ByteFolio Update 39

Disclaimer: Your capital is at risk. This is not investment advice.

ByteTree's Crypto Leaders

ByteFolio brings together ATOMIC, ByteTrend and Token Takeaway to create ByteTree’s model portfolio, known as ByteFolio. This is a selection of crypto tokens, which are weighted according to their risk/reward characteristics. ByteFolio has a modest turnover and will not suit traders. It will appeal to investors who wish to diversify beyond bitcoin, with the aim to beat it.

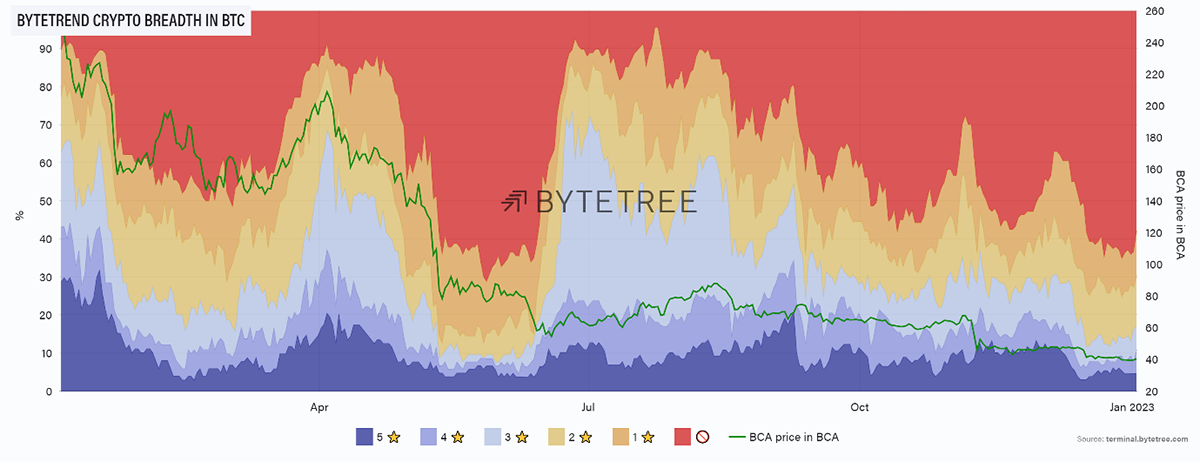

In the last edition of ByteFolio, we noted that altcoins were underperforming bitcoin en masse. In other words, breadth was deteriorating. The growing red sky means that bitcoin’s dominance of the sector is increasing. This is seen in the chart below, which is also overlaid with the green ByteTree Crypto Average (BCA) line, an approximation of the sector’s broader performance. You can see that it continues to drift lower, while BTC itself has been flat since the November fall.

Source: ByteTree

While growing bitcoin dominance is a feature of a market recovery in its early stages, we can only get fully bullish if it’s accompanied by a rising BTC price. This is because deteriorating breadth in a bear market is a sign of a widespread lack of conviction and support. This remains a time to stay cautious.