Trouble in China and the Case For Technology

Trades in Soda & Whisky

Last October, I felt markets had fallen enough, and a rally was due. This proved correct, but what worked less well was the focus on China, Asia and the emerging markets. There is trouble brewing in China beyond politics, demonstrated by the lacklustre “boom” following the reopening. The result is that money headed for Asia is on its way back to the USA. With the excitement around Artificial Intelligence, it feels like 1999.

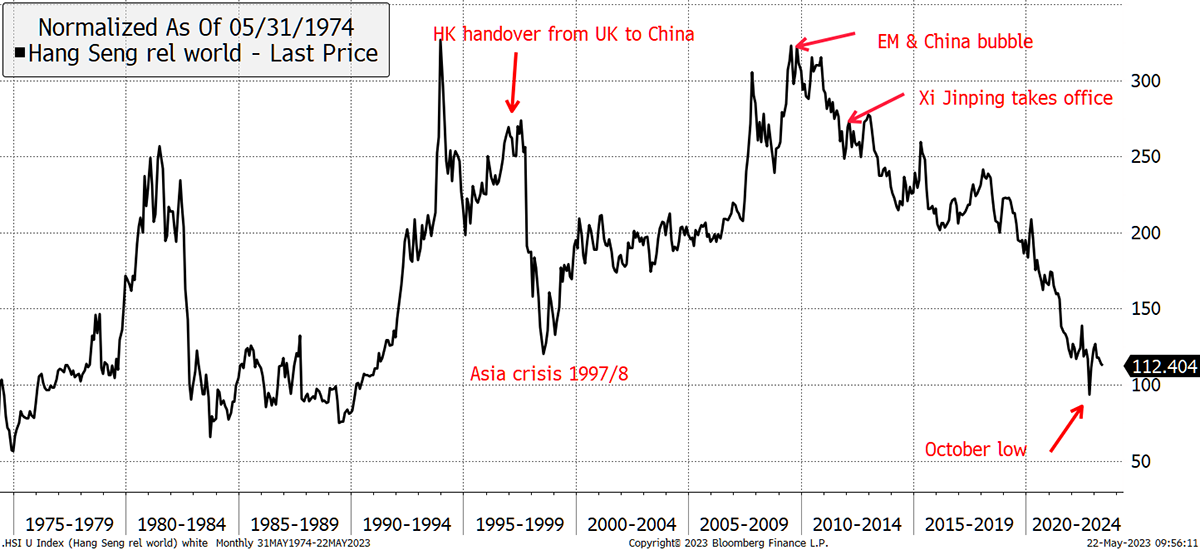

Hong Kong’s Hang Seng Index (HSI) reminds us of the ups and downs of investing in Asia. Hong Kong was truly an economic miracle, and from the mid-1970s to the mid-1990s, the HSI did 3x better than global equities. The British shouldn’t take credit for the growth, but they should be proud of their system of governance that provided fertile conditions for what followed. Unlike the UK, HK maintained a small government, and the results were spectacular.

Hang Seng Index Relative to the World Index

Source: Bloomberg

The 1997/8 Asia Crisis was little or nothing to do with the handover of power to China, but the HSI soon recovered as it hung onto China’s coattails in the 2000s; the greatest growth spurt in human history. The HSI peaked in 2010/11, along with commodities and emerging markets in general, paving the way for the US-centric decade that followed.

President Xi took office in 2012. He immediately focused on anti-corruption measures and shut down companies and critics that stood in his way. While China had embraced capitalism, the Chinese Communist Party (CCP) was in charge.

In October, when I sensed the stockmarket was ready to bounce, there was an opportunity for new market leadership. China would end its lockdown a year later than everyone else, and the economy would rebound. This would lead to an Asian decade for financial markets, which also offered better value than elsewhere. That rally has ended, and both Hong Kong and Chinese equities have turned down. If or when there is an emerging market revival this cycle, it is unlikely to be China-centric.

