Reopening

Trades in Whisky and Soda

I hope you had a good break. I most certainly did, but I have been eager to get back to work because I suspect 2023 will be an interesting year. The USA, having beaten the world index for such a long-time, will become the problem and is best avoided. In contrast, the rest of the world is a much better bet. And while there are always risks in markets, 2023 could turn out well, as so much bad news must be priced in.

To kick off the year, I am modestly increasing exposure to emerging markets, with a value ETF in Soda and a Thailand ETF in Whisky. I feel this is a simple and logical starting place from which we can build over time. I shall get to these trades later.

Little happened in markets over the break, which is probably a good thing, but several stocks in Whisky managed a minor late surge. I think that relates to China reopening its economy after a prolonged lockdown. This is important on many levels. It is helpful for the world economy because just as our economies are slowing down, China will be a counter-cyclical force.

But perhaps even more remarkable is that just a few weeks ago, there were protests in China against lockdown policies. The Chinese Communist Party (CCP) didn’t wheel out the tanks this time, but eased lockdown restrictions instead. This is a hugely positive development.

Covid is spreading rapidly in China, but as we learnt in 2020, it will spread rapidly whatever policy choices are made. China has ended the unwinnable war against covid because the alternative was eternal lockdowns. The people have had enough, and a blend of vaccines with herd immunity is the only way forward.

This will open up their economy to foreigners, but more importantly, the Chinese will travel in their millions and global tourism could be in for a pleasant surprise. Nowhere will be more relieved than Thailand to see the Chinese tourists return.

Chinese Tourists in Thailand

Source: Bloomberg

It will take a little time, but in 2023, Thailand will be one of the greatest beneficiaries of China’s reopening. Before we get there, I want to explore recent history.

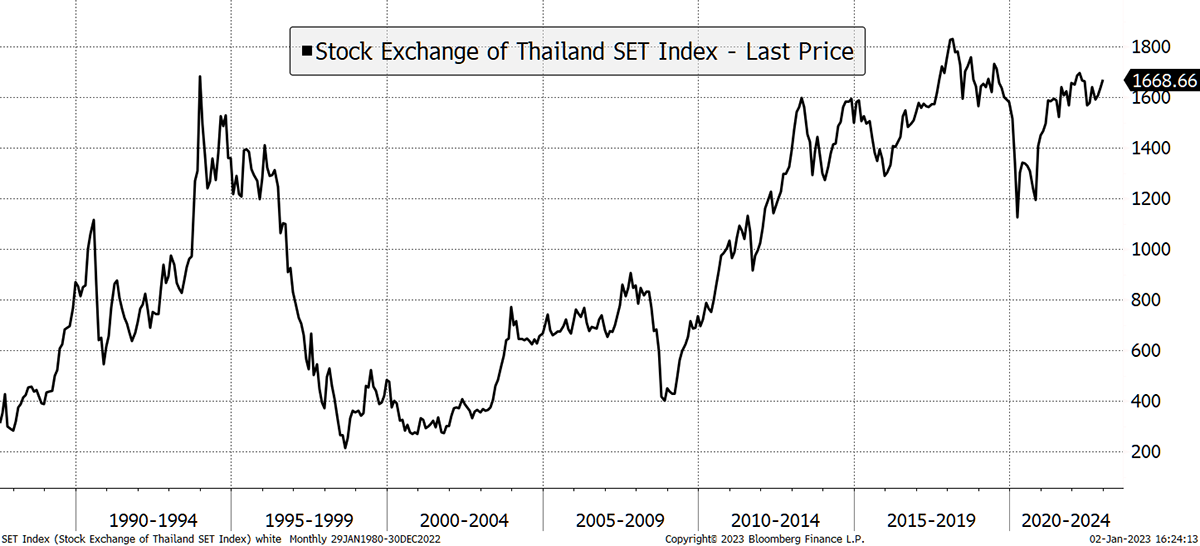

Thailand had a crisis in 1997, where the baht devalued nearly 50% in a single event. The stockmarket had peaked in late 1993 and declined by 93.3% in sterling terms by 1998. The SET got back to the 1993 high in around 2012 and has been trading in a range since. In other words, no return for 30 years. Surely it’s time?

The SET Has Been Going Sideways for a Long Time

Source: Bloomberg

Since the devaluation, the baht has been one of the strongest currencies in the world, which shows the central bank takes its job seriously. In 2005, a pound would buy THB 75, whereas today, it buys just THB 41. Little wonder the gap year kids now go elsewhere.

