Peak Nasdaq

Disclaimer: Your capital is at risk. This is not investment advice.

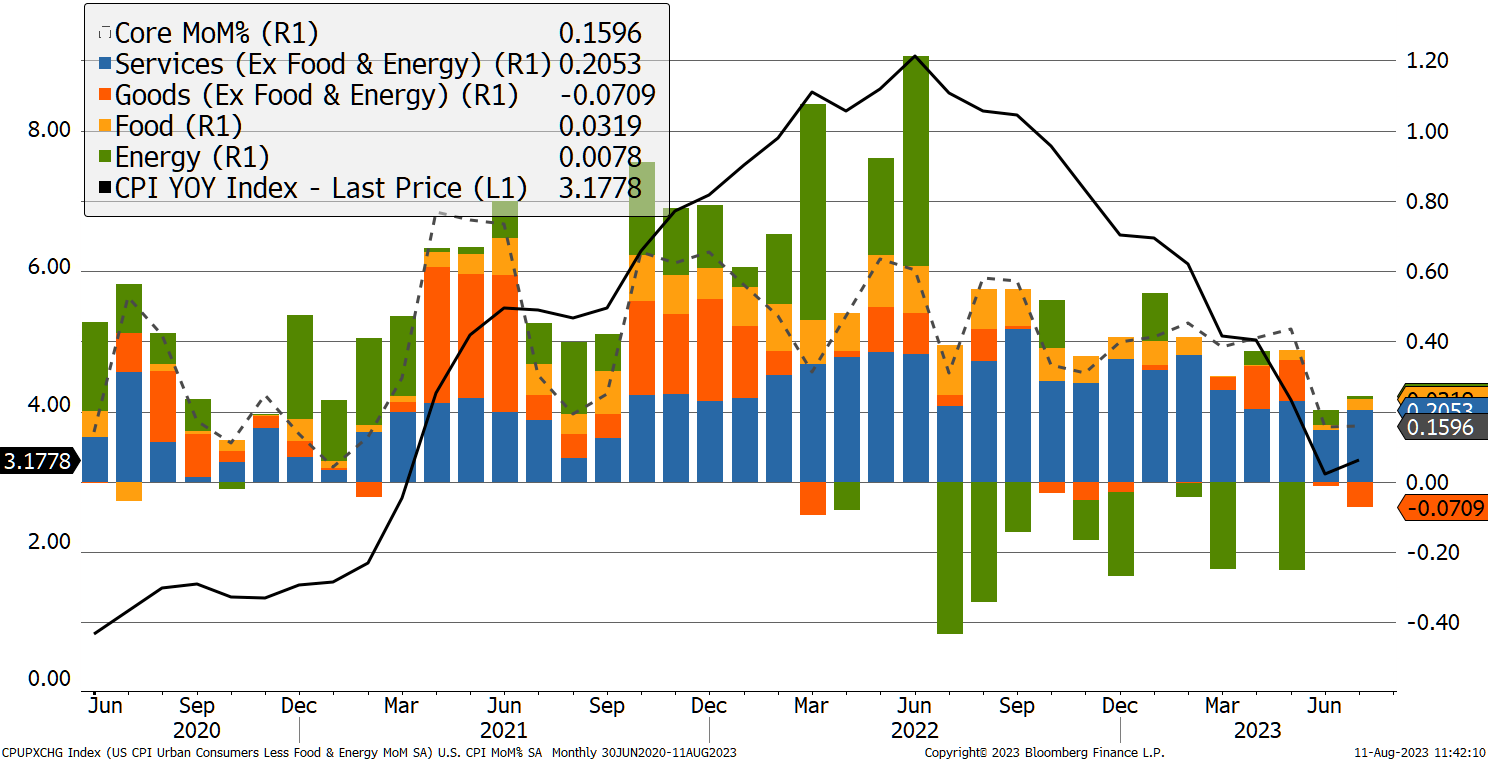

Yesterday, the US reported that core inflation had cooled slightly from 4.8% to 4.7% for the year, although flat on the month. Digging a little deeper, it was only goods prices that fell, with energy, services and food all a little higher month on month. What is really starting to stand out is that the spike in June 2022 was 13 months ago, meaning there are no more easy year-on-year comparisons. The grind against inflation gets tougher from here.

