Dr Copper and Professor Gold

Disclaimer: Your capital is at risk. This is not investment advice.

Trend-following is established as one of the most powerful investment strategies. Yet it is poorly understood. On our ByteTrend tool, for example, do you think you should be buying zero stars and selling five stars, or the other way around?

The answer is the latter, but because we’d all like to think we’re geniuses, we’re conditioned into thinking that we’ve got to buy low and sell high. Buying something that’s already gone up is counter-intuitive, yet of course, the price action is telling you that whatever it is, it’s doing well. It doesn’t always work, of course, and it requires careful and dedicated analysis to make sure you’re buying (or selling) the right trends. We delve into this in more detail in “Winning in ETFs with ByteTrend”, but the real maestros are Rashpal and Robin in the Adaptive Asset Allocation Report, whose long-term performance is off the charts. The next AAA edition is out for PREMIUM subscribers next week. Don’t miss it.

Having said that, there’s nothing like a “momo crash” to throw a spanner into the trend-following works. Charlie M covers the phenomenon of momentum crashes in this week’s Multi-Asset Investor and explains why this is an opportunity, not something to be scared about. What’s happening is an about turn in market leadership. Headlined “The Return of Dividends”, a new position is added to the Soda portfolio to increase exposure to this new leadership group.

Activity in ByteFolio has been more cautionary as breadth continues to deteriorate. What this means is that there are very few altcoins outperforming bitcoin. While the latter has had a great run, it is very overbought in the short term. It would be good to see the upwards move confirmed by more enthusiasm in the rest of the sector. This week, the process has forced us to remove one of the names.

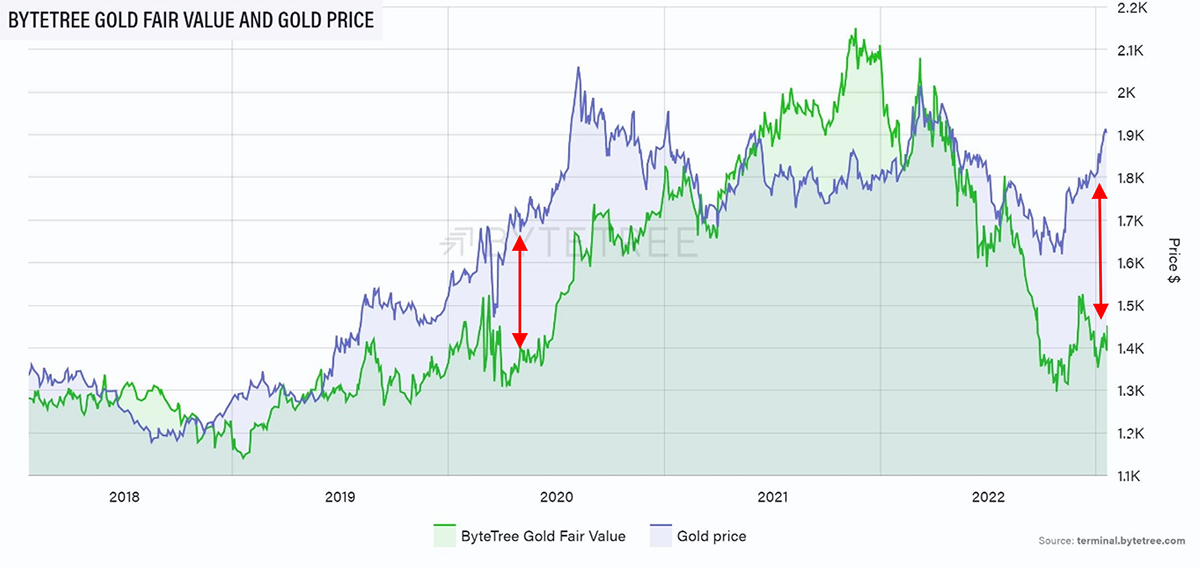

That said, it might be that bitcoin is currently being driven more by the macro narrative than the crypto narrative. That would make sense looking at gold’s recent performance, which is far from joining the “inflation is dead” party. Note that gold and bitcoin were very early to signal impending inflation problems when they surged in 2020, at a time when many commentators felt that inflation would be transitory. Note also how there was a disconnect between ByteTree’s gold fair value and the price back then on account of complacency in bond markets, which were sending the wrong signals (and subsequently got routed). We see the same now. Who’s right, bonds or gold?

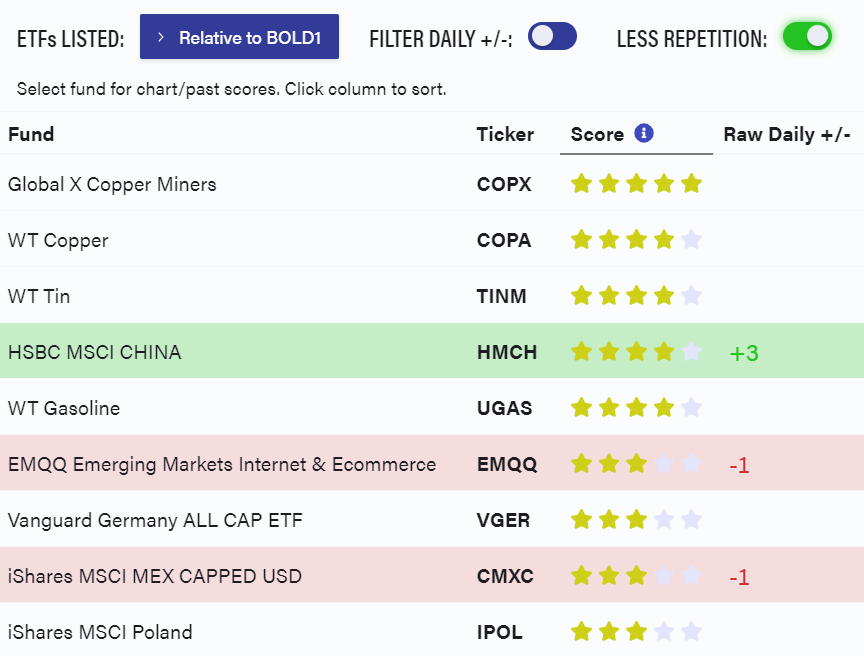

If our ByteTrend commodity ETFs are anything to go by, the smart money might be heading towards the pet rock and its digital sidekick. Measured relative to the ByteTree BOLD Index (which combines gold and bitcoin), there is only one ETF on a five-star rating, which is Global X Copper Miners (COPX). WT Copper (COPA) comes in second place. Are Dr Copper and Professor Gold, who Atlas Pulse introduced us to in June last year, trying to tell us something? A renewed inflation scare amidst recession fears, perhaps? How would central bankers react to that?

Lastly, I want to highlight a particularly good note on Polygon, and its token, MATIC. This is a serious contender in the crypto world, which seems to pop up whenever there’s a new initiative. It’s a scaling solution for Ethereum and well worth acquainting yourself with.

Have a great weekend.

Charlie Erith