Running Out of Time

Over the weekend, the world lost yet another bank, First Republic. $100bn of deposits have already fled, and JP Morgan has swooped in once again. Could we end up with just two banks, the Fed and JP Morgan? Or maybe just JP Morgan. The US Treasury Secretary, Janet Yellen, says the US will run out of money by 1 June.

The shenanigans in US politics are back. The fight over the debt ceiling is a regular occurrence and always seems to go to the line. The stakes are high because if they can’t agree, the US defaults. No one really knows what that would look like, but we can only assume it is best avoided. The assumption is that because it has never happened before, it never will. I cannot guarantee that is right.

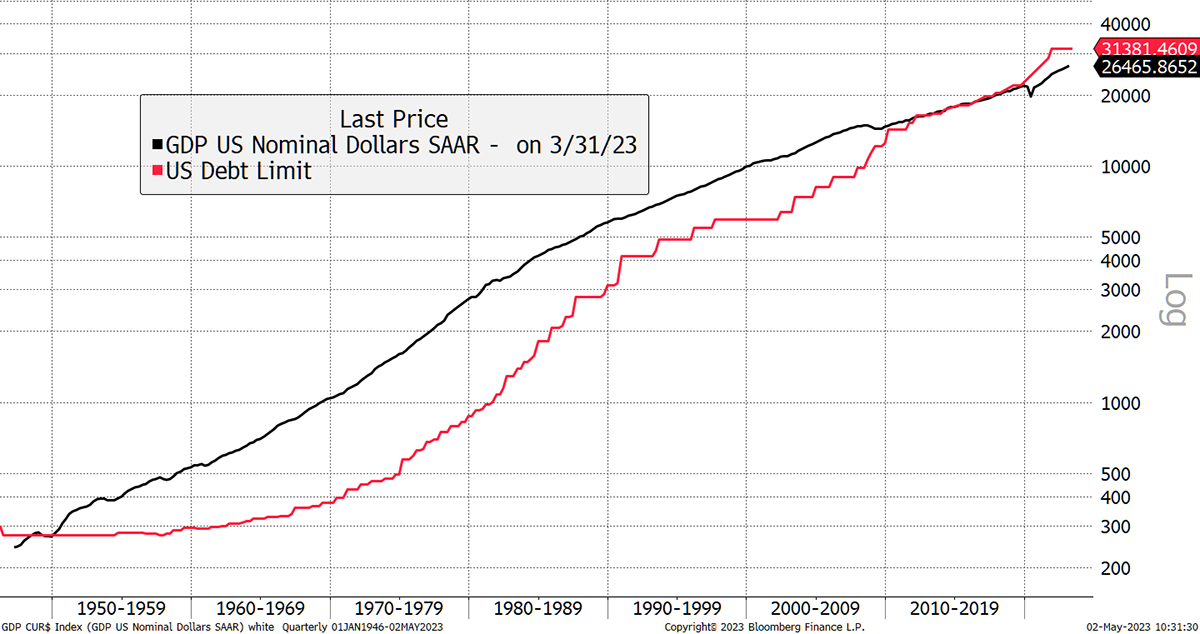

Debt Is Larger Than the Economy

Source: Bloomberg

Up until 2010, the US public debt, which is now $31 trillion, was smaller than the economy, whereas today it is larger. That has been widely discussed and is clearly not a good thing to pass on to our children and grandchildren. But if you are going to borrow far too much money, it would make sense to push the repayment as far into the future as possible, basically kicking the can down the road.

