Revisiting Oil, Questioning Silver

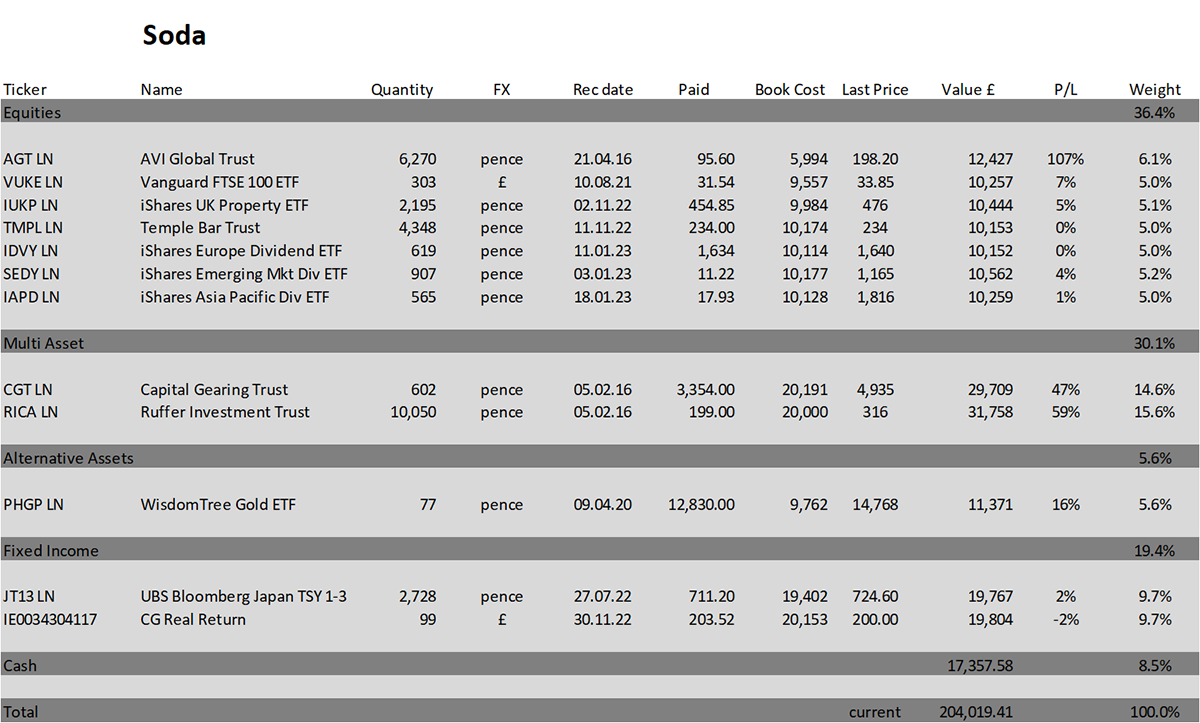

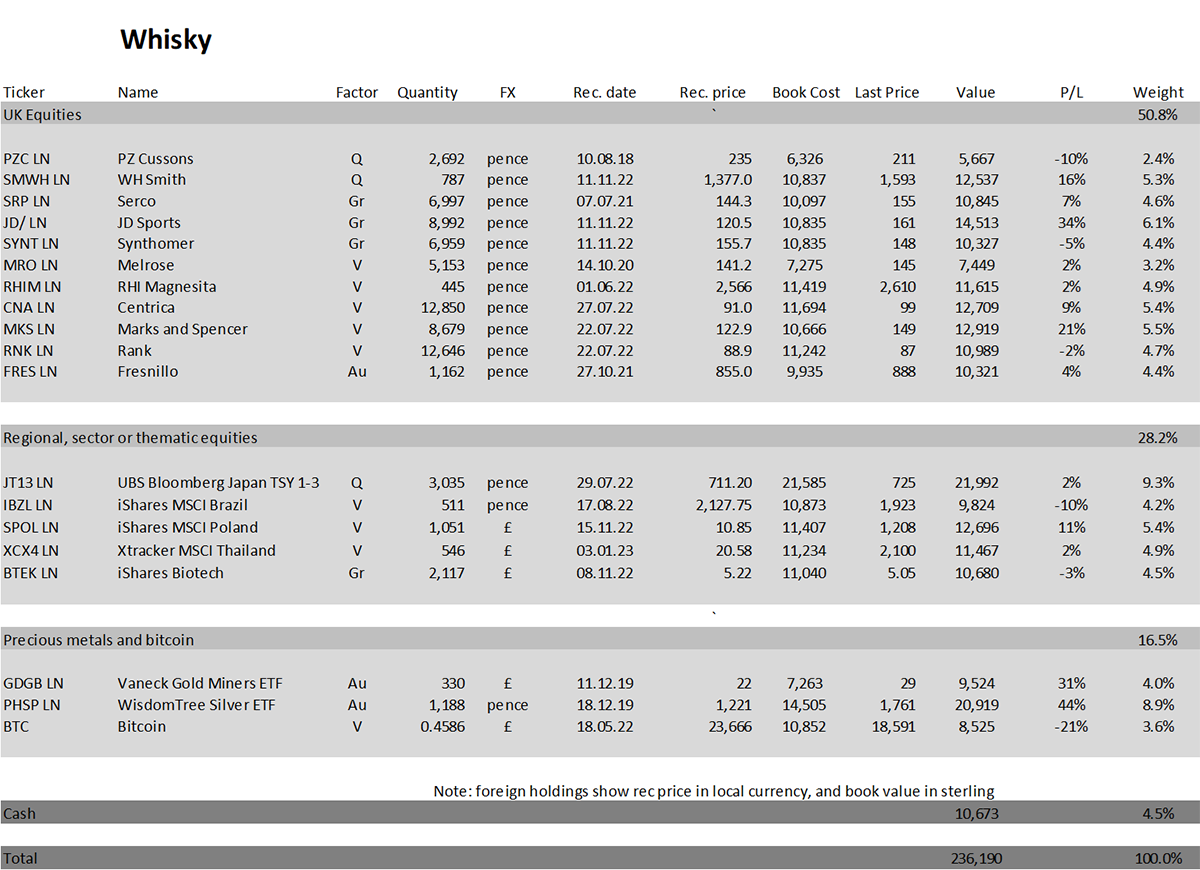

Trades in Soda and Whisky

Commodity prices have kept us alert, but then again, they always do. They collapsed in 2020, when the world economy shut down, taking US oil futures briefly into negative territory, only to surge again when the economy reopened. In recent years, we have owned various commodity investments and, having taken profits last year, exposure is currently on the light side.

This week, I am revisiting oil because those Chinese holidaymakers, eager for a well-deserved break, may well be enough to break the cycle. I am adding a modest position to the major energy companies in Soda.

In Whisky, I am buying an oil exploration company, Harbour Energy, while selling Fresnillo. Another busy week, but these are changing times, and we must avoid capital loss whenever we suspect it is coming. At the same time, we must embrace opportunities as they arise. Before we turn to precious metals, let’s start with oil.

