Bitcoin’s Reawakening

Disclaimer: Your capital is at risk. This is not investment advice.

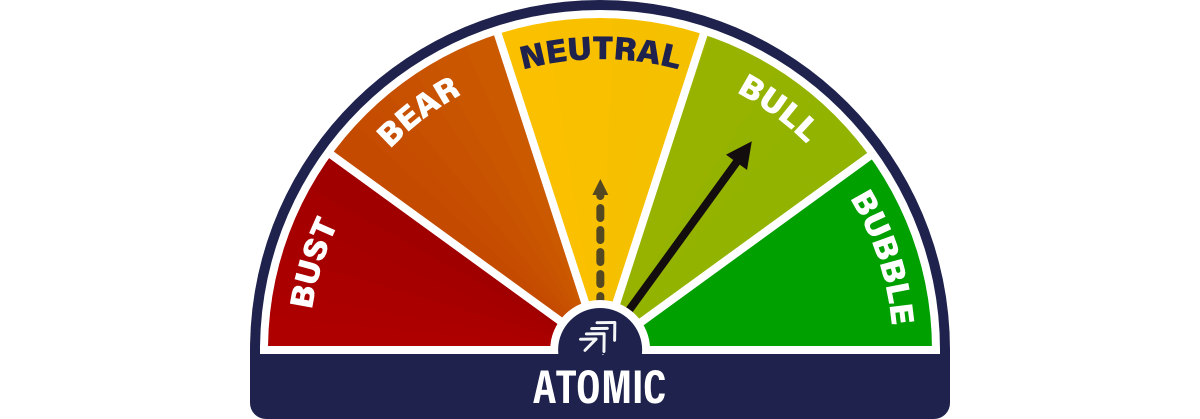

ATOMIC 87;

My thanks to Charlie Erith for his splendid work on these pages since October. I’m sorry folks, but he’s moved on to manage The Bitcoin and General Fund full-time, so you’re stuck with me again. ATOMIC, ByteTree’s deep dive on Bitcoin, will be published monthly, with flash notes when necessary. The one small change is that I will increase coverage of notable crypto-related stocks such as MicroStrategy, Grayscale, the miners, and others.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto Stocks.

Highlights

| Technicals | Bitcoin price at the cycle average, IRR is 50% |

| On-chain | Strong, and ignore fees |

| Investment Flows | The Reawakening |

| Crypto Stocks | Larry speaks |

| Macro | The Fed remains tight |

Technical

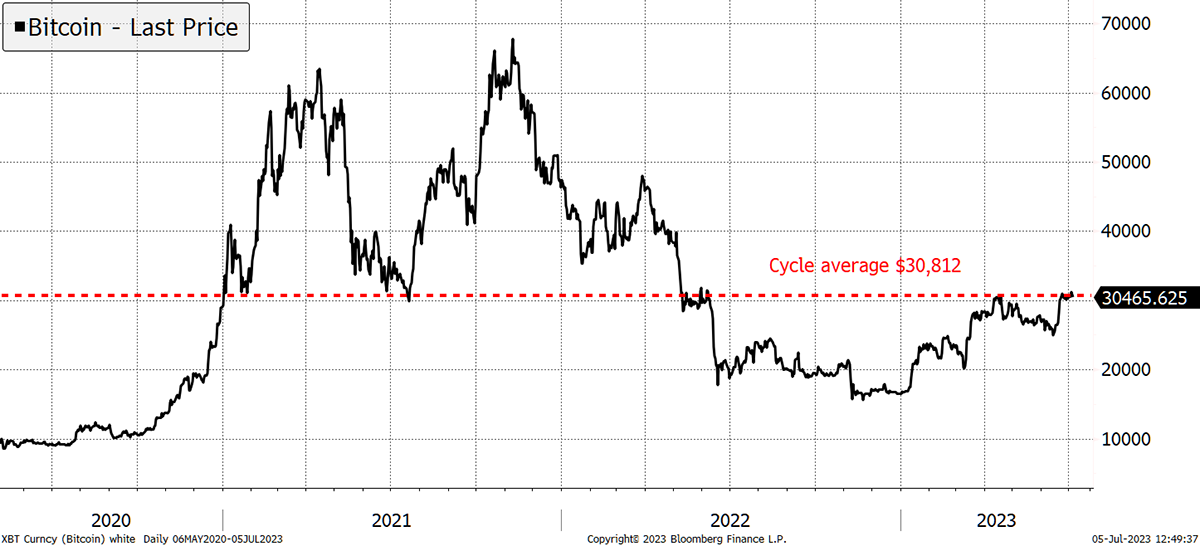

The average price of Bitcoin since the last halving in May 2020 is $30,812, which is close to where we are today.

