Market Dislikes the Long-Term

We live in an era of divergences, and the collapse of the bond market is behind it. Perhaps not just that, but the high asset prices and excessive borrowing that came with an era of low rates. The reversal was always going to be painful; we just didn’t know when or what it would look like. One of the latest things to emerge, which partially explains the strength in gold, silver and possibly Bitcoin, is the jump in long-term inflation expectations. This is happening as actual inflation has been cooling, but what does it mean?

You hear so many explanations about inflation. Most popular are those related to the supply and demand for goods and services. The pandemic led to supply chain disruption, and prices rose. It also had stimulus packages and furlough schemes, which maintained demand at a time of limited supply. Then you have the financial crowd who point to central bank money printing. In truth, all of these will cause inflation, and cool it in reverse, but that’s all about the present.

When long-term inflation expectations are rising, while short-term expectations are cooling, the message from the bond market is that we should be more concerned about long-term inflation than short-term.

Clear so far.

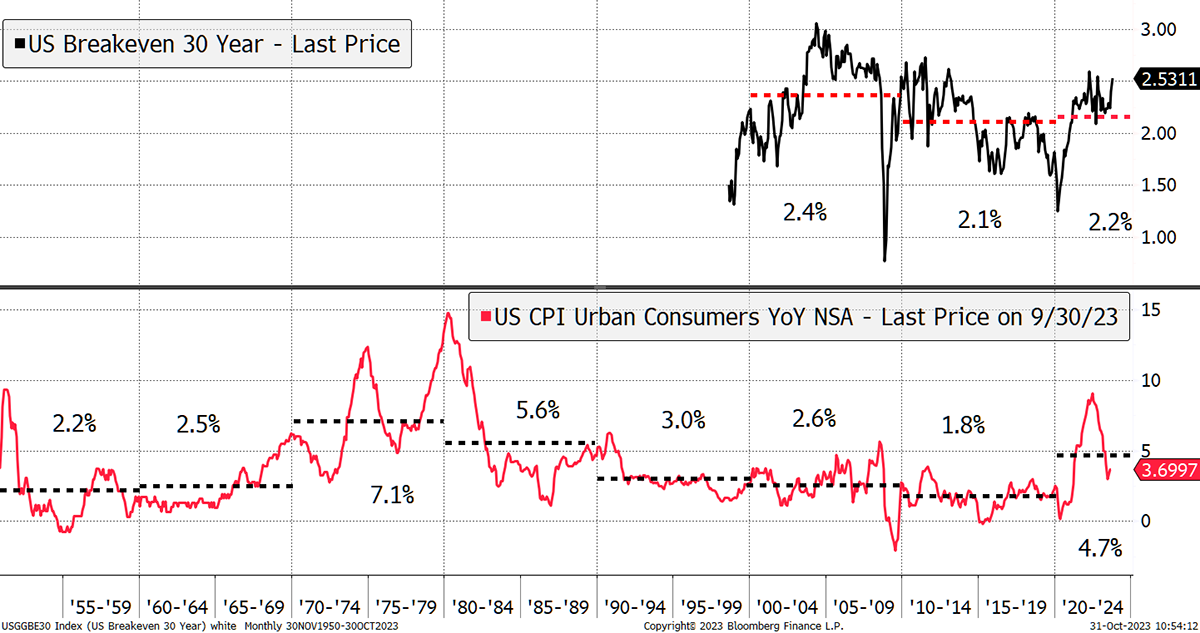

Looking back at the average rate of inflation (actual in red), we see many periods hovering around 2%. The 1950s were 2.2%, jumping to 2.5% and then 7.1% in the 70s. It then cooled for 40 years until today, where the latest decade average is 4.7%, more than twice the benign 1.8% seen in the 2010s.

Average Inflation by Decade

Inflation expectations for the next 30 years are shown in black (top). We only have data since TIPS were launched in the late 1990s. Long-term expectations were reasonably good at matching actual inflation. In the 2000s, they averaged 2.4% against 2.6% actual. In the 2010s, it was 2.1% against 1.8% actual. Yet in the 2020s so far, it’s 2.2% against a harsher 4.7%.