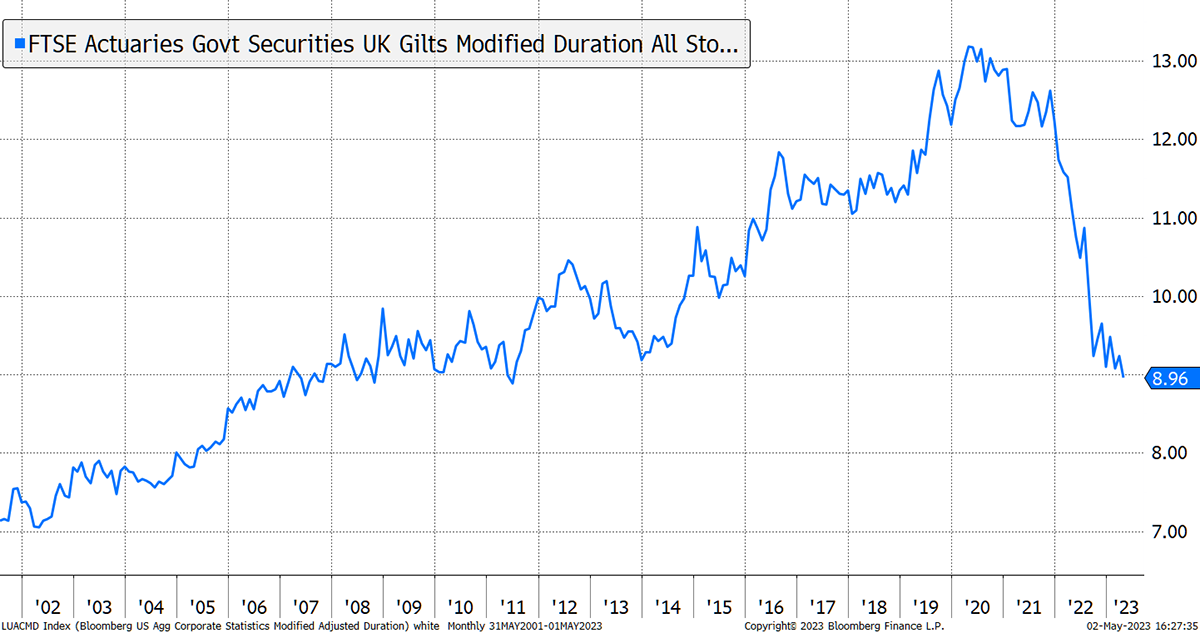

In the UK, the opposite is happening. In recent years, the UK government had bragging rights that they had one of the longest-duration gilt books, averaging 13 years. Over the last couple of years, that has shrunk to less than 9 years, and in a very short space of time.

UK Public Debt Maturity Is Falling

Source: Bloomberg

With shortening debt maturing, the next time there is a funding crisis, the borrower will have fewer options. It is no longer a future problem but one in the present. This could put government debt under pressure and is another reason why it is hopeful that bond yields will fall significantly from here. In my opinion, that game is up.

The stress in the private banks is another matter. Warren Buffett’s deputy Chairman, Charlie Munger, didn’t think the recent banking crisis would be as bad as 2008 but highlighted that the regional banks held too much in real estate loans. He said,

“We have a lot of troubled office buildings, a lot of troubled shopping centres, a lot of troubled other properties. There’s a lot of agony out there.”

Actions speak louder than words, and Berkshire Hathaway have not been buying bank shares despite the lower share prices. In the past few weeks, Zions (ZION), Keycorp (KEY), Comerica (CMA), East West Bancorp (EWBC) and Truist Financial (TFC) have all seen 50% share price falls, and Buffet has sat on the sidelines. It can’t be good. Julien Garran, strategist from the Macro Strategy Partnership wrote,

“We do not believe that SVB’s bankruptcy and FDIC’s resolution of Signature Bank & now First Republic over the weekend signals a systemic problem at the banks. Rather, it reveals a systemic problem in the economy, especially in private debt and private equity.”

We have seen buoyant conditions for private equity. They have purchased businesses and property with huge amounts of debt. Garran is concerned that the game is up, and the system needs to clear. The risk is a scramble for cash, leading to large liquidations of illiquid assets. This is never a pretty sight, and you have to wonder if the financial system is “running out of time”.

The Yen

As you know I believe the yen is a safe haven. Kazuo Ueda, the new governor of the Bank of Japan (BOJ), has successfully kicked the can down the road yet again. For many years, the BOJ has been doing things very differently, and the expectations have been that this will change, and it inevitably will. But last week, they disappointed, and zero rates will plod on for a while longer.

