Rally as Momentum, Oil, Inflation and Bonds All Come Together

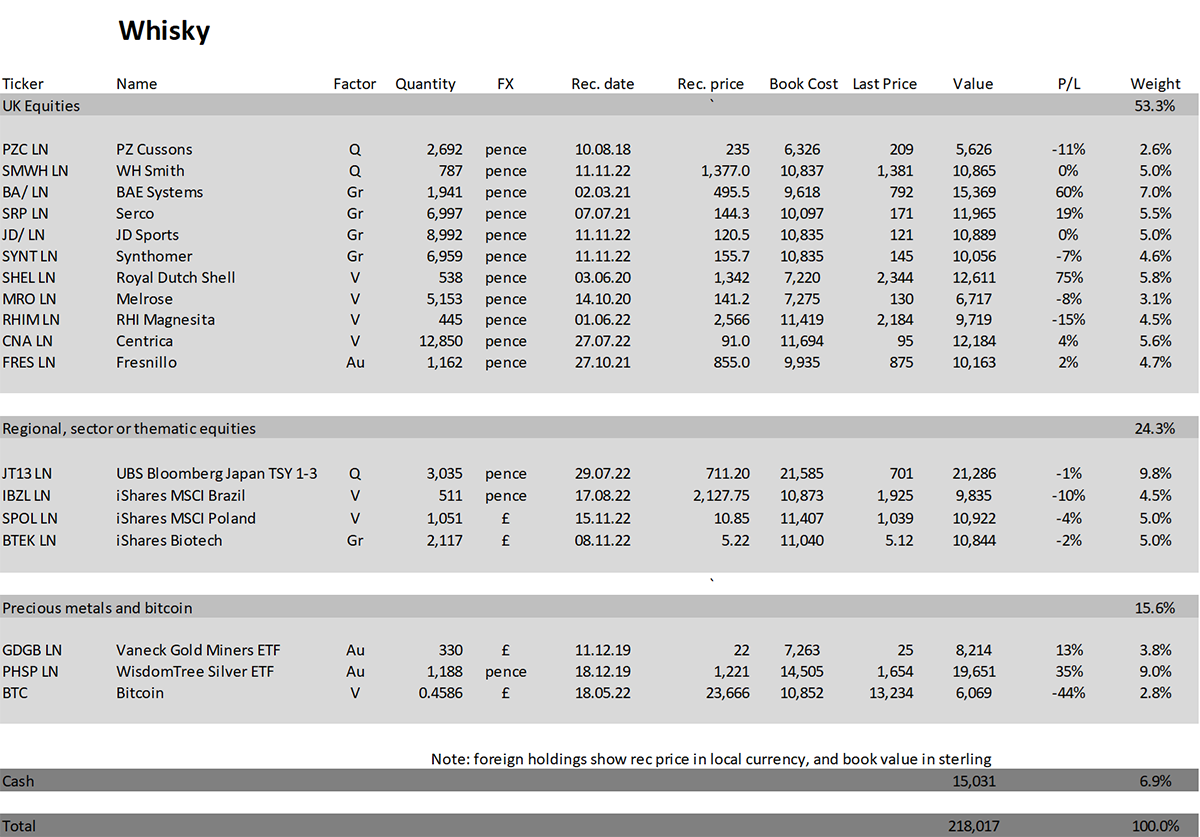

Trades in the Whisky Portfolio

Put simply, it feels a bit like 2001 when the unwind of the technology bubble was devastating, but the value stocks were fine. I am avoiding the landmines and pursuing value. Some stocks may not work out, but by diversifying, we should ensure a more than satisfactory outcome.

I am recommending two consumer stocks, Marks and Spencer (MKS) and Rank Group (RNK), and taking profits from Shell (SHEL). These trades take advantage of the momentum (momo) crash that is underway that was recently discussed. I will also show you how that ties in with the newfound stability in the bond market, and why a lower oil price will cool inflation.

