The Ruffer Investment Company

This week we review the Ruffer Investment Company (RICA). But before we do, I was very satisfied with last week’s review of the Capital Gearing Trust (CGT), which ended with a discussion with the co-manager, Chris Clothier. He answered your questions clearly and confirmed that they have a resilient strategy. Of particular note, their net asset value has fallen slightly, but the widening discount has made a little pain feel a lot worse. Those who purchased this fund in the last year haven’t had the remarkable experience shared by long-term shareholders.

My only disappointment was some of their investments prior to the rate hikes, in the income-generating closed-ended funds. These had been trading at premiums in recent years, which included property, infrastructure, and renewables. That wasn’t something we saw in CG portfolios in years past, but they said they were attracted by the index-linked inflation protection.

In any event, these are now trading at discounts, so the damage is behind us. When market liquidity returns, and rates cool, there is upside to look forward to in these areas. Better still, CGT has around 30% in dry powder (short-dated bonds etc.) ready to take advantage of value opportunities as they arise.

On that note, Chris described how asset prices have come under pressure while interest rates have risen. That is largely behind us, and there has been some pain in the transition, especially in bonds. The good news is that we have left behind us a 2022 CGT portfolio with a 1% yield and look forward to a 2023 CGT portfolio with a yield closer to 6%.

Opinion

I have no hesitation to hold on to CGT in the Soda Portfolio and continue to treat it as a low to medium risk, long-term investment. I may even add exposure, taking it back towards 20% at a later date, but I would be more comfortable doing that when I have reduced bonds in preference for equities. In other words, when this miserable market chapter is behind us. If you don’t own CGT, you should consider it.

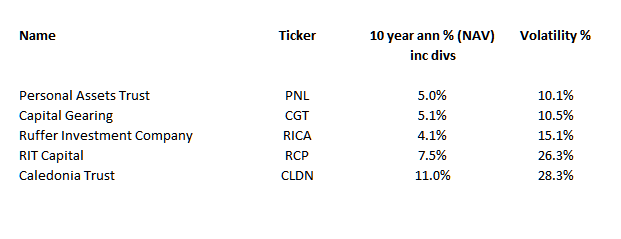

Comparing the Absolute Return Investment Trusts

RICA and CGT have similar investment objectives but different approaches. You could also add Troy’s Personal Assets Trust (PNL) to that list, which I do not own. RIT Capital and Caledonia would also be on the list but are much more volatile. They are family offices (Rothschild, Cayzer) with long-term investment objectives.

UK Diversified Investment Trusts

In many ways, these funds are completely different, but they have one thing in common: they all seek absolute returns. That is, they are actively managing money in search of profit rather than trying to beat an index. That might sound strange, but the vast majority of money managed by professional investors aims to beat an index.

Looking back over 10 years, CLDN has done the best, but when I measure its share price return instead of net asset value (NAV), that drops to 9.4% per annum instead of 11%, and 6% for RCP. That means CLDN and RCP are trading at deep discounts, which one day will likely close. But still, shareholders aren’t feeling the love because they can only sell at the current price and not the NAV. It is also the case that these higher-return funds have made more money, but with that comes much higher price volatility. They also hold large amounts of illiquid assets, such as private equity and property, which take time to sell, assuming you want a good price.

In contrast, PNL, CGT and RICA are less volatile and are much more liquid portfolios. PNL is the most liquid as it holds gold, high quality equities (Unilever, Nestle, Diageo etc.) and government bonds. CGT is mostly liquid, with, say, 80% in government bonds and other highly liquid securities, and around 20% in corporate bonds, preference shares and other funds and equities, which would take a little time to sell at good prices. RICA is probably 90% liquid, with most of that held in their “illiquid strategies portfolio”, which owns long-term value. Given the closed-ended nature of these funds, none should be deemed to have liquidity risk, unlike RCP and CLDN, which most certainly do.

I like all of these strategies, but it is worth noting that the more liquid and less volatile funds are much more sensitive to their discounts and premiums, and their managers control that as best they can through issuance and buybacks over the cycle. Currently, all three have swung from premium to discount, which says much about the state of the market. There’s a lot more to say here, and CLDN and possibly RCP may find their way into our portfolios, but I’ll focus on RICA for the time being. Time is on our side.

