Bad Money Out, Good Money in

Disclaimer: Your capital is at risk. This is not investment advice.

ATOMIC 56

Reckless over-leverage has exacerbated bitcoin’s fall, but signs are that the worst offenders have left the building. This creates a platform for bitcoin to re-set and prove itself as a monetary network and store of value, something that the emerging world urgently needs.

ByteTree ATOMIC

Analysis of Technical, On-chain, Macro, Investment Flows and Crypto.

Highlights

| Technicals | Sector subdued, dispersion within |

| On-chain | Institutional Dominance comes down |

| Macro | Tough times in emerging markets |

| Investment Flows | Holding power hugely encouraging |

| Cryptonomy | European crypto regulation |

Technical

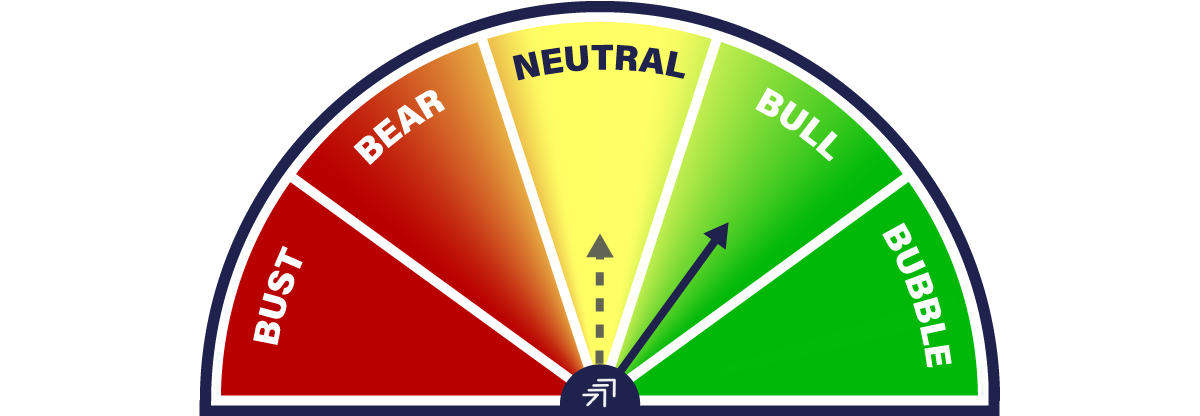

On ByteTrend, Bitcoin remains on zero stars out of a possible five. The price has vacillated around US$20,000 over the last week, with no indication of any trend reversal. Both the long (280-day) and short (42-day) moving averages continue to slope downwards, with the price trading well below both. We might see a star appear over the next few weeks if the price touches the 20-day “max” line again (light green line), but in isolation, that’s been an unkind indicator of late, marking a point of re-capitulation.

Source: ByteTree. ByteTrend for Bitcoin, measured in USD, over the past year.

