BOLD's First Anniversary

Disclaimer: Your capital is at risk. This is not investment advice.

On this day last year, I had the pleasure of launching the 21Shares ByteTree BOLD ETF (BOLD SW). Here’s me ringing the cow bell at the SIX Exchange in Zurich with the team from 21Shares. It’s never a good idea to stand in front of someone tall.

Having written about gold for 20 years, and bitcoin for nearly 10 years, the project began in November 2020, when we first discussed the idea of blending Bitcoin and Gold together in an Index. Having coined the term “BOLD”, I had to see this through. To me, combining the world’s two most liquid alternative assets was a no-brainer.

I was put in touch with Vinter, a startup specialist crypto-index firm based in Stockholm. They were new on the scene but were evidently competent. I knew that being their first client was risky, but it would ensure we got preferential treatment and service levels that I could only dream of. That proved correct, and now I am pleased to see that Vinter are on their way to becoming the market leader.

It was an unusual project because crypto had never before been combined with a traditional asset such as gold. Calculating a theoretical index on a spreadsheet was the easy bit, but making it investable was harder. For example, crypto trades 24/7, whereas gold is closed overnight and at weekends.

After extensive research, we finalized the index rules, which would see Bitcoin and Gold combined on a risk-weighted basis. Using 360-day historical volatility, the risk would be radically reduced rather than holding bitcoin alone. Finally, the exposure to each asset would be brought back into line each month.

The risk-weighting would give a higher allocation to the less risky asset. That has typically meant approximately 80% in gold and 20% in bitcoin. In addition, rebalancing transactions would take place at the end of each month, ensuring that risk was kept in check.