The Ruffer Investment Company

RICA released its annual report. I will show the highlights, but please read the report and ask the fund manager, Duncan MacInnes, your questions on Friday. Register for the webinar here.

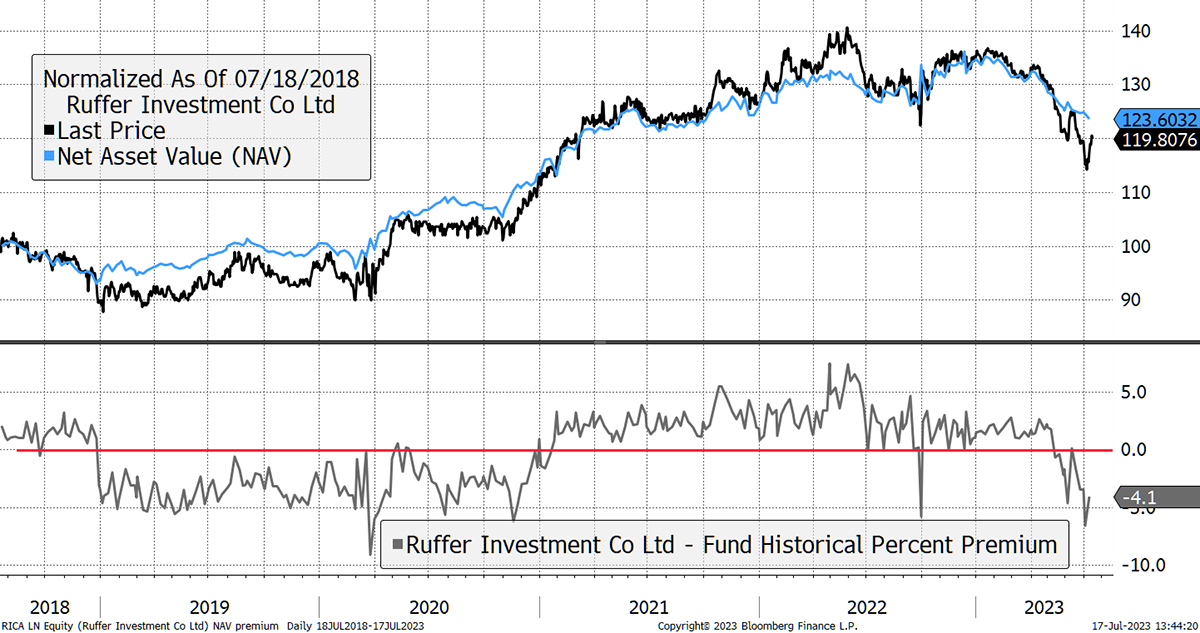

From the highest point in 2022 to the lowest last week, the shares were down 20%, now a slightly less painful 15%. Once again, it’s the discount that hurts most as the NAV is down 9% from peak to trough.

Ruffer Investment Company

That’s still not very palatable, and the reasons are very similar to what we heard from CGT. They successfully hedged interest rate risk, so that hasn’t been a problem. However, they have been too cautious on equities because they believe raising rates is draining liquidity which will result in a recession and lower share prices. The pound has rallied, which they didn’t see coming, and the risk exposure they had was more around commodities than big US tech. That said, they owned a little. They also own inflation-linked bonds and have exposure to currencies such as the yen. It is starting to sound familiar.

CGT, RICA and many others, including myself, have followed a cautious path and ended up in similar areas, which haven’t yet rewarded investors. The clever trick in 2023 has been to own the seven largest tech stocks. This they describe as a surge in “dispersion” whereby some stocks go up while many others go down. That contrasts with recent years, where most stocks have tended to move together – all up or all down. Looking into next year, they see high dispersion as a positive tailwind for stock pickers.