After the death of his revered and long-reigning father, there were concerns when the current King came to the throne, but other than that, Thailand has been remarkably stable. I look at that chart of the SET above and see a crisis that is well and truly behind us and a market that is ready to make new all-time highs.

Furthermore, I was impressed by how it responded to the Chinese news, managed to weather lockdowns, and has been the first Asian country in recent months to demonstrate market leadership. That is normally a very good thing and is a taste for what’s yet to come.

Buy 5% Xtracker MSCI Thailand ETF (XCX4) in Whisky

The SET is a well-diversified index with the largest sectors in energy, consumer staples, industrials and healthcare. I like that it is light in real estate, which can sometimes be dominant in smaller country indices, especially in Asia.

Thailand is a calm market. It may surprise you to learn that the SET is currently less volatile than the S&P 500. That certainly hasn’t always been the case, but currently, it implies it has fewer problems.

XCX4 trades in GBP, and I have checked it is available on Hargreaves Lansdown. The charge is 0.5% per year which is fine. The dividends are not paid out and instead reinvested, so you will see a slight pickup in the capital return.

Risk

This is a diversified country fund which I deem to be medium risk. While volatility is currently low, I would expect the SET to have a slightly higher risk than the FTSE 100 over the long-term.

There is no reason your broker or platform should not allow you to buy this ETF. If it is not present, then I suggest you politely ask them to add it.

Buy 5% iShares Emerging Markets Dividend (SEDY) in Soda

I also want to add this fund, but at this point, just a small holding to start the process of building exposure to emerging markets. I believe we have time, but having sold Berkshire Hathaway two weeks ago, I felt equity exposure was on the low side.

We have owned SEDY before and having searched for suitable diversified ways to invest in emerging markets, without being overly exposed to China, I ended up in the same place as last time.

Asian regional indices are really badly constructed, as there seems to be total confusion between developed and emerging markets. For example, Asia Pacific ex-Japan is basically Australia, which, let’s face it, isn’t very Asian.

Back to SEDY it is. SEDY tracks the Dow Jones Emerging Market Dividend Index, which is a nice way to capture emerging market value, which is what I am trying to do. SEDY also pays a high dividend yield which is 9.4%, according to the iShares factsheet. The dividends are paid quarterly.

Exposure is mainly Brazil (28%), with China (18%), Taiwan (9.5%) and India (8.5%) following. Most of the exposure is in materials, financials, utilities and energy. The fee is 0.65%, and the shares trade in GBP.

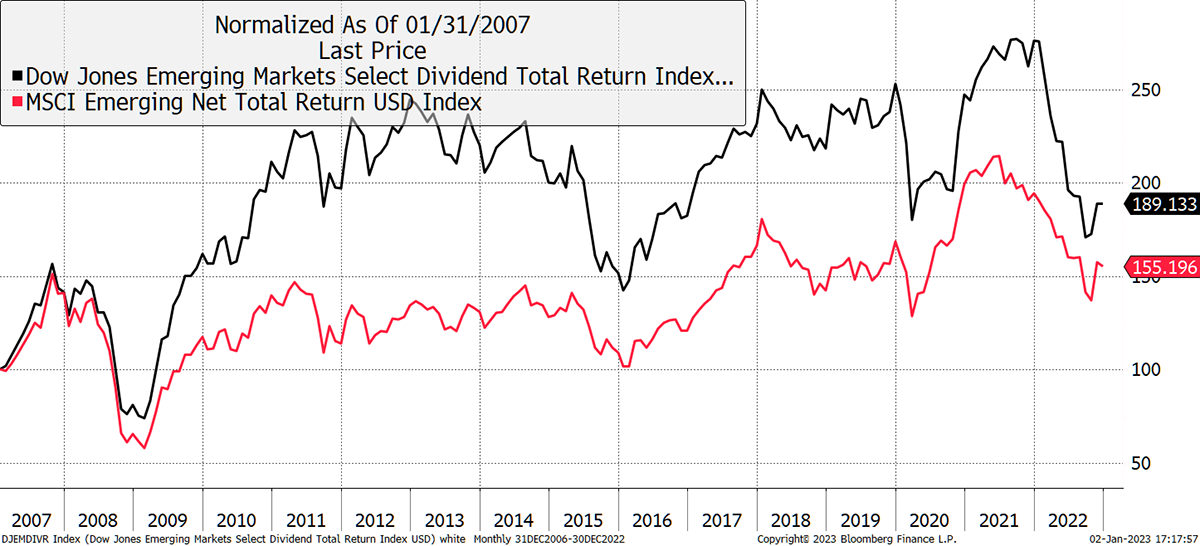

Looking back 15 years, SEDY seemed to outperform in 2009/10, only to give it back later on.