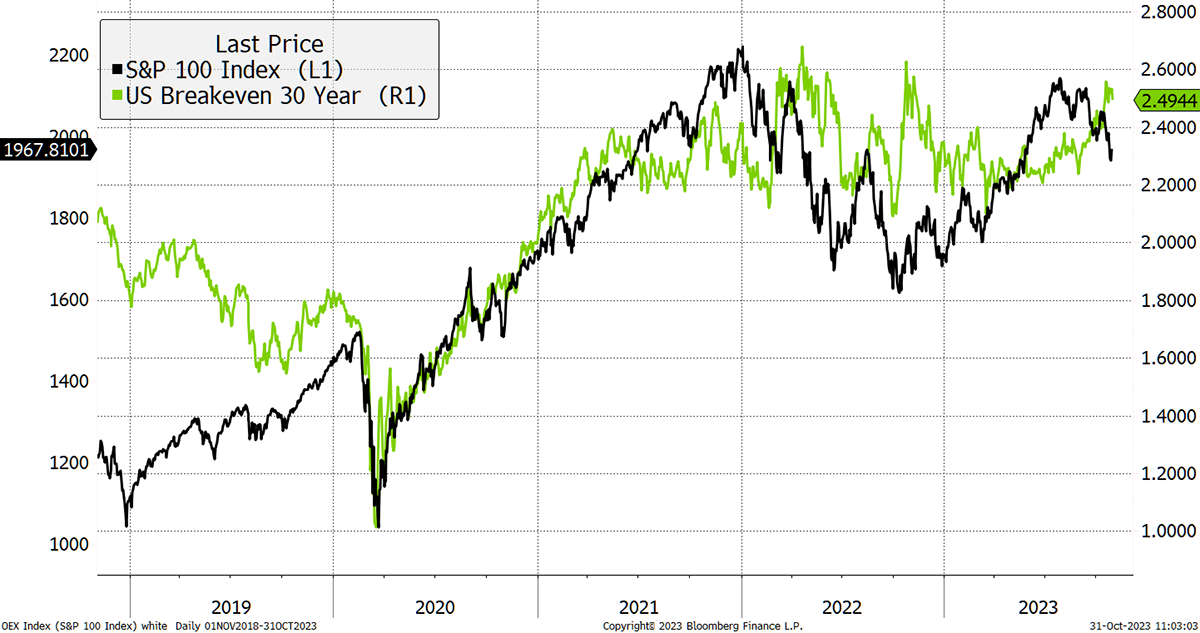

I have covered this, saying it was one of the conundrums about the current era. Expectations have obediently obeyed the Fed’s forecasts of 2%. They are now rising, just as the short-term factors are falling sharply as the economy cools. We are not used to this sort of thing, as inflation expectations normally rise and fall with the economic tide, reflecting higher or lower demand for goods and services. That’s why we tend to associate rising expectations with a buoyant stockmarket and vice versa. Notice how recently expectations have risen while stocks have fallen. Normally, they have been correlated.

Stocks and Great Expectations

Inflation isn’t just a reflection of short-term economic conditions; it’s also monetary and a measure of economic efficiency. When economies fail, inflation rises, making it harder for transactions to take place. In contrast, we see low inflation as a form of stability, enabling transactions and contracts to be written long into the future.

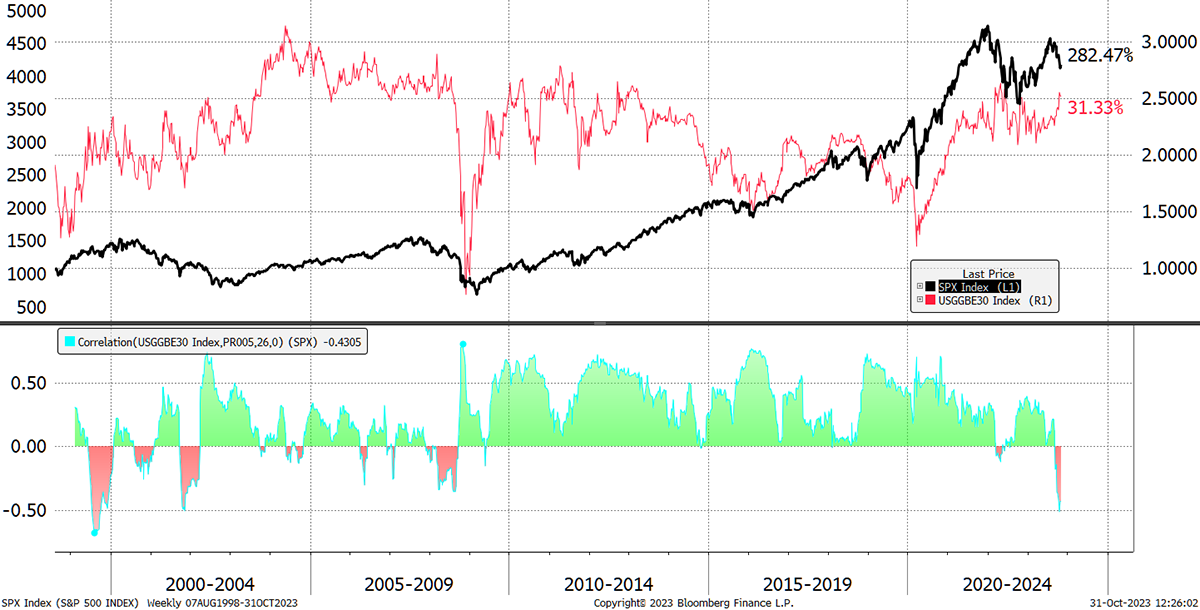

Taking that chart back to the late 1990s, there is a recent breakdown in the correlation between the stockmarket and inflation expectations. Once again, we don’t like what we see. The correlations (lower chart) were negative in the dotcom bust, the credit crisis and today. That doesn’t sound too good.

The Stockmarket Dislikes the Long-Term Inflation Expectations

This could become a problem, and if so, the natural hedge would be TIPS, which directly benefit from higher long-term expectations. I know they haven’t paid us yet, but they will. There’s more in the Postbox.

Action:

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority. https://register.fca.org.uk/

© 2024 Crypto Composite Ltd