It's Risky Out There

Disclaimer: Your capital is at risk. This is not investment advice.

In a busy week for ByteTree, the theme was risk.

Robin and Rashpal wrote about risk in the Adaptive Asset Allocation Report with the opening line:

“The story is the same. Globally we are in a bear market. However, bear markets have rallies. Seasonally, the best period for one is from December to late May. Global equity markets have rallied but very few of them have made annual rolling highs which confirms that the rallies are still part of a bear phase.”

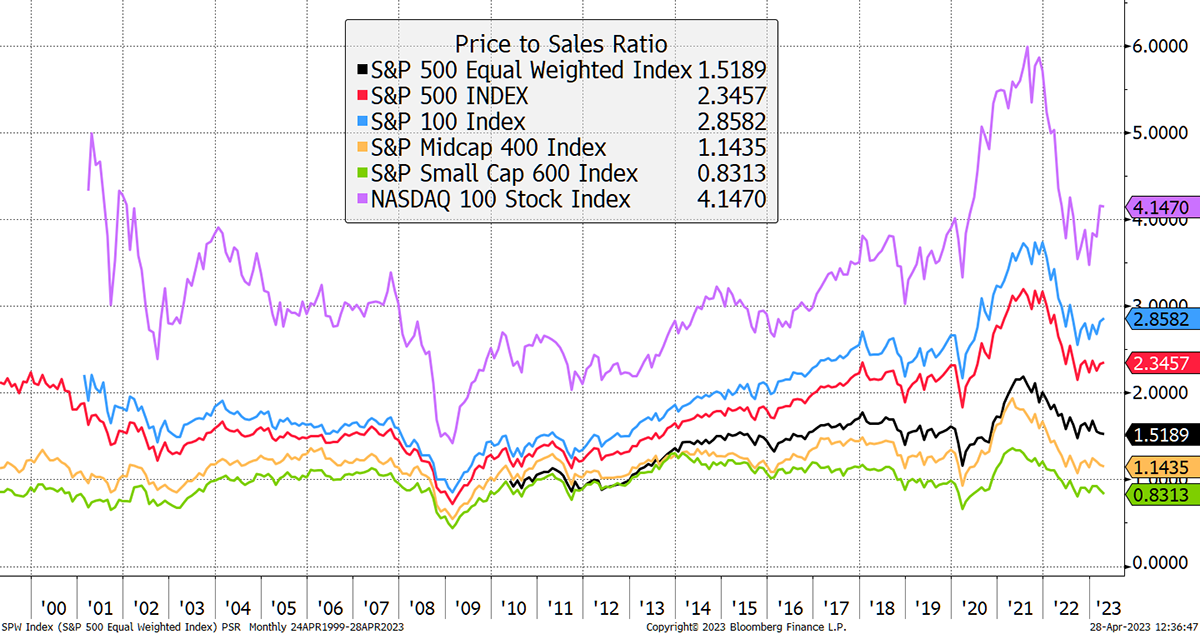

Rashpal illustrated that by showing how while the world index was seemingly going up, new highs in the individual stockmarkets were nowhere to be seen. It’s a great point, which can be demonstrated by this simple valuation chart of US large, mid and small caps.

Small Is Beautiful

It’s all about big tech, which brings us to my piece, where I talked about risk and recessions, showing the madness in the bond market. “This has never happened before” is becoming a routine statement. Yet investors can’t get enough bonds, almost as if last year never happened, government finances were sound, and inflation was genuinely transitory.

That explains why many now deem the big tech stocks to be the new treasuries. It’s a dangerous choice, but with the surge in US Sovereign default swaps, you can see why some think that way. This is what the chart would look like if a country decided to shift from a developed market to an emerging market.

Are US Treasuries Really Risk-Free?

No one thinks that’s happening to the USA this week, but it’s risky out there, that’s for sure. That’s why I stick to sound investment principles.