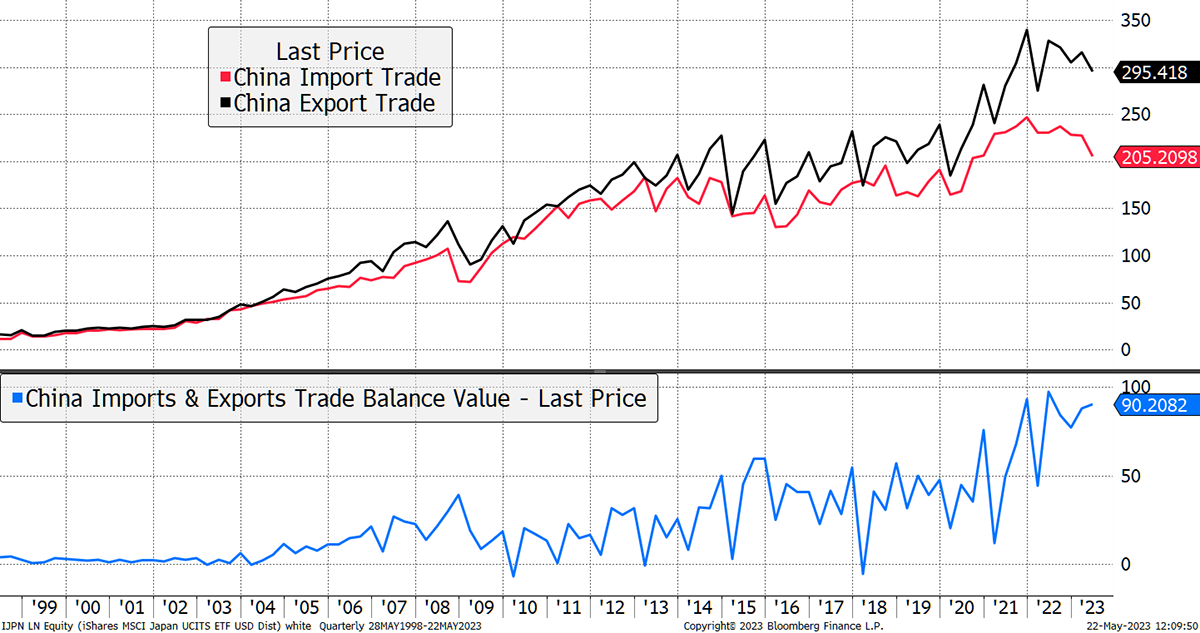

We keep hearing how companies are moving their supply chains closer to home, and cooling Chinese exports reflect that. But more notable are Chinese imports, which have fallen rapidly. They are more closely linked to the strength of the domestic economy and reflect a weaker order book.

China’s Slowing Imports

Source: Bloomberg

Putting together imports and exports and the resulting trade balance is vast. The $90 billion you can see in the chart (blue) isn’t per year but per month. China’s annual trade surplus is more than 1% of global GDP. It really is staggering. But this could be as good as it gets, and China may face a diminishing role in future global trade.

The other side of China’s economy comes from investment. The vast construction of urban housing and infrastructure has led to a high, and challenging, debt burden. These factors have come together, and given the weak reopening rebound, it is time to question the strength of China’s future economic might. Moreover, even if they succeed against the odds, our participation may not be welcome.

If China isn’t the answer to this cycle, somewhere else is. The inescapable fact is the money is once again headed back to US tech. Prices fell sharply in 2001/2, and so there is much better value than there was. This goes against much of what I have been saying in recent months, but…

“when the facts change, I change my mind. What do you do sir?”

John Maynard Keynes

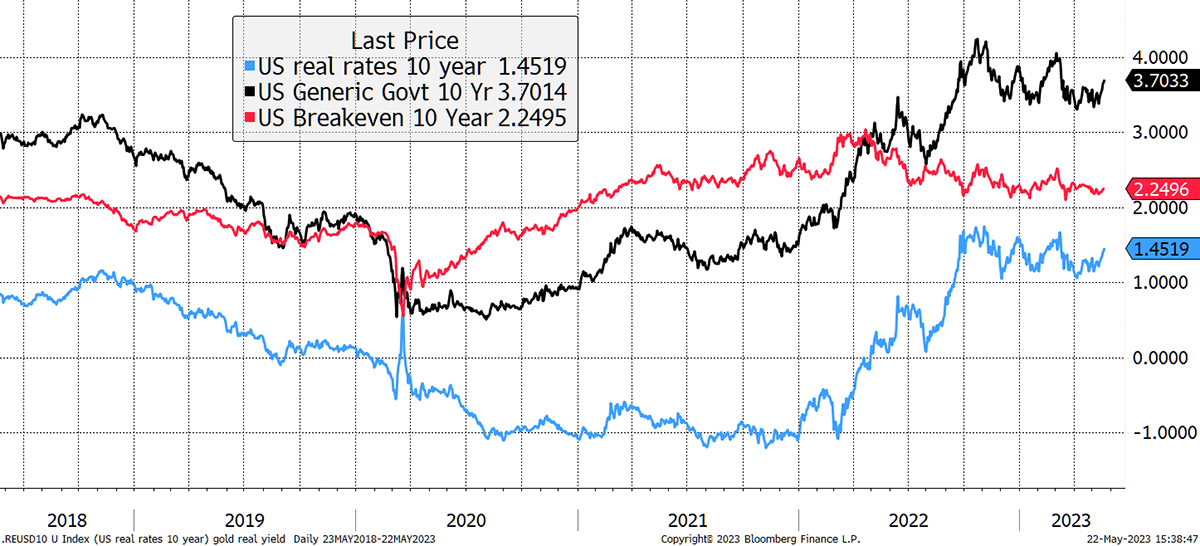

The Late 1990s

Inflation is seemingly under control (4.9% and falling), at least for the time being. US interest rates are at 5.25% while the 10-year is at 3.7%. That means the bond market is pricing in six rate cuts which would only happen in a deep recession. Bond yields are rising again, which might mean the imminent recession call is too harsh. But let’s not forget that if the bond yield breaches 4%, bad things happen. Last October, we lost another UK government, and in March, we lost a handful of banks.

Are Bond Yields Too Low?

