ByteFolio Update 48

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree's Crypto Leaders

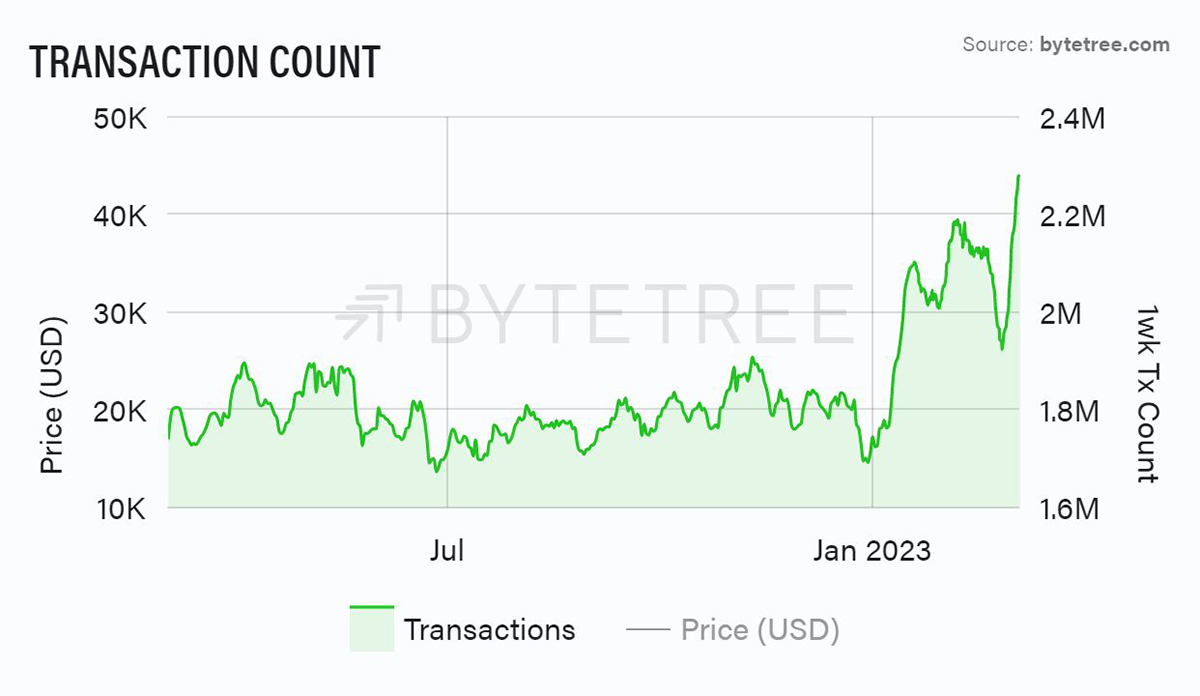

Last week’s rising crypto optimism has been deflated somewhat via a combination of concerns about the crypto-related banks in the US and market caution about a more stubborn inflation outlook. ByteFolio took a small hit as new entrant Ethereum Name Service (ENS) fell steeply, and MATIC continued to consolidate after its recent outperformance. Overall, however, we consider the outlook to be constructive. On-chain activity is solid (the transaction activity on the bitcoin network is very encouraging), and the technical setup remains fine.

Source: ByteTree

I watched the recent Elvis film this weekend. It’s amazing to think that his gyratory on-stage antics were seen as a probable cause for irretrievable moral and social decline. He was subsequently banned from so much as wiggling a little finger on TV, not that he conformed.

The episode chimed in the context of the current crypto-bashing by the SEC. It was a reminder that for all the claims of being the land of the free, the USA has always been quick to ban new stuff when it threatens the established order. In that sense, it’s no different from most other countries – it is the fear of the new. The saving grace is that processes are in place to gradually adopt and embrace the new as times and conventions change. We must hope and believe that this will be the case with crypto.