What is Uniswap? A Comprehensive Guide

Disclaimer: Your capital is at risk. This is not investment advice.

Token Takeaway: UNI;

Uniswap is the leading Decentralised Exchange (DEX) in the crypto space. Built on the Ethereum blockchain, it provides a decentralised, peer-to-peer trading platform where trades/swaps occur directly among users without intermediaries. This comprehensive guide will examine the fundamentals of Uniswap and its native token, UNI.

Overview

For a long time, Centralised Exchanges (CEXs) have been the initial point of entry for most investors and crypto asset users. These exchanges are governed by a central authority and require users to place their funds under the custody of the exchange. That might sound fine on paper, but it is anything but fine in reality. Numerous CEXs and centralised lending protocols have shut down withdrawals, filed for bankruptcy, and lost user funds in hacks and thefts, causing widespread panic. However, since they offer similar functionality as a traditional stockbroker and provide a wide range of services, people still tend to prefer CEXs.

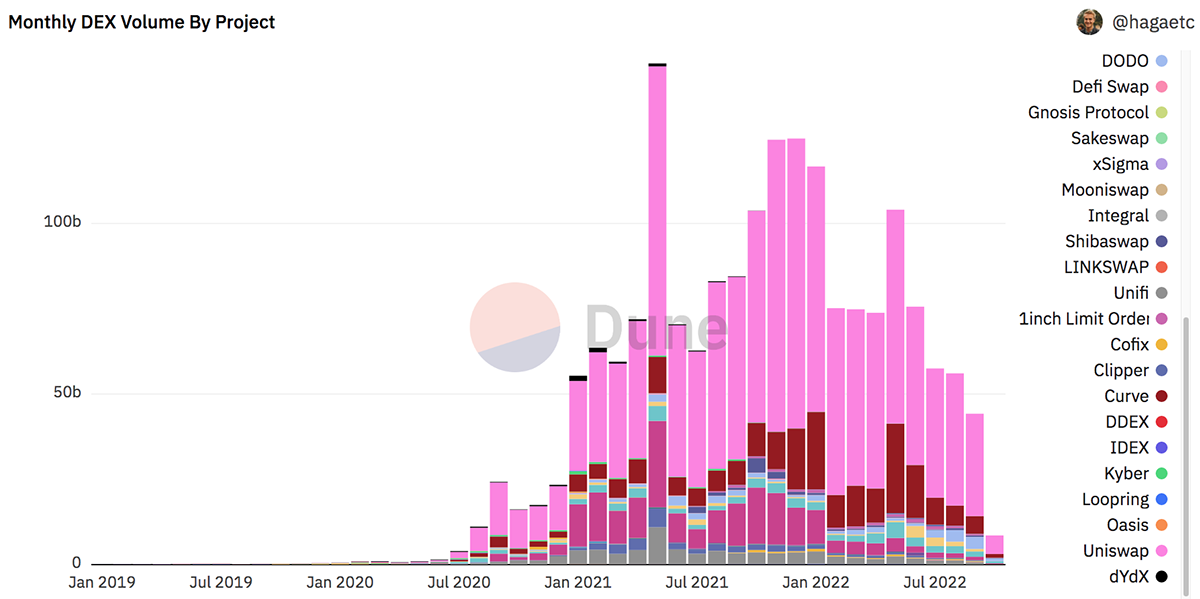

In a true crypto fashion, Decentralised Exchanges (DEXs) were launched to combat centralisation and improve security and accessibility. Starting in mid-2020, DEXs have seen a meteoric rise. In fact, DEXs have accounted for over a trillion dollars in volume in the last 12 months alone.