The Need for Oil

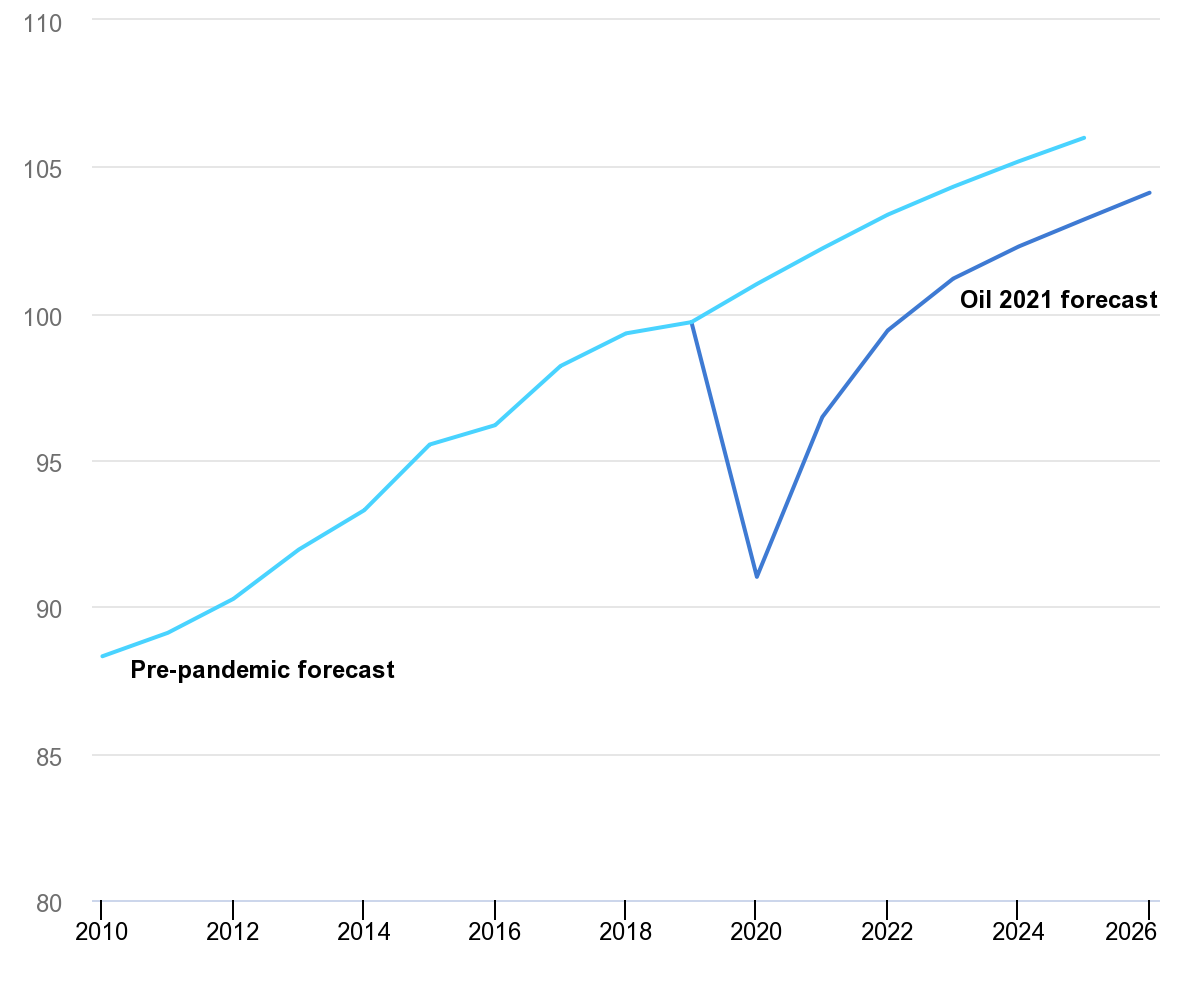

We consume around 1.4% more oil each year, a point I keep coming back to. The pandemic knocked this temporarily, but forecasts have already recovered to 104 million barrels per day (mbpd) by 2024. The pandemic changed nothing; it merely postponed the inevitable. With China back on the move, and alternative sources struggling to keep up, I cannot see our thirst for oil falling anytime soon.

Source: IEA

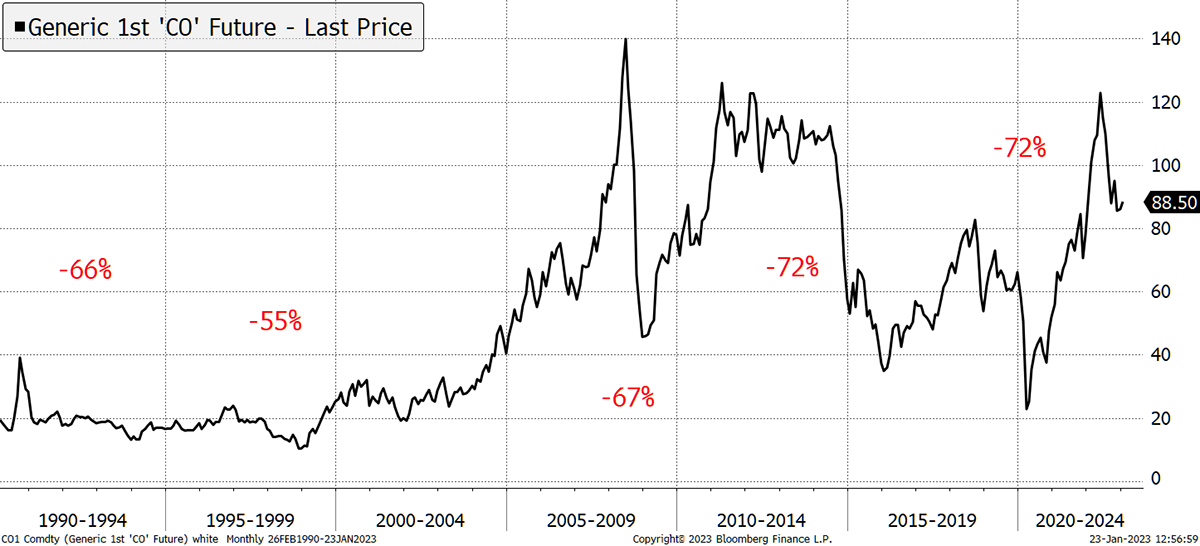

Recessions aside, we have always needed more energy each year, but this has not prevented the oil price from being hugely volatile. In 2008, demand was for 88 mbpd, but an economic shock saw it fall to 83 mbpd the following year. The price reaction for a 6% fall in demand? -67%.

