Going for a Song

There are a growing number of investment trusts trading on unusually wide discounts, and some of these will be great opportunities. Yet that probably won’t always be the case as some are inevitably troubled. The sector is going through a period of disruption, and it will be the survival of the fittest.

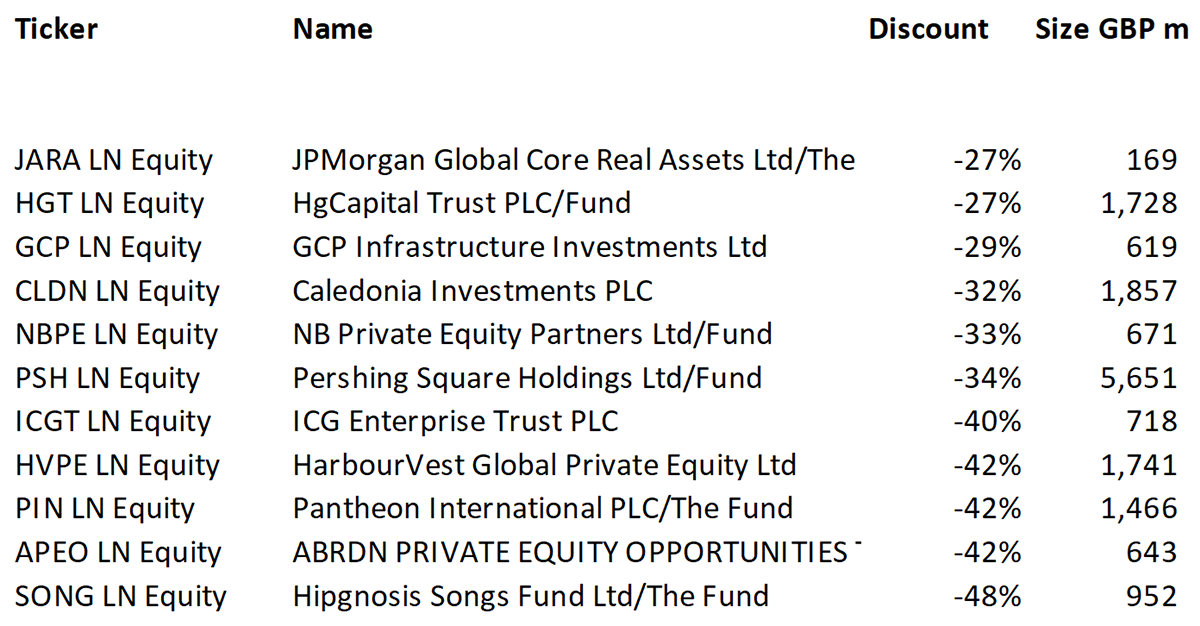

I show a list of the larger closed-ended funds with discounts greater than 20%.

The Soda Portfolio has owned Caledonia (CLDN), Pantheon (PIN) and Aberdeen (PEO, formerly Standard Life SLPE) in the past, all with great success. I am itching to own them again, but too many uncertainties remain, and in some cases, I wonder if there’s any discount at all.

To remind you, if you buy a fund at a 48% discount to net asset value, which is supposedly what the assets could be sold for, it has the potential to rise in price by 92% when the discount closes. In the case of Hipgnosis, it’s clearly going for a song.

Hipgnosis Songs Fund (SONG)