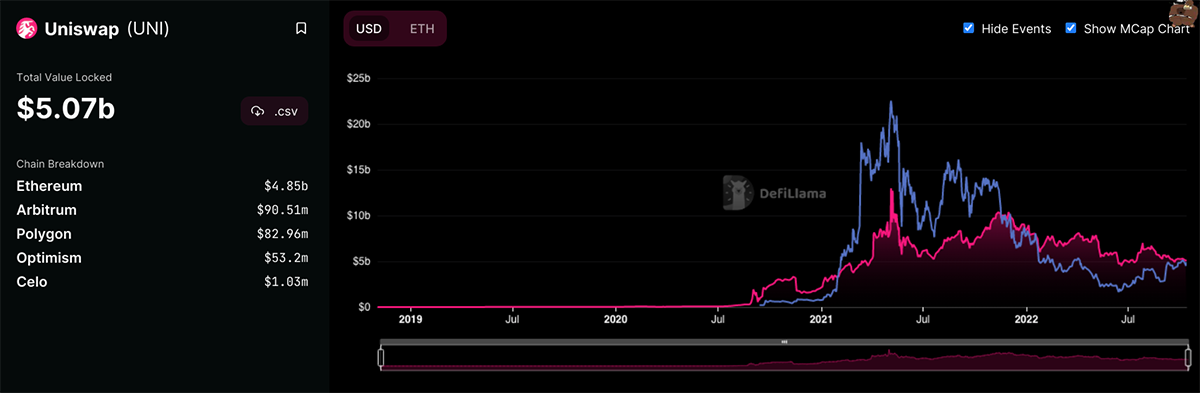

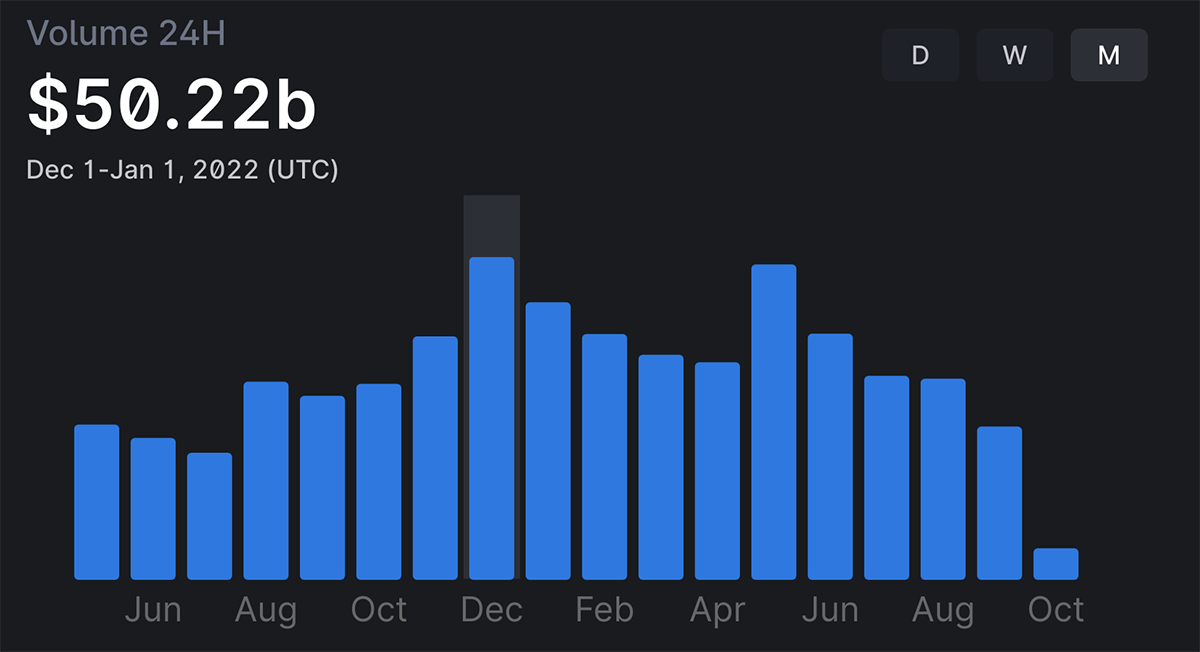

As highlighted in the above chart, the majority share of volumes (pink) is the Uniswap DEX. Uniswap has the highest market share and the most users, handling billions of dollars in volume. In fact, the average monthly volume for the last six months was $34bn.