Bitcoin Price at the Cycle Average

The history of the Bitcoin price has a cycle around the halving events, where the new supply growth literally halves. Compared to past cycles, or epochs, this cycle has been a gentle affair as the price moves have cooled.

Calming Cycles

Observations:

- At the time of halving (red vertical line) to the next cycle’s lowest price, saw the Bitcoin price appreciated by 16x in epoch 2, 4x in epoch 3, and 2x in the current epoch. There’s some symmetry there, although possibly coincidental.

- The highs have always overshot, which goes with the territory. But the average price of each epoch has grown from $338 to $5,720 and to $30,812 today. That is 17x from epochs 2 to 3, falling to 5x from epochs 3 to 4.

- The current price sits at epoch 4’s average. Historically, Bitcoin has always rallied into the next halving.

This dampening of Bitcoin shows the trendline that links the lows over the past 5 years. There was previously a 100% p.a. trendline which dates back to 2013. This new trendline has slowed to 50%. That’s still a very big number, which you won’t find anywhere else for a big liquid asset.

50% Trendline

With halving just 9 months away, I expect Bitcoin to defy gravity and see the price above the cycle average by that time. A new high is asking too much, but somewhere in the $40k to $60k range seems likely.

Then epoch 5 will end in April 2028, and by that time, this trendline will be at $100,000. Recall that price is normally above the trend, possibly by 2x or 3x, so don’t write off the next cycle.