Dividends versus the Index

Source: Bloomberg

The underperformance of dividends over the index between 2012 and 2019 was largely down to weak commodity prices. As a result, you’d think it would have done better last year in a more buoyant time for commodities. Yet SEDY held Russian equities, which were effectively destroyed by sanctions. Considering it had assets confiscated, it really hasn’t been a bad result.

Emerging markets in Soda kick off with a modest 5% position while I keep searching for other ways to capture the great rotation from the US and to the rest of the world.

Risk

This is a diversified fund which invests across different countries. While some of those countries have unknown risks, the high level of diversification makes this medium risk, and in my opinion, slightly higher risk than the FTSE 100 over the long-term.

There is no reason your broker or platform should not allow you to buy this ETF. If it is not present, then I suggest you politely ask them to add it.

Action:

Buy 5% iShares Emerging Markets Dividend (SEDY) in Soda

Buy 5% Xtracker MSCI Thailand ETF (XCX4) in Whisky

Postbox

I am interested in your view on broader macroeconomics. We know the debt is off the chart and out of control and, in my opinion, beyond the level where any country’s taxation can repay this while maintaining services, which is why it appears the infrastructure is falling apart, sticky plasters and all that. In that respect, I buy into the ‘Great Reset’, which would appear to take the guise of the abolition of worldwide currencies and the introduction of CBDCs, making currency worthless and, over time, eliminating debt designated in local currency. Do you believe this is a road we will take, and if so, do you still believe the likes of Bitcoin will still become an alternative asset class as governments do everything to bring about more centralisation?

Here in the UK, the NHS is a good example of a crumbling system. Having supported it for years, the press has finally turned against it, demanding reform. There are other examples in the developed world, generally around infrastructure. On a recent trip to Vienna, I was pleased to experience a train strike, and the airports seem to be worse. It is nice to know that it’s not just us Brits facing this alone.

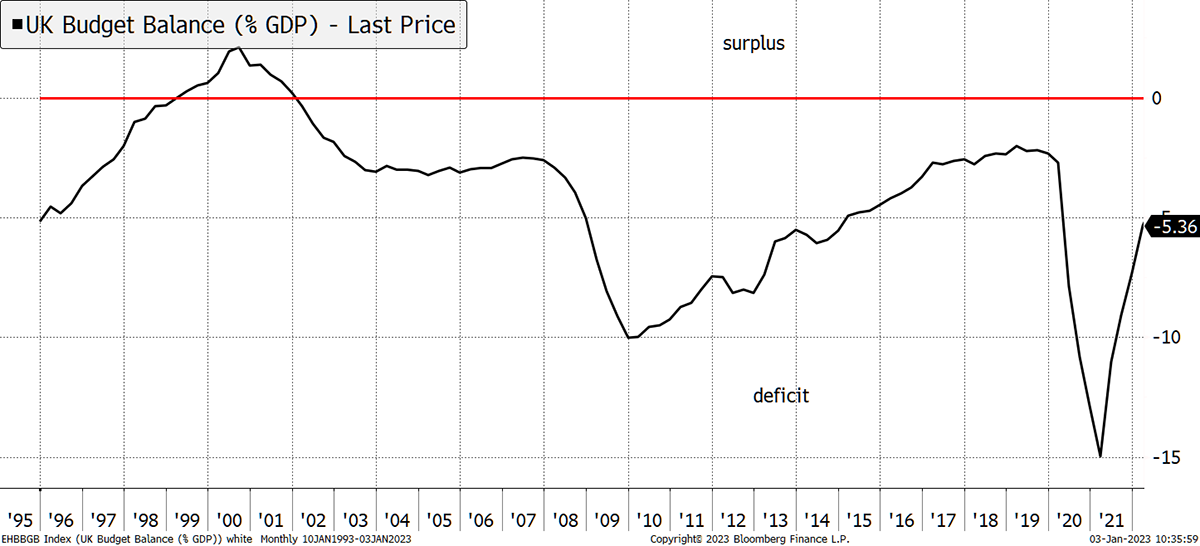

Public finances are the problem, and the last time the UK’s books were balanced was in 2000 under Labour. But it was John Major, who left office in 1997, who set that in motion. He was the last British politician who managed public finances efficiently and effectively.