Inflation Cools

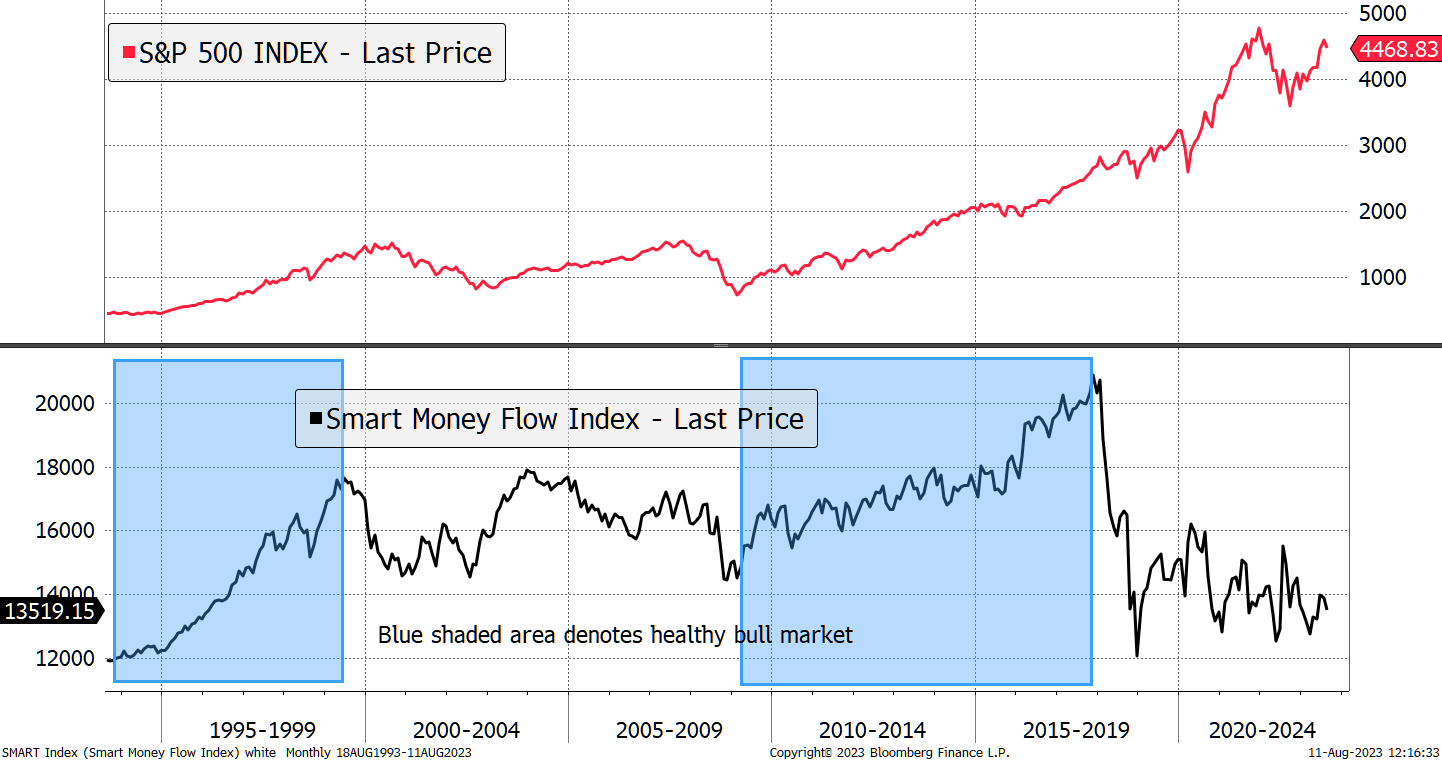

Initially, the market liked the news, with the S&P 500 up 1% at the open, only to close flat a few hours later. You can track that with the Smart Money index. It measures the Dow Jones Index at the opening and compares it to the last hour of trading. The idea is that “dumb money” drives the market open, which is emotional and excitable, while the “smart money” quietly does the real business in the run up to the close.

Going back 30 years, there has been a clear difference between the healthy bull markets highlighted in blue, where the Smart Index rose, and the other periods. That doesn’t necessarily mean the stockmarket did not make progress, but it was certainly a rougher ride. According to the Smart Money Index, things have been bumpy for a while.

Smart Money

The market rallied on the soft inflation data, but it didn’t last. In my humble opinion, interest rates may indeed be at or close to their peak, but they will remain higher for longer, and that’s not good for blowing bubbles. The Smart Index’s steady decline is urging caution.

While it’s hard not to be impressed by technological advances, serious investors know that price matters. Those who overpaid for the future in March 2000, by owning the Nasdaq, only recently caught back up with the world index. With the Nasdaq making up 21% of the world index, you have to question how much more there is to give.

It is a noble feat that the Nasdaq ever caught up given the -67% correction from 2000 to 2006 (Nasdaq relative to the world). That was six years of hell for tech investors, but admittedly, that era sowed the seeds of the revolution that followed. There’s nothing like a quiet period for the brains to really get to work, and after all, it paved the way for the iPhone.