Risk Management

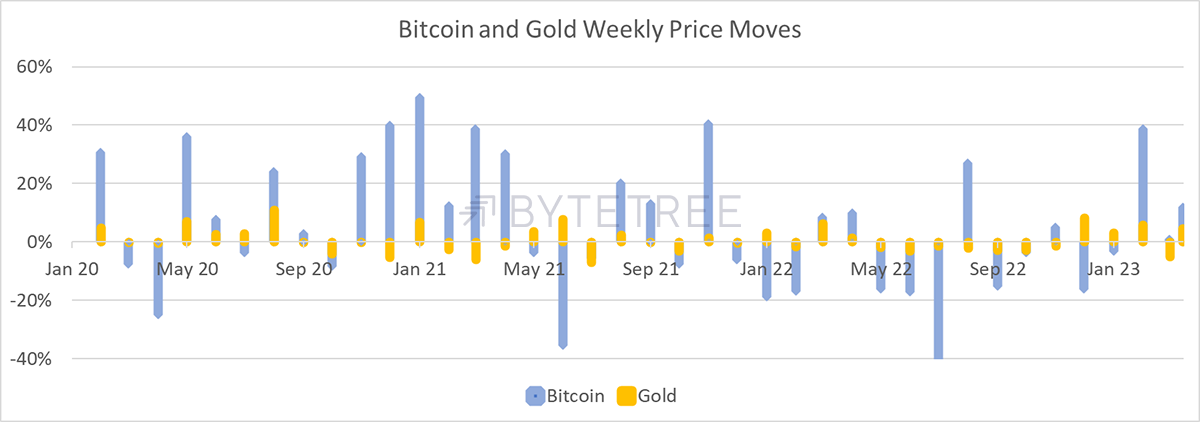

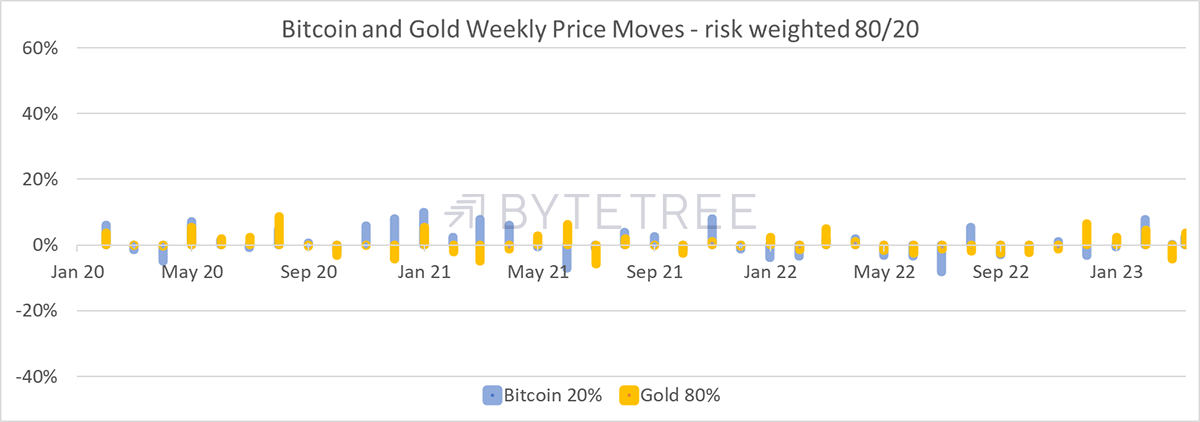

On an excitable month, you might see bitcoin move by 40% and gold by 10%, often in opposite directions.

In this case, risk-weighting simply means that having $80 invested in gold is roughly the same risk as having $20 in bitcoin. The risk of losing $10 is about the same. Using the same scale, this is what it feels like to own the two assets in risk-weighted proportions (80/20). With +/- 10% being the new extreme, it is easier to get a good night’s sleep.

The outcome of the Bitcoin and Gold combination surpassed my highest expectations. I have been active in the gold market since 1999. I am told I still hold the record for the largest single trade in a London-listed gold ETF from my time managing the megabucks at HSBC Asset Management.

Like many gold fans, I found bitcoin intriguing. It was either a fraud, the enemy, or an opportunity. I first came across it in 2012 and was dismissive, just like a leading London hedge fund manager that I contacted yesterday. He is still dismissive, but unlike him, I changed my mind in 2013 when bitcoin first broke above $100.

Is Bitcoin Real?

ByteTree was founded in November 2013 to find out what was under the hood. There was this thing called a “blockchain”, and I wanted to learn more. I hooked up with Mark, the coder, who was ByteTree’s only employee. His task was to plug into the blockchain and relay what was going on.

If the price of bitcoin was moving around violently, and yet inside the blockchain, there was little activity, I would have concluded this was tulip mania. Bitcoin would be just a “thing” that crazy people were bidding up aimlessly.

Yet if the blockchain processed hundreds of thousands of transactions, then bitcoin was not a thing but a vibrant network. Better still, the value would be proportional to the size of that network (network effect). Since there were no limits, the bitcoin price had the potential to surge over time. Mark’s data left me in no doubt that the Bitcoin Network was vibrant and that bitcoin was for real. That hedge fund manager might take a moment to examine that same data.

Bitcoin’s supply side was finite and designed around the idea of digital gold. A fixed supply with a growing network was a fabulous combination. Just like gold, bitcoin quickly became liquid, and despite extraordinary bubbles and crashes, it all made sense. At least more sense.

As my research progressed, I came up with various bitcoin valuation methodologies to complement my valuation work in gold. Most analysts believe assets without cashflows cannot be valued, but that lacks imagination. One main benefit of holding alternative assets is to have exposure outside of the financial system, as it boosts portfolio diversification.