UK Budget – Always a Deficit

Source: Bloomberg

There are two solutions. One is that we carry on pretending and vote for more free stuff from the government. You don’t need Labour to do this anymore as the Conservatives seem to have mastered the art too. Recently, they have shown a glimmer of prudence with tax hikes in an attempt to balance the books, but we all know you cannot tax your way to prosperity.

Inflation helps here because you can engineer it such that the economy grows in nominal terms quite quickly, but slower in real terms. The aim is to inflate away debt, or as Russell Napier says, “steal from old people slowly.” By old people, he means those who have saved, and redistribute to those without savings. This financial repression occurred in the 1970s.

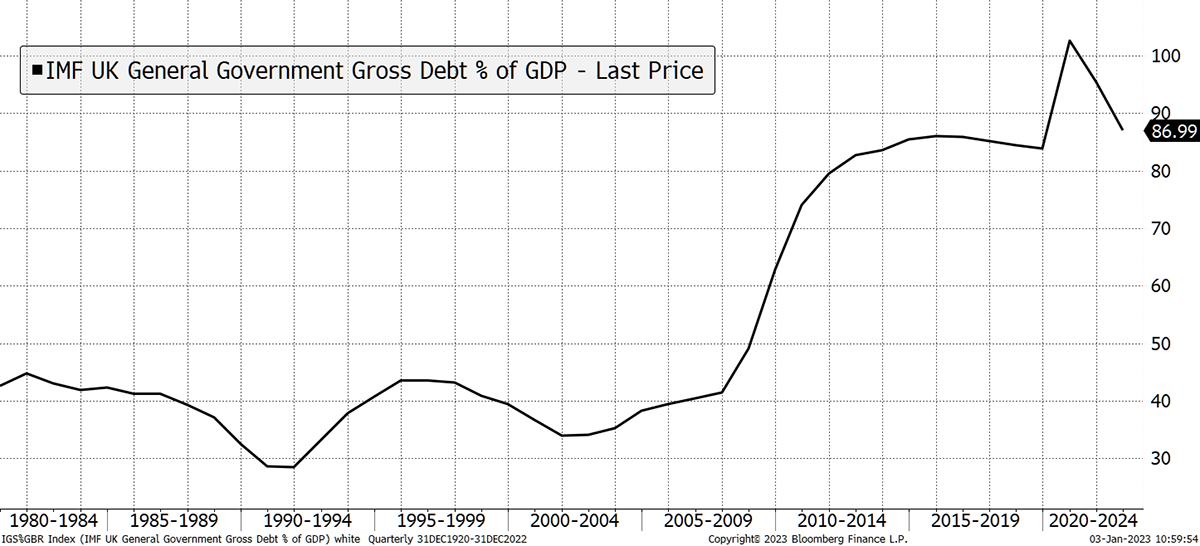

The other way is austerity. George Osborne tried this in a very modest way. Spending carried on rising on his watch, and as a result, he barely managed to get debt to GDP lower despite being seen as the nasty tough guy.

UK Debt to GDP Needs to Fall

Source: Bloomberg

Austerity tends to work best when it is forced upon you, such as in Iceland, Ireland or Greece in 2008, or in Thailand, Indonesia and South Korea in 1998. They had no choice, so they made difficult decisions, and an era of stability and prosperity followed. I do not believe democratic politicians can embrace tough austerity without it being forced upon them.

Of the two choices, the first is far more attractive. We inflate away debt and slowly pinch bits here and there. Windfall taxes, higher taxes, stealth taxes, capping allowances and so on. Jeremy Hunt was made for this sort of thing.

The Great Reset is a third way. It is one of those things people have been talking about for years, but no one seems to know what it is. Somehow you cancel the debt and start again. But much of that debt is held by pension funds, so how do people retire? But inevitably, it involves gold, bitcoin and CBDCs.

I believe gold, bitcoin and CBDCs will all become more relevant, with or without a reset. They become more relevant because more investors recognise the dangers inherent in government finances, which are feeble in most developed countries. When those finances become fragile, we will see currencies fall, and alternative assets naturally protect investors from that. In simple terms, more investors will invest in alternatives over the coming decade.