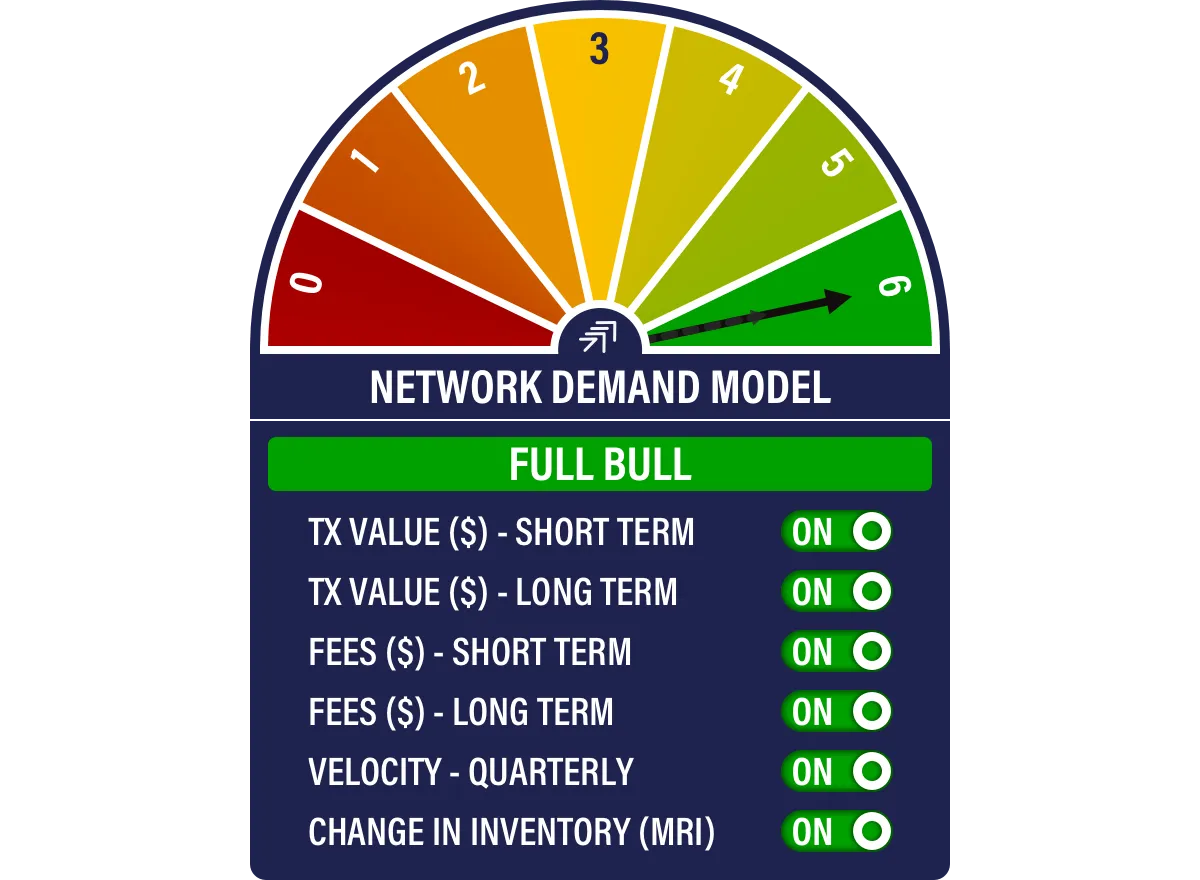

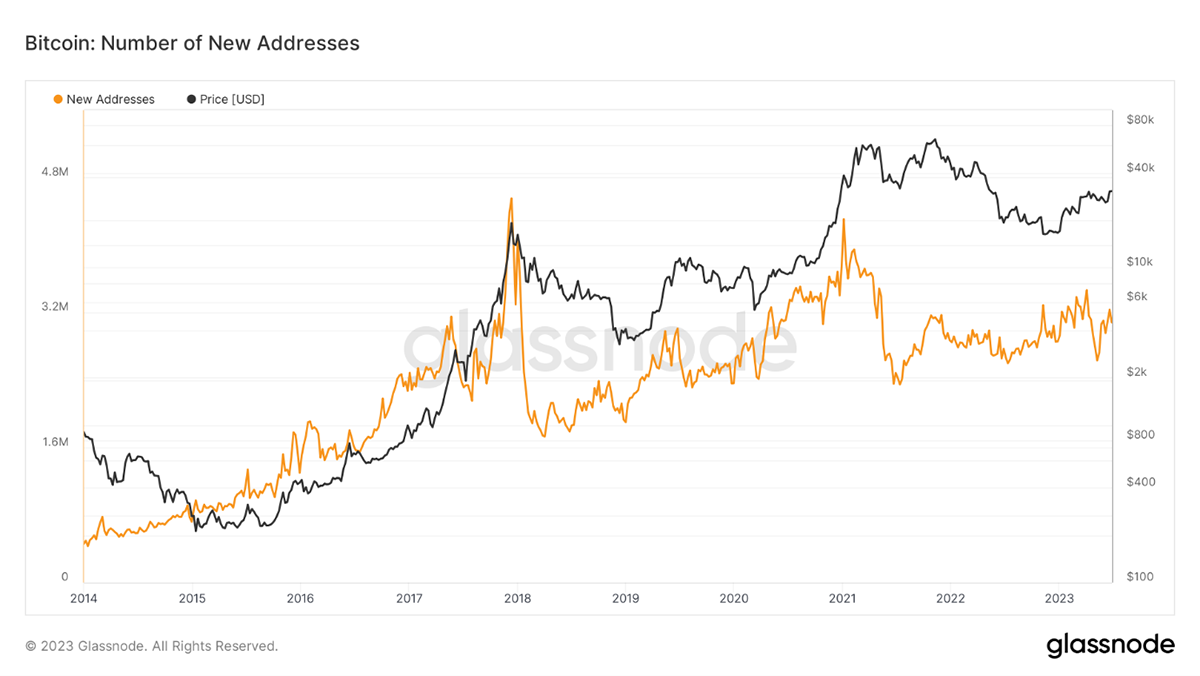

On-chain

The blockchain is firmly in growth mode, with all the underlying network demand indicators registering 6 out of 6. Furthermore, this chart from Glassnode shows that new addresses are rising again, which is something I would associate with a bull market, despite being quantitatively hard to prove.