Some of you think I’ve gone mad because the market seems to be on the edge of disaster, mainstream media headlines are alarming, and I’m buying equities. Accordingly, I ask you to bear in mind the following.

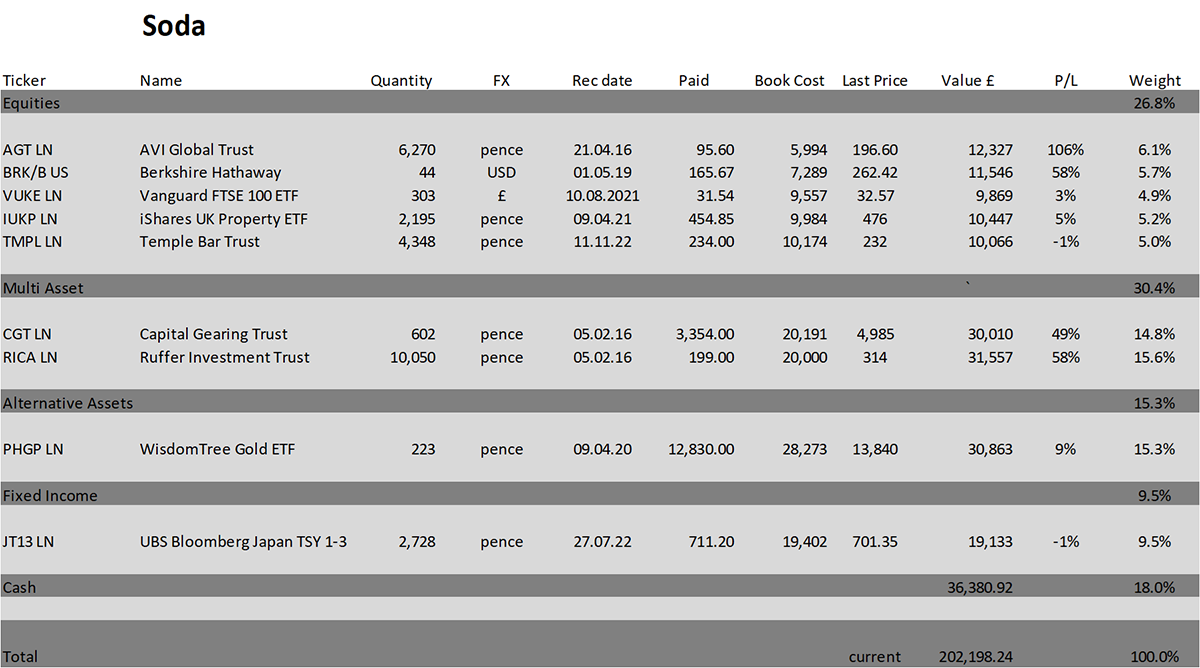

- The Soda Portfolio remains very defensive and is not even close to being positioned for a bull market. I would need to add nearly 30% of the entire portfolio to equities to do this.

- Soda proceeds with caution in search of longer-term opportunities. I’m still searching.

- I believe a massive rotation is underway following the collapse in the prices of riskier assets since February 2021.

- I don’t believe there is a new bull market in the sense that the major indices will take off, but there is a major rotation underway, and we must grasp these opportunities while we can. Put another way, markets have stabilised.

- The Whisky Portfolio has a more adventurous role during times like this and is much better able to adapt. If I am wrong, I will move into reverse, and quickly.

- Recall that the suggested mix is 60/40 or 80/20 of the Soda/Whisky portfolios. If that principle is followed, then the recent increase in equity exposure is much less than it seems.

More on the Momentum Crash

The momentum (momo) effect works best from the middle of a bull market to the middle (or late) stages of a bear market. It then goes into reverse towards the end of the bear market and settles down when the next bull market is already established.

