Ethereum Breaks Higher

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio 64;

It is nice to see some good news from Ethereum as the price edges ahead of Bitcoin. A sustained move above $2,000 would be most welcome.

Ethereum Price

The data show that the Ethereum network is growing again, but there is no surge in activity as yet, but that’ll come sooner or later.

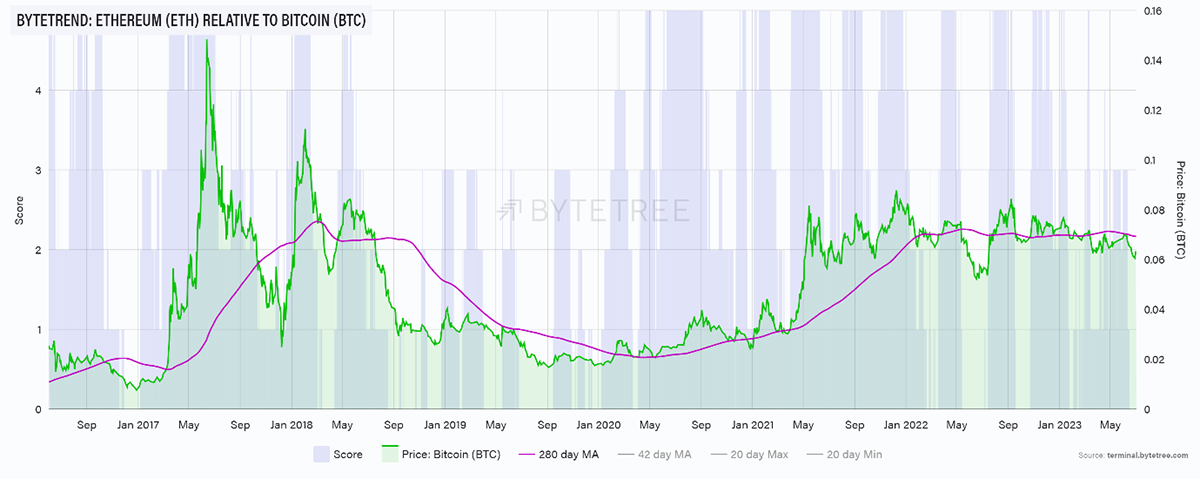

It’s interesting how stable the ETH-BTC relationship has become, with 0.07 being the average for nearly two years. To make a new all-time high, you’d need to see flippening.

ETH in BTC

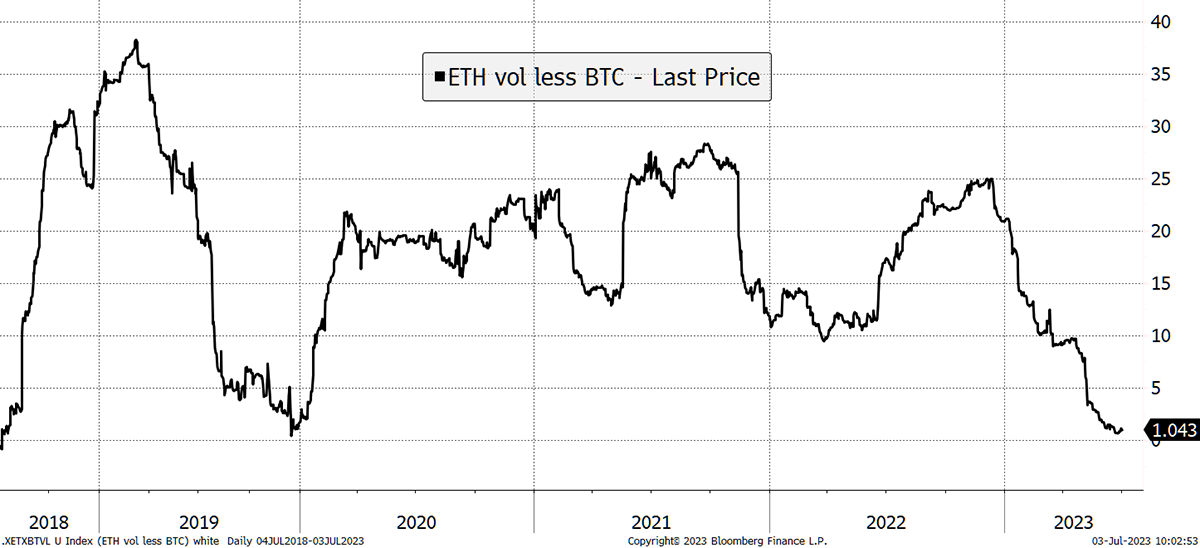

ETH has also seen a drop in volatility too. Over the past 180 days, ETH volatility has been just 1% higher than BTC volatility, last seen in late 2019. That is down from a 25% gap earlier in the year. Surely another sign of better times ahead for crypto.