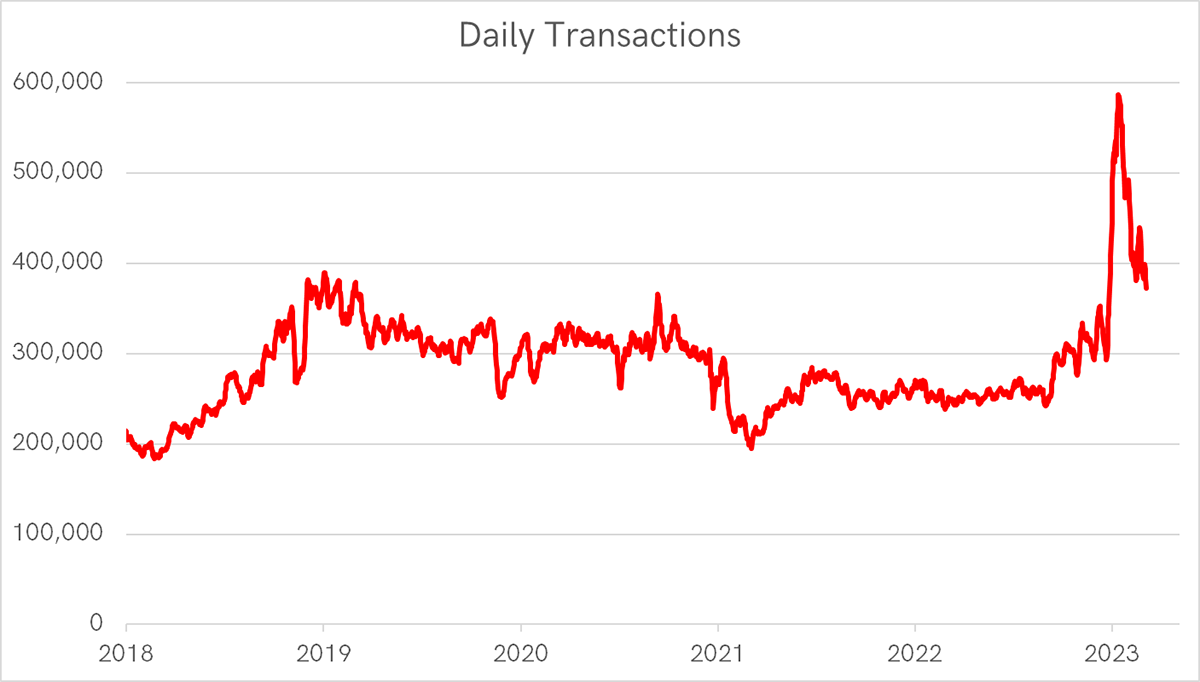

The one potential negative we will have to face is the surge in daily transactions caused by the boom in ordinals. This trend has cooled, which has seen transactions fall. This should not be considered bearish on Bitcoin and should be ignored when the Network Demand Model picks it up in a few weeks’ time. I will overrule accordingly.

The good news is there is a lasting solution to ordinals courtesy of BRC-69. This new implementation basically allows ordinals to be stored on the blockchain much more efficiently, so the risk of clogging up the network has dissipated. Effectively the block space per transaction shrinks. That’s the thing I have observed over the past decade. Every problem is solved. Remember they cut off the banks in 2014 or so. What happened? Tether. Don’t bet against this space.

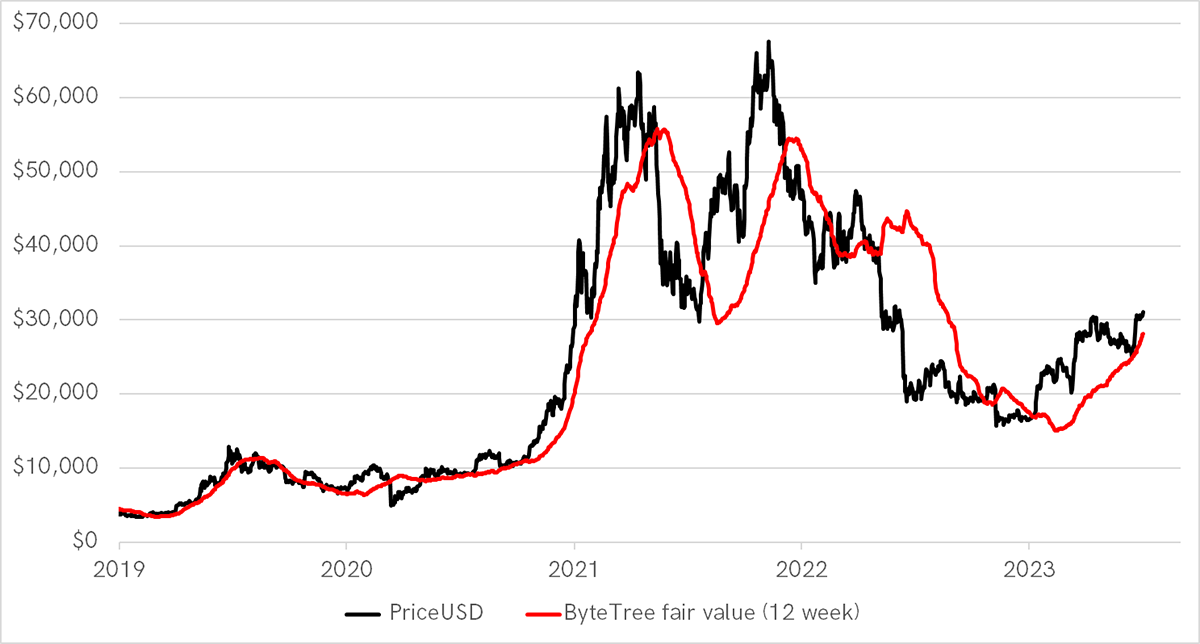

The network activity on the blockchain is growing again. This determines our fair value, which is around $30,000. It has been a lagging indicator of late but is a useful check and balance.

