Introducing The Multi-Asset Investor

A New Report from ByteTree Research

I am delighted to announce the launch of The Multi-Asset Investor (TMAI) at ByteTree Premium. As of now, TMAI will continue to give investment insights to the many who have been following the Whisky and Soda Portfolios that I previously managed at the Fleet Street Letter (Southbank Research), where I spent seven happy and productive years.

ByteTree delivers high quality research in liquid assets based on sound financial principles and, with that, actionable portfolios that our clients can follow. We cover multiple asset classes including global equities, bonds, commodities, currencies and crypto.

We have built the tools and research capabilities to empower our clients to take control of their financial affairs and make more informed decisions. This is especially relevant during times of economic and market turmoil when things change quickly.

In more normal times, passive investing, whereby you simply hold low-cost index funds (or a high-cost managed portfolio service), can provide a satisfactory outcome. Sadly, we no longer live in normal times. Government spending and central bank money printing will no longer support financial markets as they have over the past 20 years.

We are departing from a world where this wall of money drives markets. Instead, money will go to the people at the expense of markets. The people want a pay rise to fight off the cost-of-living crisis, and they’ll get one. Interest rates and inflation will be higher. You can no longer rely on quantitative easing and ultra-low interest rates to support asset prices from shares to houses.

It is crunch time for markets. Active management, which embraces sound investment principles, will flourish while the passive investor will flounder. We last saw this in the 1970s when a balanced portfolio of bonds and equities saw a decline of 60% of its purchasing power.

Welcome to financial repression.

My career spanned 17 years at HSBC Global Asset Management as the Head of Absolute Return, where I oversaw the management of $3bn of client assets. In 2001, my team was an early pioneer in multi-asset portfolios when balanced portfolios (equities and bonds) were the norm.

You don’t get to $3bn of assets without doing something right. We did that by embracing underappreciated asset classes, such as emerging markets and commodities, from 2002. Yet portfolio volatility was kept low by diversifying into other asset classes such as bonds, property, private equity and hedge funds. It was a recipe for success.

Risk management has always been at the forefront of my investment approach. It is right to invest in something with perceived risk when it offers good value and good potential. Good value gives you a margin of safety so that even if things go wrong, there is unlikely to be a significant downside.

On the other hand, it is eventually wrong to own popular assets which are overpriced and have no margin of safety, such as US tech in recent years. These trends can go on for longer than can be rationally explained. But in the end, sound investment principles always win the day.

Even when things go wrong, it is vital to remain diversified so that the worst outcome is avoided. Never bet the ranch.

In 2015, I left HSBC, which was the best apprenticeship I could have wished for. I had years of access to the leading minds in finance. Yet, in the years after the financial crisis, banking was no longer a pleasurable sector to work in. Many of the freedoms I had enjoyed before 2008 turned into constraints. I had a track record that I was proud of, and it was time to move on.

Within days of leaving HSBC, the Money Week editor-in-chief and Financial Times columnist, Merryn Somerset-Webb, asked me to take over the editorship of the Fleet Street Letter, which was an investment publication in print since 1938. I had always enjoyed reading good investment letters and was already writing Atlas Pulse (ByteTree’s monthly gold letter). Merryn was a fan and offered me the role.

I have been writing the Fleet Street Letter for nearly seven years, until yesterday. It has been a thoroughly enjoyable experience, and that coverage continues on ByteTree Premium as of now.

In writing that investment letter, I approached it as an advisory stockbroker would in a world before computers. That was a relationship where your broker would call you to discuss what was going on in markets and give you some ideas to trade. That service continues to exist for the super-rich in private banking but is much harder to access for the many.

In the 1990s, there was execution only, advisory and discretionary stockbroking. As online dealing gained popularity, and regulatory pressures built, advisory broking became the casualty as the investment world morphed into execution-only (no advice) and discretionary (fully managed).

I believe that personal relationship from advisory is missing in today’s investment landscape. On the one hand, you don’t want to be paying 1.5% dealing commissions, which is a plus, but there is little to steer you. ByteTree’s research and data bridges that gap, giving clients the information and tools they need to make better decisions.

ByteTree research shouldn’t be thought of as a tip sheet but as a portfolio service that crucially blends the ideas together. This embraces what I had learnt in multi-asset investing and risk management. For example, if oil is going up, own some good oil companies, but think: what else is happening, what could go wrong, and always remain diversified.