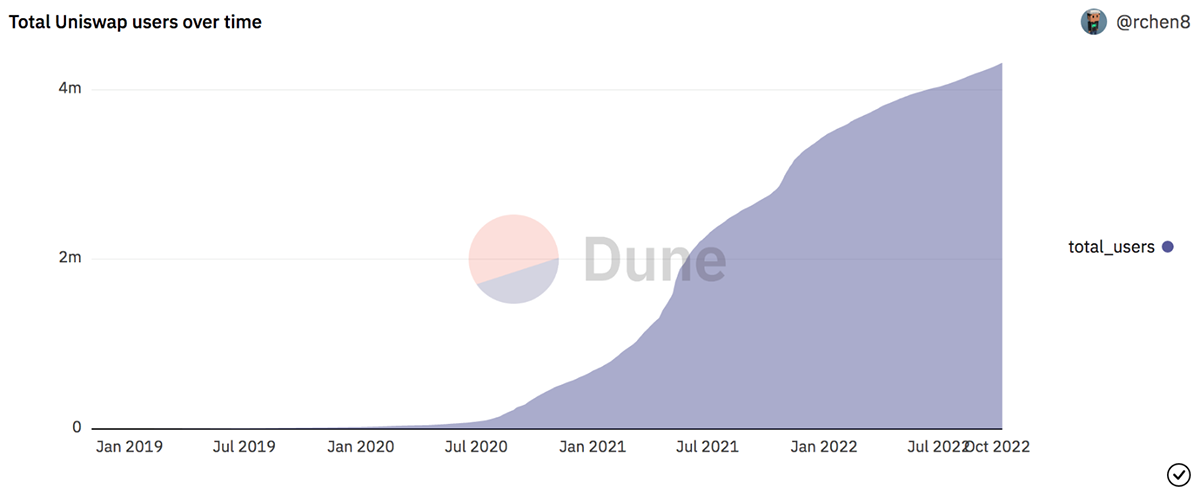

Since its launch in November 2018, Uniswap has grown significantly and attracted millions of users worldwide. It provides trading and swapping tokens in automated markets. To date, Uniswap has processed over 113 million trades, which accounted for over $1.2tn in total volume. With a $4.4bn in marketcap, it is currently the largest DEX in the crypto space.

How Does Uniswap Work?

Unlike centralised crypto exchanges, Uniswap doesn’t have an order book to facilitate trades. Instead, it uses an Automated Market Maker (AMM) mechanism. AMM is basically a computer program that executes specific tasks when certain conditions are met. In this case, it allows users to trade/swap tokens against a liquidity pool instantly in a permissionless manner.

A liquidity pool contains the token you want to swap and the token you want in return. These tokens are deposited by other users who want to provide liquidity. In return for their contributions, they receive Liquidity Provider tokens (LP tokens). LP tokens represent the liquidity provider’s share in the pool and can be used to reclaim their deposits and trading fees generated as rewards.

Additionally, these LP tokens can also be used as collateral to borrow other crypto tokens from a decentralised lending protocol. To maximise rewards, people use the borrowed crypto to provide additional liquidity to the same pool and receive more LP tokens in return, repeating the whole process multiple times.