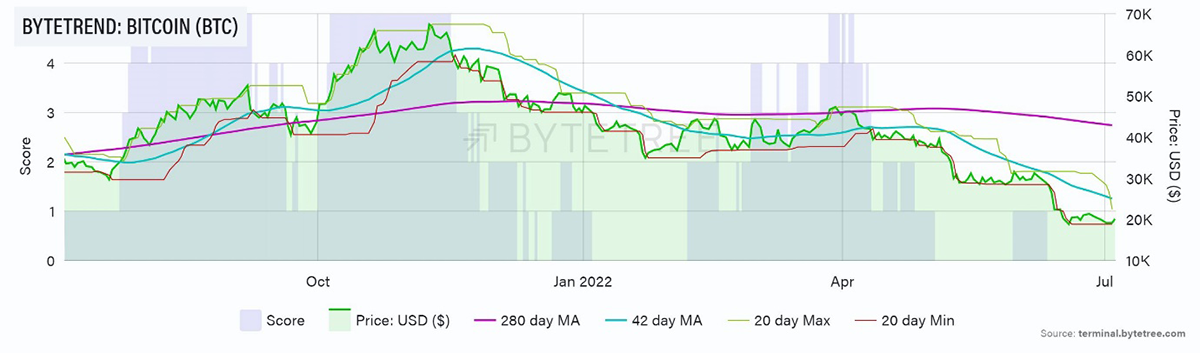

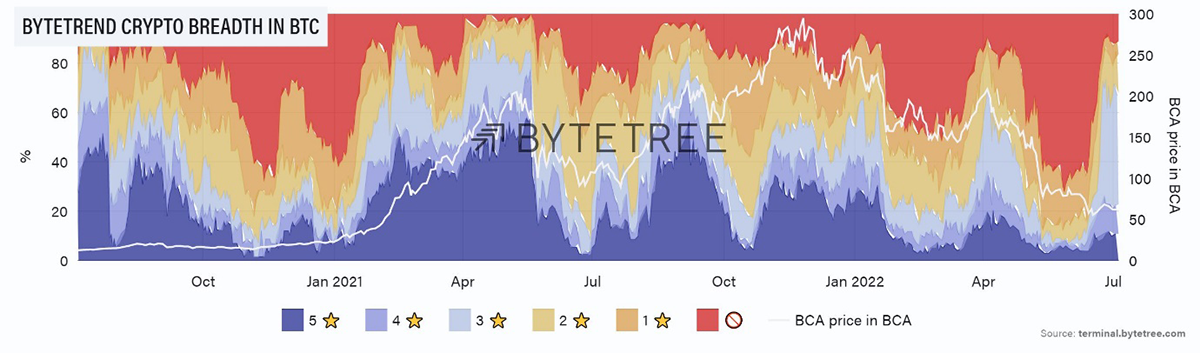

The bearish set-up is further illustrated by the breadth chart (the chart below shows the number of ByteTrend stars in the top 100 tokens when calculated relative to the US$), which continues to show a large red sky. This means that very few coins/tokens have any trend stars at all.

The good news is that the last time the crypto universe was in such bad shape, in March 2020, marked the bottom. The same can be said of the low in late November 2018, after which bitcoin rose three-fold over the next 8 months.

Source: ByteTree. ByteTrend crypto breadth, measured in USD, since January 2018.

Within crypto, the picture is more interesting. The chart below calculates trends relative to bitcoin (as opposed to the US$ above). While the overall asset class remains weak, we are starting to see more dispersion internally. In other words, a number of coins and tokens are starting to outperform bitcoin. Several protocols are now trending higher relative to bitcoin. These are the names that we are examining as we build ByteFolio, our model portfolio, which is updated on Mondays.

Source: ByteTree. ByteTrend crypto breadth, measured in BTC, since July 2020.

Note that the chart above also shows the ByteTree Crypto Average (BCA, white line), now back to levels last seen in early 2021. This is a composite price of the top 100 coins (ex-Bitcoin) and gives a good idea of the scale of the recent fall.