Oil Is Hugely Volatile

Source: Bloomberg

Do you remember the great depression of 2014?

I’ll give you a clue: there wasn’t one, but oil still managed to fall by 72% during a period of somewhat steady economic growth. In that case, it was excess supply courtesy of USA shale. The trouble with oil is that sometimes we have too much and, at other times, too little.

Despite this 1.4% annual growth in demand, we have to live with huge volatility in energy prices. For society, this makes planning difficult (e.g. airlines’ forward purchases), but for investors, it presents an opportunity.

I reduced oil (and commodities) in our portfolios last year because 2023 was booked to host a global recession. However, the Chinese are interfering with those plans, in which case the oil price appears to be underpinned. That is not to say oil will necessarily surge, but there are reasons to believe this cycle may surprise.

After all, oil was $139 last March (intraday high) and touched $75 last month. Might a 45% retracement be enough? I cannot be sure, but I believe we are better off being neutral on energy as opposed to negative.

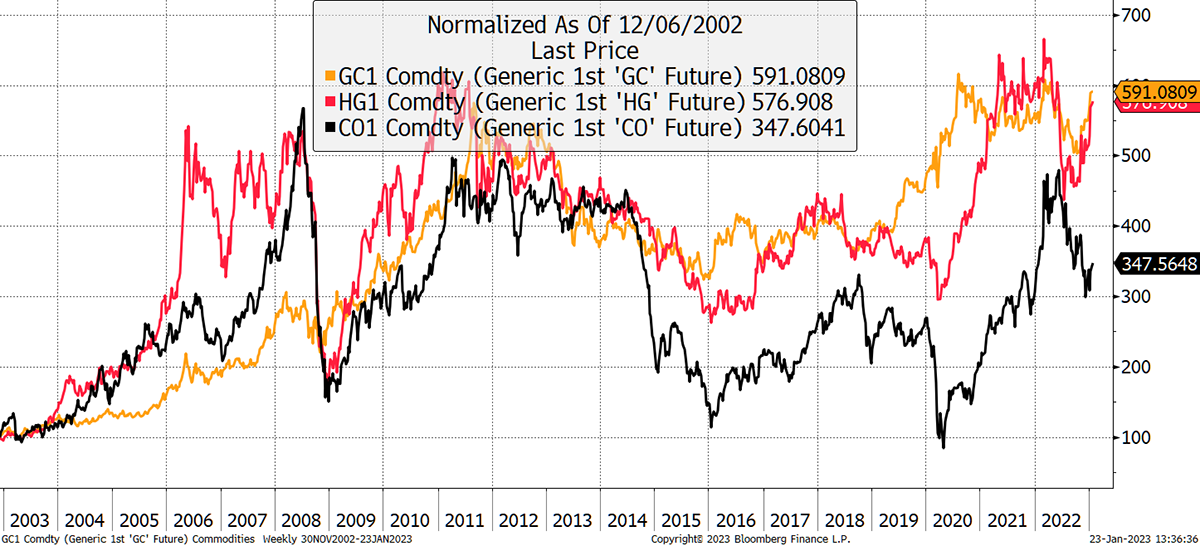

Looking back 20 years at the three most important commodities, gold, copper and oil, it becomes clear how the price behaviour of gold and copper are much more similar than many realise. As things stand, oil has been the notable laggard.

The Three Commodities That Matter

Source: Bloomberg

The spread has moved back in favour of oil, and I feel it is prudent to add energy exposure to the portfolios. This also makes me less enthused by metals, and I’ll get to that.

Current oil exposure

Looking through the Soda Portfolio, fund by fund, oil equity (or energy) exposure is approximately 3.5% in aggregate. In other words, 3.5% of Soda is invested in energy companies via the funds.

That is the equivalent of 6% equities, assuming the portfolio was fully invested (60% equities would be fully invested). The highest exposure comes courtesy of Temple Bar (TMPL), Vanguard FTSE (VUKE) and iShares Emerging Markets (SEDY). Given I have moved to a slightly more bullish view, this is on the light side, and I would like energy exposure to be higher.

