Injective Protocol: Unlocking the Potential of Decentralised Trading

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: INJ Token

Injective is the first decentralised exchange-focused layer-1 blockchain platform. Integrated with the Cosmos ecosystem, it was custom-built to host Decentralised Exchanges (DEXs) that aim to shape the future of crypto trading. The platform offers developers a user-friendly environment equipped with plug-and-play financial infrastructure components, facilitating the seamless creation of highly efficient, fast, and cost-effective dApps. This Token Takeaway will examine the fundamentals of the Injective Protocol and analyse the value proposition of its native token, INJ.

Overview

Injective is an innovative Layer-1 blockchain platform with a clear vision to revolutionise the DeFi sector. Established by Eric Chen and Albert Chon in 2018, Chen is the current CEO of Injective Labs, the company responsible for the development of the Injective Protocol, while Chon serves as its CTO.

At its core, Injective Protocol enables developers to create a diverse range of DeFi dApps, such as decentralised spot and derivatives exchanges, automated trading applications, launchpads for token offerings, and even sports prediction markets. Injective offers all that in an open, fully decentralised and trustless manner. By providing this innovative infrastructure, Injective aims to disrupt and elevate the DeFi landscape, ushering in a new era of finance where users worldwide can access truly free, fair, and transparent financial services.

Funding

Injective has been successful in securing significant funding from various sources since its inception. Its first pre-seed funding round took place in October 2018, raising $500k from Binance, which laid the foundation for the project's growth. In July 2020, Injective conducted its seed funding round, raising an impressive $2.6 million, with Pantera Capital leading the investment efforts.

As the project gained momentum and recognition in the crypto space, it went on to raise an additional $3.6 million in the INJ token offering led by Binance Labs in October 2020. Subsequently, Injective has had two venture rounds: raising $10m in April 2021 and a substantial $40m in August 2022. The project's total investments have now reached an impressive $56.7m.

Injective's success has not gone unnoticed by renowned venture capital firms and investors. The project enjoys support from influential entities such as Jump Crypto, Cadenza Ventures, and Mark Cuban. This recognition from top investors solidifies its position in the DeFi industry, highlighting its potential for future growth and innovation.

In January 2023, Injective launched a $150m venture capital-backed ecosystem fund to “support promising projects building within a diverse array of sectors including interoperability, DeFi, trading, PoS infrastructure, rollups and scalability solutions”. The $150m capital was pooled by Injective’s previous backers and many new well-known VCs, including Kraken Ventures, KuCoin Ventures, Delphi Labs, Flow Traders and Gate Labs.

Injective Architecture

The Injective blockchain was built using the Cosmos Software Development Kit (SDK), a powerful toolset for blockchain development. Injective leverages the Cosmos-based Tendermint proof-of-stake (PoS) consensus protocol to establish a robust and efficient consensus mechanism. Tendermint-based consensus mechanisms are widely adopted in the industry due to their reliability and popularity.

One of the key strengths of the Tendermint-based consensus is its Byzantine Fault Tolerance (BFT) property. This means the network can continue to function smoothly and securely even with malicious actors attempting to corrupt the network. This exceptional resilience makes Tendermint one of the most secure systems for validating transactions and ensuring the integrity of the blockchain. Thanks to Tendermint's capabilities, Injective achieves virtually instantaneous transaction finality. Moreover, the platform boasts impressively fast transaction processing speeds, reaching up to 10,000 transactions per second (TPS).

Injective's capabilities extend beyond its native chain, allowing it to perform cross-chain transactions seamlessly across various blockchain networks. It supports interoperability with Ethereum and Moonbeam, enabling users to transfer assets and data between these networks and Injective's native blockchain. Additionally, Injective is Inter-Blockchain Communication (IBC) enabled, meaning it can interact and exchange data with other IBC-compatible blockchains, such as the Cosmos Hub, fostering a broader and more interconnected ecosystem. Moreover, Injective can also facilitate cross-chain transactions with Wormhole integrated chains, such as Solana and Avalanche.

You can read more about Cosmos SDK, Tendermint and IBC in a previous Token Takeaway on Cosmos.

Built-in DEX Features

One of the unique selling points of the Injective Protocol is that it offers an advanced, fully decentralised and trustless on-chain order book-based DEX development infrastructure. This means users can create DEXs and trade on fully permissionless spot and derivative (futures and options) exchanges. The platform's on-chain features include managing limits on order books, trade execution, order matching, transaction settlement, and trading incentive distribution through its exchange module. This comprehensive infrastructure empowers users with full control over their trades and offers a completely decentralised trading environment.