The credit crisis of 2008-2009 is a good example. The losers (red) were dominated by the banks, which were in deep trouble from 2007, and collectively lost around 80% of their value by 2009. The winners (blue), and not dissimilar to this time, were dominated by commodity stocks just as oil peaked at $146 in July 2008. Oil then dropped to $38 just in time for Christmas, resulting in the past winners collapsing in the late stage of the bear market.

The Winners Saw Pain in 2008, While the Losers Led the Subsequent Rally

Source: Bloomberg

The market bottomed on 9 March 2009, and by this time, the winners were defensive stocks such as healthcare and utilities and were slow to recover. Again, this was not dissimilar from what happened this time. When the market finally turned up, it was the past losers that led the way, and it was a good time to own the banks.

I recall Barclays (BARC) rallying from below 50p to 350p between March and August 2009. The house builders also delivered spectacular gains, and both groups had been heavily depressed.

In this cycle, the momo winners are dominated by energy, utilities, materials and consumer staples, while the momo loser portfolio includes industry, real estate, tech and consumer discretionary stocks. My recent recommendations have all been in the latter groups. Given events, I have good reason to believe they are positioned for recovery, although it won’t be plain sailing.

The momo crash is telling us that either we have already seen the worst or, at the very least, we are at the mid to late stages of this bear market. Either way, it is time to swap sides and rebalance the portfolios accordingly.

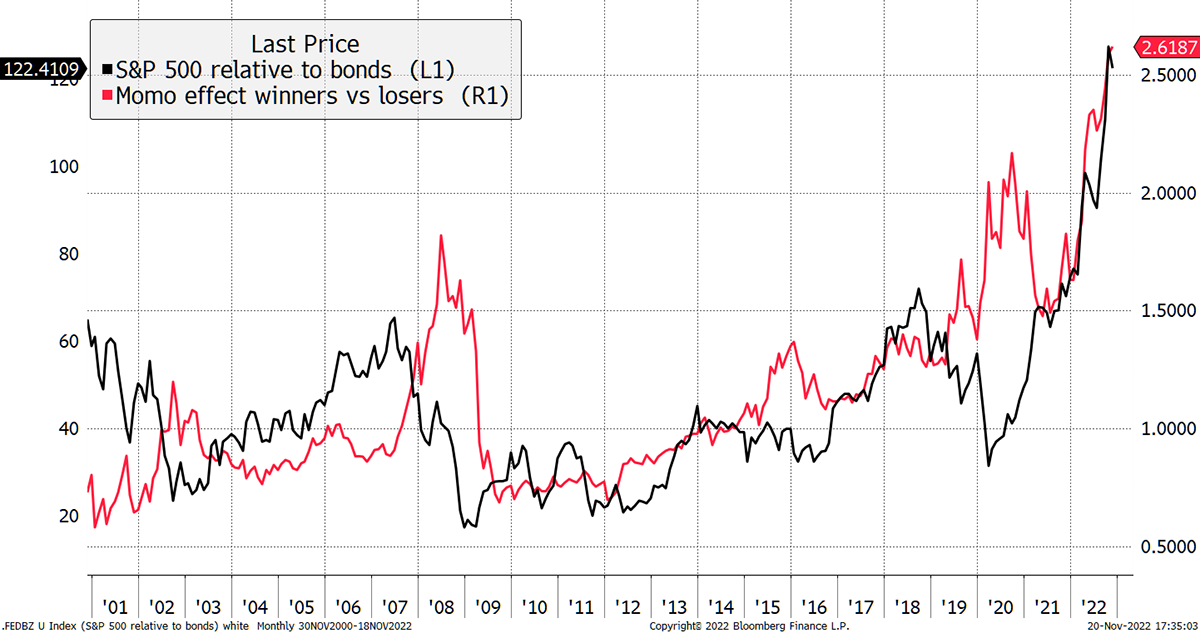

Momentum and the Relationship Between Bonds and Equities

Going back 20 years, we have not previously seen momo linked to the relationship between equities and bonds. However, the correlation today is high, as shown in the chart below. This tells us that stability in bonds will reverse the equity market leadership. In other words, it is proof that the current momo crash is being driven by the welcome stability in bonds.