Bitcoin Fair Value

You will have noticed I have used charts from Glassnode and Coin Metrics. That is because ByteTree’s live Bitcoin data is being upgraded. We haven’t focused on it for 4 years, so this is long overdue. The simplest solution was to shut it down and fire it back up in the autumn with new features.

Watch this space.

Investment Flows

In June 2022, when Terra LUNA collapsed, the contagion effect saw redemptions from the Bitcoin ETFs. The funds are fighting back, with 16,000 BTC added since 19th June. That is a bull market pace which has mopped up the entire new supply over the past two weeks. It is a reminder of how powerful a BlackRock Bitcoin ETF would be.

Crypto Stocks

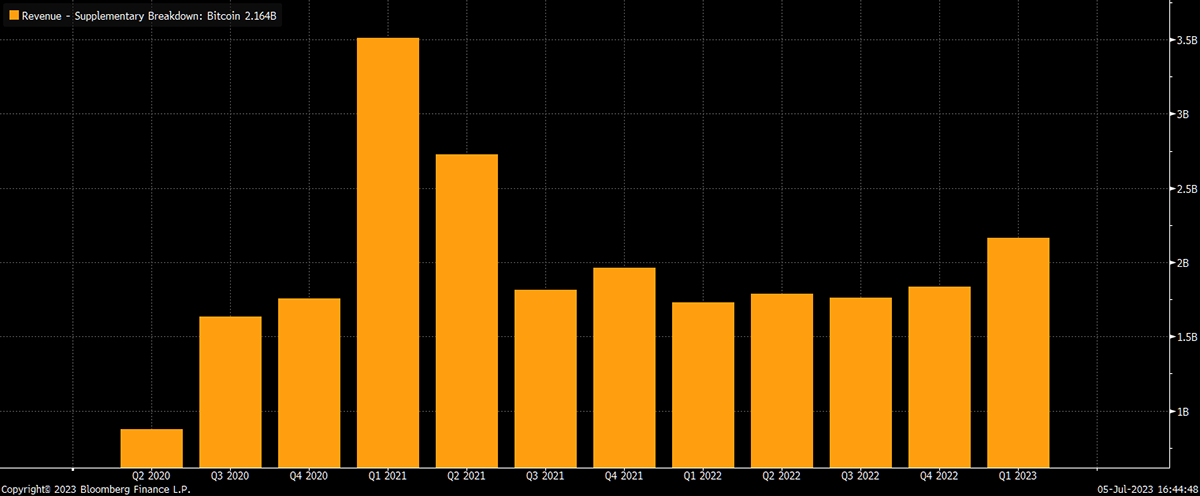

I stumbled across this from Block (SQ), Jack Dorsey’s payments company, which discloses their sales of Bitcoin. The last two quarters have seen growth resume, with Q1 2023 back above $2 bn.

Block’s Bitcoin Sales Have Risen

The next announcement is on 3rd August, and I would expect to see Q2 beat Q1. With numbers like this, it is easy to explain why the network remains balanced despite minimal institutional inflows this year and last. SQ alone sells enough Bitcoin each quarter to fund Bitcoin mining, which partly explains why the network has achieved equilibrium. The miners are currently selling 900 BTC every day for $27 million.

The network is in equilibrium when institutional investors have barely started getting involved. Just imagine what happens when the global wealth management industry starts to allocate capital to Bitcoin. That new trendline could last for years. In my opinion, regulators such as the SEC and FCA have been reluctant because they see a spot Bitcoin ETF as an endorsement. They would rather Bitcoin quietly went away. But it won’t. Every time, it bounces back stronger.

This is why the Blackrock Bitcoin ETF, probably branded iShares, is so important. It legitimises Bitcoin within the investment community. Better yet, is how their CEO, Larry Fink, has publicly statedthat Bitcoin is the new gold, an international asset, an alternative. Thanks Larry. I’ve been waiting 10 years for that.