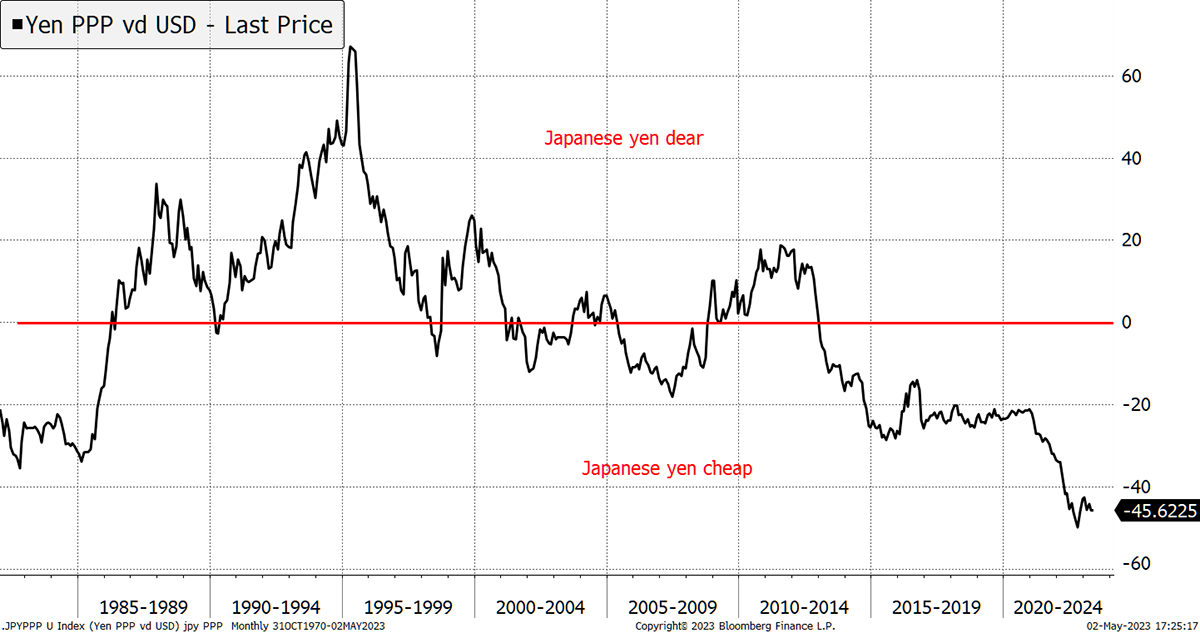

My thesis for owning the yen is very simple. The yen is deeply undervalued. It would either rise because the BOJ changed policy, which is inevitable (one day), or it shoots higher in a financial crisis.

The Yen Is Undervalued

Source: Bloomberg

Global investors have been using the yen as a “funding currency” because it has the lowest yield. That basically means FX investors short the yen (borrow) and buy US dollars, capturing the yield difference (aka “carry”). If we have a crisis in markets, investors will be forced to close this position, and the yen will surge, just like it did in 2008.

I can see that it hasn’t worked so far because we haven’t yet had a crisis in markets, and moreover, the pound has risen. The yen is down 3% since my recommendation, but I feel strongly that holding yen is the right thing to be doing.

Melrose (MRO) and Dowlais (DWL)