Perhaps my views and the great reset are the same thing. I see the outcome evolving, where the reset thesis assumes there is planning involved. I do not believe Hunt and his friends in Davos are smart enough to pull off a coordinated Great Reset. But I do believe alternative assets are in for a good decade.

Portfolios

A Note for New Readers

The design of The Multi-Asset Investor investment process is to blend Soda and Whisky according to the level of risk you wish to take. Hopefully the clue is in the names as to which portfolio carries more risk. Most investors would be best suited to 80% in Soda and 20% in Whisky (a less risky blend) or 60% in Soda and 40% in Whisky (a riskier blend).

Example

A recommendation is often, but not always, 5% of either portfolio. If I added 5% of ABC in Whisky and you followed a 40/60 Whisky/Soda approach, then ABC would be 5% x 40% = 2% of your overall pot. If you followed a 20/80 Whisky/Soda approach, then ABC would be 5% x 40% = 1% of your overall pot.

This approach enables the Whisky Portfolio to pursue more adventurous opportunities than if it was designed to be the entire strategy. The inevitable, and hopefully infrequent, failure of some individual recommendations means the maximum loss is limited to between 1% and 2% of the overall pot, which is within a reasonable scope. Cautious investors can be 100% Soda, but a little Whisky brings your investment journey to life and will hopefully boost returns in the long run.