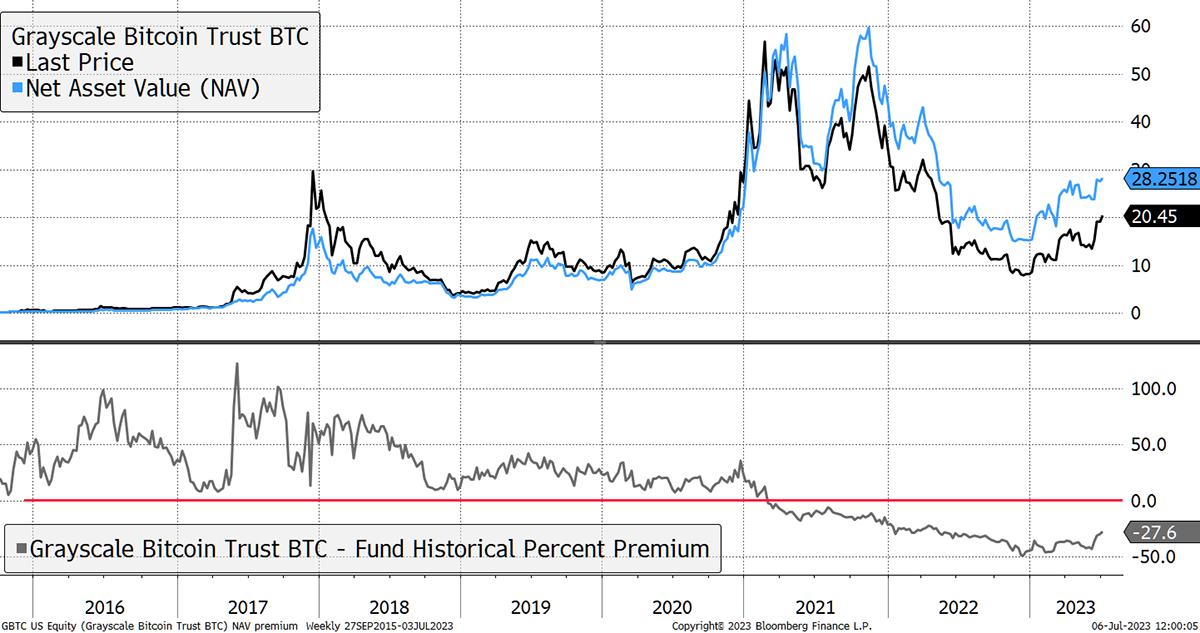

GBTC is the new prediction market for the iShares Bitcoin ETF. The old premium of 100% back in 2016/17 turned into a 50% discount as investors realised they were stuck in a lobster pot. That has narrowed to 27% because if an ETF is approved for iShares, then GBTC will follow, and the discount will be zero thereafter.

Grayscale Bitcoin Trust (GBTC)

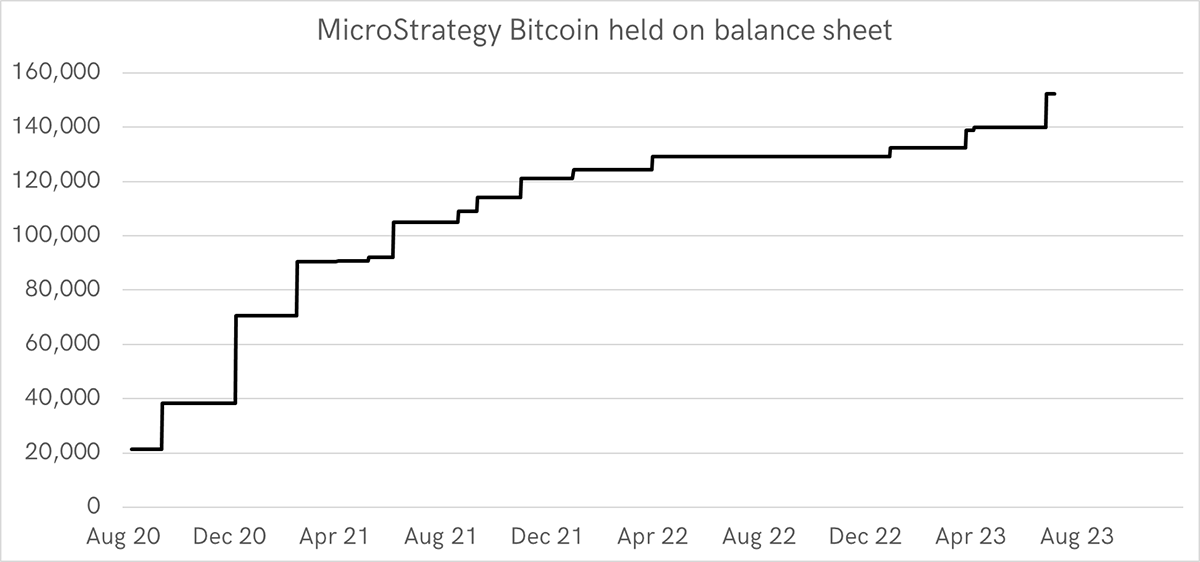

The MicroStrategy (MSTR) CEO, and Bitcoin head of sales, Michael Saylor, just bought another 12,333 BTC taking the total to 152,333 BTC held on the balance sheet.