Nasdaq Relative to the World

What troubles me about the chart above is the recent triple top. Just like in 1999, tech saw a period of excess from 2020 courtesy of the pandemic; an acceleration in the trend. The two recent attempts to make a break away new high have failed, and that is despite tech and AI being the talk of the town. Another reason for caution.

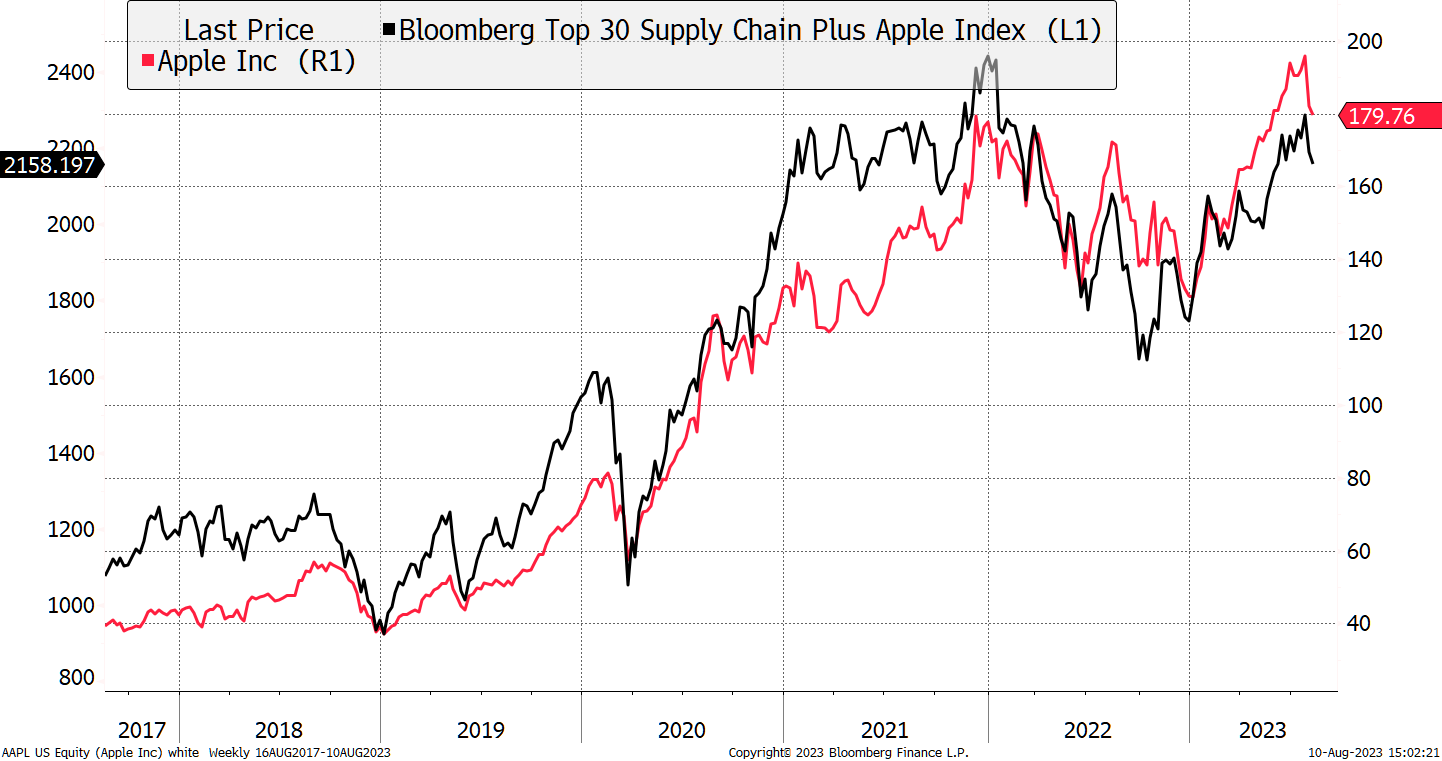

The iPhone is indeed a great success story, but it is strange that the world’s most valuable company, worth $2.8 trillion, has seen falling sales over the past three quarters, while the recession is yet to bite. A contracting company is no crime, but when it trades on 30x earnings, it is a dangerous place to be.

I show Apple alongside the companies that dominate its supply chain, and unsurprisingly, they are highly correlated. Some analysts use the suppliers as a leading indicator.