On-Chain

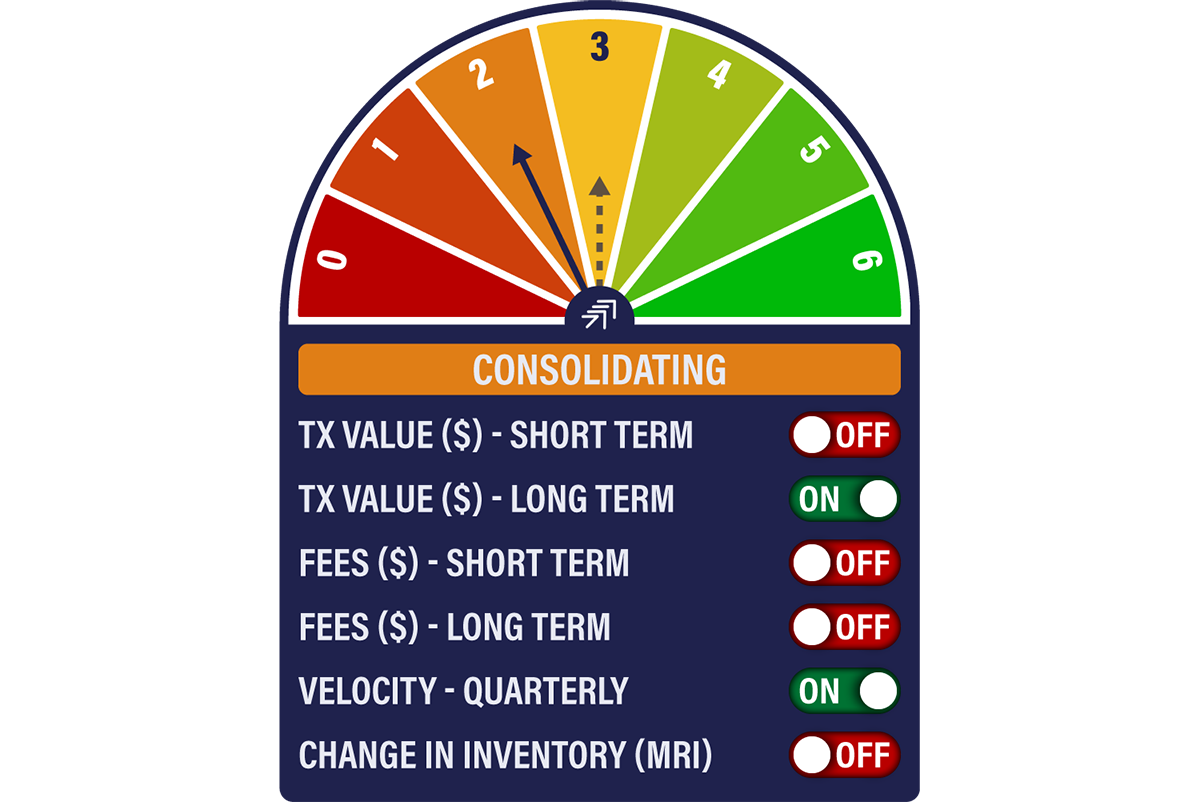

The Network Demand Model has fallen back to 2/6 this week, with the short-term spend indicator turning off. As feared, the short-term spike that accompanied the two recent bouts of capitulation has failed to follow through. Transaction activity remains subdued, unsurprising, given recent events in the space.