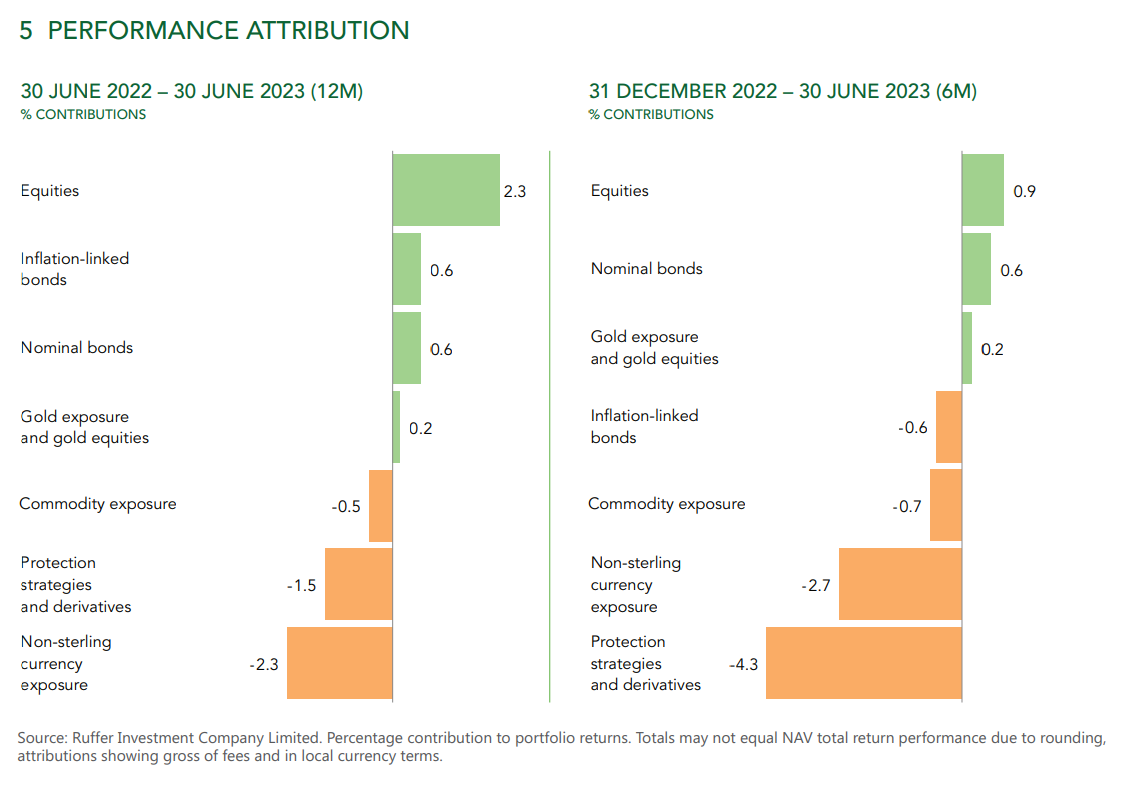

It can all be summarized in their attribution table.

They have made a little from equities and short-dated bonds. Commodities have cost them, but not as much as foreign currency and protection strategies, which is similar to insurance premiums that pay out in the event of a market crash. The biggest detractor of performance has been trying too hard to avoid losing money! The irony.

Ruffer have been here before, and I have no doubt they will come out of this era. In contrast to CGT, with a 6% yield, it now has time on its side. RICA is shelling out on protection. I will be highly focused on this part of their portfolio in the webinar.

Action:

No action

Postbox

Thank you for a useful session on Friday. Being a holder in (for me) sizable amounts of Capital Gearing, Ruffer and Personal Assets I was interested in the opinion that all three had the same fundamental objective but approached it by different means. So I am happy to hold all three. I never liked all my eggs in one basket, especially since the time I had all my Bank of Scotland shares which had gone up about 6 times in a single company PEP when BoS failed. I was too busy with my career to make the effort to deal with the risk that I was aware of. It is so true that losing your own money is a good way to learning a lesson!

And..

Thank you Charlie for organising and for your prior outline / analysis. Thank you for your insight and targeted questions holding accountability and identifying directions. Very good to get a face and impression, a personal feel of a fund. Enjoyed the webinar immensely.

I don’t want to turn this into a TV show, but I think that at times like this, a webinar goes a long way in explaining what is happening.

Using HL and AJ Bell platforms (ISAs & SIPPS), I’m unable to place an online order and therefore must call the dealing number that incurs an elevated charge, which I’m loath to do. In both instances the dealer mumbles something about market volatility and liquidity (no other explanation) as the reason I can’t place an order online. Can you comment please. Could these shares be difficult to trade when I want to exit? Many thanks for the guidance you give, it’s much appreciated.