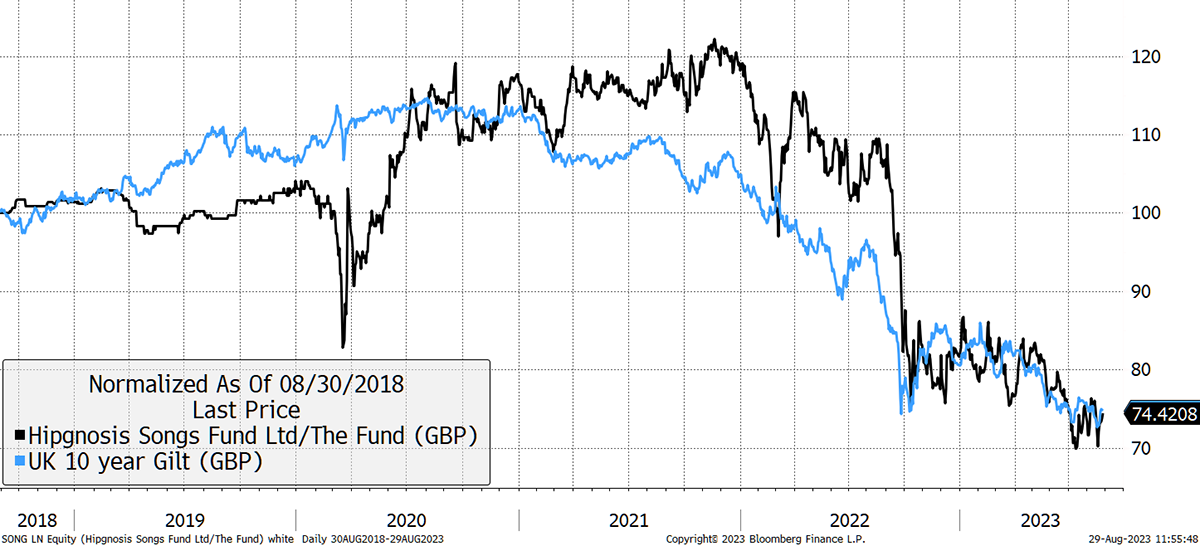

SONG has one hell of a catalogue, but not being a music mogul, I have no idea what it is worth. But perhaps that doesn’t matter because, over the past five years, the share price has basically followed that of a 10-year Gilt.

Songs and Gilts

SONG shares might have followed gilt prices, but the net asset value hasn’t. The company publish valuations that have barely changed for two years. I am not saying they are wrong, but for whatever reason, the music industry does not link gilt yields to the value of their catalogue. Perhaps they are not linked, and the value of music is genuinely independent of rates. Or perhaps it isn’t, and cool music execs don’t discuss gilt yields often enough. Perhaps they should.

Financial purists would say the value of the songs is an estimate of their future cashflows, with a discount rate applied. If the net asset value has fallen only slightly, it could be that financial investors are underestimating the intrinsic value of the music catalogue or that the music industry should pay more attention to financial maths.

I suspect it’s the latter, and so I would not be tempted to recommend SONG at this point. I don’t think the 6.7% dividend yield is attractive when it is unlikely to grow, on their numbers, when there are unknowns. Yet if the NAV fell in line with gilts, and there was still an attractive discount to NAV, this would be one hell of an opportunity.

I do not mean to sound critical of SONG, but with the shares down significantly, it may well be fairly priced on some measures, but it is highly unlikely to trade at a 48% discount to NAV. I do not believe their NAV fully reflects the changing environment. If I am wrong, there has not been sufficient transparency and comparison with other music portfolios to give me confidence in that.

These closed-ended funds in songs, infrastructure and private equity are often referred to as alternative closed-ended funds. They can have wildly different portfolios, but all suffer from the same key issue, i.e. a blend of liquidity, scale, true NAV, transparency, fees, and leverage.

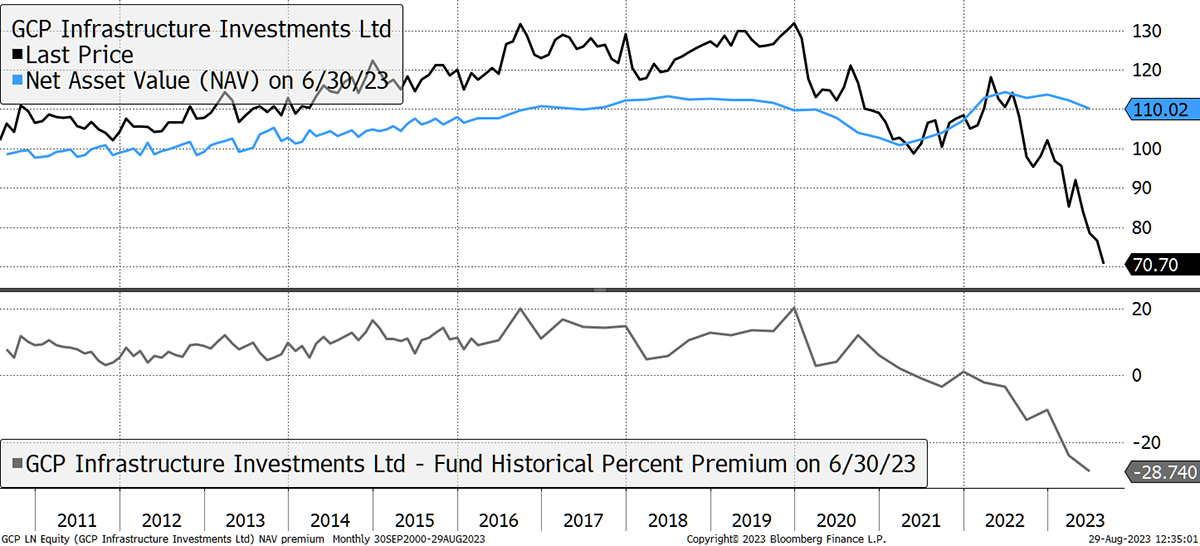

GCP Infrastructure (GCP)