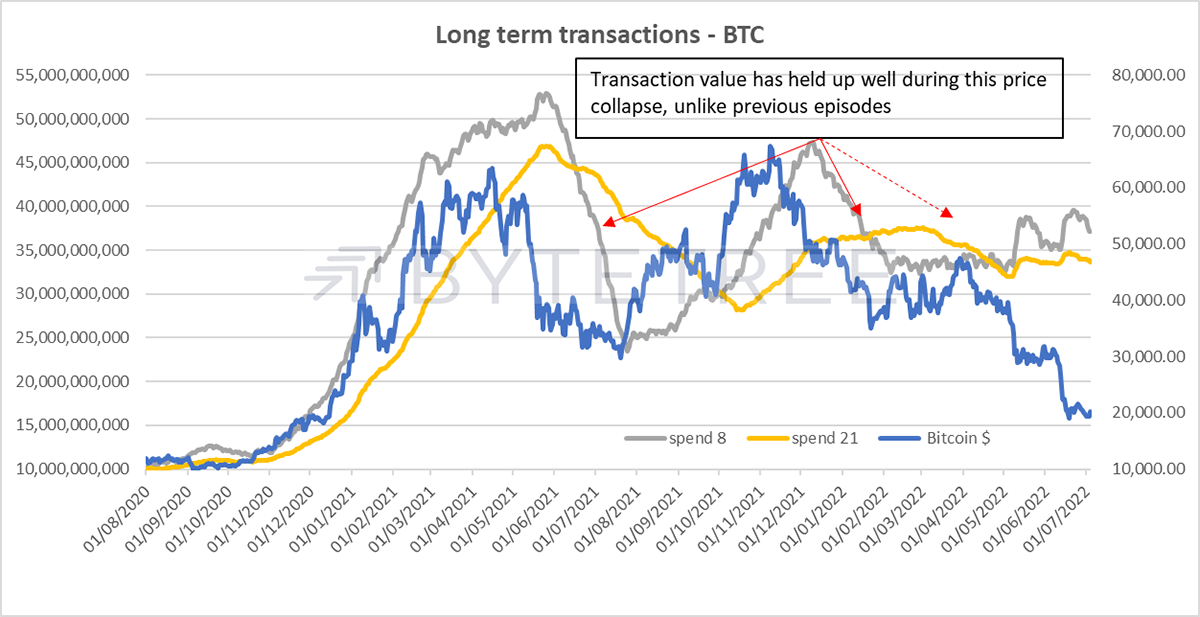

Of course, we measure transaction value in US$, so the series is pro-cyclical in that it moves with the price. This is why we use a crossover moving average technique to understand when we see trend strength.

Zooming out, we see a more constructive picture. Longer-term moving averages show that, unlike in previous corrections, activity has remained resilient, despite the price collapse. If this holds, it will underpin network valuation and reinforce our belief that bitcoin is very good value at US$20,000.

Source: ByteTree

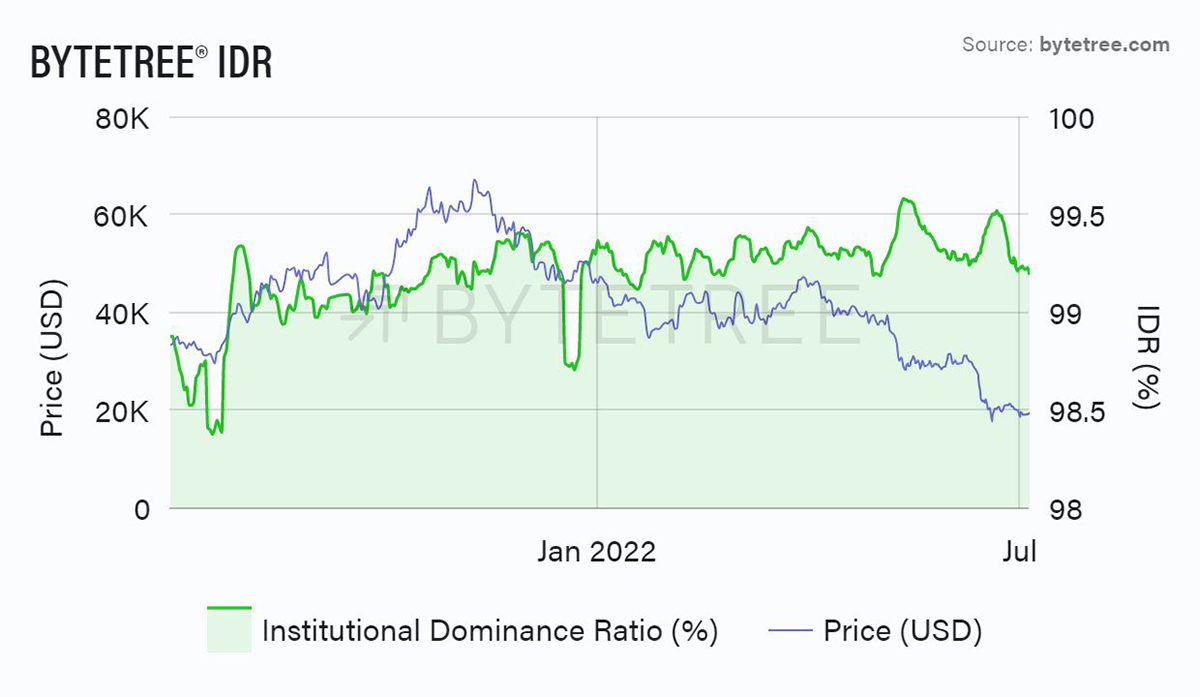

We have also seen a decline in the Institutional Dominance Ratio. This measures the percentage of volume accounted for by the top quintile of transactions and is a proxy for institutional involvement. With the collapse of some large and leveraged hedge funds in the space, the fall is hardly surprising.