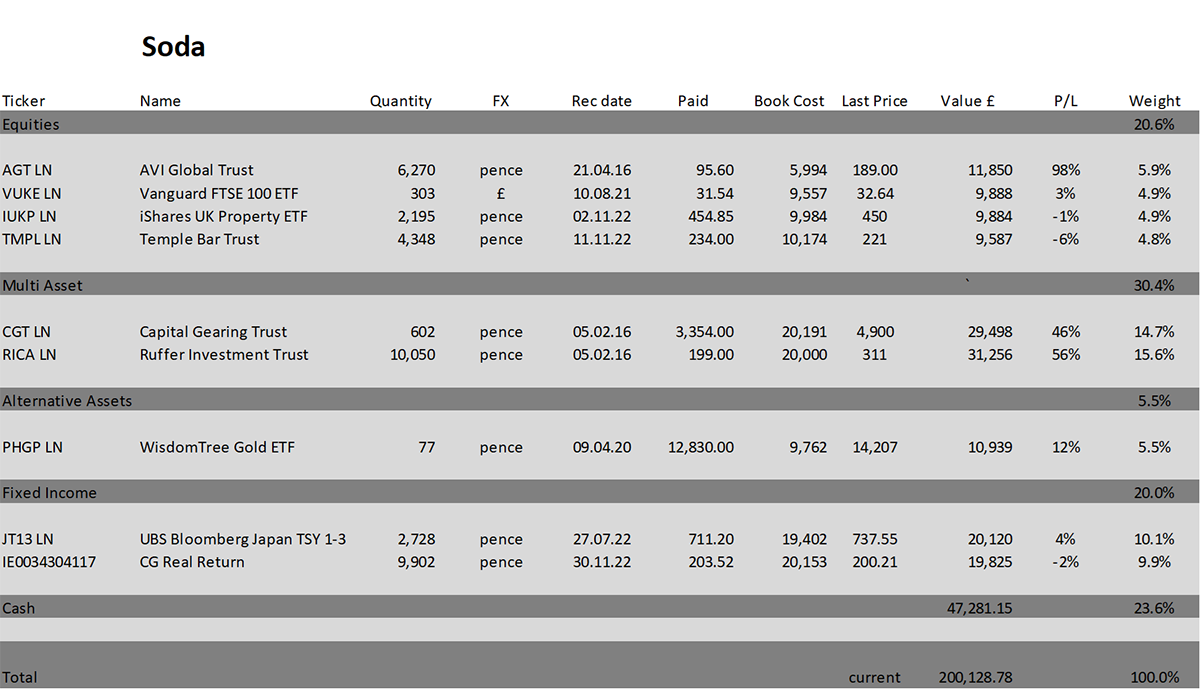

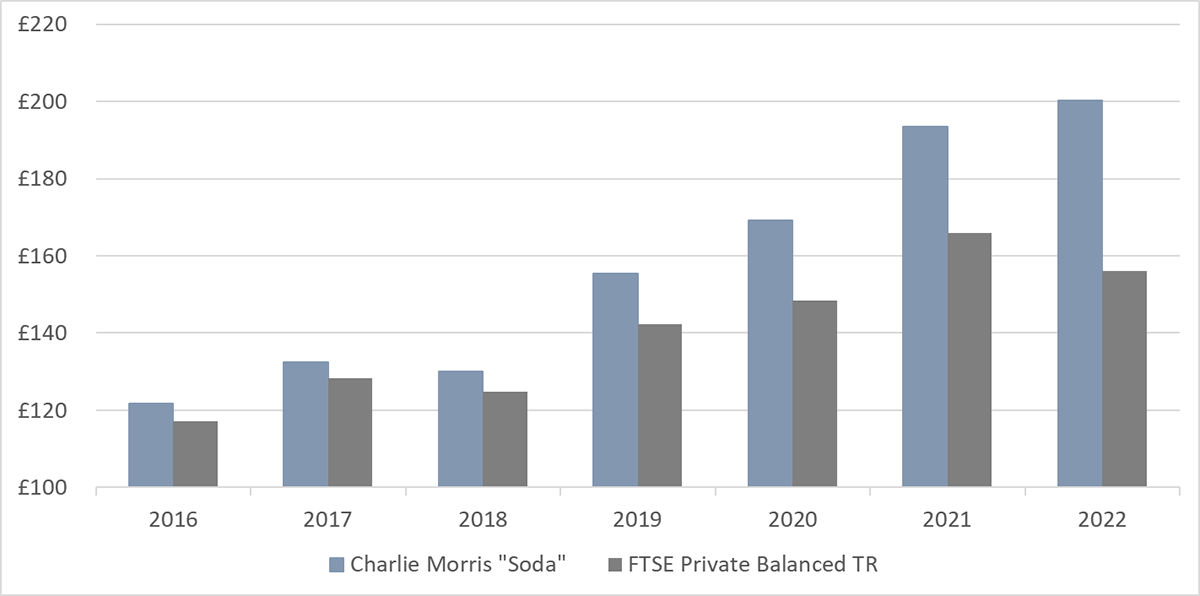

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio rose by 3.5% in 2022 vs -5.9% for the FTSE UK Private Balanced Index. Soda is up 100.2% since inception in January 2016.