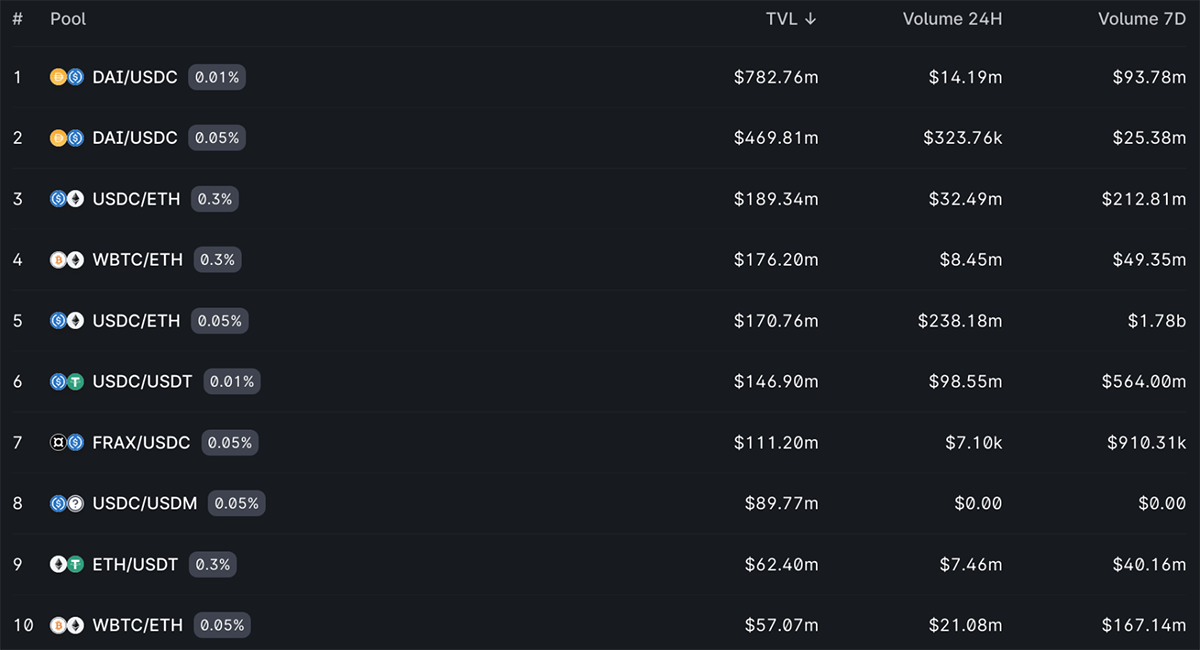

As shown in the above image, the two largest pools by TVL are the same, i.e. DAI/USDC, with $782.7m and $469.8m, respectively. The primary difference between these pools is the trading fees, which are 0.01% and 0.05%, respectively. Compared to other pools, these fees are low. Since both the tokens are stablecoins, which are less volatile than non-stablecoin tokens and have almost no risk of impermanent loss, the pool is less risky for liquidity providers.

Key Uniswap Features

Uniswap has a very user-friendly interface. Just connect your ERC-20 supported wallet to instantly start using the platform – no need for complex account setup processes. In fact, there is no Know Your Customer (KYC) or Anti-Money Laundering (AML) verification to use the platform.

Since Uniswap focuses on quality rather than quantity, it primarily offers a token-swapping service, providing over 50 liquidity pools with numerous tokens. Uniswap also offers tokens that are traditionally not available on CEXs, which attracts users. Moreover, it also provides a flexible fee structure, which I will cover in more detail in the next section.

Finally, Uniswap is an open-source protocol, meaning anyone can view or use its code. Protocols like PancakeSwap and SushiSwaps are forks of Uniswap and are often criticised for being Uniswap clones. You can read more about PancakeSwap in my previous article.

UNI Tokenomics and Fees

UNI is the native token of the Uniswap protocol. It is also primarily the platform’s governance token, allowing users to participate in the network governance process. It has around 753 million in circulating supply, with a hardcap of 1 billion tokens. At the current issuance rate, the token inflation is around 27.6%. The high inflation rate will eventually decrease as the supply reaches the maximum threshold.

With its current marketcap, UNI ranks as the 18th largest crypto in the whole industry. Additionally, it has around $5bn in TVL, making it the 5th largest DeFi protocol on Ethereum. Moreover, the ratio of market cap to TVL (MCap/TVL) for Uniswap is around 0.88, meaning it is undervalued.

Moreover, as shown in the below charts, its circulating supply increased significantly in September, while its on-chain activity is underperforming.

The UNI transactions count and its price have been highly correlated, while the downturn in transactions count could attribute to UNI’s recent poor performance.

Every trade/swap on the Uniswap platform charges platform fees and gas (network fees). Platform fees are charged per the liquidity pool’s fee rate. Following the Uniswap V3 upgrade, instead of a fixed fee of 0.3%, liquidity providers could create pools with three different fee rates; 0.05%, 0.3%, or 1%. Moreover, additional fee rates can also be added via governance proposals (0.01% was added last year).