Apple Moves with Its Suppliers

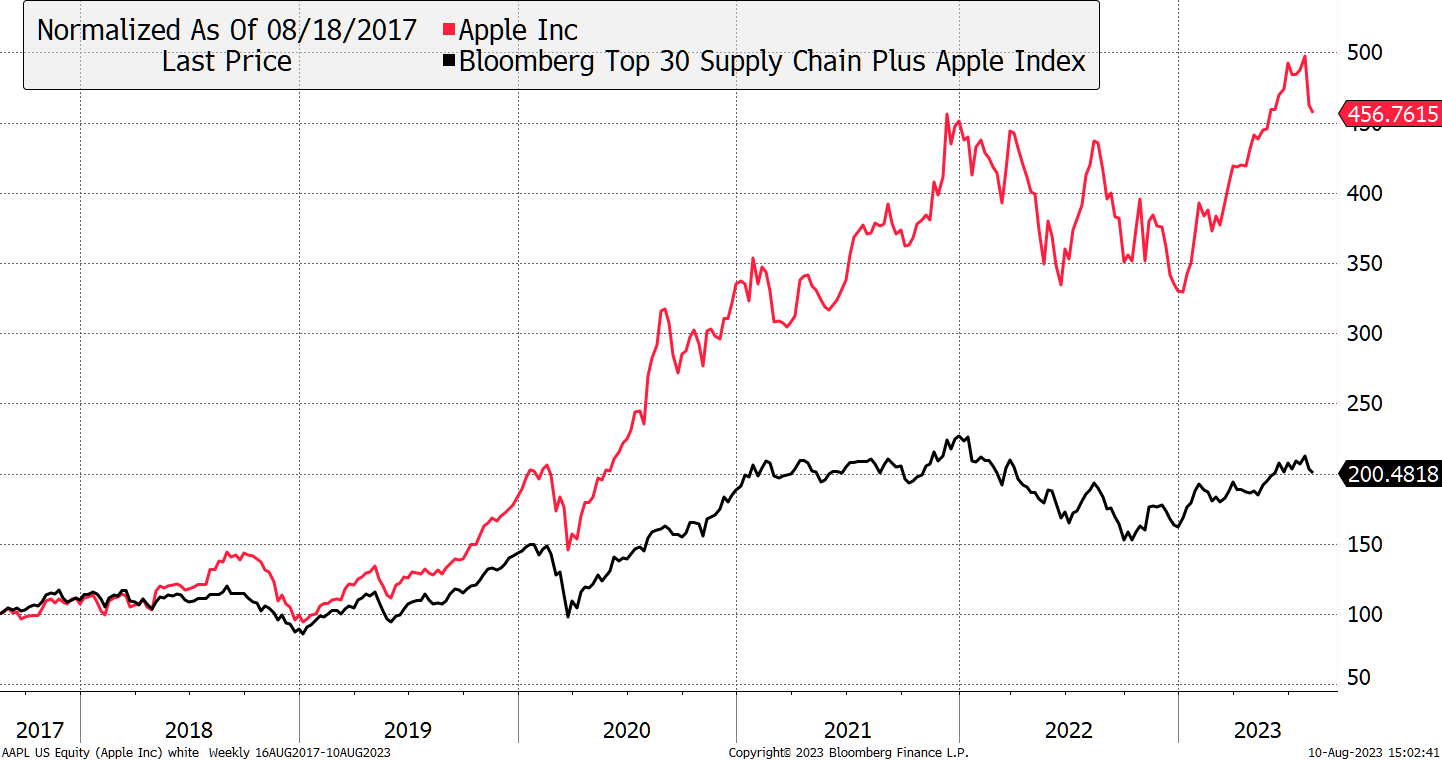

But what is truly remarkable is how the value has accrued to Apple much more so than to its suppliers. This has been exacerbated by the post 2020 surge. These sorts of things are typical of a major bubble.

Apple has Done Much Better than its Suppliers

That tech is highly priced is hardly a revelation. 2022 punctured the sector, especially the meme stocks of the pandemic. But Big Tech carried on, largely because investors saw it to be a safe haven in an uncertain world. But for that to be true, it must grow. The likes of Apple, Microsoft, Google and Amazon do not grow anything like fast enough to maintain their current exorbitant valuations, and that is why the chart above should not be ignored.

This Week At ByteTree

Outside of Bitcoin, the crypto space remains quiets, which is another reason to be cautious on tech. We highlighted how the ByteTree Crypto Average Indicator is in poor health. But the good news is that one day it will give another buy signal, and when it finally comes, it will be worth the wait. The last signal from 2020, created countless new millionaires!

Where should investors shift their attention? I make no apology for my fondness of the energy sector. The evidence is hard to ignore.

Have a great weekend,

Charlie Morris

Founder, ByteTree

Comments ()