2016 +21.7%

2017 +8.8%

2018 -1.8%

2019 +19.6%

2020 +8.9%

2021 +14.3%

2022 +3.5%

Soda vs FTSE Private Balanced Since 2016

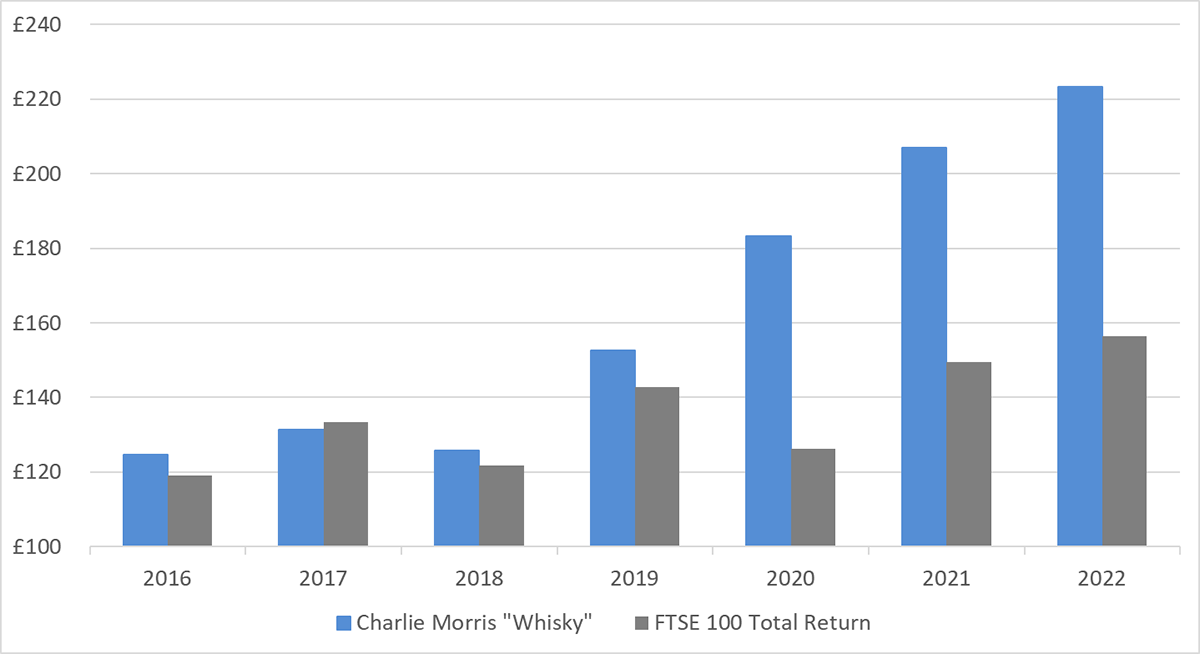

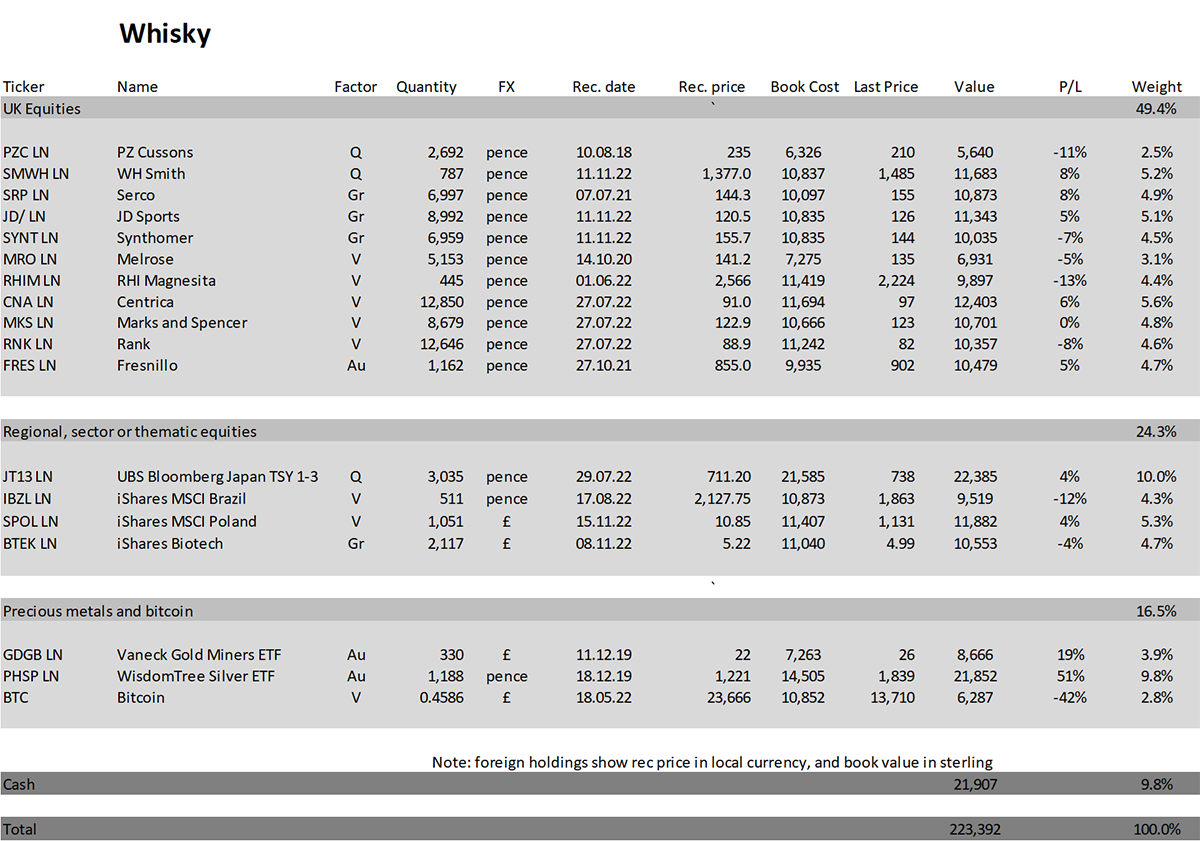

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 8.0% this year against the FTSE 100 of 4.6%. It is up 123.4% since inception in January 2016.

2016 +24.7%

2017 +5.4%

2018 -4.3%

2019 +21.4%

2020 +20.4%

2021 +12.9%

2022 +8.0%

Summary

I am not sure why the dollar is surging on the first trading day of the year, nor why our portfolios are having the best day I can remember. Sometimes these things just happen, and especially in early January.

Happy New Year, and here’s to a great 2023.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweet me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2024 Crypto Composite Ltd