Furthermore, all DEXs built on Injective leverage the same on-chain order book, enabling seamless sharing of liquidity and user base within the entire ecosystem. This unique feature provides newly developed DEXs with a kick-start in liquidity, creating a rich and interconnected ecosystem. Users can benefit from enhanced liquidity across the ecosystem, making trading on Injective's DEXs a more efficient and user-friendly experience.

Injective Protocol Ecosystem

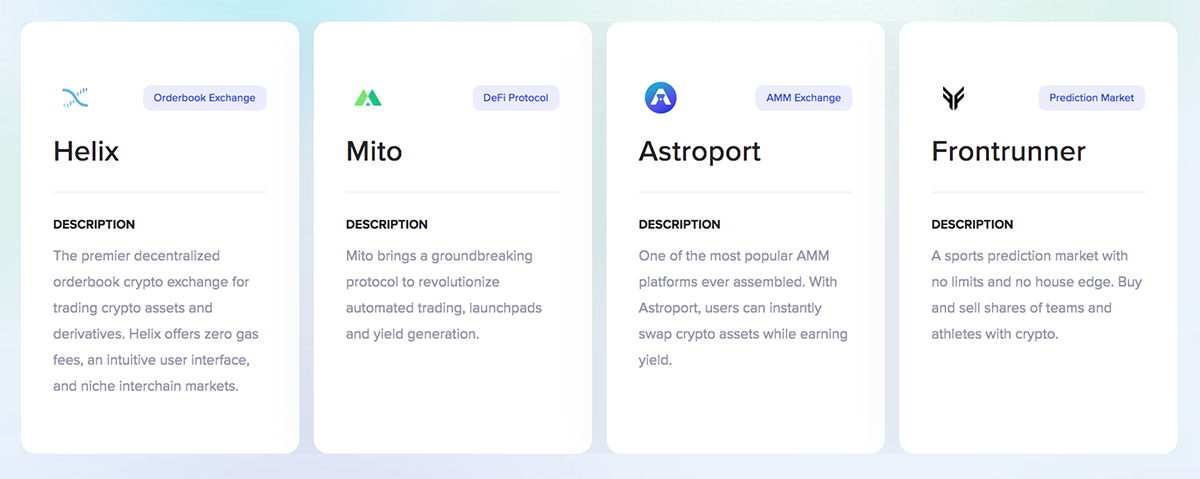

Within the Injective ecosystem are several independent dApps, including Helix, a prominent decentralised exchange that serves as a comprehensive platform for spot and derivatives trading across various trading pairs. Mito, on the other hand, is an application focusing on automated trading and launchpads, empowering users with efficient and automated trading strategies while providing a platform for promising project launches. Additionally, Injective also hosts an Automated Market Maker (AMM) DEX, Astroport. It offers seamless token swapping and yield generation opportunities for users seeking to participate in the DeFi space. Another important dApp in the Injective ecosystem is Frontrunner, a sports-betting application that taps into the growing popularity of blockchain-based prediction markets.

Since Helix is the most popular DEX on Injective, let's explore some of its features. Through its decentralised order book, Helix enables users to execute trades efficiently while ensuring transparency and security. A notable feature of Helix is its gas fee-free trading, offering cost-effective and frictionless transactions for users. Moreover, the exchange's seamless interoperability with both the Ethereum and Cosmos networks allows for enhanced flexibility and accessibility, enabling users to interact with assets and liquidity across multiple blockchain networks.

Another honourable mention is Wavely, and like Helix, Wavely is a DEX built on Injective. Both exchanges share the same order book, meaning an order placed on Helix will also appear on Wavely and vice-versa.