The last time the institutions left the scene (apart from Christmas) was in July 2021, at the bottom of the China mining ban correction, as can be seen below. It might be that the institutions were largely responsible for pushing the price back up in the second half of the year, and we are now seeing their retreat. For many, this is a healthy development, as it returns ownership of bitcoin to those who believe in its long-term use case as an independent monetary network rather than as an instrument of pure speculation.

Source: ByteTree. ByteTree Institutional Dominance Ratio (%) and bitcoin price (USD) over the past year.

Macro

Inflation remains front and centre. While problematic in developed markets, it’s nothing compared to emerging economies. Turkey and Pakistan, for example, just announced 78.6% and 21.3% annual increases in consumer prices in June. In Pakistan’s case, the highest for 13 years. Wholesale prices in India increased 15.9% in May, the highest in 30 years. The pressure is showing up in the currency markets as interest rate differentials and deteriorating government finances continue to bite. The Japanese Yen has lost 18% against the US dollar this year alone, while the Indian Rupee pushes towards 80 to the dollar. The Turkish Lira has lost half of its value against the US$ in 12 months.

Markets, however, are suggesting that the worst of the inflation problem is behind us. But, as argued last week, policy risk is high. Will authorities stick to their guns and stomach a recession, or will they relent to political pressures and ease off the brakes, with the likely consequence of prolonging the problem?