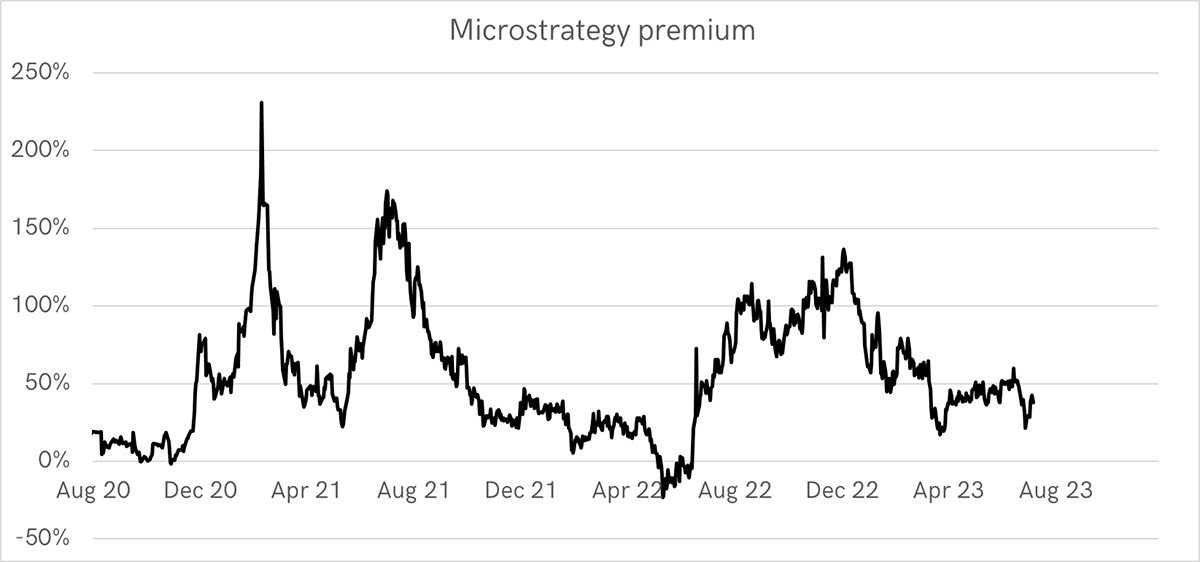

MSTR has seen its premium rise slightly to 40%, which is still much cooler than it was last year.

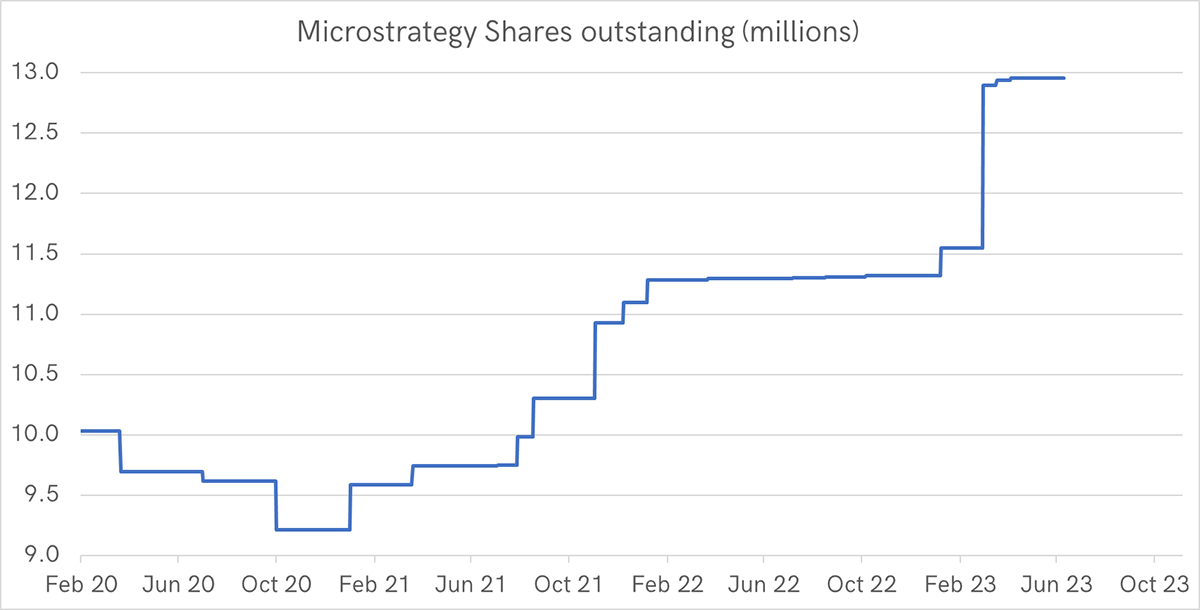

A 40% premium isn’t so bad when you consider the leverage. If you think Bitcoin is going to $100k, then MSTR will beat the spot price because of the debt. Saylor used to fund his purchases with cash on the balance sheet, but he soon spent that. Then he issued $2.2 bn of debt but soon spent that too. Recognising his remaining asset was the premium, he started issuing equity in late 2021, and a lot more of late.