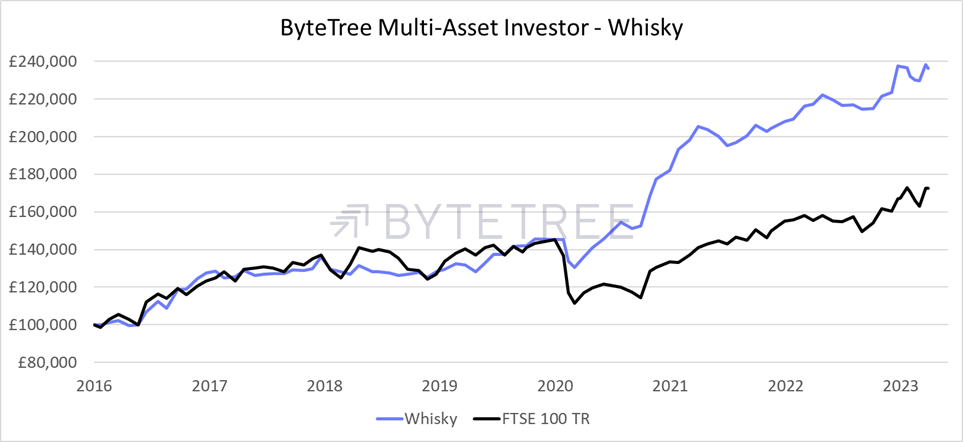

One of my stocks was Melrose (MRO), a UK industrial conglomerate, which recently spun off Dowlais (DWL). The Whisky Portfolio invested £7,275 in October 2020. From that came £233 in dividends and a special dividend of £953 in August 2021. With the two new holdings worth £9,150, the total return has been 41%. That’s not shooting the lights out, but a nice outcome from a sound value-based decision. Here’s an extract:

MRO was a classic value stock that appears ragged much of the time but turned out well. In this case, the spinoff led to value creation. The larger MRO (mkt cap £5.5bn) is the part the market seems to like, while the newly created DWL (mkt cap £1.75 bn) is the “rump”.

Spinoffs are one of those areas in markets where the rump normally wins. A sort of hare and tortoise situation. MRO is the “sexy” aerospace business, whereas DWL is the “dull” auto business (formerly GKN), which Melrose acquired in 2018. That dull old business is killing it with parts for EVs. I will look at this more closely and decide what to do.

That sort of decision-making has done well over the years and the eight-year track record (following my 17 years at HSBC Asset Management) is looking pretty solid. I sometimes beat the bull markets, but more often, I have avoided the bears.

In 2023, crypto has turned the corner, and the Bitcoin chart is warming up for halving, which is less than a year away. If the next cycle is anything like the last cycle, we’ll see some strength over the next 12 months, followed by a surge late next year. New supply will fall to just 0.9% per year, roughly half the level of Gold.