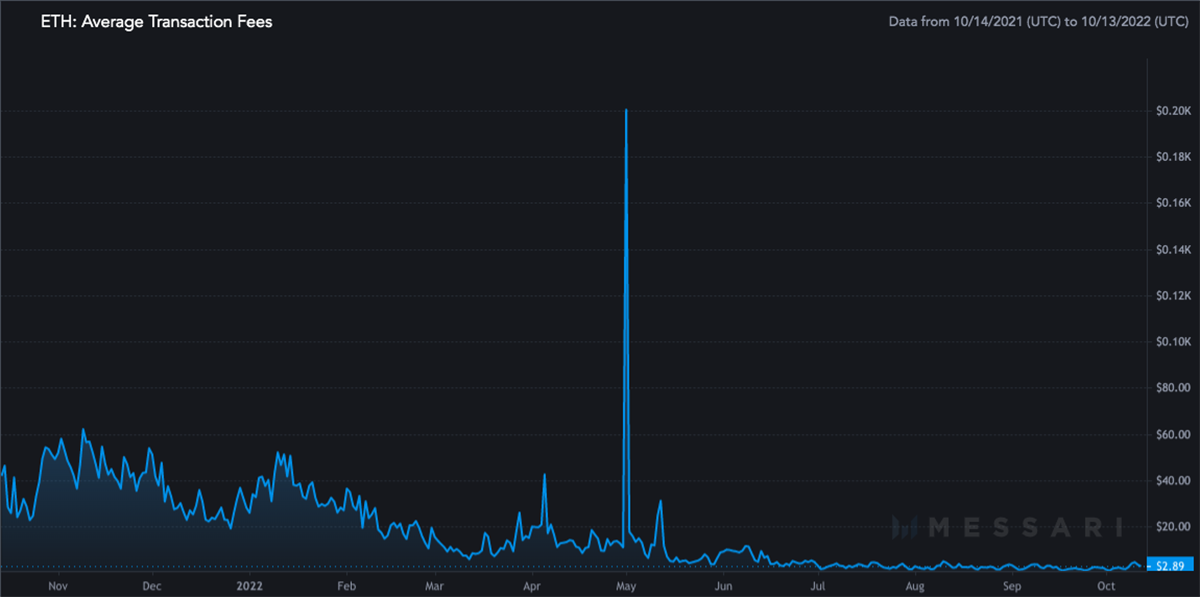

The Ethereum gas fees have also decreased significantly in the past few months. An average transaction on the Ethereum blockchain costs around $2.89. However, the gas fees on Uniswap fluctuate a lot, and a user can select fees depending on their urgency. Note that the gas fees can only be paid in ETH, hence having ETH in your wallet while swapping tokens on Uniswap is essential.

Competition and Concerns

Uniswap competes with all the exchanges in the crypto space. Since it has managed to outperform all the DEXs, its next big competition is the CEXs. Below is a comparison table for Uniswap and the largest CEX, Binance.

| Uniswap | Binance | |

| Launch | 2018 | 2017 |

| Volume for September 2022 | $23.6bn | $556bn |

| Total Volume in 2021 | $681bn | $9.5tn |

| Average Website Visits (6 months) | 3.67 million | 97 million |

| Custody of Funds | Non-custodian | Custodian |

| Users | 4.3 million | 120 million |

| Number of Tokens Offered | 48 | 356 |

| Accessible Worldwide | Yes | No, it cannot be used in USA, Singapore and Ontario. Restricted usage of services includes China, Malaysia, Japan, UK, Thailand, Germany, Italy and Netherlands. |

| Trading Fees | 0.01%, 0.05%, 0.3%, or 1% | 0.1% |

| Ecosystem | Ethereum | BNB Chain and BNB Smart Chain |

| Services | Swapping/trading and liquidity providing. | Spot and derivatives trading, lending and borrowing, NFT marketplace, launchpad, liquidity farming and staking, leveraged tokens, P2P trading, etc. |

| Regulation and Compliance | No regulation or compliance (yet). | Required to comply with all the individual countries’ rules and regulations. |

Source: Uniswap; Messari; Business of Apps; Binance; CoinGecko; SimilarWeb. A comparison table for Uniswap and Binance.

Although Uniswap and Binance are very different, their primary use case is the same. To compete and participate in the DEX space, Binance also has a DEX called Binance DEX. Finally, as shown above, Binance currently provides more value and serves more users. Nonetheless, Uniswap has its own addressable market and continues to grow.

Although the Uniswap platform offers great security in general, the funds are still vulnerable to theft. On July 11, 2022, a hacker managed to steal $8m via a “phishing scam” by guaranteeing a free airdrop of 400 UNI. These incidents are not specific to a platform or an exchange but cause serious reputation damage.

Uniswap Current Performance and Future Outlook

Uniswap has created a monopoly by taking over 65% of the market share in the DEX space. With high volumes and liquidity, Uniswap also attracts whales and institutions.

Uniswap has maintained a decent monthly volume, as shown in the chart above. The total volume in December 2021 and May 2022 amounted to around $50bn.

