ByteFolio Update 45

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree's Crypto Leaders

ByteFolio brings together ATOMIC, ByteTrend and Token Takeaway to create ByteTree’s model portfolio, known as ByteFolio. This is a selection of crypto tokens, which are weighted according to their risk/reward characteristics. ByteFolio has a modest turnover and will not suit traders. It will appeal to investors who wish to diversify beyond bitcoin, with the aim to beat it.

ByteFolio creeps higher this week relative to BTC, but prices in general have been weaker due to negative regulatory developments for crypto in the USA. The last few weeks have seen a concerted and coordinated effort to sever crypto’s ability to interact with the banking system.

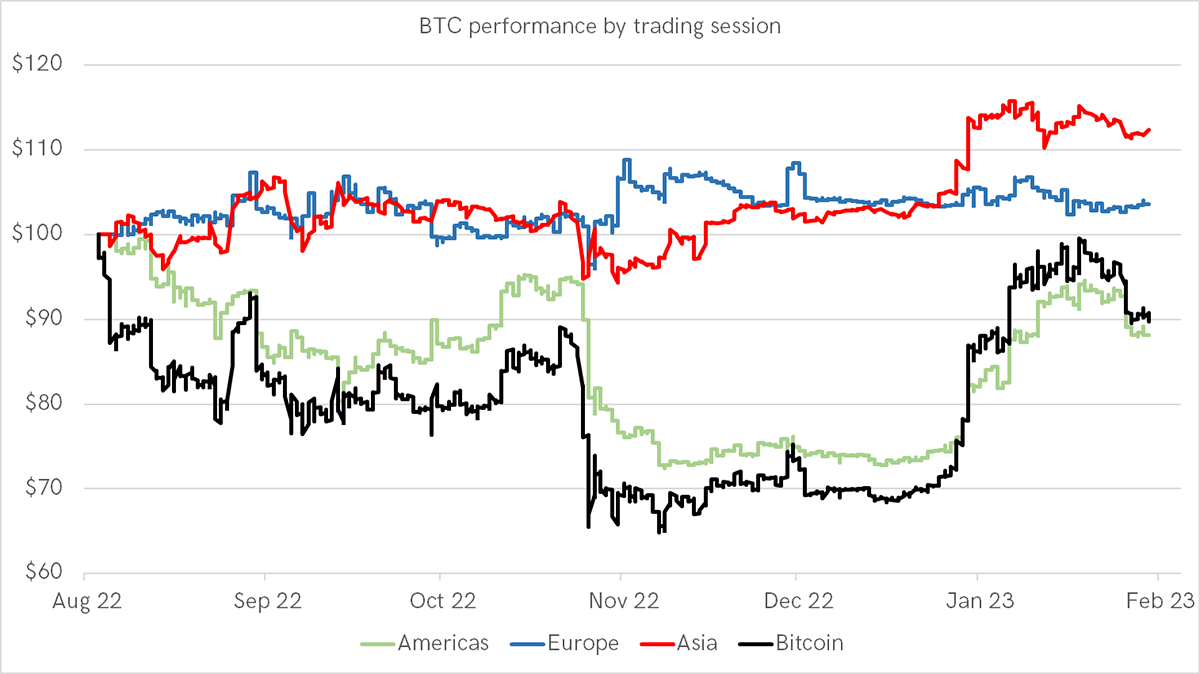

We discuss the implications later on, but the importance of the US market in price formation can be seen in the chart below. It shows that bitcoin has been heavily driven by that market since the collapse of FTX.

Source: Bloomberg, ByteTree

How US politicians and regulators behave towards crypto is clearly important, given the dollar’s hegemonic position in world affairs, so this is obviously a setback (and a genuine worry for any free-thinking Americans). But it is not terminal. Crypto will of course survive and thrive elsewhere, and the benefits of its development will accrue to those countries that don’t take such an illiberal stance.