The Stockmarket Rotation Is Being Driven by Stability in Bonds

Source: Bloomberg

That doesn’t necessarily make bonds a buy in search of gains, but it removes a huge risk that has panicked the stockmarket this year. If I was at DEFCON 1 (borrowing a phrase from the Pentagon but in relation to a stockmarket crash rather than nuclear war) over the summer, I now think that we are closer to DEFCON 3 or 4. Stability in bonds is welcome, and that comes from evidence that inflation is cooling.

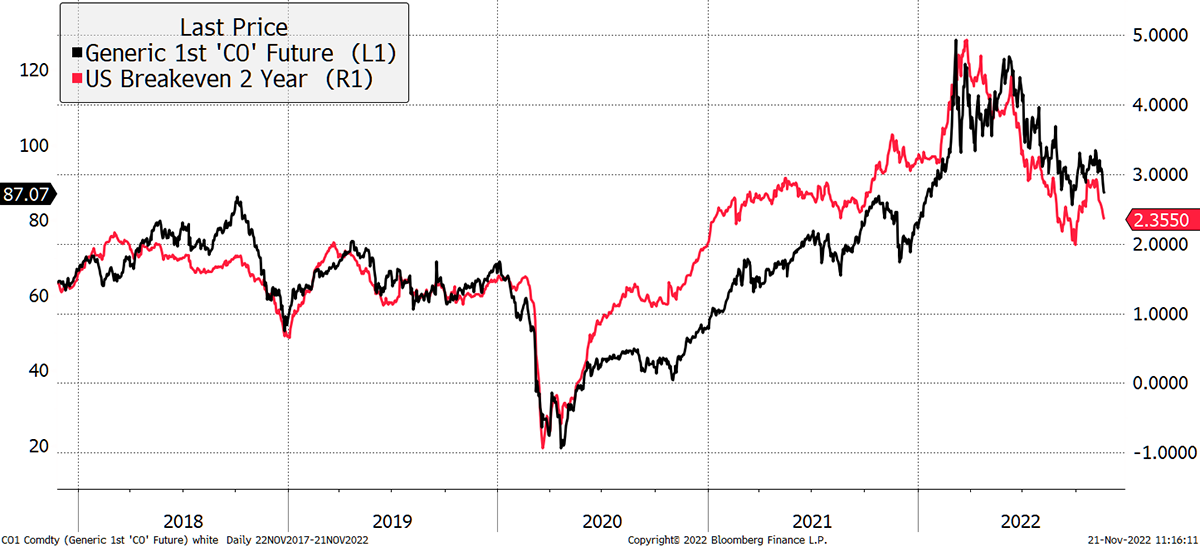

Oil Slides

If the oil price stays weak, inflation will fall, as energy is the single most important input cost into the global economy. US inflation expectations closely mirror the oil price. It is easy to see why the fight against inflation might be seen to have been won in some circles. While we are still talking of high single digits, or even low double digits in the UK and Europe, forward-looking indicators foresee much lower numbers.

Crude oil has just slumped below $90 and is now close to being flat over the past year. This will reduce inflation – perhaps more than we think – as is suggested in the chart below.

Inflation Back Under Control

Source: Bloomberg

Oil stocks have been popular this year, and I believe investors will be sorely disappointed if oil continues to slide. By my reckoning, the oil price is now in a downward trend.

The iShares US Momentum ETF (MTUM), which captures the winners, is 20% invested in energy stocks compared to 4.5% in the S&P 500. That is a significant overweight position which has been great but will be devastating should the oil price turn down. If that happens, there will be heavy selling pressure.