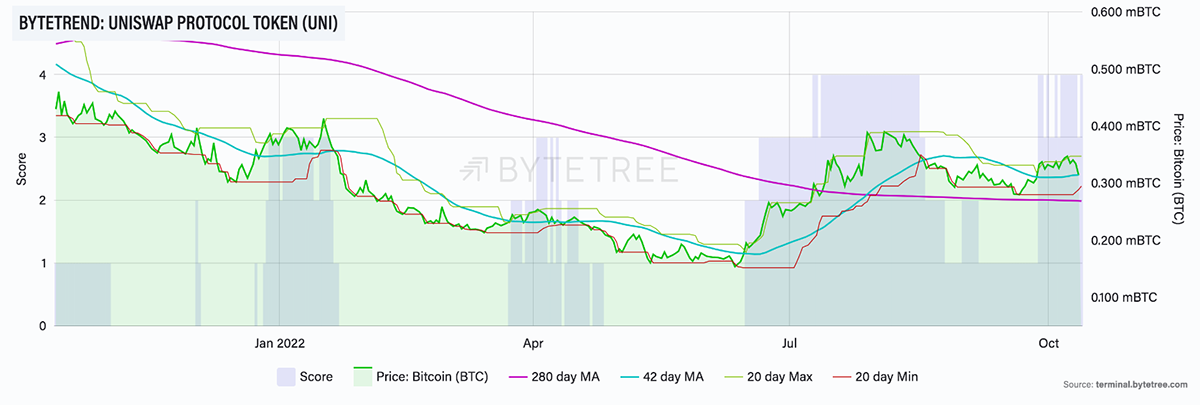

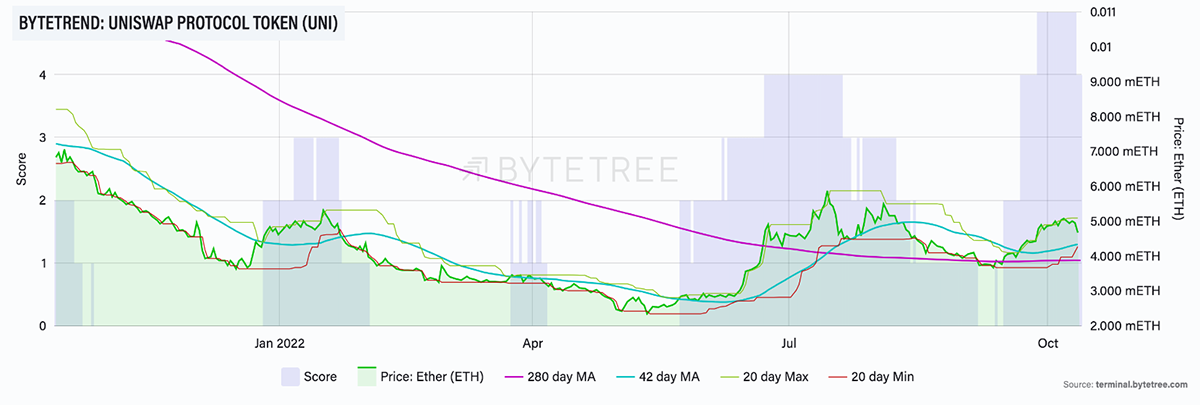

As illustrated in the below charts, UNI currently holds a 4-star trend score against BTC and ETH on ByteTrend, showcasing a bullish trend against the two largest cryptos.

One reason for Uniswap’s rapid success is that it was built in the largest DeFi ecosystem, Ethereum, while the gas fees being at an all-time low brought a new influx of users. With its flexible fee structure, Uniswap also has the potential to draw in new users from centralised exchanges, as Binance and Coinbase still charge around 0.1% and 0.5%, respectively. Moreover, with the success of ‘The Merge’, the native blockchain is on track to become significantly more scalable, which will indirectly benefit Uniswap over the coming years.

Conclusion

Since its launch in 2018, Uniswap has grown to serve millions of users worldwide, managing billions of dollars in volumes and TVL. Although it is the leader in the DEX space, with a huge market share, it is still far off from surpassing CEXs. Currently, the poor on-chain performance and a surge in its circulating supply remain a concern.

Nevertheless, with flexible and lower platform fees and gas, numerous tokens and liquidity pools, and passive income options for liquidity providers, Uniswap continues to onboard new users. Additionally, being part of Ethereum’s DeFi ecosystem, especially with the upcoming changes, is of huge benefit to Uniswap. Already a winner in its niche, there’s significant growth potential in the future.