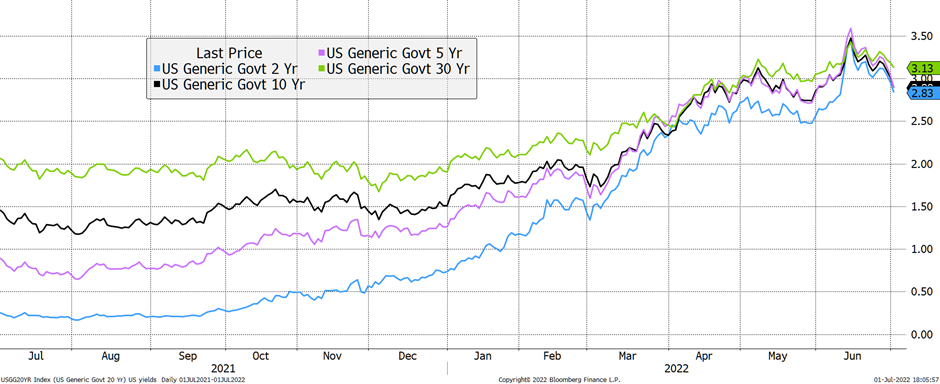

Source: Bloomberg

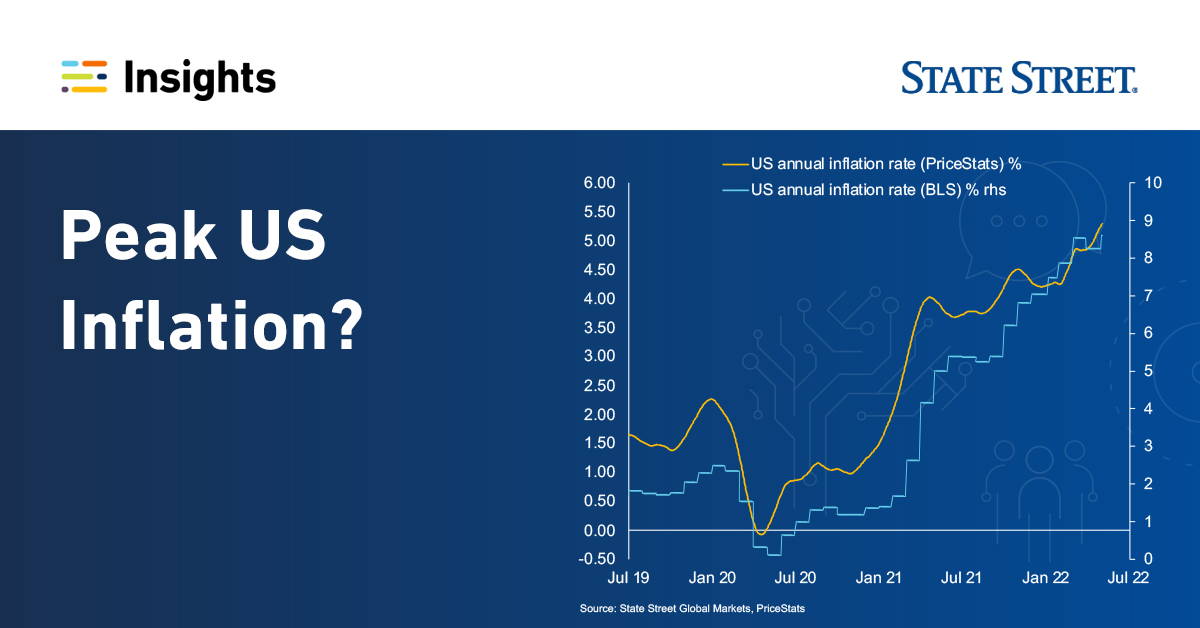

The bond market is taking the view that inflation is peaking, with yields topping out a fortnight ago (see above). But can we be so sure? China’s factories are starting to switch on, with the latest Caixin Purchasing Managers’ Index reading 51.7 in June (vs 48.1 in May and against expectations of 50.1). The oil price has barely budged (anti-oil protesters continue to glue themselves to just about anything), and unrest over wage settlements is only just getting started. The State Street US PriceStats series, shown below, is particularly worth noting. As they say in the commentary on their site:

“The US PriceStats series is not distorted by re-opening sectors such as used cars or airfares as a result it shows a lower annual inflation. But having initially peaked in March, it is now rising sharply once again in early June, a troubling sign for those hoping the official inflation trend has peaked.”

Source: State Street

If the US data does continue to deteriorate and the Fed continues to raise rates, life is going to get even tougher elsewhere. Rising US interest rates relative to the rest of the world means a stronger dollar, which will continue to choke off economic activity.

From the comfort of a developed economy armchair, the case for “hard money” seems somewhat archaic. But seen through the eyes of the less fortunate, the use case is very real. Bitcoin has failed to be a safe harbour in the recent market meltdown, as the speculative element has been exposed and eviscerated. As the dust settles, however, bitcoin’s true test begins. It is an extremely interesting phase.