GCP is much closer to financial markets because the management are financial people investing in infrastructure assets, and they probably wear suits rather than sunglasses. It invests in 52 assets relating to schools in Slough or Police in Nottingham under private finance initiative (PFI) contracts. It also owns wind and solar, social housing and other assets, with renewables being the dominant exposure.

Once again, the NAV has barely fallen despite the carnage in the bond market. The stockmarket is far more concerned about their asset valuations than their investment team seems to be.

Infrastructure NAVs are Resilient

The yield is expected to be a whopping 9.9%, and GCP are buying back their own shares to support the price. Furthermore, they are exploring a merger with GCP Asset Backed Income (GABI) and RM Infrastructure Income (RMII). These smaller trusts, valued at £240 million and £80 million respectively, would beef up the GCP trust and give it more scale. What has become key in the closed-ended fund world is liquidity, and in order to survive, the smaller funds are merging with their larger rivals.

These funds have not fully acknowledged the significant rise in the discount rate. If and when they do, these funds will no longer be cheap, and until then, the clouds remain. This is what I mean when I say I want to avoid liquidity risk because it’s easy to buy but then hard to sell.

Private Equity

This is the group that I am naturally most interested in, as private equity is basically equity that isn’t listed on the stockmarket. And here we are, putting it straight back onto the stockmarket.

I have kept an eye on these funds for years, and they have generally delivered high returns. Every time there is a crisis or a major market event, the discounts widen. And once the NAVs start rising again, when the crisis is over, the discounts start to narrow, leading to rapid rises in their share prices.