This new supply of equity should put a lid on the premium. He’ll have to play his cards right because the danger is he issues too many shares, and the next time investors want out, it’ll ends up like GBTC. Furthermore, a Blackrock ETF will dampen demand for MSTR, so proceed with caution. Still, the good news is that the balance sheet risk is declining now he has stopped racking up debt.

MSTR is one of the few ways many investors can access Bitcoin as being a share, it hasn’t been banned. That’s the risk here because when the ETFs are widely and freely available, MSTR will lose its relevance.

Macro

Keeping it simple, Bitcoin likes the dollar and bonds to fall and inflation to rise. Bitcoin has 2 out of 3.

Despite all the tough talk from the Fed, the dollar has remained surprisingly soft. Little wonder asset prices remain buoyant. It’s a 0/5 on ByteTrend.

Soft Dollar

And real rates, the 2-year yield less 2-year inflation expectations, continues to rise (chart INVERTED), which ought to put downward pressure on Bitcoin, but it hasn’t.

As I keep saying in my gold letter, Atlas Pulse, it remains a mystery why the bond market has failed to acknowledge inflation. Even when inflation touched 9%, the 2-year only briefly forecast 5%. Today it is back to 2% as if nothing ever happened. In which case, there is no need for rates to be surging. When the economy cools, they will be cut and Bitcoin will surge. Maybe Bitcoin is looking over the hill.

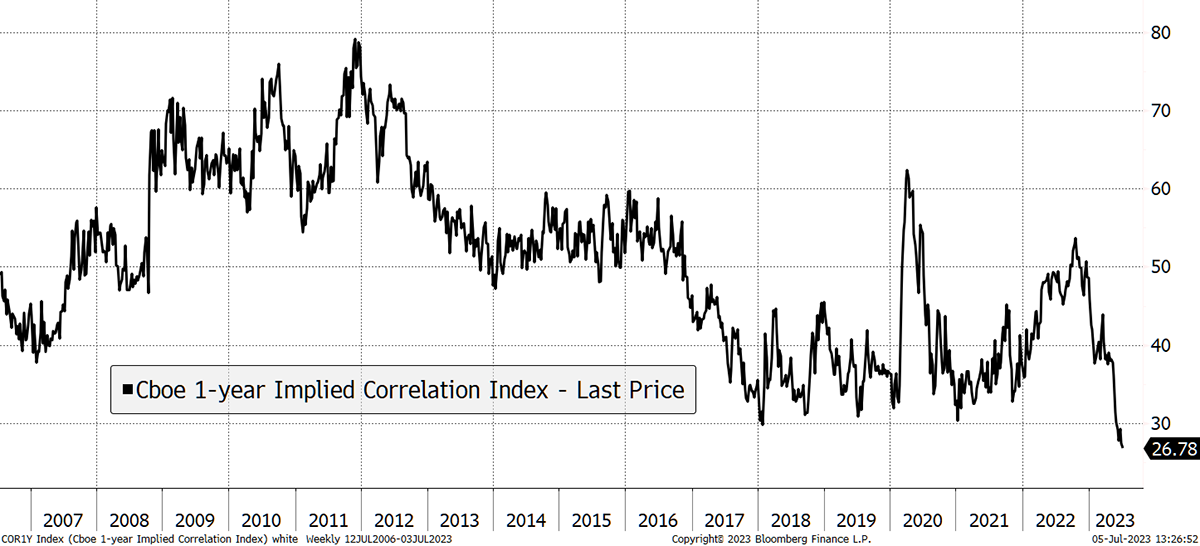

I’ll leave you with this chart of the S&P 500 stock correlation. We see high correlation during a crisis such as 2008. Correlation has just made the lowest recorded print.

Low Correlation Looks Like a Bubble

One explanation is that the mega tech bubble stocks are so big that it has changed correlation because there is the S&P 493 and the Top-7.

Or maybe it’s just a bubble, and Bitcoin comes out smelling of roses.

Summary

The crypto space all seems to be getting very real and happening quickly. Love him or loathe him, cutting off Nigel Farage’s bank accounts has woken the masses as it could happen to anyone. Banks are abusing their privileged position and aren’t fit for the 21st century – an age when money needs functionality.

This is why we embrace crypto.

Your feedback helps the team to build the best service we possibly can. Have no shame in making suggestions, and if you do not understand something, then please ask.