One piece of news that caught my eye in the last few days is that China has had its first Covid-related death since late May. If this results in a new round of lockdowns, the impact on China’s (and the world’s) economy will imply reduced demand – and lower prices – for oil.

The old saying is that the best cure for a high oil price, is a high oil price. High oil prices either encourage new supply or quash demand. Either way, this statement holds true.

Selling Shell in Whisky

Shell is a great company and still offers long-term value, but nothing like the value it offered in 2020 when I first recommended it. I am selling Shell in Whisky, and I believe this is a good time to take profits. Naturally, if energy prices turn up again, I will have to find new ways to reengage with the sector. I fear that it may be on the wrong side of the momo crash.

I am not saying commodities are dead or that the long-term pressures aren’t still a concern. They are. For two years, the market has been sending a loud and clear message that we need to do more to address the long-term shortage of supply relative to demand.

A Note on the Cost of Living Crisis

Cheaper energy will bring some relief to the cost of living crisis, which is welcome. That will boost consumer spending at the margin, as each pound you don’t spend on utilities will likely end up elsewhere in the economy.

There is this idea that slowdowns and the higher cost of living causes discretionary spending to collapse. That is painful, but then we have long seen the UK’s high streets being over-supplied with mid-range restaurants and retail outlets. We are now hearing of failures, especially of some of the more recent business models. For the survivors, less competition will be welcome.

Buying 5% Marks and Spencer (MKS) in Whisky

I recommended this company in 2019, and it wasn’t one of my best calls thanks to Covid. Nevertheless, it is a great company and trades on a very low valuation. When I joined the city in 1998, MKS was a darling. The analysts felt it could do no wrong until 1998 when it started to sink.

The analysts had their heads buried in spreadsheets and failed to notice that the range had little appeal. The press criticised the analysts, saying they should have discussed that range with their wives, who gave it the thumbs down. The MKS shares peaked at 748p in 1997, whereas today, it trades at around 122p, despite having grown over the years.

Both their food, clothes and online services are excellent. The shops have new formats which are well received. High Street brands will close their doors, and MKS will be a survivor. Their website ranks highly, along with Next (NXT) in contrast to the likes of ASOS (ASC), which is sliding.

The shares offer compelling value, trading on 7x 2022 profits, and are yet to restart their dividend. But with record sales forecast for next year, that should pick up. So far, 3.6p is pencilled in for late next year, and this is justifiably cautious as the balance sheet is the priority.

This is a simple case of a stable company trading at a very low valuation. Consumers will trade down from premium brands, and MKS will benefit.

Risk

MKS is a blue-chip, profitable, liquid single stock and I deem it to be medium to high risk.

Buying 5% Rank (RNK) in Whisky

RNK has reinvented itself many times over the years and today has casinos and bingo alongside online gaming. I am not normally one to engage with this sector, but I see this opportunity as too good to miss.

As a leisure company, the shares were impacted by lockdowns. Their digital side held up, but the casinos and bingo had to close, leading to negative cashflow. Profits have since partially recovered, and the company trades on 13x earnings but is yet to reinstate the dividend. Pre-covid that amounted to 7.6p per share. With the shares below 80p, a full dividend recovery is something to look forward to.

RNK should recover to pre-Covid levels because recent weakness can be attributed to a lack of tourists, principally from China. Their lockdown will end at some point, and I have seen the Chinese get down to business in London’s casinos. It’s an impressive sight.

Even if new Covid-related restrictions delay the return of droves of tourists from China, the business is stable. I have confidence in the online side. All of their websites, in both the UK and Spain, rank well among peers. I see this as a stock with a simple and profitable business model that has been heavily oversold.

Risk

RNK is a profitable single stock. It is a mid-cap company and, therefore, less liquid than a blue-chip stock. I deem it to be medium to high risk.