Source: Bloomberg

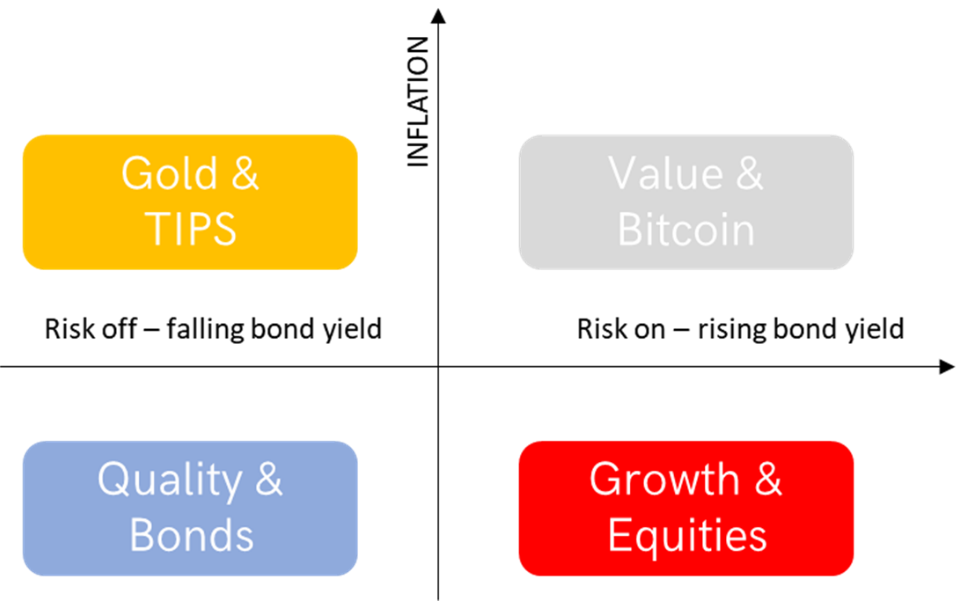

Rising yields with falling inflation means rising real rates. The way to protect yourself against higher real rates is with growth stocks. Higher yields, and especially real yields, put downward pressure on asset prices. The way to get past that is to find businesses that can grow quickly. We find ourselves moving into a growth environment, which will take many by surprise.

This is an important shift because in recent months, and as bonds recovered from the Truss/Kwarteng crash last autumn, high-quality stocks have been doing well. Now that bond yields are rising again, quality has come under pressure, and growth is back in the sweet spot. A quick reminder of the Money Map as we move into the red growth regime.

The Money Map

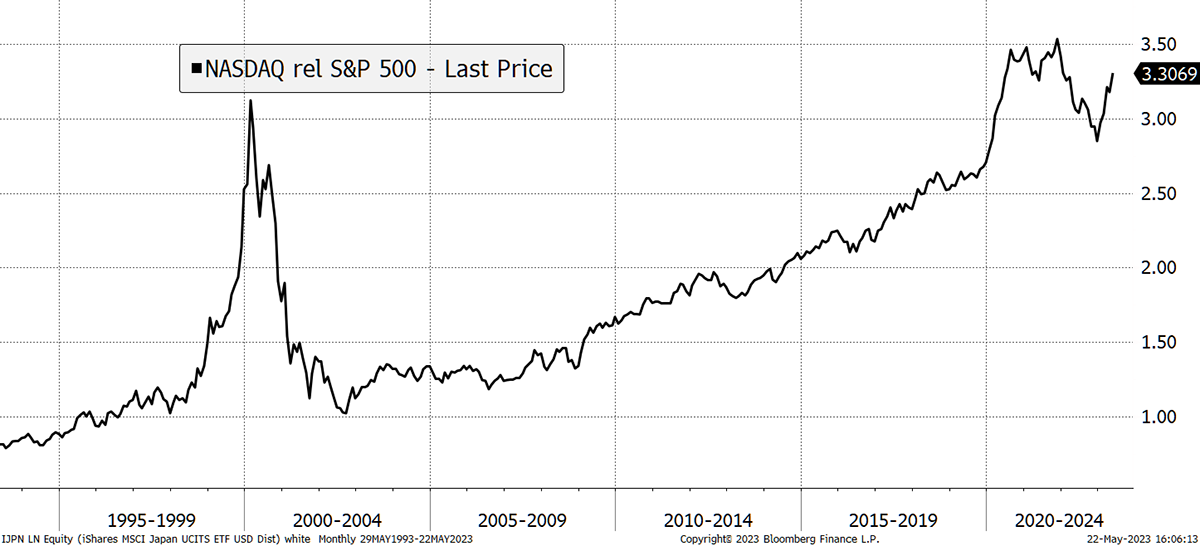

The dollar is rising again, and this is starting to remind me of the late 1990s. Strong dollar, trouble in Asia, and high real rates… which led to a technology bubble.

What was interesting about that time was how the internet and telecommunications caught the public imagination, with macroeconomic conditions that drew money into the USA. I don’t think the message here is to buy the S&P 500 or Europe as much as it is to buy growth. Certainly, that has been the message from the NASDAQ over the S&P 500 this year.

The NASDAQ Has Led the S&P 500 Since January

Source: Bloomberg

We have themes coming through on ByteTrend, which is a powerful tool. Artificial Intelligence and robotics are demonstrating strength which means the leadership is shifting from large stocks to smaller stocks.

I am no expert on AI, but it is very much in the public domain. I know it will disrupt, but principally it will eat some white-collar jobs just as machines took over the farms. This isn’t new; the PC replaced secretaries and typing pools, which didn’t end in tears, and we look back and see it as progress. These innovations are part of our economic evolution, and AI will boost productivity, which is welcome.

If you know something interesting about AI, then please write in, and I will pool our thoughts. I am recommending trades in both portfolios.