Injective On-chain Analysis

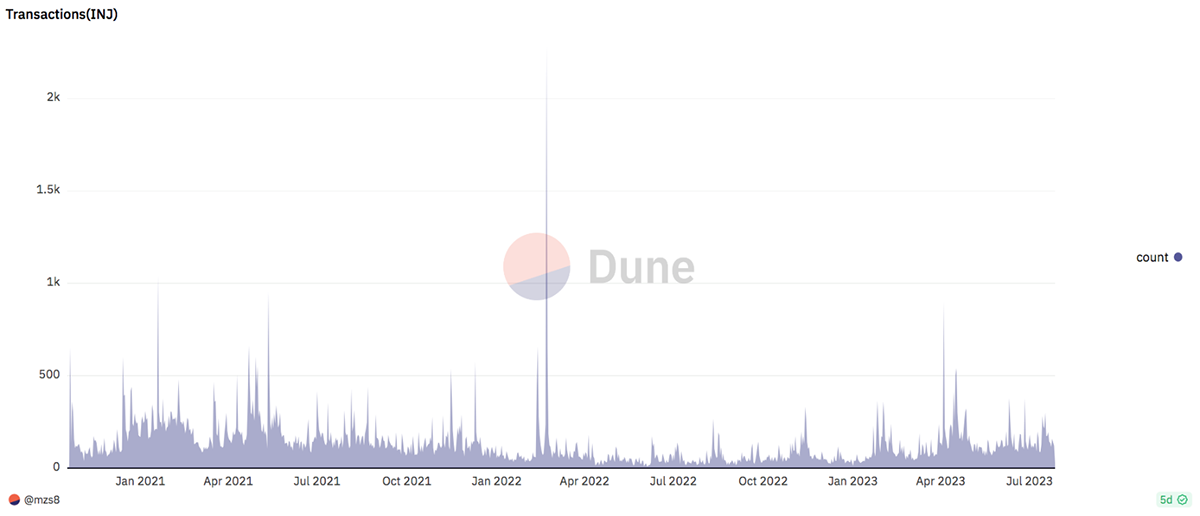

Despite its cutting-edge features and technical capabilities, performance on the Injective network has been lacklustre. As highlighted by the chart below, the number of daily transactions has been consistently low, rarely surpassing 500 since January 2021. This underwhelming transaction activity raises concerns about the network's adoption and usage.

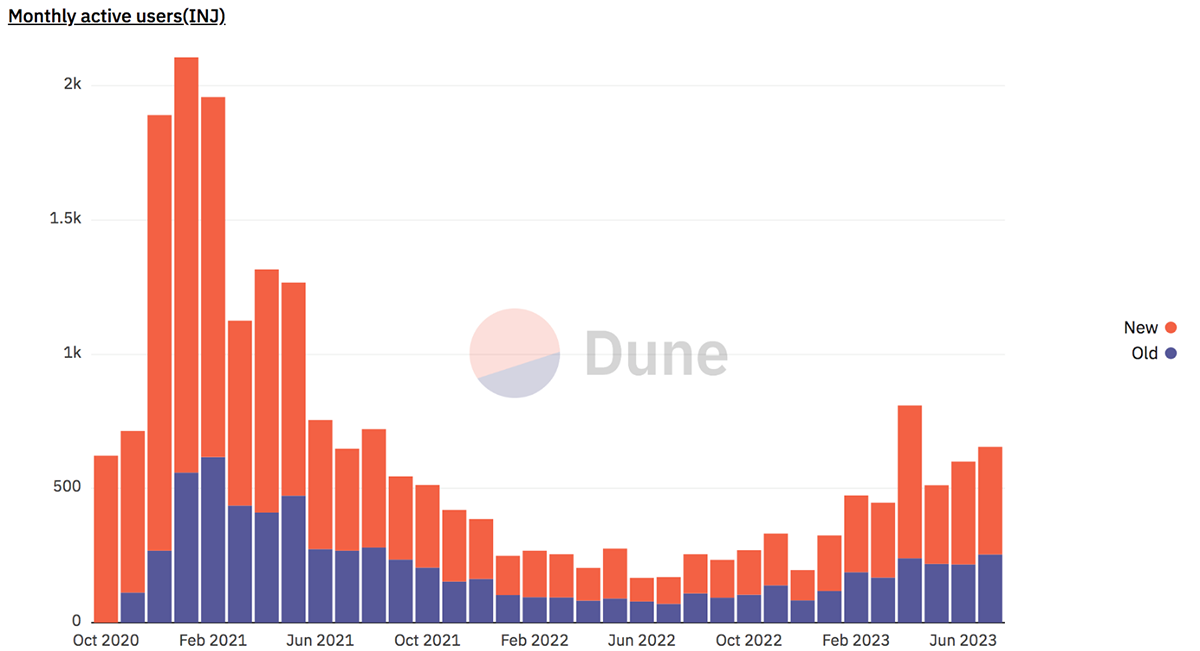

Injective Protocol has also faced a consistent decline in monthly active users since February 2021. However, there is a glimmer of hope as activity appears to be gradually picking up in recent months. The team's focus on improving user engagement and attracting new participants could potentially reverse this trend and lead to renewed growth in the future. The spike in new users in April is likely to be attributed to the month-long hackathon organised in collaboration with Tencent Cloud.

