Diversification in Crypto

Disclaimer: Your capital is at risk. This is not investment advice.

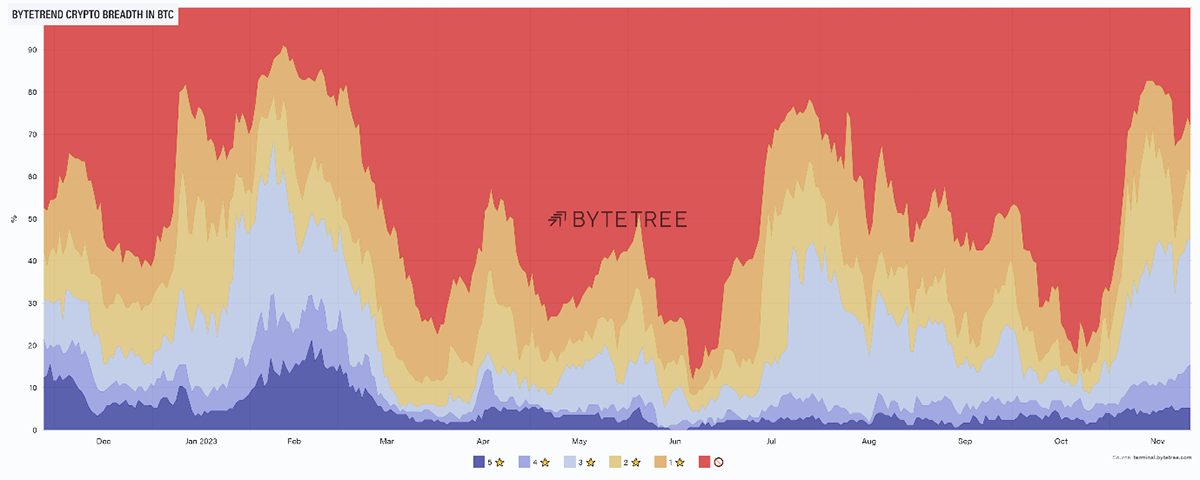

Our breadth charts confirm it is alt season. 71% of tokens are on non-0-star ByteTrend scores in BTC and 95% in USD, meaning most tokens are in uptrends, and only a few are dying compared to BTC. Better still, the breadth in Bitcoin is rising, with over half of the market neutral or better vs Bitcoin. That confirms it is alt season.

The basics of portfolio management embrace the concept of diversification, often described as the only free lunch in investing. The basic idea is that the more things you own, the less volatility and fluctuation in performance. Obviously, the highest return strategy is to go all in on a single winner, but assuming we don’t know the future, diversification is the next best strategy. The single winner can also be dead wrong.

The ByteTree view is that it’s alt season, so having been heavily focused on Bitcoin for much of the past 18 months, we now hold a diversified portfolio of potential winners. They won’t all work out, like last week’s Binance (BNB), but that doesn’t matter, as the damage has been minor. I believe we own the best of the bunch, and so if alts push on, we stand an excellent chance of beating Bitcoin by a decent margin. It’s all about capturing the winners and avoiding wasted capital in the losers.

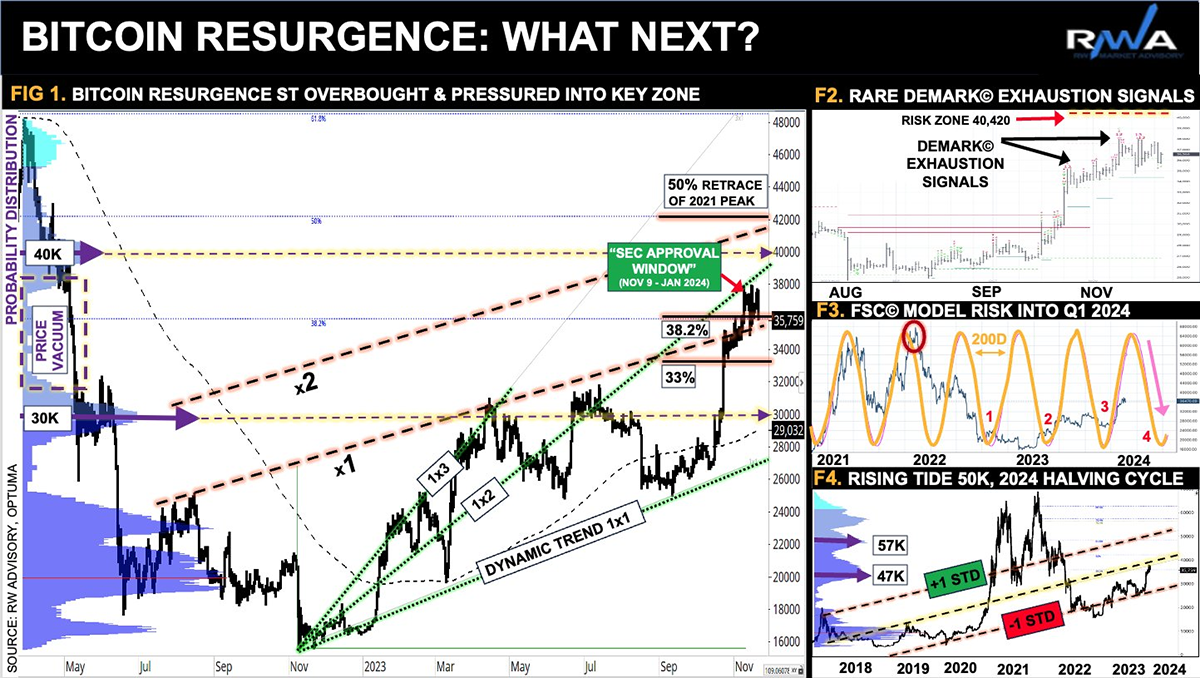

Ron William likes a good chart and asked me to share his thoughts with ByteTree crypto. He highlights it’s a bull market, possibly a little overbought in the short term, but sees $50k as the target. Thanks Ronnie.