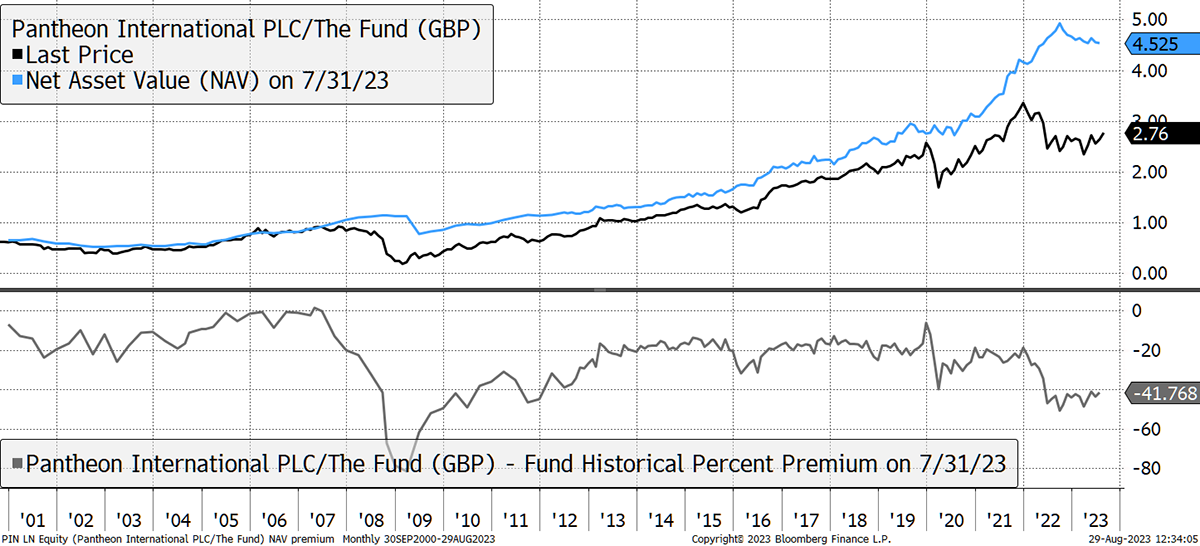

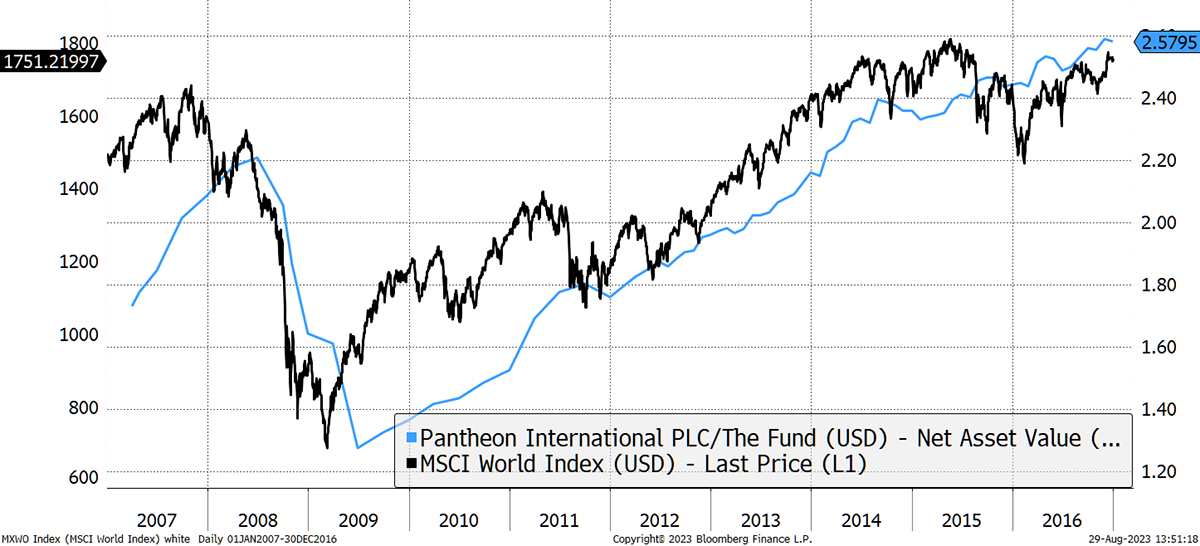

That happened to Pantheon (PIN) in 2008 and, to a lesser extent, in 2016. The discount this time is a significant 42%, which compares with a 20% average over the past decade. The NAV is down just 7.6% from the peak. Even the S&P 500 managed a 25% fall. How can their portfolio be so resilient?

Pantheon on a 42% Discount

PIN is diversified around the world, in different “vintages” (deal age), different sectors and different deal types. They have diversified away “specific risk” – risk attributable to a single company. The largest sectors are in growth by nature in areas such as healthcare and information technology. I suppose it takes time for their managers, who select and operate the companies, to shift valuations. But when they are tech-heavy, and they saw what happened to small and mid-cap tech in 2022, a 7% downward NAV adjustment is fanciful. Everyone knows this, and just like SONG and GCP, investors are sceptical of the true valuation.

Zooming in on the credit crisis in 2008, PIN’s NAV didn’t peak until nearly a year after the stockmarket in June 2008. Their trough came in June 2009, nearly nine months after the Lehman Brothers bankruptcy, in a downward adjustment that was less than the stockmarket. The NAV was then slow to catch up, and the fair value process was disrupted for several years.

Reducing the NAV Lags the Market

This is one of the things we are up against. Unless we have some sort of liquidity event, when material changes to prices cannot be ignored, then it is right to be cautious of the NAVs. The hope right now is that all is well, the stockmarket carries on upward, and these trusts catch up. However, that may not happen. A less palatable scenario is that NAVs are still overstated and yet to adjust.

It will not surprise you that I am very interested in this list, and in a sense, there are many similarities with large-cap equities, which shrug off this world of rising interest rates. Parts of the market seem to think this era of low rates is temporary and we’ll soon be back to normal.

That might be true, but I doubt it. What is more important to me is that the NAVs of the closed-ended sector are believable. That they have barely fallen at all is ridiculous, especially when you look at the world around them. One defence is they are seeing deals similar to current prices, but I do not believe there are enough deals going through to validate general price levels. Sure, the best deals are going through, but you can’t price everything off those.

In summary, I cannot wait to pounce on this sector in the Soda Portfolio, but too many uncertainties remain. And while that is true, liquidity remains poor, and it is hazardous to buy investments that become hard to sell. That is something to avoid.

Action:

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority. https://register.fca.org.uk/

© 2024 Crypto Composite Ltd