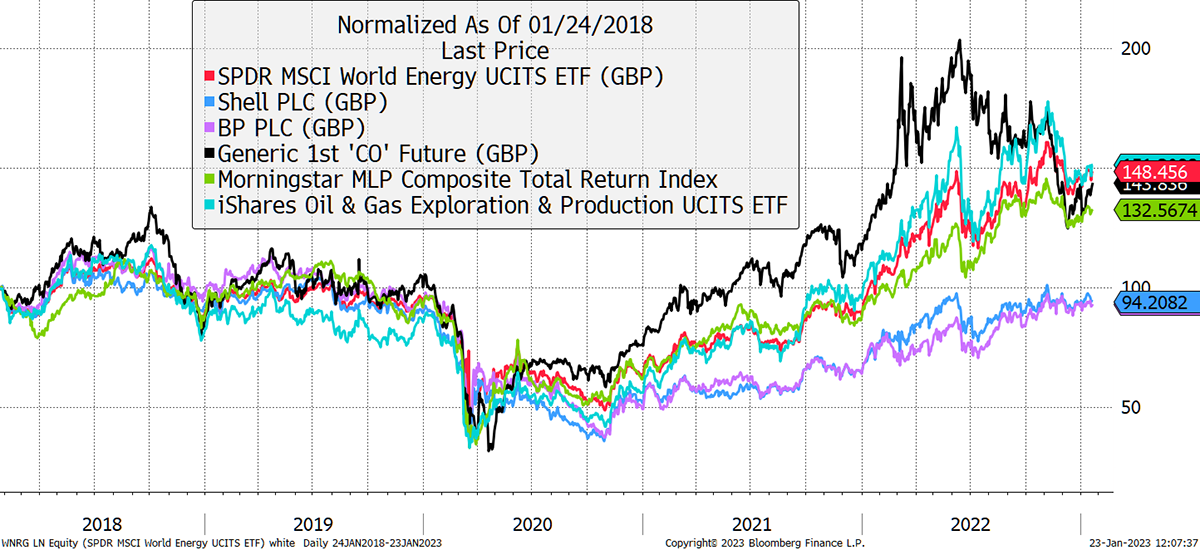

Exploring the Options

Source: Bloomberg

In Soda, I prefer diversified funds to stocks because they are less risky, and I will opt for a small holding in the SPDR MSCI World Energy ETF (ENGW). It holds BP and Shell, but also Exxon Mobil, Chevron, Total and ConocoPhillips. It is more diversified and slightly more conservative than our old holding, SPOG.

Buying 3% in SPDR MSCI World Energy ETF (ENGW) in Soda

Please note the 3% position size, not the usual 5%.

ENGW is the GBP share class of the SPDR MSCI World Energy ETF. The dollar share class has the ticker WNRG, but the funds are the same with details here.

63% of exposure is in companies based in the USA, 11.4% in Canada and 11% in the UK. There is a yield of approximately 3.7%, but it is not paid out as dividends but rolled up into capital gains, which is fine by me. The fee is an amenable 0.3%.

Risk

This is a sector fund comprised of 58 global energy companies, with most being large cap. Being single sector, and energy to boot, it is riskier than a diversified index such as the FTSE 100, but not materially so over the long-term. I have kept the weight down to 3% so that Soda’s aggregate energy exposure is boosted to 6.5%, which neutralises our position on energy. ENGW is medium risk.

In Whisky, I am going to be more adventurous, as is my duty.

Buying 5% Harbour Energy (HBR) in Whisky

I do not feel the need to buy the likes of Shell because while it offers value, it is no longer dirt cheap. Therefore, ENGW will do the same job but with less risk due to increased diversification.