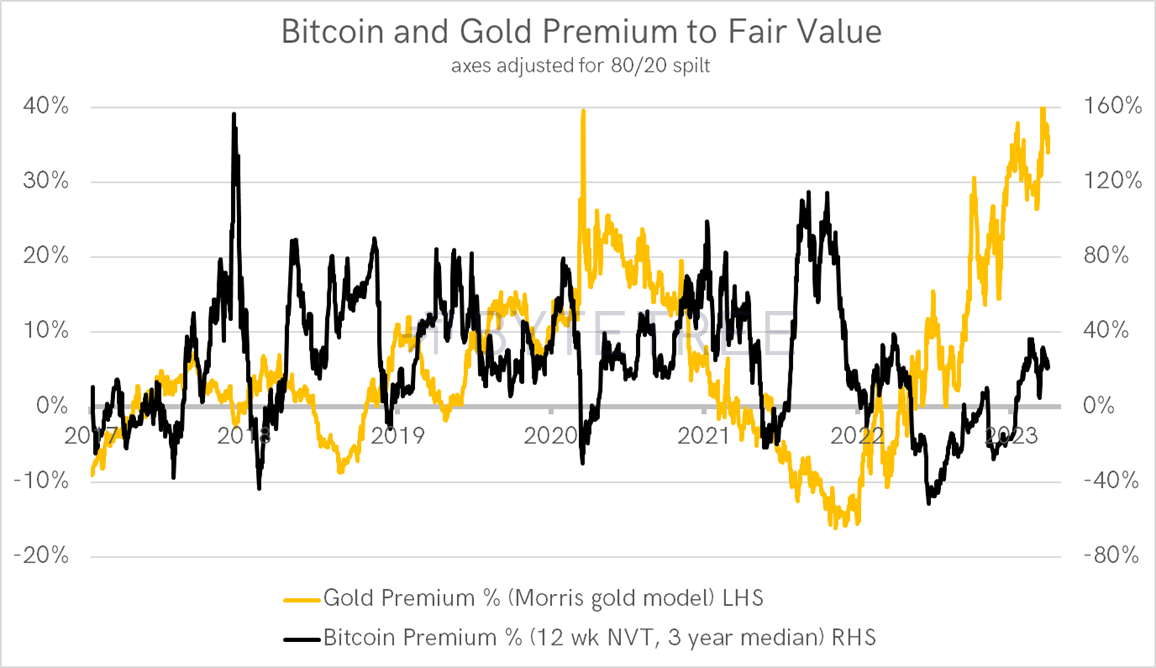

The bitcoin valuation models were based around the network effect and the simple idea that a larger network leads to a more valuable bitcoin. When I plotted my Bitcoin and Gold valuation methods side by side, the negative correlation jumped off the page.

When gold was overpriced, such as in mid-2020, bitcoin was cheap, and by late 2021, the situation had reversed. Also note that at the bitcoin peak in 2017, gold offered good value. These two assets moved up and down but never seemed to be overvalued at the same time, which made them natural diversifiers.