The success should be measured by the outcome of the portfolio rather than the individual recommendations. Some tend to do extremely well, but not always. That is the point of diversification.

Gold is a good example, as it is often seen as portfolio insurance that is more likely to beat the market during the bad times than the good. Even though it hasn’t shot the lights out in 2022, it has proved resilient, which is not a bad outcome in a brutal year for financial markets.

The Multi-Asset Investor manages two model portfolios, named Whisky and Soda, with risk management and opportunity at their core.

Soda should be considered medium risk and has low turnover focusing on asset allocation, while Whisky is medium to high risk and more active. Clients are encouraged to have a core holding in Soda with a satellite holding in Whisky. A spilt of 80% Soda and 20% Whisky would be more cautious, while a 60/40 approach would be more growth orientated. That decision is left to clients.

Since Soda covers asset allocation and can often see no trades for weeks or months, Whisky keeps the conversation alive as there is always something happening in markets. Whisky works much closer to the coal face, actively seeking profitable investment opportunities in individual UK stocks, ETFs and investment trusts.

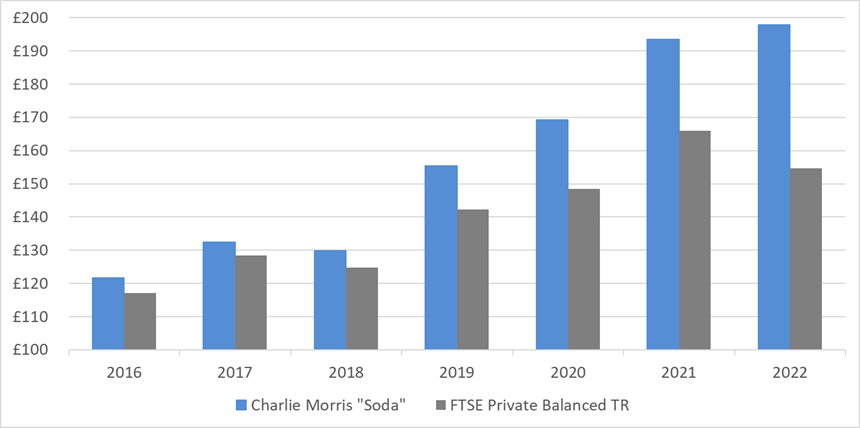

I started managing these portfolios on 1 February 2016. Soda was measured against the FTSE Private Balanced Portfolio Index. This, or something similar, is how most wealth management firms measure their portfolios. It is broadly 60% equities and 40% bonds, although some of that may be classified as property or alternative assets.

Over my tenure to 25 October 2022, Soda returned 98%, in contrast to the FTSE Private Balanced Index, which returned 59%, including dividends.

The Soda Portfolio

Source: ByteTree Asset Management. Total return in GBP 1/1/2016 to 25/10/2020.

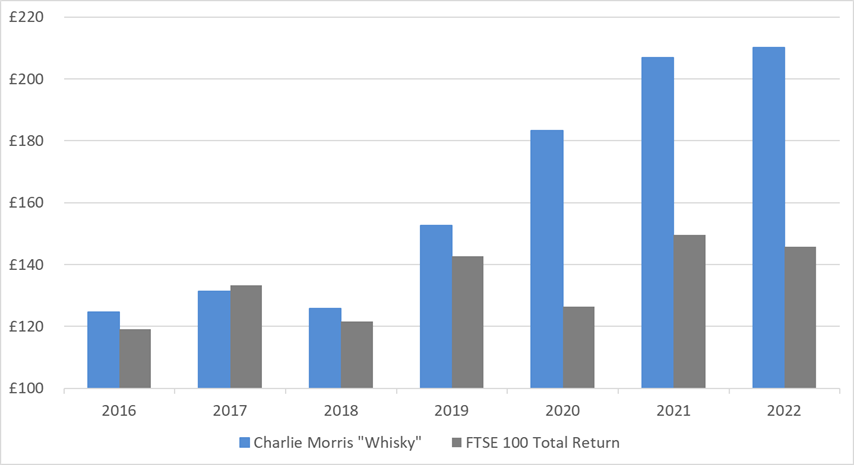

Over the same period, the Whisky portfolio returned 109.4% against the FTSE 100 Index of 52%%, including dividends.