Institutional Flows

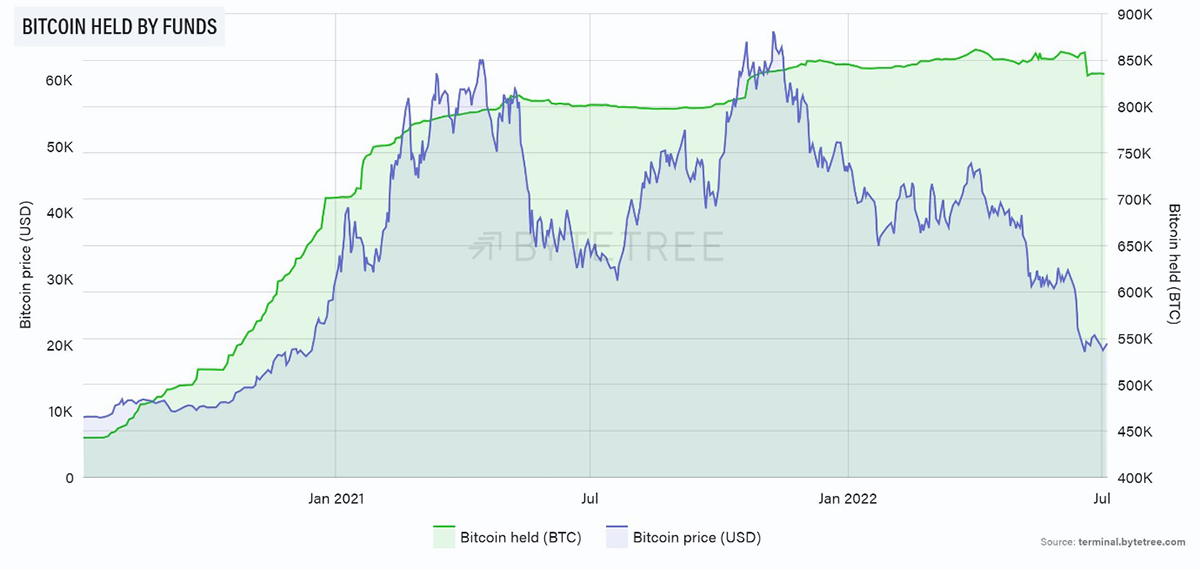

Bitcoin held by funds has barely budged for the second week in a row. The stoicism of the holders in the face of such a large sell-down is encouraging.

One observation about the funds that we monitor is that they are long only and unleveraged. The relative lack of movement lends further credence to the received wisdom that the lion’s share of damage in this sector is caused by reckless over-leverage. No surprise there. It’s the same in the traditional finance sector, but that’s where the similarities end. The traditional finance sector gets bailed out by the taxpayer when everything goes wrong, which means there’s little in the way of punishment for perpetrators or tightening of standards. Crypto, by contrast, has to fend for itself. This makes adjustments fast and brutal but also cleans out the miscreants and realigns the ecosystem.

Source: ByteTree. Bitcoin ETF holdings (BTC) and price (USD) since July 2020.

Cryptonomy: European crypto regulation

Europe became the first continent to implement uniform digital asset regulation after the Markets in Crypto-assets (MiCA) bill was approved by the EU’s Economic and Monetary Affairs Committee last week. The billwas first proposed in September 2020 and made some significant headway this year after the European Parliament voted in favour of the draft in March, as highlighted in ATOMIC 39 and 40.

German MEP Stefan Berger, who is the lead on the MiCA bill, said in a statement:

“MiCA will ensure a harmonised market, provide legal certainty for crypto-asset issuers, guarantee a level playing field for service providers and ensure high standards for [customer] protection. Tokenisation will be as ground breaking for the financial world as the introduction of the joint market was in the 17th century”

One of the key aspects of the bill is that the standardised rules will apply to all 27 EU member states, thereby unifying lawmakers on a large scale. The new regulation includes requirements on the issuing, offering and trading of crypto assets, the operation of service providers, consumer protection, and prevention of market abuse and illicit activities.

The environmental impact of crypto assets is also at the forefront of the bill, where cryptoasset providers are now required to disclose the energy consumption and impact of the assets they list. An early draft had initially set to ban proof-of-work blockchains like Bitcoin due to their higher energy consumption, but this was reworded ahead of the vote in March.

Following the collapse of UST, large stablecoins are now subject to tougher regulation. A cap of 200 million euros in daily transactions has been set, and stablecoins will also be required to maintain enough reserves to cover claims from users, which bans algorithmic stablecoinsby extension.

According to Bloomberg, the response to the MiCA bill from the crypto industry has largely been positive. Crypto service providers have advocated for regulatory clarity for many years to protect their businesses and safely progress innovation. The European Council will still need to approve the bill before it comes into force, but the end is in sight.

Summary

Bitcoin and crypto’s underlying principles are enlightened but become tarnished by hubris and greed. Signs are that the bad elements have been largely removed in this cycle, hopefully creating a foundation for the next phase of the journey.