Action:

Sell Shell (SHEL) in Whisky

Buy 5% Marks and Spencer (MKS) in Whisky

Buy 5% Rank Group (RNK) in Whisky

Postbox

I bought the Japanese yen holding more or less at the same time as your recommendation, but with a slight delay for Hargreaves Lansdown to have the JT13 ETF available for investors, but the position is down almost 4%. Given that this was intended to protect us from a fall in the value of sterling, do you think that it is worth continuing to hold this position, as the yen has come under considerable downward pressure? Do you see a recovery in the value of the yen in the near term?

The yen was purchased to diversify against a weak pound, along with dollars and gold. I deemed the yen attractive due to the significant value it presented.

Yen strength has historically been associated with risk-off conditions as investors buy it when things go wrong, rather like the Swiss Franc. This year the opposite happened as the Bank of Japan held rates at zero and continued to suppress the 10-year bond yield, in contrast with the central banks in other developed markets, which have seen rates rise substantially. As a result, the yen fell and became extraordinarily cheap. I felt it added something different and interesting to the portfolio mix in July. Recall that if something isn’t different, it isn’t a diversifier.

Sterling Yen Is Still in the Trading Range

Source: Bloomberg

The risk of a sterling collapse has fallen because it has already happened. The Hunt budget may have made us all miserable, but the gilt market and the pound liked it. The yen has been flat against a global currency basket since the summer, but sterling’s recent rally has gone against this trade.

Cooling inflation would attract yen buyers, and a change in Japanese policy could see it soar. It is very much on my mind, but I think it’s a hold for the time being.

Inflation is now at 11% and interest rates on savings are increasing, though not as fast as they should. However, 3% or 4% is now available for 1-year deposits. So the real value of money is reduced by 7% to 8% per year in a savings account. Am I correct in thinking that equities now need to provide a much greater return on capital and higher dividends to justify the risk? Does this not imply that equities have further to fall in value? Unless they are already in a position to provide a return in the region of significantly more than 5% per annum they cannot compete with cash deposits in maintaining the nominal value of your money plus interest? (I note that as of last week both Soda and Whisky Portfolios were showing a return of just over 5%... Thank you!)

I agree, which is why I have been cautious this year and remain so. Soda is lightly invested, while Whisky is making the most of available opportunities.

Inflation hurts bonds more than equities because profits and dividends grow over time. Bond losses resulting from inflation are permanent, whereas equity losses from inflation will eventually be recovered (hyperinflation excepted).

As I have been saying, equities ought to become cheap before they become a lasting inflation hedge. In the 1970s, PEs collapsed in the US and the UK. In high-inflation countries such as Turkey, the market PE is very low. But within that framework, the market tends to recover into falling inflation and falls when inflation rises. I sense we are in for an inflation soft patch, which is why I am exploiting value situations.