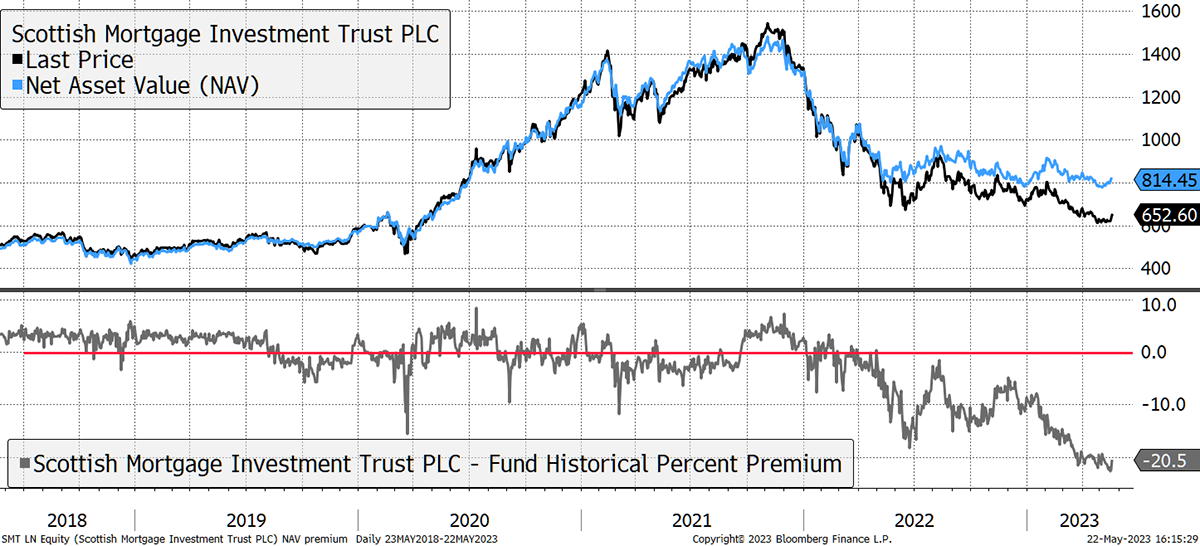

Buying 8% Scottish Mortgage Trust in Soda (SMT)

You’ll know by now that I’m rarely keen to chase a racy investment theme. Fortunately, we have SMT on our doorstep that trades on a 20% discount to net asset value. The price is back to March 2020 levels, so I feel safe in calling this a value trade.

SMT was the UK’s most popular technology trust and has fallen from £15 per share to £6.50. I have kept a close eye on it, and with conditions turning in its favour, I think this is a great opportunity. Moreover, its inclusion will rebalance the portfolio in the right direction.

Scottish Mortgage Trust

Source: Bloomberg

Most blame SMT’s discount-to-net-asset-value on the unlisted companies, and there is some truth to that. But its competitor, Polar Tech Trust (PCT), trades at a 12% discount and has no unlisted assets, so there is an opportunity in capturing negative sentiment in the sector.

SMT’s private assets total 29.9% of the portfolio and comprises 53 companies. The remaining 70.1% represent 47 publicly traded companies. At a 20% discount, you are effectively writing down the private companies by two-thirds. The bottom line is that if you like tech, this is an excellent opportunity.

SMT is managed by Baillie Gifford, which are a partnership based in Edinburgh. They are the UK’s giant when it comes to tech investing and have good connections in Silicon Valley. I have not embraced tech for a while, and that has been a wise decision. Things change, and we cannot let this one slip by. The annual management fee is 0.56%.

Risk

This trade is relatively simple. The SMT share price is down 60% from the peak, the trust trades at a wide discount, macro conditions have turned back in its favour, and its volatility has fallen from bitcoin-like levels a year ago (55%) to 23% today, which is in line with a high-quality stock. SMT is highly liquid, so it would be easy to sell. I deem this to be medium risk, but a year ago, I would have said high risk due to the valuations and the extreme volatility.

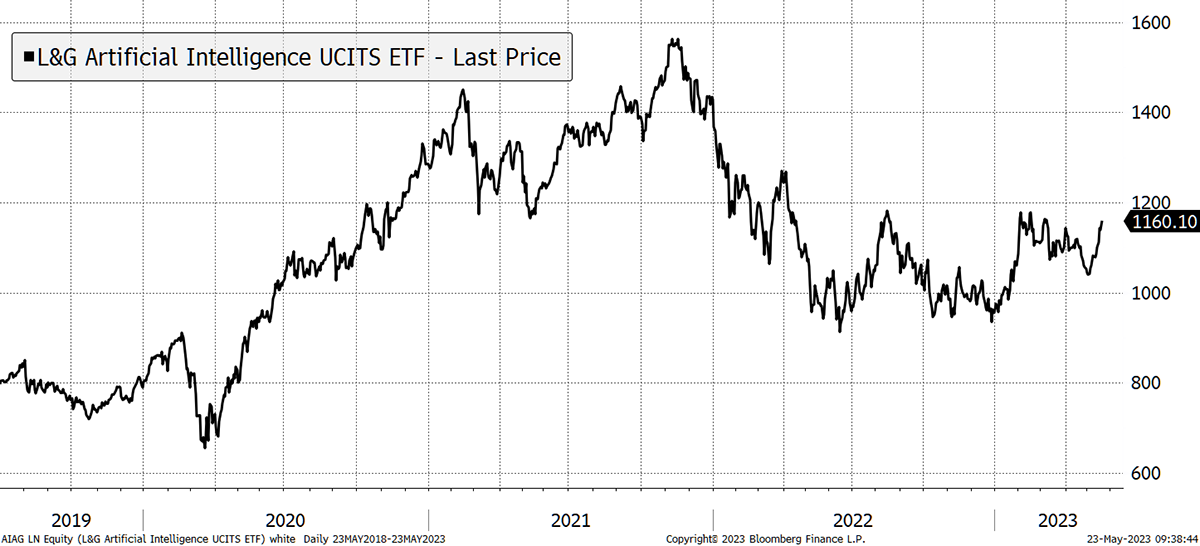

Buying 5% L&G Artificial Intelligence ETF (AIAG)

The talk around Chat GPT has ballooned since its release last November. Some stocks, such as chip maker Nvidia (NVDA) and C3.AI (AI), have done well since, but I would have expected more given the significance of the technology. In any event, AIAG tracks the ROBO Global Artificial Intelligence Index TR, which finally wants to break out. ROBO’s investment committee have put a list of relevant stockstogether, and they make sense to me. Most exposure is in the USA, with 20% around the world.

