Waiting for Alt Season

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio 66;

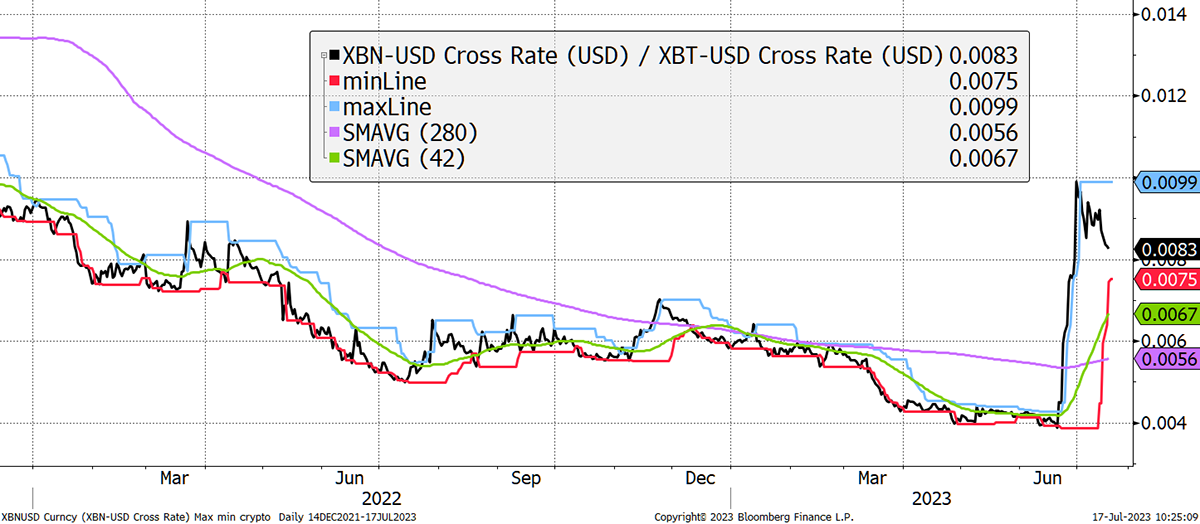

It is reassuring to see the recent hype over Bitcoin clones fade away. Litecoin (LTC) is back to a 2-star ByteTrend in BTC, while Bitcoin SV (BSV) is reassuringly back to 0 stars. Yet Bitcoin Cash (BCH) remains 5 stars in BTC. I suppose a 150% rally does that. The only surprise is how the 200-day moving average is positively sloping and whether that remains so.

