Back to Basics

Disclaimer: Your capital is at risk. This is not investment advice.

ByteFolio 60;

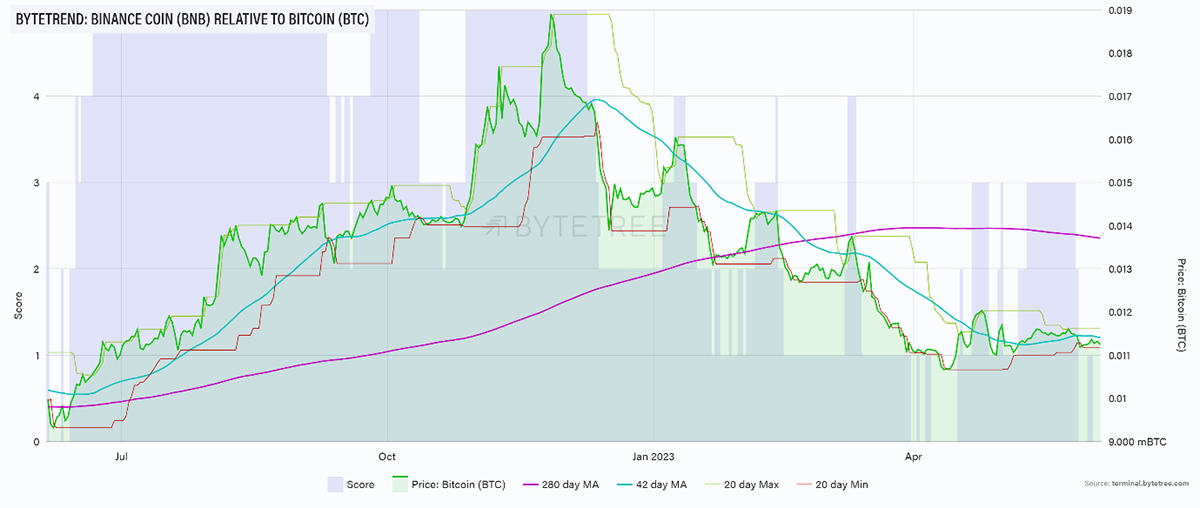

ByteFolio is stripped back to the bare essentials this week as the Binance Coin (BNB) breaks trend relative to BTC and will be removed. Binance has been under pressure on multiple fronts of late, some of which are discussed below. That leaves us with holdings in just Bitcoin and Ethereum, which is an appropriate reflection of the state of the market at the moment.

BNB Scores a 0-star Trend on ByteTrend in BTC

The good news is that despite the lack of breadth in the market, ByteFolio has risen this week as ETH outperforms BTC. There is likely to be some resistance at around the 0.07 level on the ETH/BTC cross, a level which was rejected in April, but the strength of ETH’s fundamentals gives us confidence that ETH will continue to outperform BTC. Proceeds from BNB will therefore be allocated to ETH.

One of the features of crypto markets of late has been the drop in exchange volumes, which is hardly surprising in an environment of regulatory uncertainty and rising interest rates. While this affects the optics of digital asset markets, it doesn’t necessarily affect the substance. In the same way that the short-term share price behaviour of an equity doesn’t tell you about a company’s monthly sales, volumes of bitcoin traded on exchanges don’t tell you anything about activity on the network.