AI Is Just Getting Going

Source: Bloomberg

IAG is the GBP share class, and the dollar class is AIAI. They are the same investment with the same outcome, but GBP investors will save an FX charge with AIAG. The annual management fee is 0.49%.

Risk

Like SMT, AIAG has a relatively low volatility of 22%, although it was much higher last year. Their factsheet says risk level 7, the highest possible. These firms do that to protect themselves, so anything that could possibly go wrong is flushed out in advance. With 68 stocks and the top 10 making up less than 20% of the fund, this is diversified across liquid stocks. I deem this fund to be medium risk given that the significant correction in the sector is behind us.

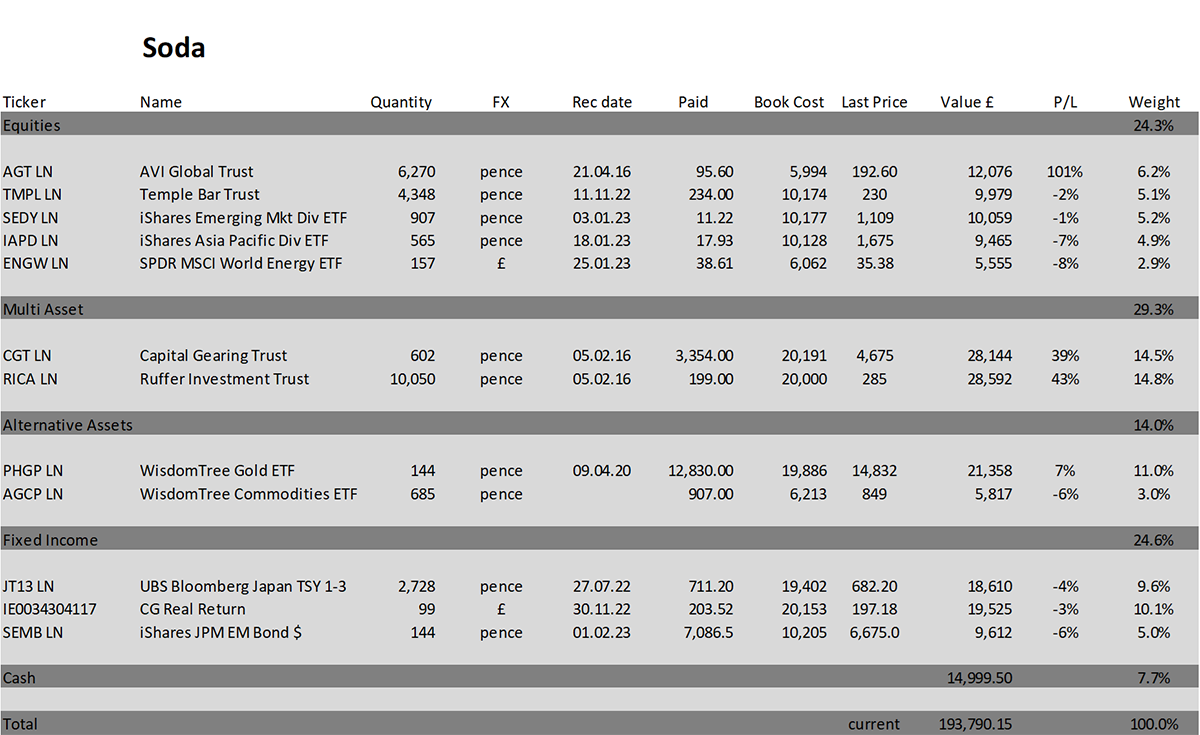

Selling iShares Asia (IAPD) in Soda

IAPD has 30% exposure to HK. The rest is mainly Australia and Singapore cyclical stocks. In the absence of a strong Asian recovery, this is no longer the place to be.

Action:

Buy 8% Scottish Mortgage Trust (SMT) in Soda

Sell iShares Asia Pacific ETF (IAPD) in Soda

Buy 5% L&G Artificial Intelligence ETF (AIAG) in Whisky

Postbox

Having digested last week’s newsletter, I am not clear on one point. We are holding the yen as it will surge if Western markets drop again. You show ‘Japanese stocks like a weak yen’; it follows that the potential rising yen position, held against a fall in Western stocks, will not be good for Japanese stocks. You conclude that ‘when we do get the surge, we sell yen and buy (Japanese?) stocks’. That sounds like we sell a surging yen and buy falling Japanese stocks. Or are you proposing a fine tuned trade of old yen until the surge is finished and then buy stocks as it falls. This sounds more like a timing trade, which has not been a focus for the portfolios in the past. Or am I misunderstanding? I continue to get great benefit from your writing, thanks.

I am sorry to have confused you, but fear not, as these things genuinely are confusing, and you are in good company.