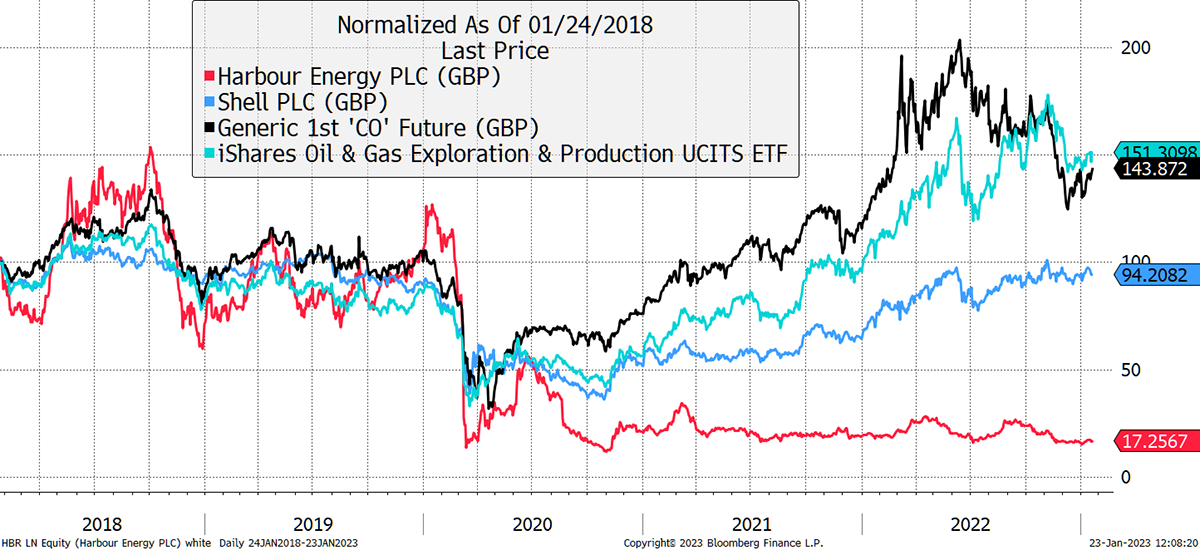

I have become interested in Harbour Energy, where the value is compelling. It has missed out on this cycle entirely and, unlike Shell, is dirt cheap.

Harbour Is Undervalued

Source: Bloomberg

I mentioned HBR a couple of years ago in the Fleet Street Letter, saying how I was tempted but wrote:

“The reason I haven’t recommended it is because, on reading the small print, the company hedges its oil. That means that it has locked in a price of $60 per barrel for the next year. The company won’t benefit from higher prices of oil until its hedges expire and it can set new ones at higher prices.”

Then came the windfall tax, and Harbour quite rightly cried foul. But I think the situation has improved markedly. The 19 January trading statement is upbeat.

It struck me that HBR continue to “forecast to be net debt free in 2023”, had made a “significant gas discovery in Indonesia”, “increased production”, “lower costs”, and “estimated cash flow of $2.1 bn”. If only all statements could read more like that.

The bottom line is that HBR trades on 2.8x next year’s forecast earnings, and it will be debt free, while buying back stock. The only sad bit was that following the tax grab, the company will be looking for opportunities overseas in the future. Our Chancellor of the Exchequer is doing a fine job of destroying UK oil and gas production.

Risk

This is a UK mid cap oil exploration stock, and by its nature, high risk. Risk comes from the oil price, the UK government who can tax it, safety and environmental factors, and others. One risk we do not face is liquidity as the company has a market cap of £2.7 billion and the shares typically trade £14m per day.

HBR is high risk.

Reducing Precious Metals

In recent weeks, I have somewhat cooled my enthusiasm towards precious metals. In late November, I reduced gold in Soda for the first time since 2018 and bought inflation-linked bonds, which offered better relative value. To be clear, we still hold gold, just much less.

There is so much I could say here, but those interested should read my last issue of Atlas Pulse, where I cover gold in detail each month. I can understand why gold is trading at high prices from the Chinese perspective because they no longer wish to buy US Treasuries, but as a value investor, I can see increased risk.