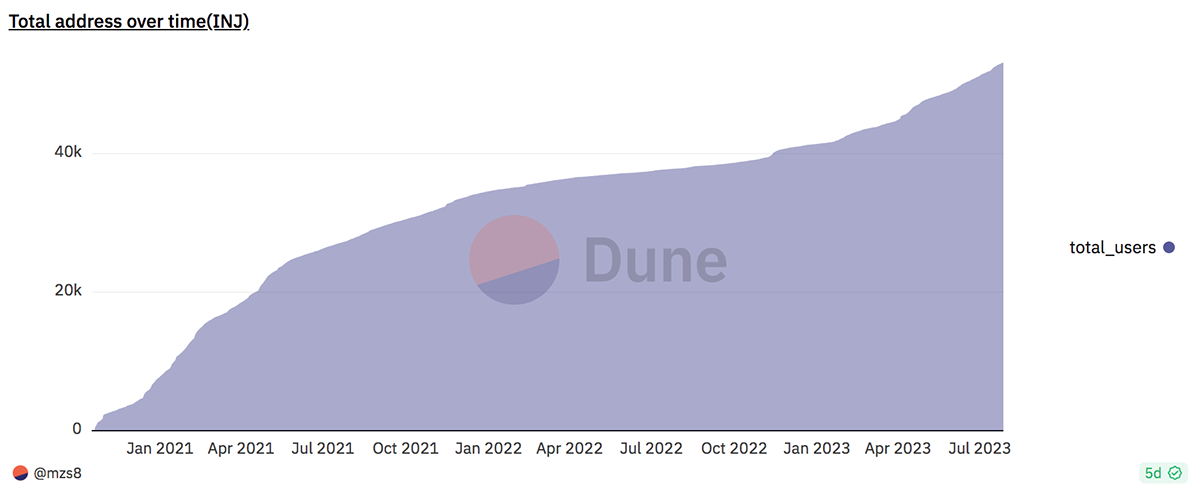

As illustrated in the chart below, the number of total addresses has consistently grown over time, recently surpassing 53k addresses.

Despite the apparent growth and adoption shown in the chart above, there are some concerning statistics regarding INJ token holders. According to the same Dune dashboard, there are only 15,671 wallets with a non-zero INJ balance, and less than 700 of those wallets hold over 1000 INJ tokens. Combined with the low daily transaction volume, this raises concerns about the possibility of artificial numbers inflation, perhaps through the creation of dummy wallets. After some deep digging, we were unable to find any other quality data sources to compare this data to, but we will keep searching.

INJ Tokenomics

INJ, the native utility token of the Injective ecosystem, was launched in an Initial Exchange Offering (IEO) on Binance in October 2022. INJ’s maximum supply is capped at 100 million, of which 83.7 million is currently in circulation. Out of the total INJ supply on the market, 41.6 million is currently staked for a 14.88% yield. On top of INJ being used for staking (or delegating), it also gives governance rights to token holders, allowing them to propose and vote on proposals in the ecosystem.

To instil deflationary pressure on the INJ token supply, Injective implemented a buy-back and burn mechanism in December 2021. Under this system, 60% of the trading fees generated by dApps on the Injective platform are auctioned off in return for INJ tokens. Subsequently, these acquired INJ tokens are permanently removed from circulation, i.e. "burned", which currently totals 5.7 million INJ (worth $12.3m). Reducing the total supply of INJ tokens in this manner creates scarcity and increases the value of the remaining tokens in the market.

Competition

Injective faces fierce competition in the blockchain space, with numerous smart contract development platforms competing for prominence. As the DeFi industry experiences a surge in innovation, established platforms like Ethereum, Binance Smart Chain, and Tron present formidable challenges to Injective's ambition of revolutionising decentralised finance.

In this highly competitive landscape, Injective must find more innovative ways to differentiate itself and carve out a unique position in the market. With established platforms boasting large user bases and diverse ecosystems, Injective will need to showcase its strengths and offer compelling advantages to attract more users and developers to its platform.

Summary

Injective is a Layer-1 smart contracts development platform focused on harbouring a DeFi ecosystem. Since DEXs lie at the heart of DeFi, Injective offers many custom-built features to develop DEXs. That is why it harbours not only DEXs but also independent DeFi dApps, like Frontrunner and Astroport.

The Injective Protocol sets itself apart with its innovative exchange module, boasting an on-chain, fully decentralised and shared order book, ensuring shared and neutral liquidity across the ecosystem. The platform's DeFi dApps-friendly architecture and trustless mechanism offer an attractive proposition. Yet, despite these strengths, network usage and token activity have been lacklustre, and competition presents a formidable obstacle to its growth. Nonetheless, INJ's robust tokenomics and the team's dedication, supported by the ecosystem fund, position it as a contender in the blockchain space.