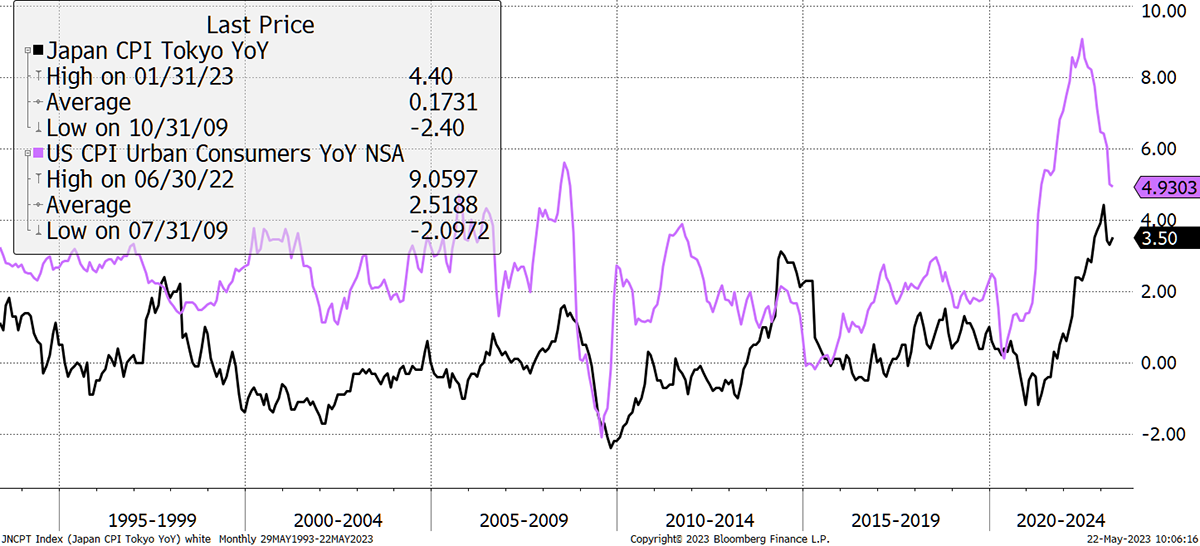

The yen has been weakening because it hasn’t been hiking rates like we have seen around the world. The lack of interest explains temporary weakness, but we must not mistake that for value destruction. Japanese inflation is lower than in the US or Europe. Inflation causes the intrinsic value of a currency (purchasing power) to fall, so with 30-year average inflation of 0.17% compared to 2.5% for the dollar, the yen has the upper hand. It is therefore deemed to be significantly undervalued (perhaps by 50%).

US and Japanese CPI Since 1993

Source: Bloomberg

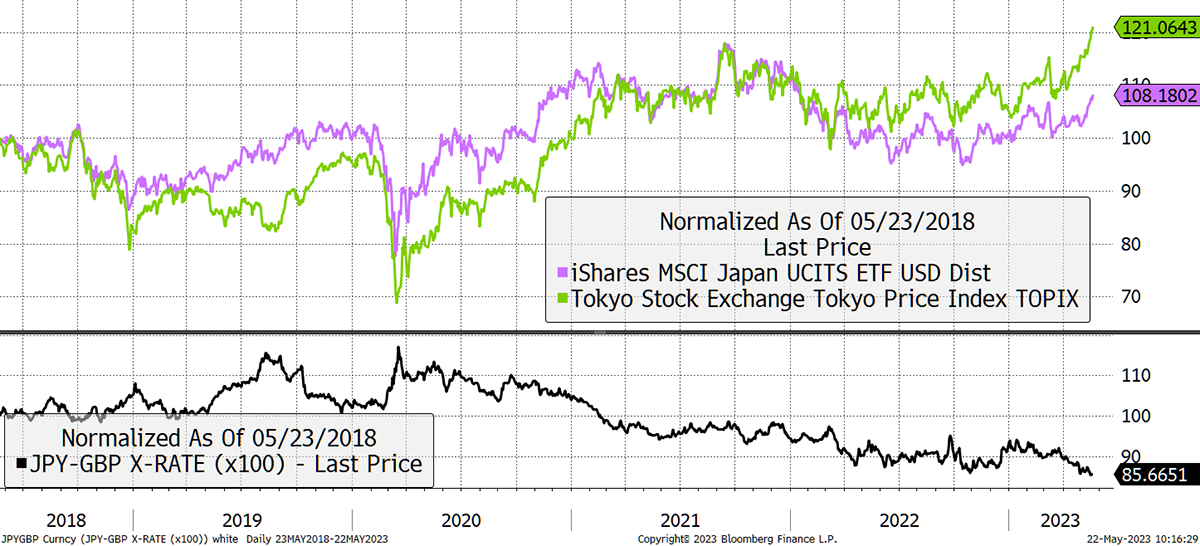

A weak yen flatters the Japanese stockmarket in yen terms, just as a weak pound flatters the FTSE in GBP terms, as we saw over the Brexit vote. The pound fell as the FTSE rose. Here I show the Japanese market in yen (green) looking good. When measured in GBP (purple), it is 13% behind, which reflects the GBP vs JPY (black) change in the FX rate.

Japanese Stocks Flattered by a Weak Yen

Source: Bloomberg

The yen’s value would be realised if there was a change in policy and the Japanese central bank hiked rates (likely at some point), or there was a shock to the system causing US and UK rates to fall. If that happened, we would have a strong yen, and JT13 would rise in price, just as markets are weak and prices are low. I could then sell the yen and buy cheap equities. They might be Japanese equities if they appeared attractive at the time. But they wouldn’t have to be. I would be looking out for discounted investment trusts, cheap stocks and so on. I hope that helps.