ETH Volatility Closing on BTC

ETH is trading at the bottom of the range, with some renewed strength, and is therefore likely to run ahead of BTC in the near term. The bigger question is; how much outperformance over BTC is likely thereafter?

It’s easy to forget that crypto is basically $600 bn in BTC, $230 bn in ETH, $48 bn in XRP, and $40 bn in BNB. After that, they drop off quickly. For ETH to seriously beat BTC, it would have to become the number one asset in crypto, meaning ETH’s utility would become more valuable than BTC’s monetary properties. That’s a big ask. One strong indicator would be ETH having lower volatility than BTC. If that happens, I may start to believe it.

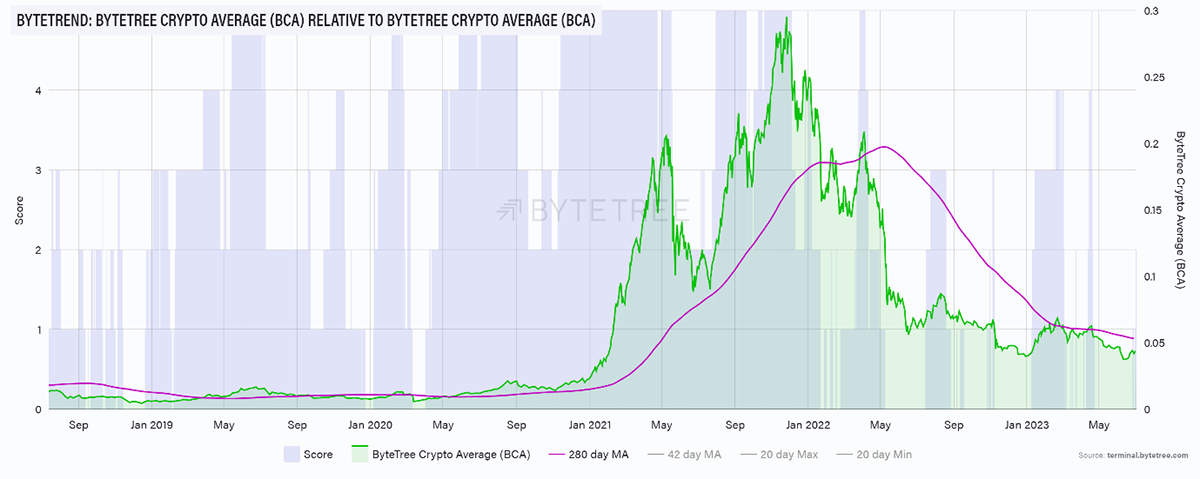

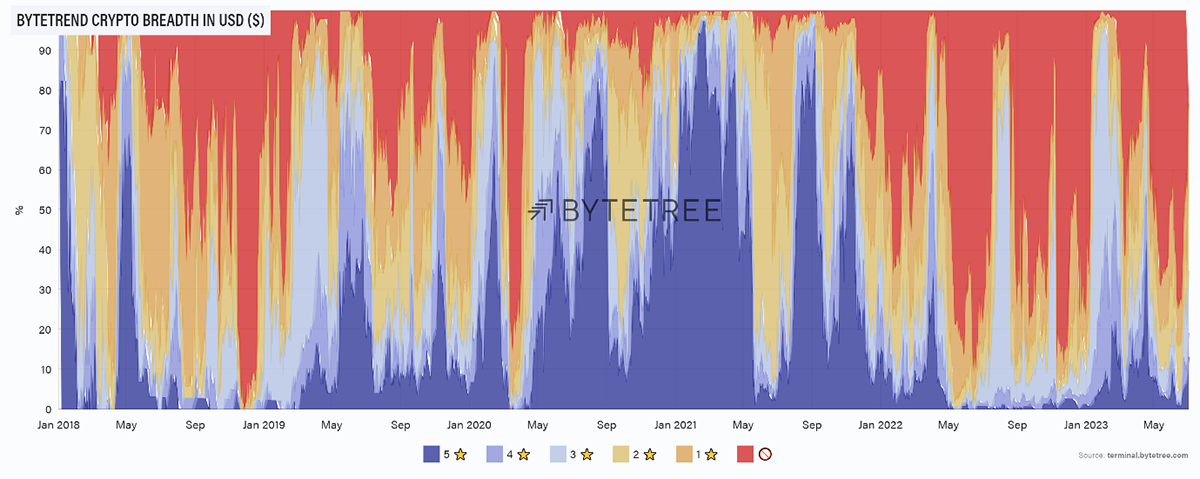

On the rest of crypto, the blue line is rising again, which is welcome. That means the trends are improving. There is no new leadership emerging yet, but at least crypto strength in dollar terms is on the rise.

Crypto Breadth Is Improving

Another useful indicator is the ByteTree Crypto Average (BCA). This looks at the unweighted daily performance of the top 100 tokens. When it is rising, that means most coins are rising, and vice versa. It currently has two stars but seems to be improving, meaning that the good times are on the way.