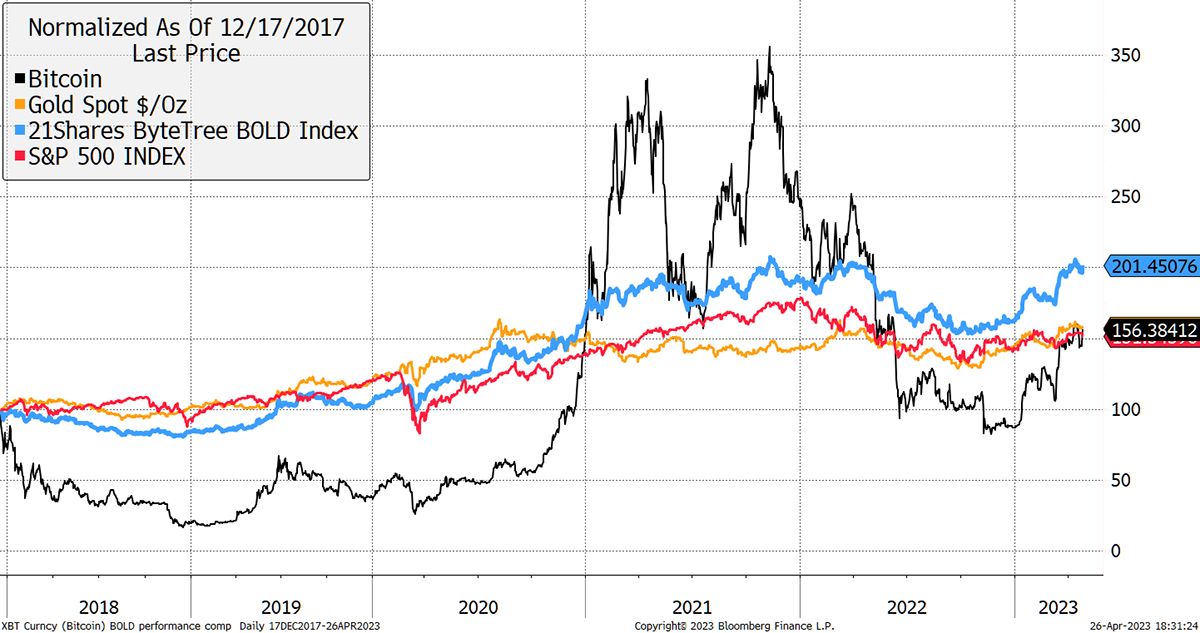

This is borne out in the BOLD Index (blue in the below chart), which has more in common with mainstream assets than many people suspect when neither bitcoin nor gold do alone. An interesting test for BOLD is to start from the worst time in recent years, the 17th December 2017 bitcoin price peak. As of yesterday, bitcoin is up 56% since, but start a few months earlier, or later, and that return becomes much higher. Over the five-year period, gold is up 57%, and the S&P 500 is up 51% (ex-dividends). It is remarkable how the three performances are so close over this time frame. A coincidence, perhaps.

Starting at the 2017 Bitcoin Peak

Yet the BOLD Index is up 101%, outperforming bitcoin, gold, and the S&P 500. How is this possible?

The answer is risk-weighting and rebalancing. During the bitcoin surges, rebalancing transactions detract from performance. But those bitcoin surges have only occurred for short periods of time. Since 2013, bitcoin has spent 88% of the time in consolidation and 12% in strong upward price trends. Investors are much better off in BOLD than bitcoin during the lengthy consolidation periods.

Furthermore, BOLD works for gold investors too, in all periods other than the bitcoin bear markets. Fortunately, while these have been painful, they have tended to be quick. Indeed, gold’s bear market in 2013 coincided with a bitcoin surge, so gold investors were much better off holding a little bitcoin.

BOLD Has Arrived

The BOLD Index was a theoretical construct until a year ago when the ETF was launched by 21Shares, the leading crypto ETF issuer. This idea was conceived in November 2020 and finally launched on 27th April 2022. It was complex because just as gold does not trade weekends, while bitcoin never sleeps, the custody arrangements are completely different as well. It took time, but BOLD was launched. The world’s first ETF with dual custody arrangements and the world’s first ETF first blending crypto with a traditional asset.