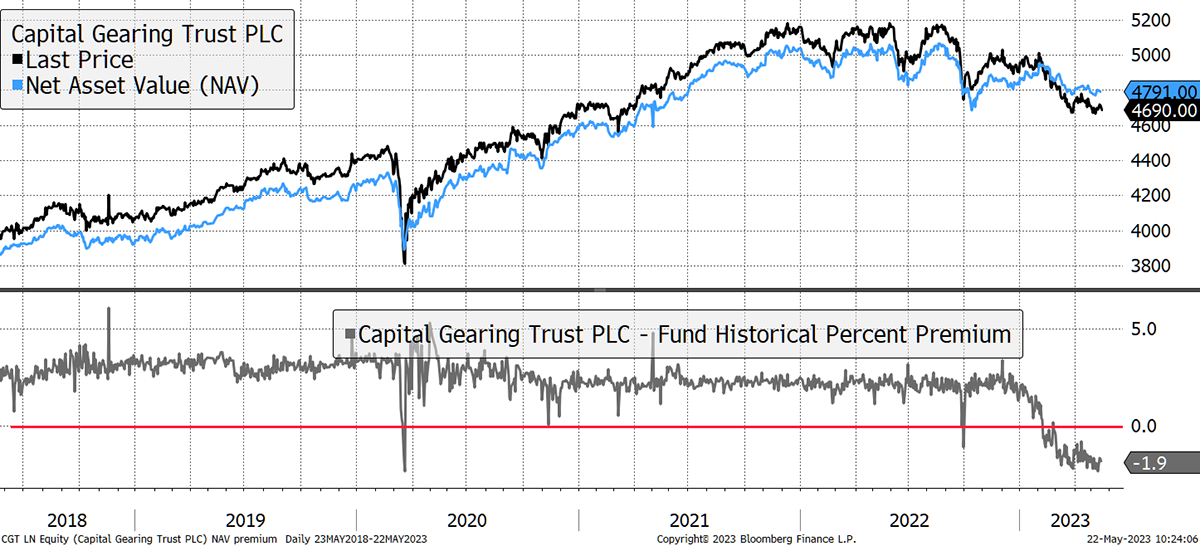

The market does not like Capital Gearing (CGT). In a significant down trend since Jan this year. Curiously not long after Eoin Tracey sold with comments about invisible use of gearing. As capital preservation is their goal, with barely discernible yield, should this remain a core Soda holding? Thanks for your continued astute market commentary.

This year the price is down 4.2%, while the net asset value is down 0.9%. The share price premium has moved from a historically consistent +2% to a -2% discount. CGT’s board have authorised stock buybacks to limit the potential for the discount to widen further. That will ensure liquidity for investors that wish to sell, and with £1.2 bn of assets, the fund has deep pockets. The assets are overwhelmingly liquid.

A Rare Opportunity to Buy Capital Gearing at a Discount

Source: Bloomberg

Capital Gearing was taken over by Peter Spiller 40 years ago. Back then, it used to employ gearing, but Spiller wound that down. In a call this morning, CGT confirmed “it has had no gearing for at least two decades”.

CGT is one of the least risky funds out there and comes with an excellent 40-year track record. I like it because it helps to balance the portfolio, has low charges and would be difficult to replicate with ETFs and so on. They have a very good habit of avoiding bear markets, which is a powerful dynamic in compounding returns.

While I am fond of Eoin, he is mistaken in this instance. I can only assume he looked at the fund name and made an assumption. I can categorically inform you that CGT has no gearing.

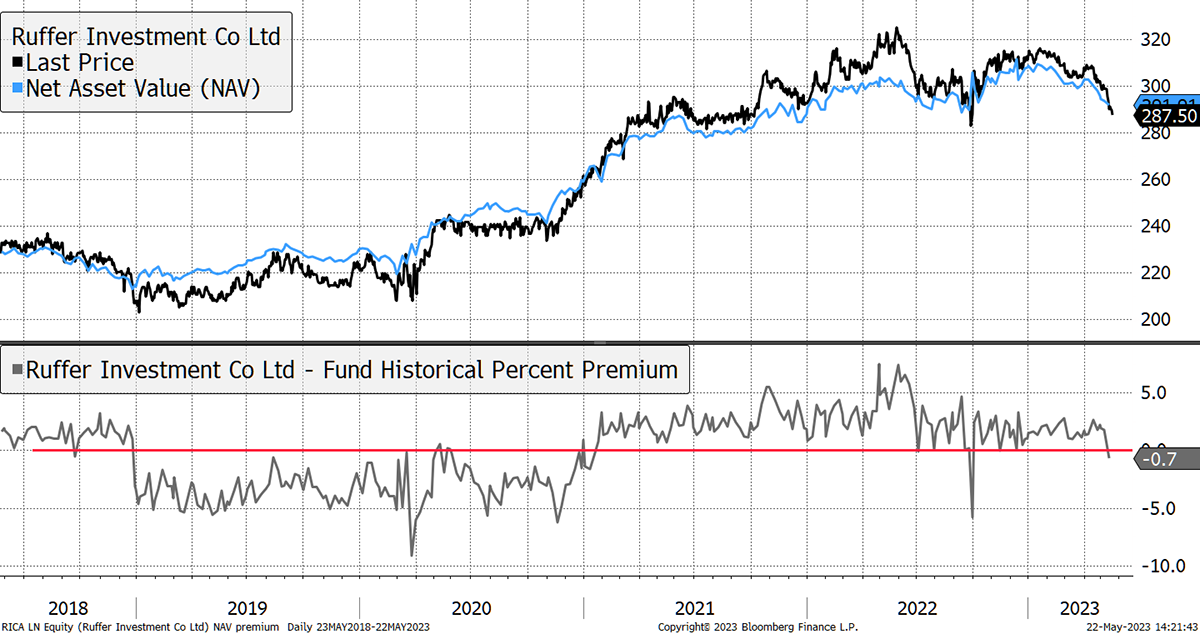

Ruffer (RICA) is seeing similar problems with its premium moving to a discount. We will just have to be patient with these funds. I have little doubt they will do well over time, but they are overly defensive for the present.