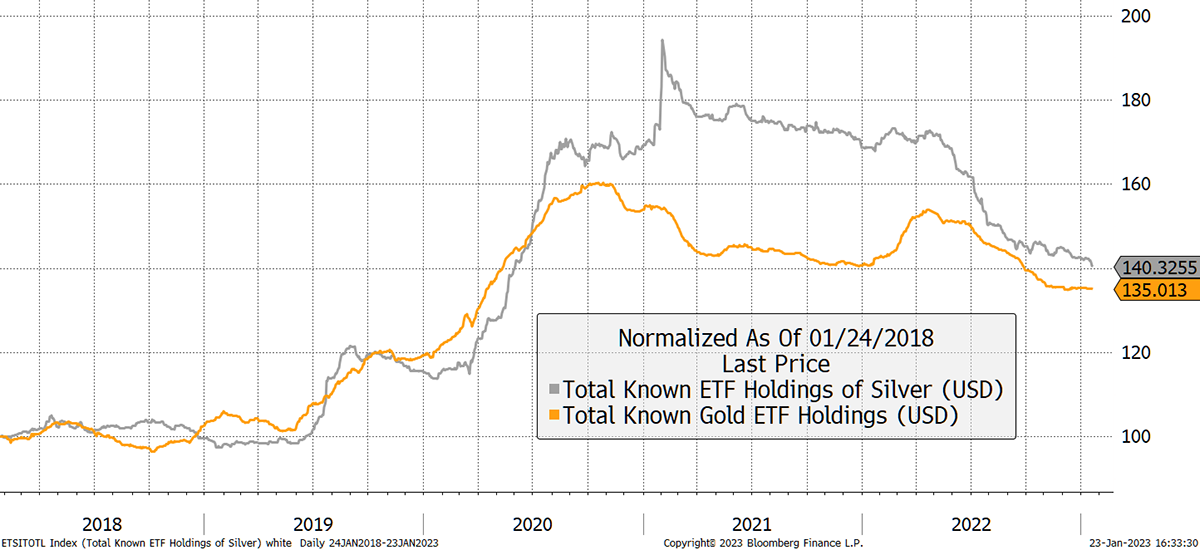

Another question is, why haven’t investors been buying gold and silver this cycle? They basically stopped buying in 2020. Investors normally buy gold as a safe place to hide during bear markets. Given equities were in a bear market last year, this is highly unusual.

What really stands out are the outflows from silver, which seem to be relentless. The ETFs held 190 million ounces (Moz) in early 2021, which has subsequently shrunk to 140 Moz. Do they know something we don’t? Or are investors just wrong?

Weak Flows in Precious Metals

Source: Bloomberg

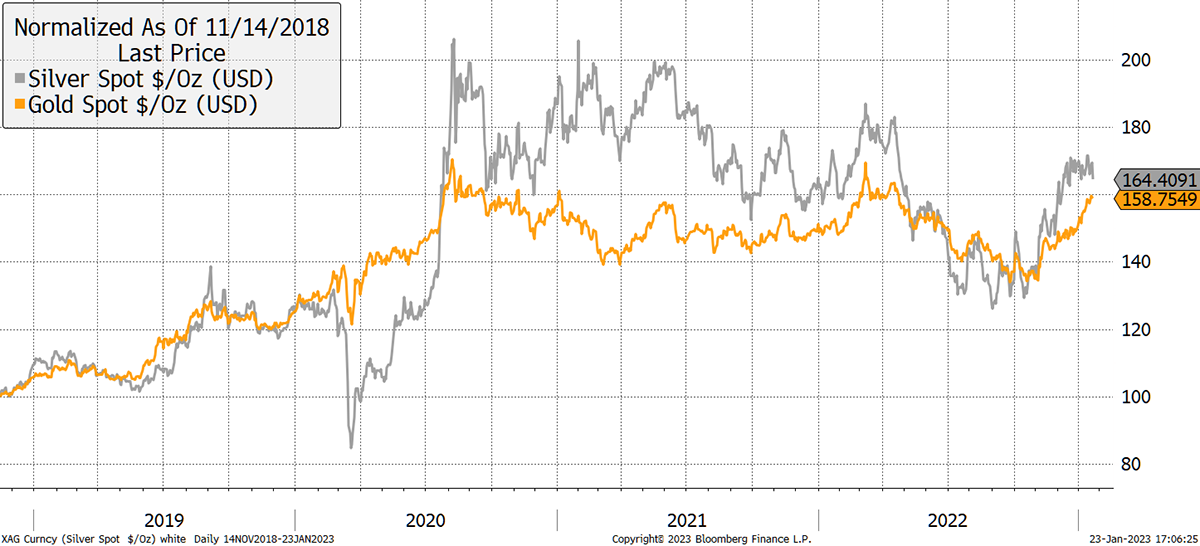

I can’t help but notice how silver has had a poor start to this year. Maybe the message from the market is the war against inflation has been won, or maybe just that equities are back, and the end of the world has been postponed yet again. I believe this cycle will be the first cycle in many years where interest rates go up and then stay up. That would be potentially toxic for precious metals.

Silver and Gold

Source: Bloomberg

And as I keep saying, bitcoin and gold are basically opposites. If bitcoin is entering a bull market, then that’s probably not great for gold. And if gold is under pressure, you don’t want to be anywhere near silver. This thesis is very simple, and I will elaborate in the next issue of Atlas Pulse, hopefully on Wednesday.

We still own some gold in Soda and some silver and gold miners in Whisky. I am selling Fresnillo this week, but I want to make it clear that I am questioning the case for precious metals. I would be a raging bull if inflation took off again while rates stalled. But if inflation is contained and rates keep rising, precious metals are not the place to be.