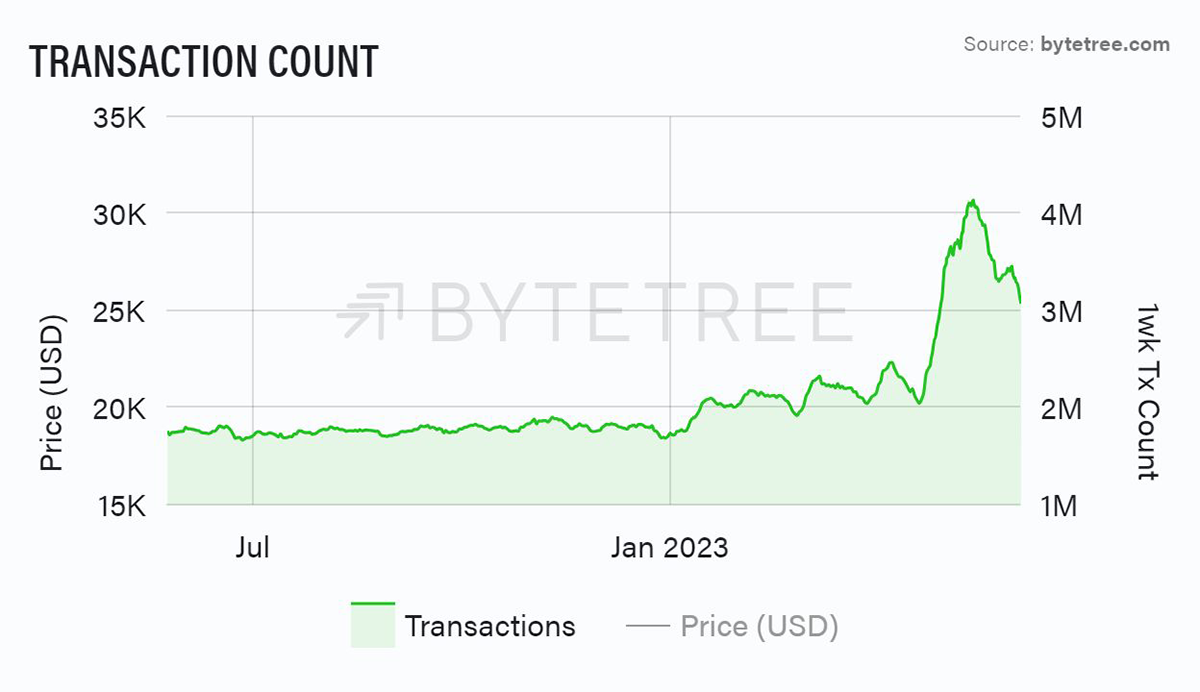

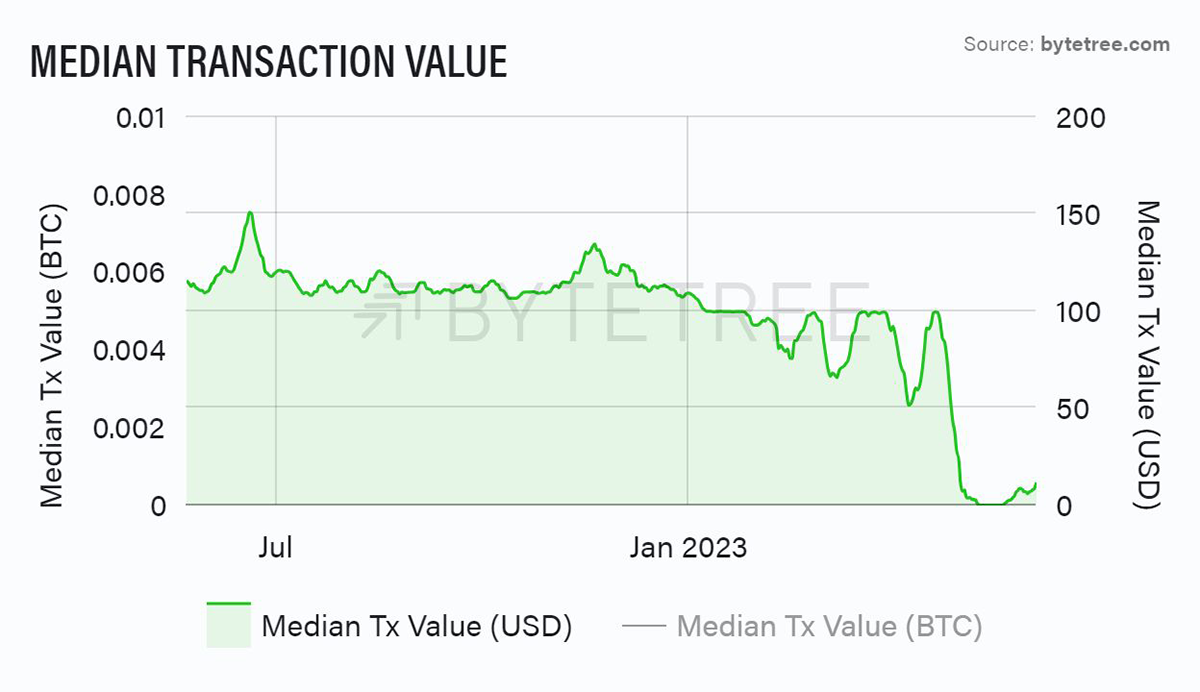

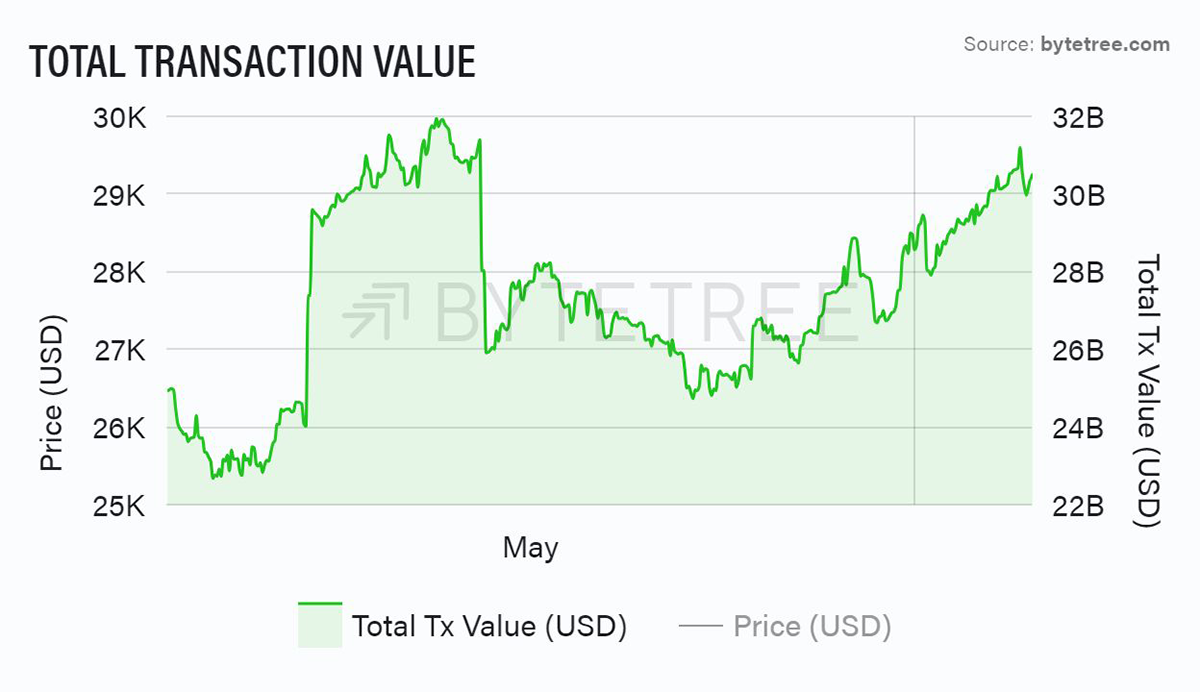

Therefore, it is worth continuing to remind readers that bitcoin’s on-chain activity remains strong. In fact, over the last fortnight, the total value transacted has moved sharply higher again, probably as a result of lower congestion on the network. This has released demand for lower-cost transactions after the recent period of extremely high fees. The following charts show, in order, a falling number of transactions (Ordinals are fun but largely useless and expensive), a rising median transaction value and finally, the rising value transacted.

As long as we continue to see the final dynamic in the ascendant, we can be positive about the future of the network.