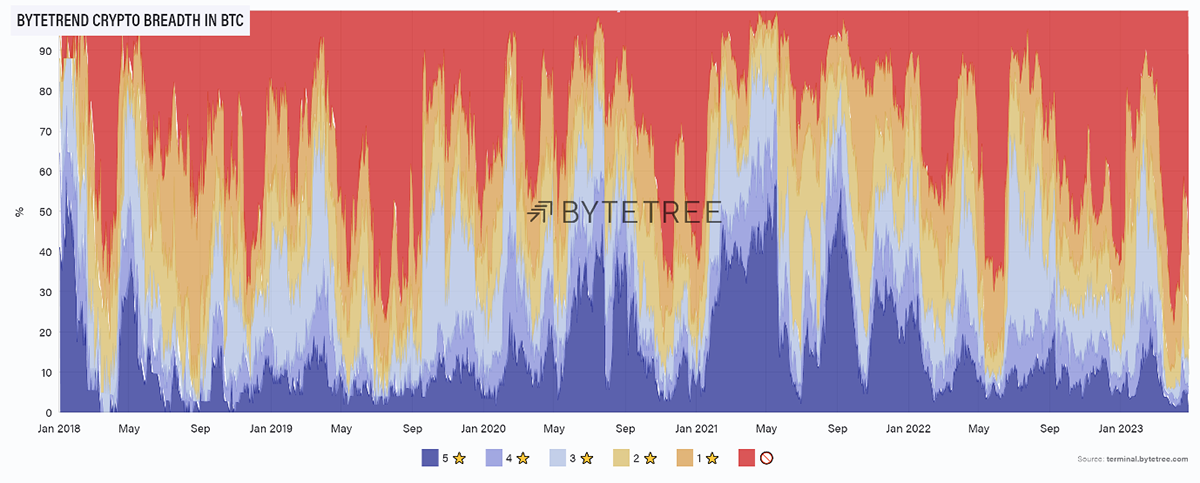

Just as large caps are crushing small caps in the stockmarket, Charlie Erith tells how it is the same story in crypto. Many believe the driver is the surge in sovereign CDS. After all, alternative assets sit outside of the financial system.

Bitcoin Is in Charge

If Bitcoin was lagging the crypto market, you’d see lots of blue, meaning that many tokens had stronger trends than Bitcoin. Instead, you see lots of red, which means Bitcoin is leading the market. The last great alt rallies were in 2017 and 2021. It seems to be late-cycle stuff.

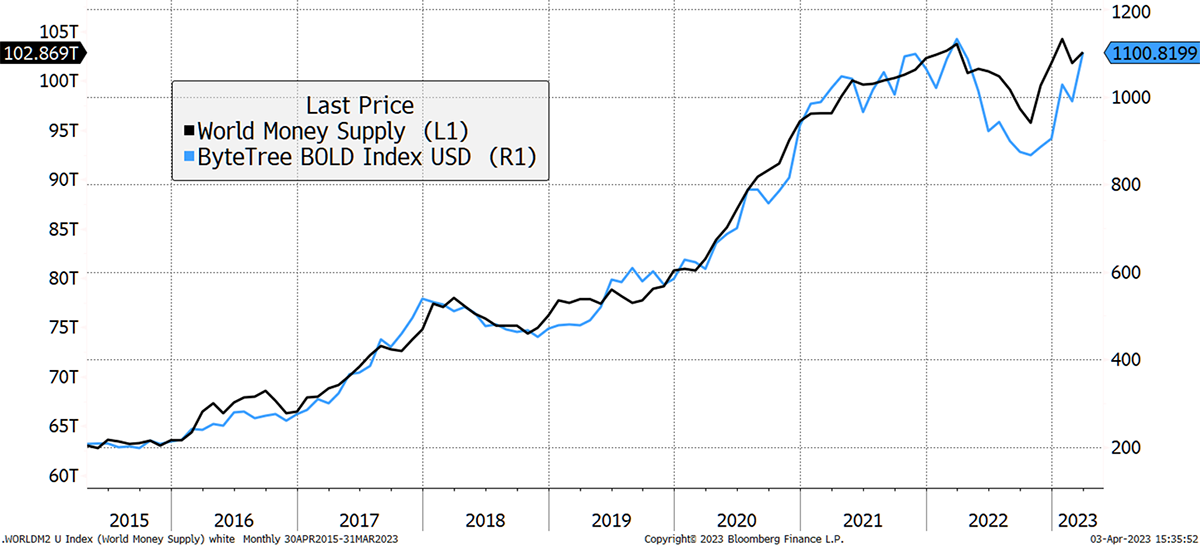

Happy Birthday BOLD

Finally, we celebrated BOLD’s first anniversary on Thursday. If you missed this piece, then do try and read it over the weekend. Despite a collapse in Bitcoin last year, and general mayhem in markets, BOLD finished its first year above water and 5% ahead of the S&P 500. A highly respectable outcome.

Moreover, it continues to be the world’s most efficient inflation hedge. In this case, it is closely linked to money printing. In fact, more closely than any other asset or combination thereof. Remarkable.

BOLD and the World’s Money Supply

Have a great bank holiday weekend,

Charlie Morris

Founder, ByteTree

Comments ()