Selling Fresnillo (FRES) in Whisky

The mining analyst at UBS recently published a sell note on FRES, citing high costs, and believed the market consensus had forecast their cost base too low. If precious metal prices fall while costs rise, that’s a painful combination. I originally recommended FRES as a cheap stock, but their margins have failed to recover and will only do so if gold and silver prices move much higher. The earnings forecasts keep on falling, and so I have decided to sell.

Action:

Buy 3% in SPDR MSCI World Energy ETF (ENGW) in Soda

Buy 5% Harbour Energy (HBR) in Whisky

Sell Fresnillo (FRES) in Whisky

Postbox

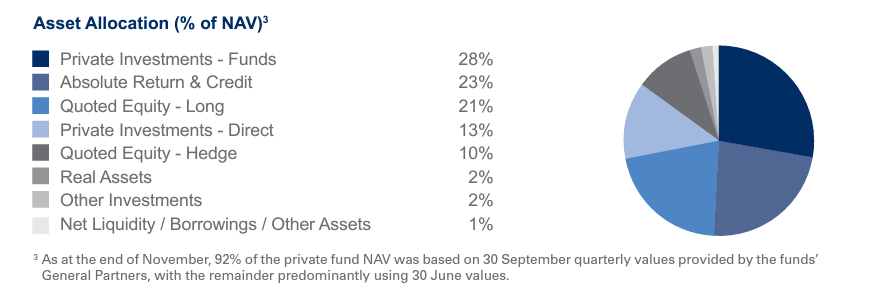

What do you think of RIT Capital Partners (RCP)? I used to like them, but they don’t seem to be doing well at the moment. Their factsheets on the website don’t seem to tell you much. They trade at around a 20% discount to NAV. Could this be a good deal, or likely to continue losing money?

I have followed this for years, and I think RCP were very much on the A-Team but have been relegated to the B-Team. Many still believe in them because they carry the Rothschild brand, which in finance, is a bit like being Man U, whether you win or lose.

They hold lots of private equity, and no one knows what that is actually worth. But definitely less than it was.

Their factsheet is full of financial mumbo-jumbo, which is off-putting. “Private investments -funds + direct” amount to 41%. That should terrify investors. Absolute Return and Credit 23%. Crikey, I’m running for the hills. The discount needs to be wider before I would touch it.

Portfolios

A Note for New Readers

The design of The Multi-Asset Investor investment process is to blend Soda and Whisky according to the level of risk you wish to take. Hopefully, the clue is in the names as to which portfolio carries more risk. Most investors would be best suited to 80% in Soda and 20% in Whisky (a less risky blend) or 60% in Soda and 40% in Whisky (a riskier blend).

Example

A recommendation is often, but not always, 5% of either portfolio. If I added 5% of ABC in Whisky and you followed a 40/60 Whisky/Soda approach, then ABC would be 5% x 40% = 2% of your overall pot. If you followed a 20/80 Whisky/Soda approach, then ABC would be 5% x 20% = 1% of your overall pot.

This approach enables the Whisky Portfolio to pursue more adventurous opportunities than if it was designed to be the entire strategy. The inevitable, and hopefully infrequent, failure of some individual recommendations means the maximum loss is limited to between 1% and 2% of the overall pot, which is within a reasonable scope. Cautious investors can be 100% Soda, but a little Whisky brings your investment journey to life and will hopefully boost returns in the long run.

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio is up 1.9% this year and is up 104.0% since inception in January 2016.

2016 +21.7%

2017 +8.8%

2018 -1.8%

2019 +19.6%

2020 +8.9%

2021 +14.3%

2022 +3.5%

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 5.7% this year and up 136.2% since inception in January 2016.

2016 +24.7%

2017 +5.4%

2018 -4.3%

2019 +21.4%

2020 +20.4%

2021 +12.9%

2022 +8.0%

Summary

The commodities landscape is complex. Where are the winners and losers as the world economy slows down just as China speeds up? My conclusion is that it’s a bit late to be an oil bear, and while I’m always happiest being a gold bug, now is the time to ask difficult questions.

Trustpilot

Thank you very much to the 31 people who have reviewed ByteTree on Trustpilot. Please keep them coming; it’s important to us as we build the readership.

It only takes a moment to leave a rating, even if it means leaving a 4-star, like David did. Thanks David, we’ll try harder! Perhaps it’s good to have the occasional 4-star as it looks more believable, but we still prefer 5s.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweet me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2024 Crypto Composite Ltd