The Whisky Portfolio

Source: ByteTree Asset Management. Total return in GBP 1/1/2016 to 25/10/2020.

I also did a stint at Atlantic House Fund Management (AHFM), a specialist firm in derivatives, from 2018 to 2020, where I was hired to launch their Total Return Fund. That period was fascinating because I got to grips with the multi-trillion world of derivatives.

I spent months researching various derivative strategies and came to the conclusion that careful selection of the underlying assets would always win the day. The AHFM Total Return Fund beat 48 funds to be number one by the time of my departure*.

*Source: Trustnet

I moved to ByteTree full-time in July 2020. The time had come to go all in. Today ByteTree offers a growing list of useful tools and a growing research capability, making it ever more compelling.

In 2021, we launched crypto research with ATOMIC, followed by ByteFolio (actionable crypto portfolio) and Token Takeaway (crypto project research). Crypto is undergoing one of its notorious bear markets, but it will once again rise from the ashes as computers continue to change the world.

In 2022, we have brought in Robin Griffiths and Rashpal Sohan to cover the world’s leading trends in markets using ETFs. I had met both while working at HSBC. Robin in 1998, and Rashpal a few years later, who was Robin’s assistant. Rashpal crunched the numbers using his mathematical and computing skills, while Robin travelled the world (first class probably) wooing the clients. They make a great team, and we are thrilled to include them in ByteTree Premium.

The Multi-Asset Investor continues my work from seven years at the Fleet Street Letter and begins on ByteTree Premium today.

A modestly priced ByteTree Premium subscription costs £25 per month and covers all of these publications mentioned in addition to our comprehensive, and growing, data set. That gives investors powerful insights into bitcoin’s blockchain, fund flows, trend-following indicators for crypto and ETFs, gold valuation, and more. What you see today is the tip of the iceberg, and we are excited about the forthcoming “macro room”.

These are challenging times in financial markets. Governments have spent many years writing checks they cannot cash, and it is payback time. Quantitative easing (QE) and zero interest rates were never going to end well, but the surprise is how the bond market put up with it for as long as it did. Financial historians will be bemused by the monetary policies of this era.

Combine that with unrealistic policies towards energy and net zero with a declining workforce and collapsing global supply chains, and the world has an inflation problem. With energy and dollars being the sole beneficiaries of 2022, investors have had a tough year. Yet it has been possible to avoid the worst of the bond and equity crash by, once again, sticking to sound investment principles. That is value and diversification.

Asset allocation, effective diversification, risk management, value, and growth come together to build portfolios that can withstand tough environments and thrive over time.

The Whisky and Soda portfolios have proved to be effective during bull and bear markets. They combine 25 years of experience and lessons from financial history into a simple strategy that is accessible to a wide range of investors.

I hope you join us as the Multi-Asset Investor starts its journey on ByteTree Premium.

The Multi-Asset Investor is issued by ByteTree Asset Management Ltd, an appointed representative of Strata Global which is authorised and regulated by the Financial Conduct Authority. ByteTree Asset Management is a wholly owned subsidiary of CryptoComposite Ltd.

General - Your capital is at risk when you invest, never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid. Overseas shares - Some recommendations may be denominated in a currency other than sterling. The return from these may increase or decrease as a result of currency fluctuations. Any dividends will be taxed at source in the country of issue.

Funds - Fund performance relies on the performance of the underlying investments, and there is counterparty default risk which could result in a loss not represented by the underlying investment. Exchange Traded Funds (ETFs) with derivative exposure (leveraged or inverted ETFs) are highly speculative and are not suitable for risk-averse investors.

Bonds - Investing in bonds carries interest rate risk. A bondholder has committed to receiving a fixed rate of return for a fixed period. If the market interest rate rises from the date of the bond's purchase, the bond's price will fall. There is also the risk that the bond issuer could default on their obligations to pay interest as scheduled, or to repay capital at the maturity of the bond.

Taxation - Profits from investments, and any profits from converting cryptocurrency back into fiat currency is subject to capital gains tax. Tax treatment depends on individual circumstances and may be subject to change.

Investment Director: Charlie Morris. Editors or contributors may have an interest in recommendations. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of CryptoComposite Ltd. ByteTree Asset Management (FRN 933150) is an Appointed Representative of Strata Global Ltd (FRN 563834), which is regulated by the Financial Conduct Authority. https://register.fca.org.uk/

© 2024 Crypto Composite Ltd