Litecoin Halving

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio 65;

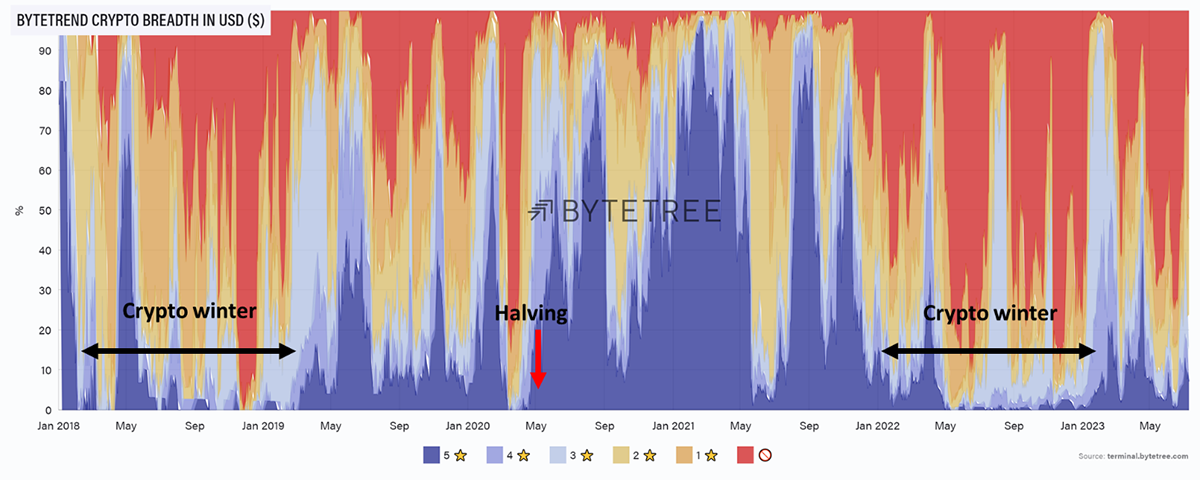

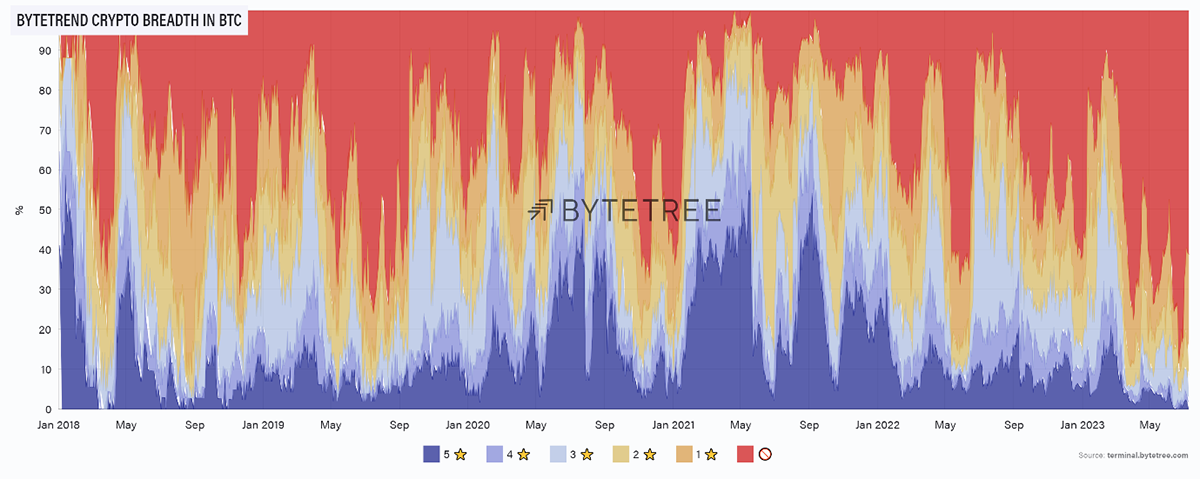

The crypto space is stabilising as the number of tokes in downtrends has fallen sharply, as shown by the retreat of the red zone on the breadth chart.