BCH Pump

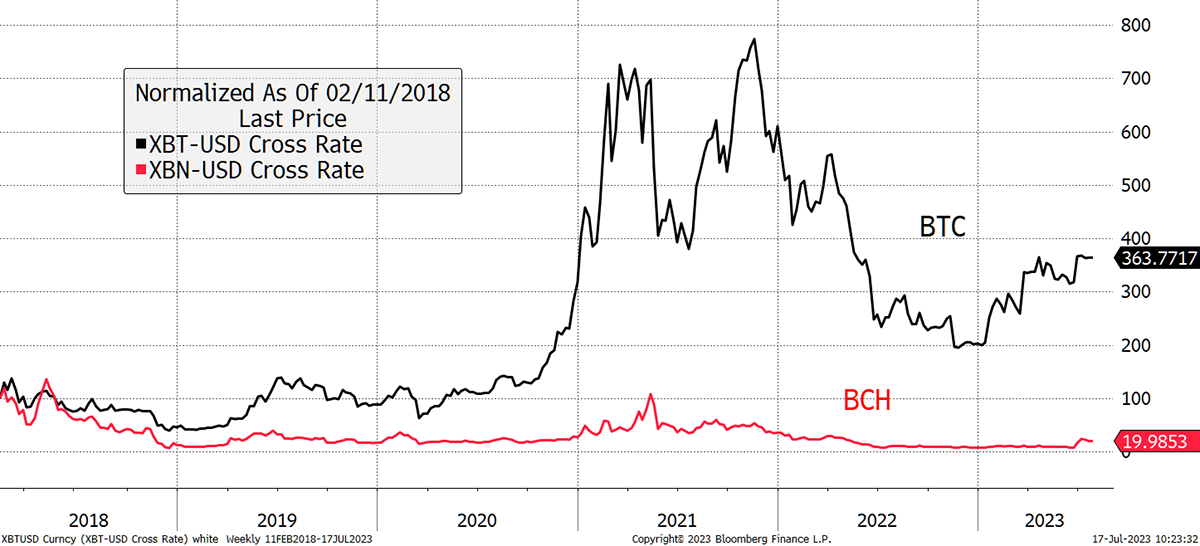

It’s worth reminding ourselves how BCH got here. It was originally a Bitcoin hard fork which spun off on 1 August 2017. Since early 2018, from where I have a price to show you, $100 invested became $19.94, or just $8 before the pump. In contrast, BTC rose by 3.5x. There is no other way to put it, but BCH has been a colossal failure.

BCH Bust

This brings me to the next point: to remind ourselves why we need to stay patient during these troubled times in markets where liquidity is being withdrawn from the financial system.

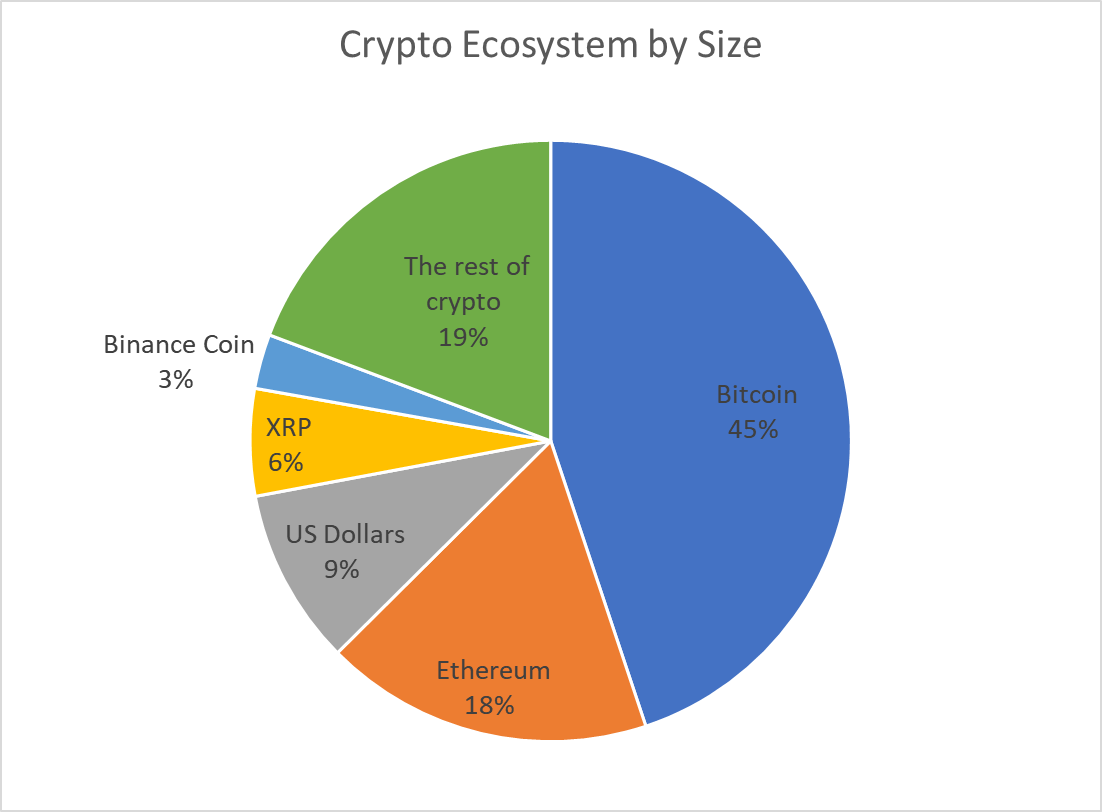

If I include the major stablecoins, Bitcoin makes up 45% of this space, with Ethereum a further 19%. US dollars, Ripple (XRP) and Binance Coin (BNB) make up 18% leaving 19% for the other 20,000+ plus crypto projects where there is generally poor liquidity.

We are waiting for liquidity to return to markets so that the new round of winners can emerge from the green area. We know that XRP never sustains a rally because they seem to sell into strength, so our only hope to get Bitcoin and Ethereum type of performance is from carefully chosen mid and small caps when the time is right.

Be patient. The good times will return, especially with the recent ruling…