Tenaris is a highly liquid share and should be easy to sell when the time comes. The US quote TN US is more liquid than TEN Italy. Liquidity is a very good reason for embracing non-UK large companies as it is much improved.

Portfolios

New readers, please find a note at the end after the summary.

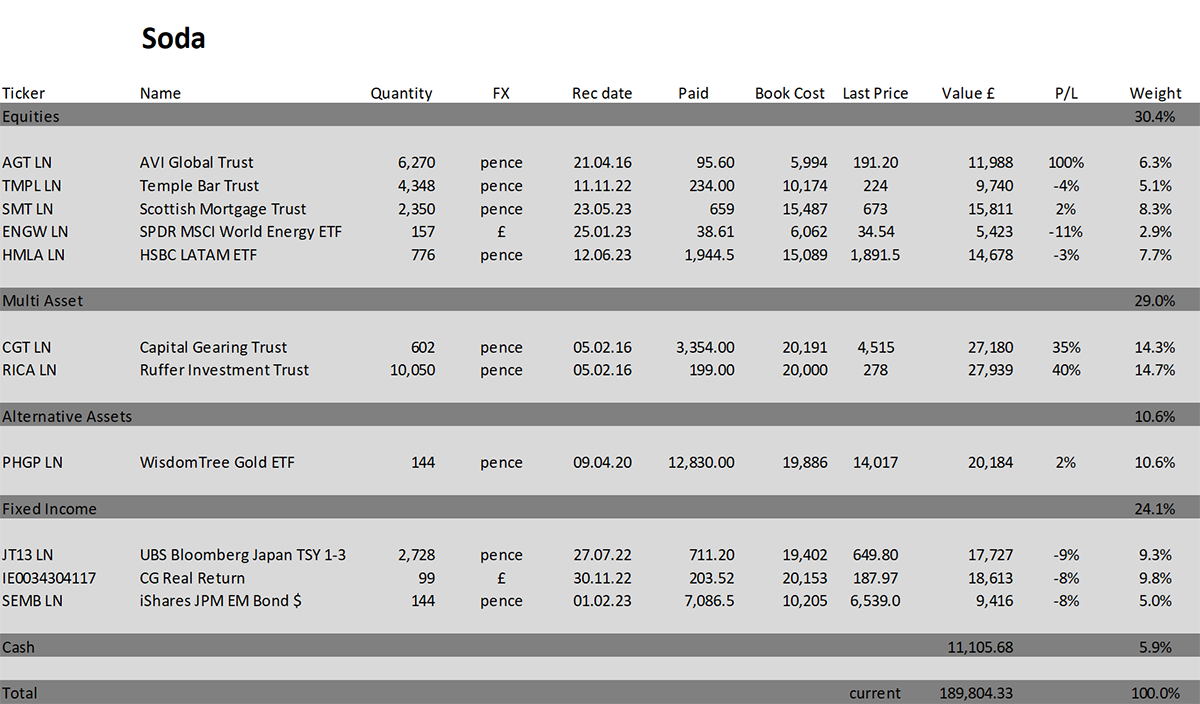

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts. The Soda portfolio is down 5.2% this year and is up 89.8% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| +21.7% | +8.8% | -1.8% | +19.6% | +8.9% | +14.3% | +3.5% |