The crypto winters in 2018 and 2022 both saw a lack of blue as the market was dominated by downtrends. Then the blue returned in 2019, briefly interrupted by the Covid crash in March 2020. The Bitcoin halving came about in May 2020, and a period of strength resumed. If history repeats itself, we should be heading into a stronger seasonal period where we see better market conditions.

However, the big alt rally may not come until after the Bitcoin halving next April. Last time, Bitcoin was very much in the lead right up to that point. Thereafter the market breadth turned blue as many tokens started to outperform Bitcoin.

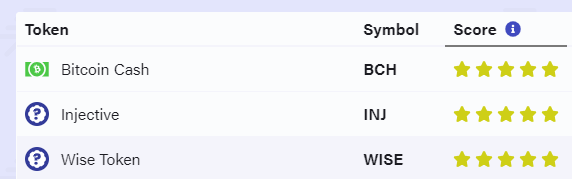

Still, we carry on looking for opportunities. There are three 5-star trends when measuring the leading 100 tokens in BTC.

Bitcoin Cash (BCH), we have rejected. Wise Token (WISE) is illiquid.

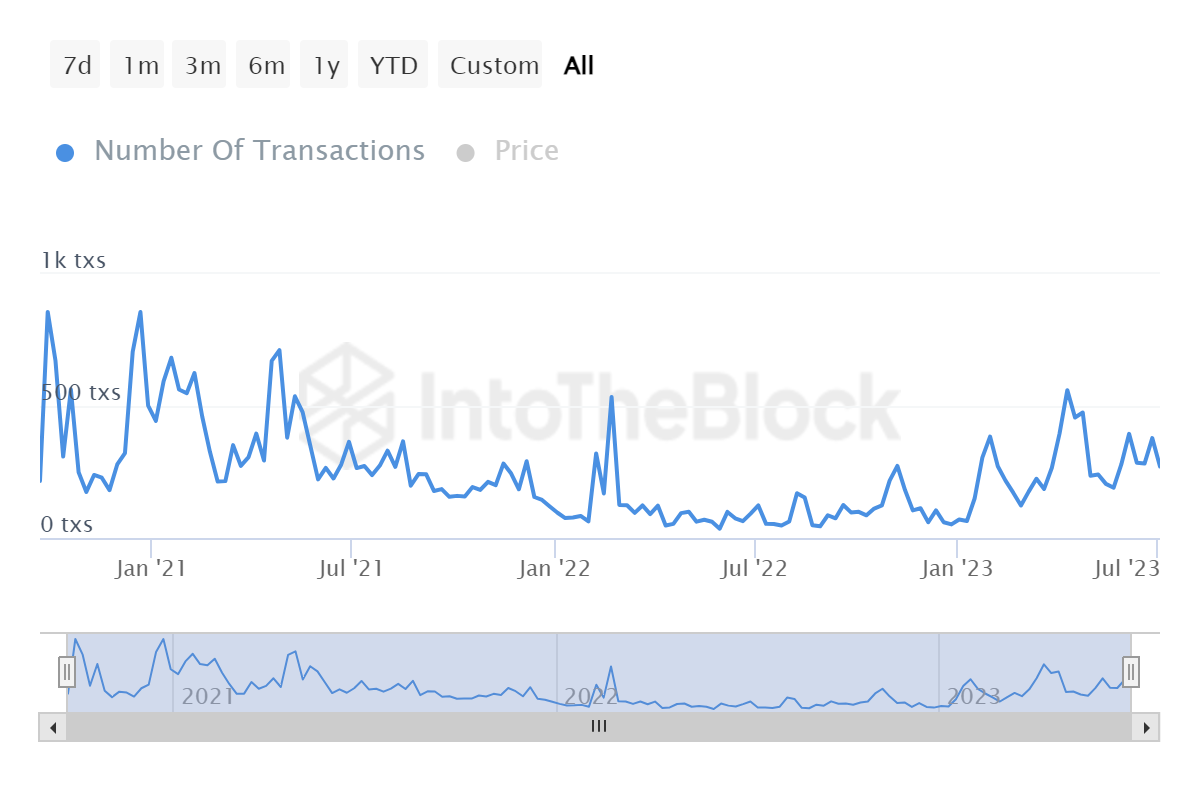

Injective (INJ) is potentially interesting, but the on-chain data is weak.