Source: Bloomberg

Portfolios

New readers, please find a note at the end after the summary.

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio is down 3.2% this year and is up 93.8% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| +21.7% | +8.8% | -1.8% | +19.6% | +8.9% | +14.3% | +3.5% |

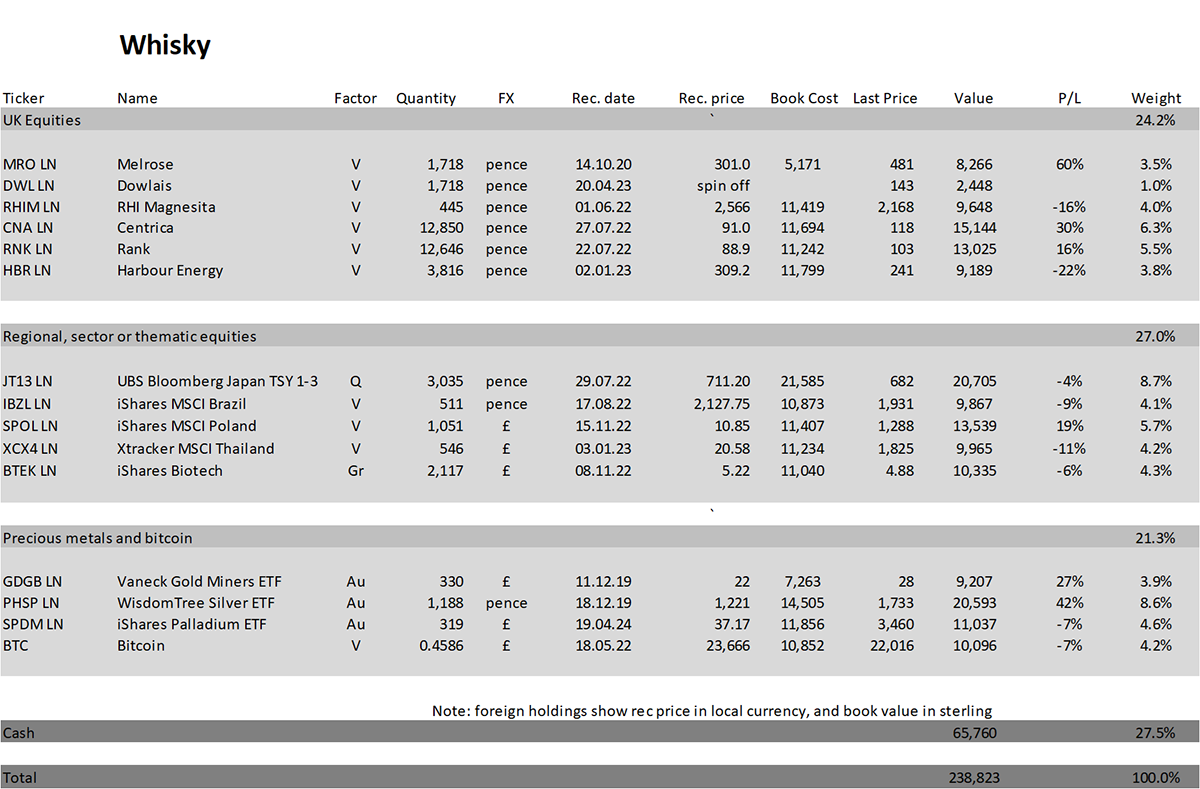

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 6.9% this year and up 138.8% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| +24.7% | +5.4% | -4.3% | +21.4% | +20.4% | +12.9% | +8.0% |

Summary

Most of us have probably been treating China as a political outlier for some time. I think we should start to worry about their economy too. This will only boost capital flows to the West, particularly the US.

Not for the first time, this piece marks a significant shift in my view based on changing behaviour in markets. The longer-term idea of investing in Asia is merely postponed until this China malaise is flushed out. Buying US tech may sound racy, but I believe this shift adds balance to the portfolio, and if it works, I may add further exposure. Buoyant tech could also bode well for palladium and bitcoin too.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweet me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

Note for New Readers

The design of The Multi-Asset Investor investment process is to blend Soda and Whisky according to the level of risk you wish to take. Hopefully the clue is in the names as to which portfolio carries more risk. Most investors would be best suited to 80% in Soda and 20% in Whisky (a less risky blend) or 60% in Soda and 40% in Whisky (a riskier blend).

Example

A recommendation is often, but not always, 5% of either portfolio. If I added 5% of ABC in Whisky and you followed a 40/60 Whisky/Soda approach, then ABC would be 5% x 40% = 2% of your overall pot. If you followed a 20/80 Whisky/Soda approach, then ABC would be 5% x 20% = 1% of your overall pot.

This approach enables the Whisky Portfolio to pursue more adventurous opportunities than if it was designed to be the entire strategy. The inevitable, and hopefully infrequent, failure of some individual recommendations means the maximum loss is limited to between 1% and 2% of the overall pot, which is within reasonable scope. Cautious investors can be 100% Soda, but a little Whisky brings your investment journey to life and will hopefully boost returns in the long run.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd

Comments ()