris@bytetree.com.

Thank you, and we wish you a Merry Christmas and a Happy New Year. See you in January.