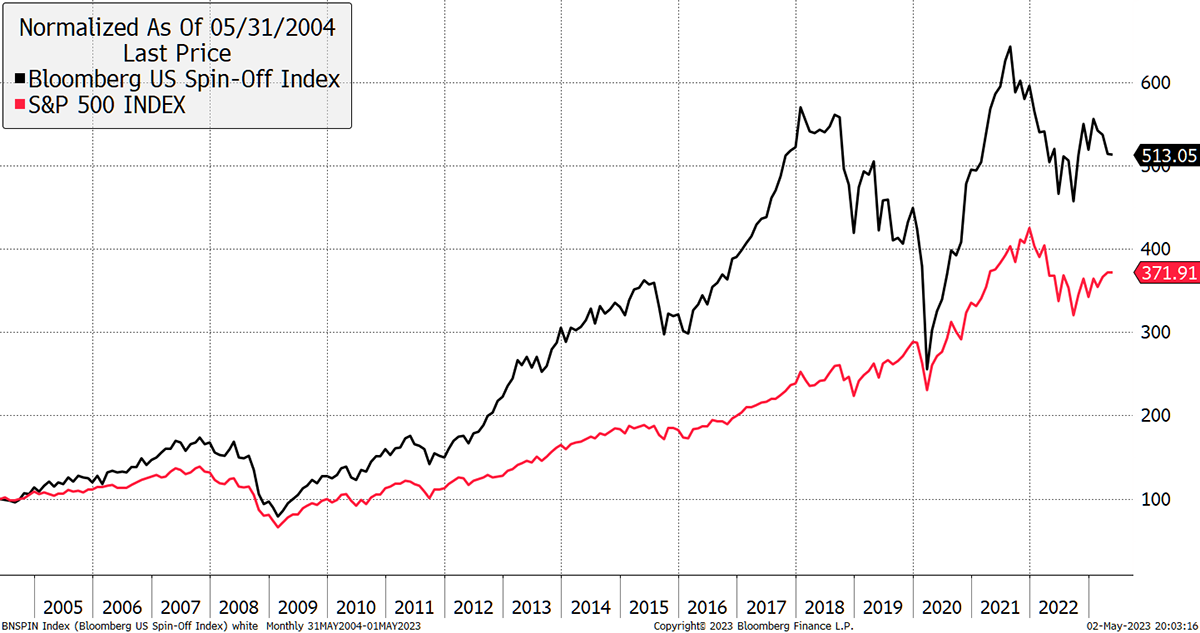

Two weeks ago, MRO demerged DWL, or as some call it, a spin-off. Some professional investors get excited by spin-offs because they are typically deemed to be the weaker part of the company and let go at a knockdown price. Moreover, the core gets management’s attention, and when the spin-off finally gets its own management, it can lead to good outcomes. See how the Spin-Off Index has beaten the market over the years, especially into 2018.

Spin-Offs Can Be Winners

Source: Bloomberg

The market likes this demerger because MRO is now a focused aerospace group which can command a premium valuation, hence the jump. Now they have gotten rid of the deadweight auto parts business, the analysts are saying MRO is undervalued because it’s a growth stock. But it’s not cheap on today’s metrics, with forecasts of 22x PE by 2024 and a measly 1.1% dividend yield.

DWL shares fell on their debut because it is a pure auto parts supplier, which is deemed to be old hat. The market doesn’t care much for cars. Yet the analysts are also saying DWL is undervalued because it is a market leader in its sector, and the shift into electric vehicles leads to growth. The counter-argument is that any gains in EVs will merely offset falling demand for traditional vehicles. DWL also has a small hydrogen division which some believe one day will become the holy grail in energy storage. Having just been spun-off, the financial metrics are unclear, but it’s cheap.

We can hold both but would probably top up DWL to make it more meaningful. Or we can sell both. Or we can sell one and top up the other. The temptation is to sell MRO and switch the proceeds into the cheaper DWL on value grounds and embrace the spin-off effect. But forgive me for not wanting to act this week. More time to think, please.

Action:

No action

Postbox

As I thought about increasing exposure to CGT and/or RICA, it came to my mind that they hold some TIPS and conventional US treasuries. How could they be affected by a potential default of the US if the debt ceiling is not risen?

I do not think this is a likely scenario, but I agree it is possible. The UK wasn’t going to vote Brexit, Trump would never get elected, and there was no way Russia would invade Ukraine. Until they did.

US treasuries are deemed to be the highest quality collateral in the world. We may think differently, but that is how the market sees it. A default is highly unlikely, and even if they technically defaulted, it wouldn’t last long because I can only presume the crisis would force political cohesion. Short-dated bonds would recover very quickly. I do not know how the long bond would behave.

A bigger risk for CGT and RICA, and other investment trusts, comes from the mega-mergers in wealth management. We’ve had Brewin Dolphin and Royal Bank of Canada, then Smith & Williamson and Tilney. More recently, Rathbones and Investec Wealth. The latter now has £100 billion in assets under management.

It also means that post-merger, they have large positions in investment trusts. That makes it difficult for them to trade in them because their risk departments will invoke restrictions. This will dry up liquidity and may see discounts widen. The risk is that these mega wealth firms are not good for investment trusts, but we shall see. It is hard to imagine them offering portfolios that don’t closely resemble the index. The counter-argument is that investors ditch the mega firms and go it alone with online brokers… just like you good folk.

Both RICA and CGT have noticeably lagged the market in recent months, made worse by CGT shifting from a premium to a discount. As always, they unashamedly take a different and cautious path, and I am sure their strategy will work out in good time.

To protect yourself against a US default, buy gold, or better still, gold with a sprinkling of bitcoin.

I’ve enjoyed reading you for years now via the FSL and now ByteTree. Thanks for your sane commentary navigating through so much noise all round! Could I ask a question about cash sitting in ISAs and SIPPs? The interest offered is derisory, and I’m looking for alternatives. There has been a lot of talk about people moving cash to Money Market funds or short dated gilts etc. Can you recommend good ETFs where one could park cash - in sterling - to get better returns, while maintaining easy access within these tax shelters to switch and use for investment recommendations in due course?