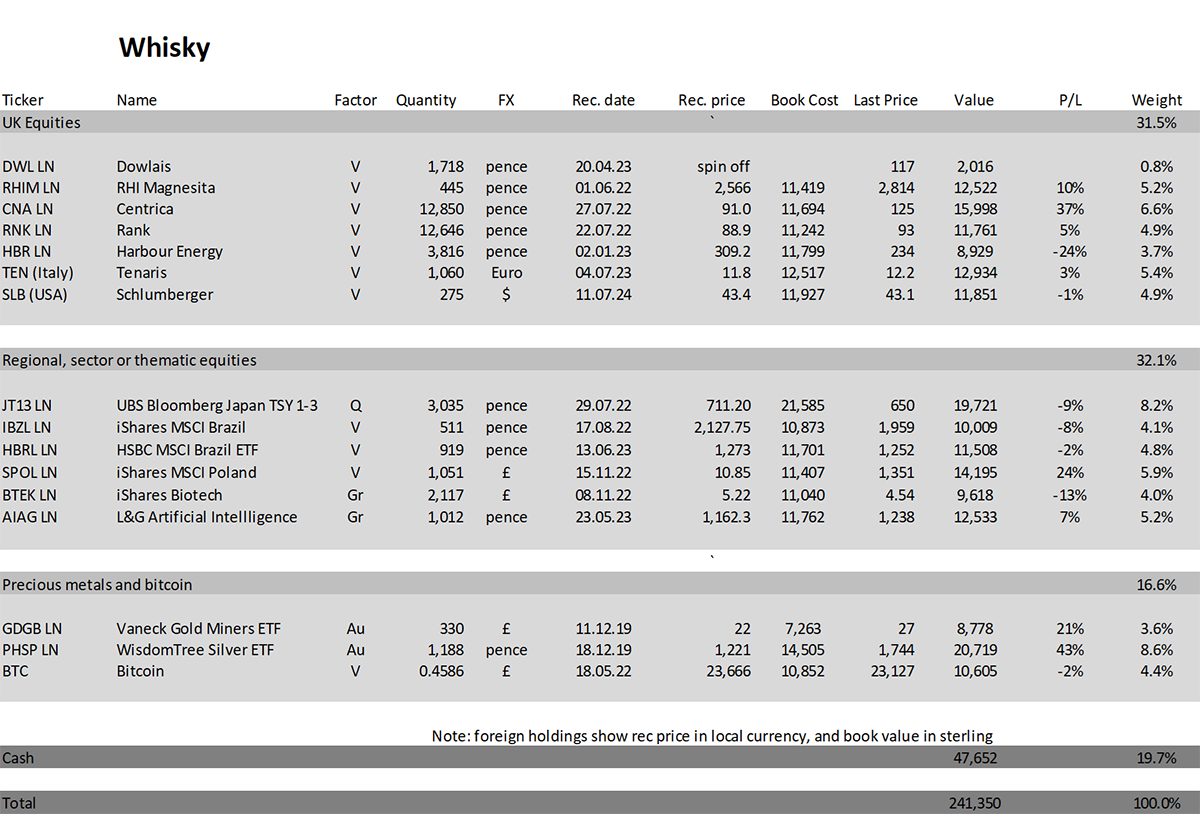

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 8.0% this year and up 141.3% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| +24.7% | +5.4% | -4.3% | +21.4% | +20.4% | +12.9% | +8.0% |

Summary

UK inflation data comes out tomorrow (Wednesday). No doubt it will be newsworthy. If it cools more than expected, that means fewer rate hikes and a softer pound.

I liked Chris Clothier’s reminder of the Larry Summers quote, former US Treasury Secretary, who quipped back in 2020 that,

“Europe’s a museum, Japan’s a nursing home and China’s a jail.”

What does that make the UK?

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com or tweeting me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

Note for New Readers

The design of The Multi-Asset Investor investment process is to blend Soda and Whisky according to the level of risk you wish to take. Hopefully the clue is in the names as to which portfolio carries more risk. Most investors would be best suited to 80% in Soda and 20% in Whisky (a less risky blend) or 60% in Soda and 40% in Whisky (a riskier blend).

Example

A recommendation is often, but not always, 5% of either portfolio. If I added 5% of ABC in Whisky and you followed a 40/60 Whisky/Soda approach, then ABC would be 5% x 40% = 2% of your overall pot. If you followed a 20/80 Whisky/Soda approach, then ABC would be 5% x 20% = 1% of your overall pot.

This approach enables the Whisky Portfolio to pursue more adventurous opportunities than if it was designed to be the entire strategy. The inevitable, and hopefully infrequent, failure of some individual recommendations means the maximum loss is limited to between 1% and 2% of the overall pot, which is within reasonable scope. Cautious investors can be 100% Soda, but a little Whisky brings your investment journey to life and will hopefully boost returns in the long run.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority. https://register.fca.org.uk/

© 2024 Crypto Composite Ltd