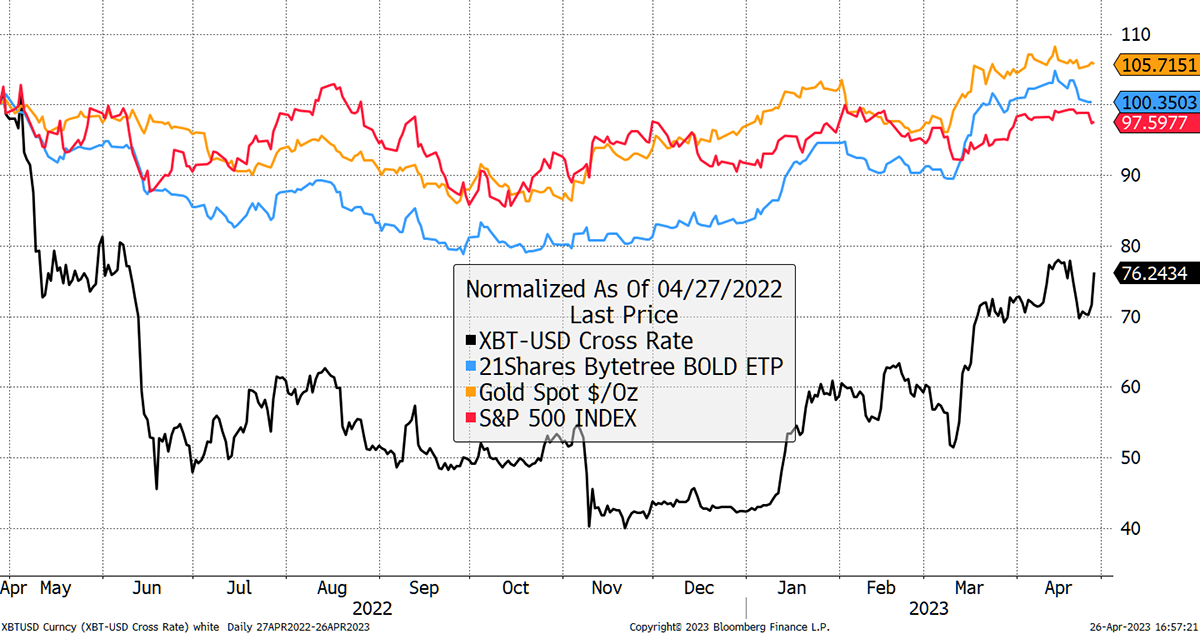

It is easy to assume that BOLD had a weak first year, but it turned out quite well, despite bitcoin crashing within days of the launch. Bitcoin trades 23.6% below the price at launch, yet BOLD held up well. The ongoing risk management, that is baked into the BOLD Index, demonstrated the power of rebalancing transactions. BOLD ended up ahead of the S&P 500, and close to gold, in an extremely tough year for bitcoin.

BOLD Proved Resilient

The optimist in me is delighted with BOLD’s first year. It was an extremely tough test, and it passed with flying colours. In addition, it also most likely means the worst is behind us.

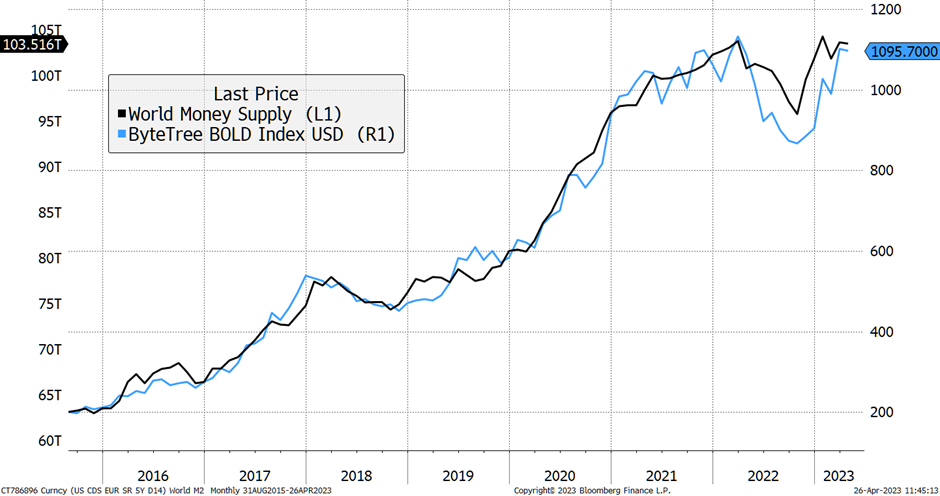

Looking ahead, BOLD keeps on surprising us with its extraordinary macroeconomic credentials. The optimized blend of Bitcoin and Gold is evidently the world’s most efficient hedge against the ever-growing global money supply. Nothing else can match it in performance or correlation, even the S&P 500.

BOLD Is the Leading Hedge Against an Increasing Money Supply

That is an attractive quality, and investors should all hold Bitcoin and Gold to protect themselves against macro risks. Better still, risk-weight the assets and rebalance frequently to keep the risk in tow. Sadly, few bother to do that, and that is why BOLD exists. It not only demonstrates the power of the strategy, but 21Shares executes it efficiently and seamlessly.

Protection against adverse macro conditions is becoming increasingly relevant. Earlier this week, a leading hedge fund manager, Stanley Druckenmiller, announced that he was short the US dollar, which most professional investors deem to be a safe haven. If he’s right, which he normally is, BOLD would be a prudent and efficient way to express that view.

It’s not just a falling dollar that BOLD would benefit from, but the other drivers of Bitcoin and Gold too. Bitcoin is also a tech trade, with superior performance to cloud computing stocks, robotics, or even artificial intelligence.

Gold leads commodities over the long term, even nickel used in EVs and agriculture. Gold also benefits from falling real interest rates, which seem to be inevitable over the medium term. Just wait until this impending recession bites.

Bitcoin and Gold are the two most liquid alternative assets in the world. They are not in competition, play different roles, have global cross-border and cultural appeal, and come together as an all-weather inflation hedge.

I was speaking with a friend yesterday when he told me, “a year ago, at launch, BOLD was the right product at the wrong time. Today it is still the right product, but at the right time”.

Happy Birthday BOLD.