I recently covered cash here. The basic point is that you should seek higher interest on your cash, and there are many ways to do this. I highlighted:

Invesco US Treasuries 0-1 Year GBP (TIGB)

This invests in ultra-short-dated US Treasuries and hedges the return into GBP, so you have no currency risk. The yield is 1.45% (paid out as income), but the total return (yield to maturity) is estimated to be 3.9389%. The fee is 0.1% per annum. This is low risk. This is a good option.

iShares 0-5 Year Gilt ETF (IGLS)

Short-dated gilts are normally low risk, but this fundfell 10% peak to trough over the past two years, making it more realistically low to medium risk. The yield is 0.8% (paid out as income), but the total return (yield to maturity) is 3.93%. The fee is 0.07% per annum.

I would remind you this is not a good time to chase the highest yields you see advertised. They could come with risks you really do not want. When investing cash, keep it simple and safe. I embrace holding cash at times like this, not so much for the income but for the opportunity. It is dry powder that can be invested when the opportunities arise. This has been Buffett’s trick for decades.

Many congratulations on BOLD’s anniversary, a great achievement to launch a successful innovation in Financial Services. Somehow, I will make an investment! Best wishes for continued success.

Thank you.

One day, the world will notice the remarkable behaviour of these two great alternative assets. Last year was a tough test, but BOLD did well despite bitcoin collapsing. Onwards and upwards.

Portfolios

New readers, please find a note at the end after the summary.

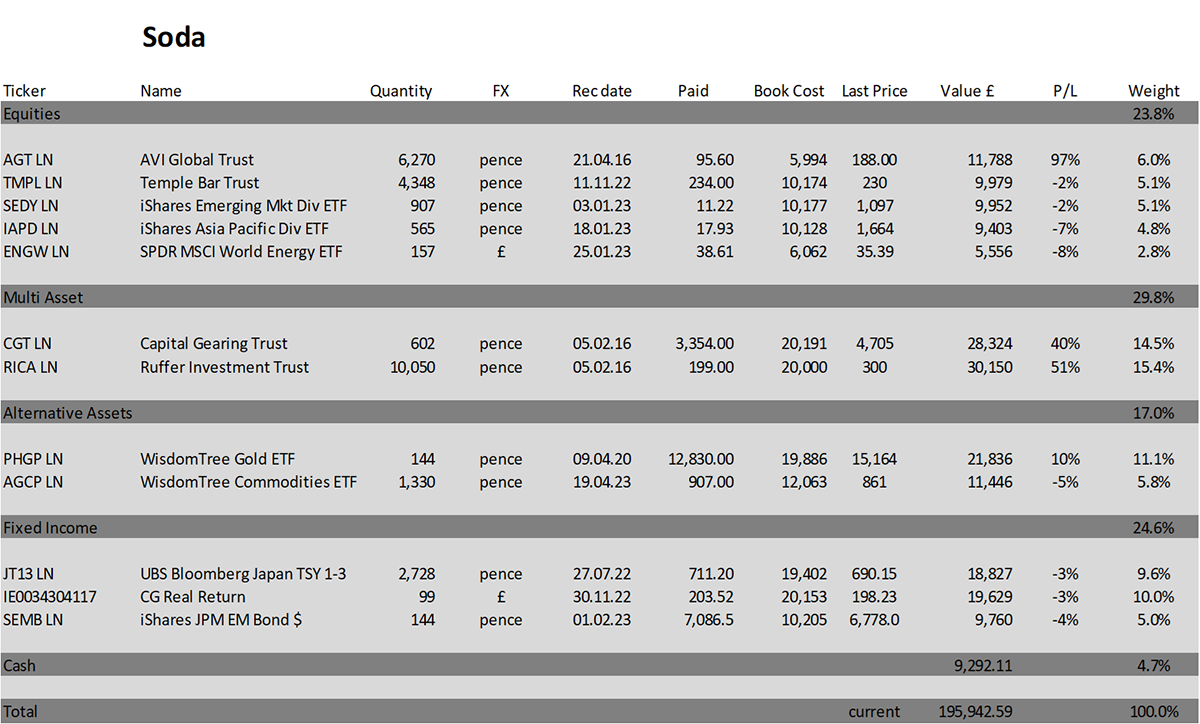

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio is down 2.1% this year and is up 95.9% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| +21.7% | +8.8% | -1.8% | +19.6% | +8.9% | +14.3% | +3.5% |