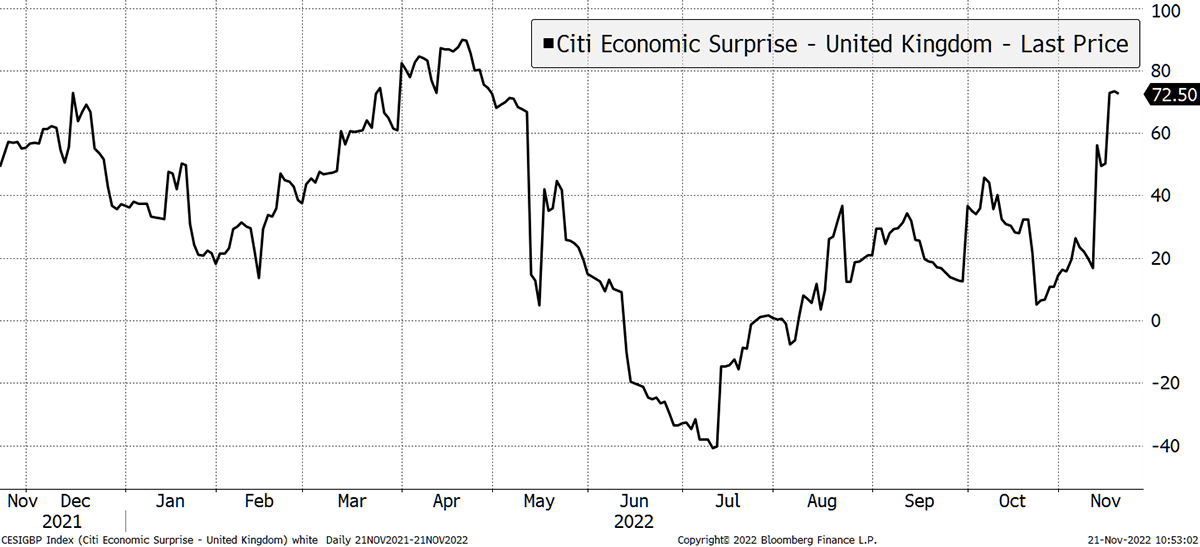

This market de-rating may be a long, drawn-out process, as dividend yields can also rise by the stockmarket standing still. The stockmarket may collapse, but it doesn’t have to. For that, I believe we need to see a severe economic contraction. Earlier this year, or even a month ago, I was prepared for the worst. But as the Citigroup UK Economic Surprise Index shows, recent news has been better than expected. Let’s make the most of it while we can.

Better Economic Data than Expected in the UK

Source: Bloomberg

I have little faith in the ability of the overall equity market to perform well, but I believe that selective pockets will provide opportunities. This is a very different investment approach from the mainstream fund managers, who steadfastly stand by the 60/40 portfolio mix. I do not believe that will work out well this decade. It did in the last decade, but that was luck, courtesy of government policies.

I do not see a static portfolio allocation solution as being the answer. There is no magic mix that will see portfolios thrive over the next decade, although emerging markets would be the most likely candidate on valuation grounds. I believe we need to pursue value opportunities as they arise and try to identify the catalysts for positive change.

It would probably make sense to invest the excess cash in Soda in short-dated gilts for the yield pickup. I suspect that we can probably find 3%. I will investigate.

Poland

Last week I showed a Polish GDP chart that was falling and mistakenly said that inflation was falling instead. As a reader kindly pointed out, there was a “gremlin”. I apologise, and it does not change my investment case, which was based upon solvency and deep value. Then another gremlin appeared in the form of a missile that everyone hoped wasn’t Russian. Whether it was or wasn’t, nuclear war has been averted, and I believe the iShares Poland ETF (SPOL) is a good opportunity.

Soda - a long-term, low turnover portfolio investing in funds, exchange-traded funds (ETFs) and investment trusts (including Berkshire Hathaway). The Soda portfolio is up 4.5% this year and up 102.2% since inception in January 2016.

2016 +21.7%

2017 +8.8%

2018 -1.8%

2019 +19.6%

2020 +8.9%

2021 +14.3%

Whisky - a tactical, actively traded portfolio investing in stocks in the FTSE 350 Index, investment trusts, global ETFs and bitcoin. The Whisky portfolio is up by 5.4% this year and up 118.0% since inception in January 2016.

2016 +24.7%

2017 +5.4%

2018 -4.3%

2019 +21.4%

2020 +20.4%

2021 +12.9%

Summary

Put simply, it feels a bit like 2001 when the unwind of the technology bubble was devastating, but the value stocks were fine. I am avoiding the landmines and pursuing value. Some stocks may not work out, but by diversifying, we should ensure a more than satisfactory outcome.

Value versus Growth

Source: Bloomberg

Thank you for subscribing to ByteTree Premium.

Please let me know your thoughts by emailing me at charlie.morris@bytetree.com, or tweet me @AtlasPulse.

Many thanks,

Charlie Morris

Editor, The Multi-Asset Investor

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of ByteTree Group Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of ByteTree Group Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority.

© 2025 ByteTree Group Ltd

Comments ()