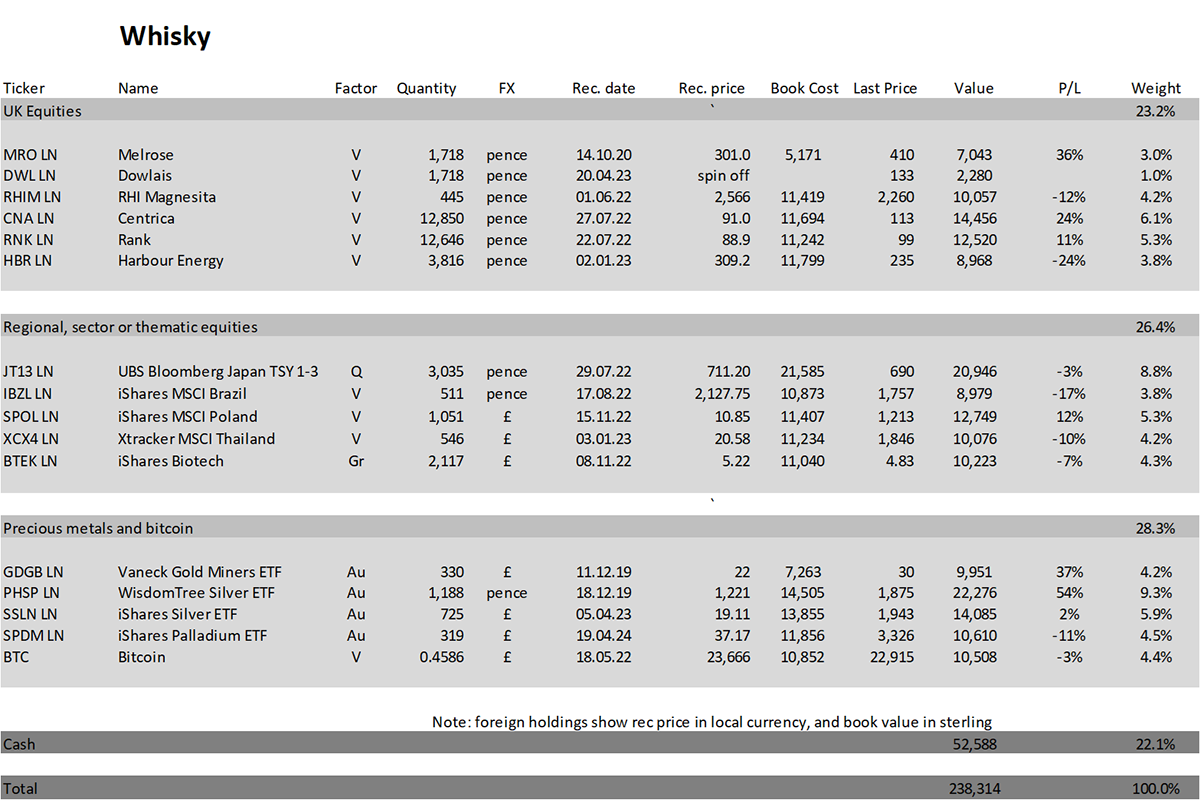

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 6.7% this year and up 138.3% since inception in January 2016.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| +24.7% | +5.4% | -4.3% | +21.4% | +20.4% | +12.9% | +8.0% |

Summary

I will be watching the coronation. I hope the world looks kindly on us Brits.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweet me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

Note for New Readers

The design of The Multi-Asset Investor investment process is to blend Soda and Whisky according to the level of risk you wish to take. Hopefully the clue is in the names as to which portfolio carries more risk. Most investors would be best suited to 80% in Soda and 20% in Whisky (a less risky blend) or 60% in Soda and 40% in Whisky (a riskier blend).

Example

A recommendation is often, but not always, 5% of either portfolio. If I added 5% of ABC in Whisky and you followed a 40/60 Whisky/Soda approach, then ABC would be 5% x 40% = 2% of your overall pot. If you followed a 20/80 Whisky/Soda approach, then ABC would be 5% x 20% = 1% of your overall pot.

This approach enables the Whisky Portfolio to pursue more adventurous opportunities than if it was designed to be the entire strategy. The inevitable, and hopefully infrequent, failure of some individual recommendations means the maximum loss is limited to between 1% and 2% of the overall pot, which is within reasonable scope. Cautious investors can be 100% Soda, but a little Whisky brings your investment journey to life and will hopefully boost returns in the long run.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority. https://register.fca.org.uk/

© 2024 Crypto Composite Ltd